If You Are Under 59 1/2

Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resort. Not only will you pay tax penalties in many cases, but youre also robbing yourself of the tremendous benefits of compound interest. This is why its so important to maintain an emergency fund to cover any short-term money needs without costing yourself extra by making a 401k early withdrawal.

However, life has a way of throwing you curveballs that might leave you with few to no other options. If you really are in a financial emergency, you can make a withdrawal in essentially the same way as a normal withdrawal. The form is filled out differently, but you can find it on Fidelitys website and request a single check or multiple scheduled payments.

If you jump the gun, though, and start making withdrawals prior to the age of 59 1/2, youve essentially broken your pact with the government to invest that money toward retirement. As such, youll pay tax penalties that can greatly reduce your nest egg before it gets to you. A 401k early withdrawal means a tax penalty of 10 percent on your withdrawal, which is on top of the normal income tax assessed on the money. If youre already earning a normal salary, your early withdrawal could easily push you into a higher tax bracket and still come with that additional penalty, making it a very pricey withdrawal.

How To Use The Contribution Calculator

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. The Growth Chart and Estimated Future Account Totals box will update each time you select the âCalculateâ or âRecalculateâ button.

Pre-filled amountsBased on our records, the following information may be pre-filled:

Salary

- Pay period. If the information is not available, the default pay period is weekly.

Contribution

- Your contribution rate. Note that we will use 8% as a default value if your contribution rate is not available or if your contribution is a dollar amount rather than a percentage.

Investment

Also Check: When Leaving A Company What To Do With 401k

Placing Real Estate Investment Question:

That is good news, and it sounds like the Fidelity brokerage account set up up process went smoothly and now you can start placing investments in alternative investments such as real estate. You can either place the investments by writing a check or by filling out the Fidelity outgoing wire directive, which we can fill out for you. for more information regarding investing in real estate.

Read Also: Can I Start My Own 401k Plan

How Do I Find My Fidelity Investments Account And Routing Numbers

Routing numbers are a form of identification for check processing endpoints. They have been in use for over a century and they are essential in transactions involving financial institutions. In simple terms, routing numbers direct funds to the right bank during a transaction. It can be identified as a nine digit number on the bottom left corner of any check.

Brokers and banking institutions use the routing number to identify the source of funds and determine where they are going to.

What Are Average Fidelity 401 Fees

We have evaluated the fees of a few Fidelity plans over the years as part of our 401 fee comparison service. Below are the averages we found for these plans.

|

Average Fidelity 401 Fees |

|

|

All-In Fees |

0.71% |

While their per-capita admin fee was below the $422.30 average in our 2018 401 fee study, that number can easily grow much higher due to the way these fees are charged.

In our experience, about 70% of admin fees charged by Fidelity are paid by revenue sharing hidden 401 fees that lower the investment returns of plan participants. Not only are plan sponsors or participants often unaware that theyre paying them, but theyre always charged as a percentage of plan assets. That means plan participants will automatically pay Fidelity higher and higher administration fees for the same level of service as their account grows. Thats not fair!

When you factor in compound interest, these growing fees can make a huge dent in your retirement savings. As such, you want to do everything in your power to avoid paying them.

If youre currently using Fidelity for your 401, your first step to avoiding these fees is to find out whether or not youre paying them. Well show you how to do that next.

Don’t Miss: How Much Can You Contribute 401k

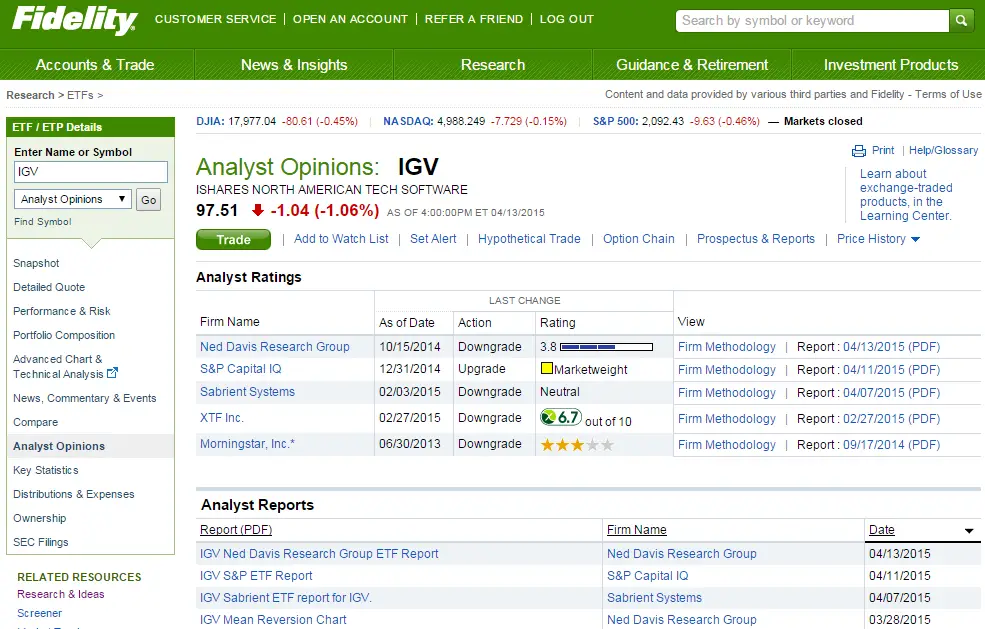

Timing Of The Brokerage Account Setup

After submitting the Fidelity brokerage forms to Fidelity Investments, between 5-7 business days , you should receive an email from Fidelity Investments that their system has updated your email address. This indicates the application is in processing.

When you start receiving emails from Fidelity, you can check if the account has been fully setup without having to wait on the Fidelity Welcome Letter in the mail which includes your new account number. Please try to log in using one of the following methods:

- If you have an existing Fidelity login , you should see the new Non-Prototype account appear under your portfolio with an account number that starts with the letter Z.

- If you do not have an existing Fidelity login, you can try to register to Fidelity.com at the following link: You will need to create a username and password.

How To Close A Deceased Loved Ones Fidelity Account

People have become more aware of their potential digital afterlife. As a result, many are leaving specific instructions for their next of kin. They might leave a comprehensive list of their accounts and access to a password manager. Even if you dont have that luxury, Fidelity makes the account closing process relatively straightforward.

Read Also: Should You Always Rollover Your 401k

What Is Fidelitys Routing Number

Want to fund your Fidelity 401k or perhaps another Fidelity retirement account? Youll probably want to know which routing numbers to use. Always double-check to make sure youre taking down the right information. A single incorrect digit means the funds will go elsewhere, failing the transaction.

Routing numbers are usually well within your reach for a quick look-up. Aside from here, you can also find Fidelity routing numbers on the financial institutions website, with live chat support available. Or, if you have your Fidelity checks handy, just look for your routing number there.

Cash Back and No Annual Fees: Fidelity Rewards Visa Signature Review

Why Did Gethuman Write How Do I Find My Fidelity Investments Account And Routing Numbers

After thousands of Fidelity Investments customers came to GetHuman in search of an answer to this problem , we decided it was time to publish instructions. So we put together How Do I Find My Fidelity Investments Account and Routing Numbers? to try to help. It takes time to get through these steps according to other users, including time spent working through each step and contacting Fidelity Investments if necessary. Best of luck and please let us know if you successfully resolve your issue with guidance from this page.

Don’t Miss: Where Can I Find My 401k Balance

If You Are 59 1/2 Or Older

Once you are six months away from your 60th birthday, you can begin making withdrawals from your Fidelity 401k without having to worry about any additional tax penalties. Your 401k is now money thats there for you to start preparing for the next stage of your life as you put the finishing touches on your career and prepare to start drawing Social Security benefits.

However, that doesnt mean you dont have to worry at all about taxes. Money withdrawn from your 401k is taxable income, so you should be careful to consider just how much you need to withdraw in any given tax year to ensure youre not hitting a higher tax bracket and seeing more of your hard-earned money lost to taxes. If you have a Roth IRA or Roth 401k, though, you can make tax-free withdrawals from those, so you can balance withdrawals to minimize the tax impact.

Your Fidelity 401k comes with the option to schedule regular withdrawals so that you can do the paperwork for your withdrawal once and then set up a recurring payment. With structured, regular withdrawals, you can set up a budget that will limit your withdrawals to what you need, and youll be able to have checks showing up on a set schedule.

Recommended Reading: How To Withdraw My 401k From Fidelity

Banks Can Have Multiple Routing Numbers

Banks and brokers have different routing numbers depending on a variety of factors. One factor is the size. For example, a major bank such as Wells Fargo has different routing numbers in each state. Smaller banks and online-only financial institutions usually only use one routing number nationwide.

An institution might also have different routing numbers to fulfill different functions. For example, Fidelity has different routing numbers used for its brokerage and mutual fund accounts.

| Fidelity Routing Numbers |

Don’t Miss: Can An Llc Have A Solo 401k

Where Fidelity Go Falls Short

Tax strategy: The company does not offer tax-loss harvesting, one of the features that makes robo-advisors stand out for taxable accounts.

No human advisor guidance: Although Fidelity Go has investment advisors managing and rebalancing portfolios, these advisors do not give financial planning guidance or answer other investment questions.

Purchase Exemption And Minimum Investment Requirements

The Fidelity Absolute Return Fund is available to investors who can meet certain eligibility requirements under the accredited investor prospectus exemption under applicable Canadian securities legislation. This Exemption is available only to “accredited investors” as defined in National Instrument 45-106, Prospectus Exemptions. The minimum purchase amount is CDN$25,000 .

If you are a financial advisor who, under applicable Canadian securities legislation, is registered as a dealing representative of a sponsoring IIROC member investment dealer or MFDA member mutual fund dealer, and you are acting on behalf of a client who qualifies under the Exemption and who can meet the Minimum Purchase Amount, please accept the disclaimer below to learn more about the Fund.

If you are a financial advisor who, under applicable Canadian securities legislation, is registered as a dealing representative, and approved as a portfolio manager, of a sponsoring IIROC member investment dealer, and are acting on behalf of a fully managed account client who qualifies under the Exemption and who can meet the Minimum Purchase Amount, please accept the disclaimer below to learn more about the Fund.

You and your sponsoring IIROC member investment dealer or MFDA member mutual fund dealer, as the case may be, are responsible for ensuring that your client who is purchasing units in the Fund meets the definition of “accredited investor” and is eligible for the Exemption.

Read Also: Where To Check 401k Balance

Determining Your Fidelity Routing Number

You can identify your Fidelity account number first through your checks, where you will see a 13-digit number at the center bottom. However, if you do not have a check-writing feature on your account, find your 17-digit account number format. Heres a guide:

For brokerage accounts that start with X, Y, or Z:

Put your Fidelity Brokerage Account number after the Fidelity prefix, 39900000. If in case the one to use the figures cannot use letters in the number field, then they do the following substitution for direct deposits:

- X to 5

- Y to 6

- Z to 7

For the brokerage account number X01999999, the 17-digit account number format would be 39900000X01999999 or 39900000501999999 if the system cannot use letters.

Other brokerage accounts and 529 college savings accounts:

For this one, you need the Fidelity prefix 39900001. Then add your 9-character Fidelity brokerage or 529 plan account number.

Fidelity Routing Number for Fidelity accounts starting with 2 followed by two letters:

- Use the Fidelity prefix 392 first.

- Add the 5-digit Fidelity fund number of the mutual fund to which you want to deposit. If the fund number is less than five digits, then add zeros before the numbers.

- Next, add your 9-digit mutual fund account numb-ppp=][vfgrer.

Identifying 17-digit direct deposit account number if T account does not have check-writing:

If T789789789 is your direct deposit number and the fund is 055, then the 17-digit direct deposit number must be 39200055789789789.

Get Help From Customer Service

This is another simple and straightforward method anyone with the Fidelity account can use to determine their account number. Customer service can be accessed by visiting any Fidelity bank outlets near you or contacting customer care through phone call. Using the live chat feature on the website can also put you through with customer service. The bank’s social platform is also a good channel for those that want to get in touch with customer care through the internet without having to use the website.

When talking to customer service, you will be required to provide your full names, the phone number that was used to create the account, home address, date of birth, next of kin, and any other information that can help them identify you as the owner of the account.

You May Like: What’s The Most You Can Contribute To A 401k

Fidelity Routing Number United States

Fidelity Routing Number is used for wire transfer transactions in your bank. Fidelity is not the usual brick-and-mortar bank. It focuses on brokerage accounts while functioning as a checking account too. Fidelity even has FDIC insurance for deposits, and it also offers interests with consumer-friendly policies. To boot, it yet has basic savings accounts. If you want a free cash account with little interest, this Fidelity will work for you. You can also get the routing numbers of similar banks in our complete Routing Numbers List.

Meanwhile, you can also wire money with Fidelity. Before you can do this, you need to have Fidelity direct deposit or direct debit routing numbers. Ensure that your Fidelity account is a checking account in the case of Automated Clearing House .

You May Like: Can Business Owners Have A 401k

Processing Solo 401k Loan Question:

I received the rollover check from John Hancock for my former employer 401k and will go into the local Fidelity Investments office tomorrow to deposit the check into the new brokerage account that you helped me set up for the self-directed solo 401k that you provide. I would like to make sure I understand the process to create a solo 401k participant loan against the balance. I think you all create the paperwork. Whats the method to move the loan amount from the fidelity account into my personal checking account. Do I just use the fidelity transfer functionality, get a check drafted or ?

Also, I will be rolling over an IRA account as well. Am I limited to 1 loan or can I take out a second loan against the additional amount?

Don’t Miss: How Much Income Will Your 401k Provide

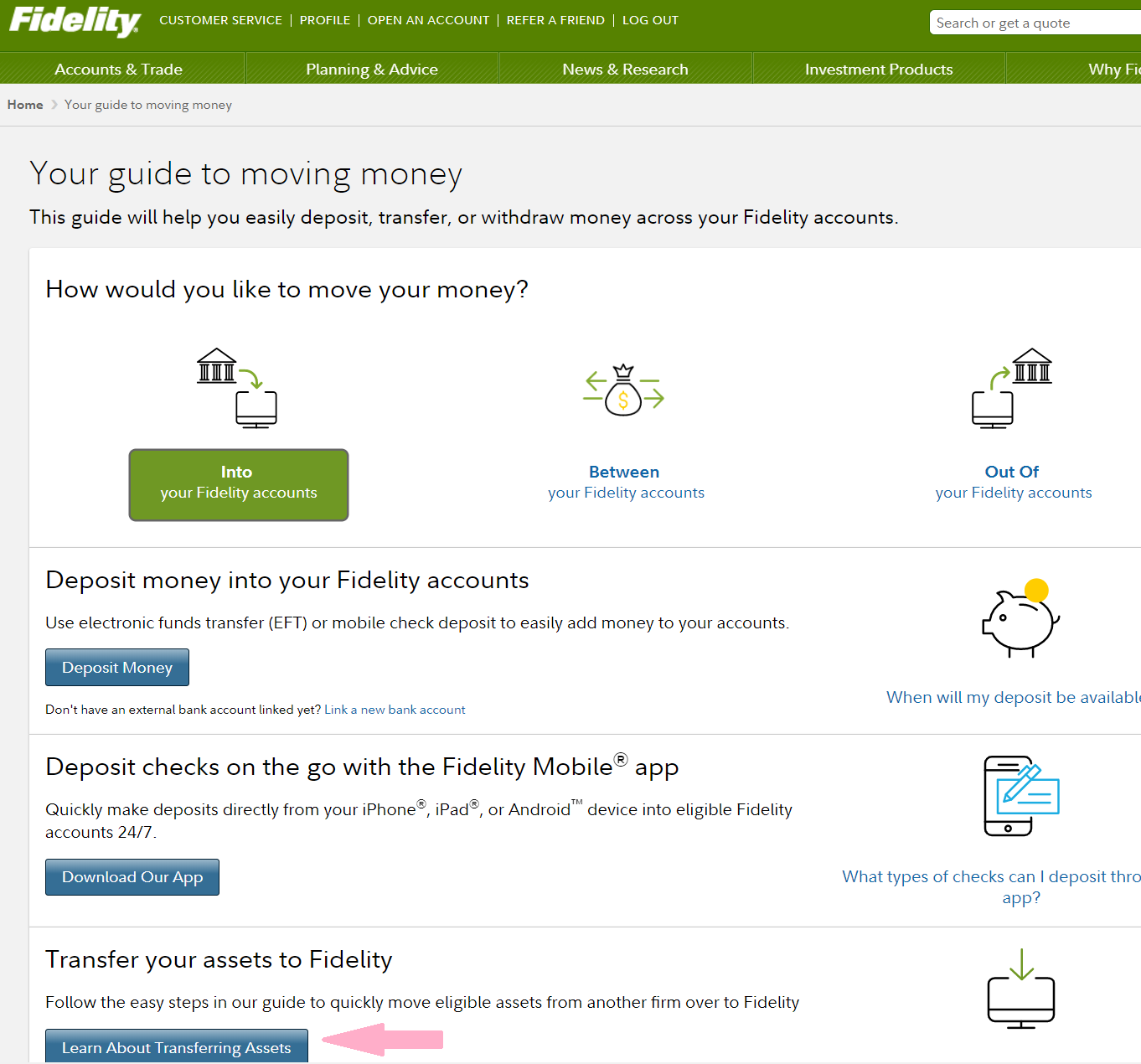

To Add Eft Using An Offline Form

If you prefer to add EFT offline, then heres what you can do.

- Download the PDF form here: Electronic Funds Transfer Authorization

- Be sure to fill out sections 1, 2, and 5, plus those sections that apply to you.

- Attach a copy of a void check, bank statement, or deposit slip

- Submit the form by following the instructions that you will find at the bottom of the form

If you want to set up EFT for a third party account , then here are the steps:

- Download the PDF form here: Electronic Funds Transfer Authorization

- Be sure you fill out sections 1, 3, and 5, plus those that apply to you.

- Attach a Medallion Signature Guarantee in part 5, or you may proceed to a Fidelity Investor Center with all involved parties present to sign documents.

- Submit the form by following the instructions at the bottom of the form

Balances Hit A New All

- Retirement account balances are at new highs, according to Fidelity Investments.

- Thanks to the markets recent run-up and increased savings, the number of 401 and IRA millionaires also hit all-time records in the second quarter of 2021.

Although many Americans continue to face financial uncertainty due to the pandemic, the outlook for retirement savers is only improving.

Retirement account balances, which took a sharp nosedive in 2020 when the coronavirus outbreak caused economic shock waves, are now at new highs, according to the latest data from Fidelity Investments, the nationâs largest provider of 401 savings plans.

The overall average 401 balance hit $129,300 as of June 30, up 24% from the same time last year, according to Fidelity.

Individual retirement account balances were also higher reaching $134,900, on average, in the second quarter, up 21% from a year ago.

Despite Covid case numbers rising in the U.S. and around the world, the yearâs market highs have been a boon for savers. In the second quarter, the S& P 500 ended up 8.2%, before retreating more recently.

Nearly 12% of workers increased their contributions during this time, while a record 37% of employers also automatically enrolled new workers in their 401 plans.

As a result, the number of 401 and IRA millionaires hit fresh highs, as well.

Together, the total number of retirement millionaires has nearly doubled from one year ago.

Read Also: How Do I Invest In My 401k

You May Like: When You Leave A Job Do You Get Your 401k

Where Can I Find My Fidelity 401k Fees

Whether due to my own ineptitude, or through deliberate camouflaging on Fidelitys part, I could not for the life of me figure out what these additional fees were. The info that I sought is information that your 401 provider must supply youyet I could not locate and account for these mysterious fees. A few days after giving up on Fidelitys website, I happened to receive an email with Fidelitys annual prospectus disclosure and viola, a CTRL F later and I finally uncovered the fees that were eating up nearly one percent of my account on an annual basis. You can find this required disclosure information under the Plan Information and Documents tab on your account.

Assuming Im not the only one who sucks at navigating an unfamiliar financial services website, I wanted to spell out those fees in somewhat plain English. For those who dont have a 401k plan through Fidelity, this information should still prove somewhat valuable, as it allows you to compare the fees in your own plan to another provider. I had a next-to-impossible time finding my own 401k providers fees, never mind search for those of competing plans.

Now, lets take a look at the Fidelity 401k fees that Im paying.