Texa$aver Investment Options For Active Employees

Saving for retirement requires more than just deciding how much to invest. It also involves choosing the right investments to match your goals. The Texa$aver 401 and 457 Program offers you a broad array of investment options from very conservative to very aggressive, Target Date Funds, as well as a Self-Directed Brokerage Account.

How To Choose A Good 401 Investment Option

I am starting my first 401 which will have 9% of my salary invested each month. I have the option of doing a Roth 401 or a traditional 401 with a range of investment options. I think the traditional 401 with investment options is good, but there are 18 different options. How can I choose which one is low-fee, low-risk, and a decent return? These are my options, which, to a first-time 401-holder/investor, are QUITE overwhelming:

Target Date Funds: Vanguard Target Retirement 2055 Fund, Vanguard Target Retirement 2050 Fund, Vanguard Target Retirement 2045 Fund, Vanguard Target Retirement 2040 Fund, Vanguard Target Retirement 2035 Fund, Vanguard Target Retirement 2030 Fund, Vanguard Target Retirement 2025 Fund, Vanguard Target Retirement 2020 Fund, Vanguard Target Retirement 2015 Fund, Vanguard Target Retirement 2010 Fund, Vanguard Retirement Income Fund

Fixed: Nationwide Bank Account, ING Fixed Account

Bond / Core Fixed Income: Calvert Group – Income Fund, Vanguard Total Bond Market Index – Inst.

Balanced: Fidelity Investments – Puritan Fund

Large Cap: Allianz NFJ Large Cap Value Instl, Fidelity Investments – Contrafund, Fidelity Investments – Over-the-Counter Portfolio, Vanguard Institutional Index Fund

Mid Cap: Columbia Acorn Z, Columbia Mid Cap Value Z

Small Cap: Brown Capital Management Small Company Fund, Invesco Van Kampen Small Cap Value Fund Y

International: DFA International Value Fund, Fidelity Investments – International Discovery Fund

Its that simple.

A Few Words About Mutual Funds Or Pooled Investment Options

We all hear about people making it big on individual stocks. But its also easy to lose money on any single investment. It may be intimidating to think about researching and picking stocks or investments with the pressure of potentially losing money.

Mutual funds and other commingled investments include a variety of investment types. That helps reduce risk.

Investment professionals with special training and tools manage mutual funds. That means you dont have to worry about the everyday decisions involved in picking individual investments within a mutual fund. And in some types of funds, the managers even adjust the mix of investments over time to help you stay on track to reach your goals.

In general, its good to have less risk as you get closer to your end goal, whether thats retirement or another date.

Thats because if the market drops, you have less time to recover from losses. Giving up some potential for growth might be worth it in exchange for lower risk.

Its also a good idea to rebalance your portfolio at least annually. Over time, some investments may grow more than others. After a while, your mix of investments isnt the same as when you started. That could mean youre taking on more risk than you originally intended.

Rebalancing takes everything back to your original mix, but if the change is more in-line with where you want to be, thats OK, too. Most financial institutions can help you with rebalancing. Some do it automatically for you.

Don’t Miss: How To Find A Deceased Person’s 401k

How Can I Protect My 401 From A Stock Market Crash

Although, there is no way to perfectly protect your investments from a financial downturn, there are solid strategies you can take to hedge against a major crash. These include keeping a diverse portfolio, not panicking when dips happen in the market, and consistently funding your 401 over time.

The Balance does not provide tax, investment, or financial services and advice. The information is presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Investing involves risk, including the possible loss of principal. Investors should consider engaging a financial professional to determine a suitable retirement savings, tax, and investment strategy.

Invest In Income Producing Closed

A closed-end fund is an investment company that offered shares in an initial public offering . After raising funds, they buy securities with them. The company then offers shares on the market for trade.

Money doesn’t flow in and out of the fund. Instead, closed-end funds are designed to produce monthly or quarterly income. This income can come from interest, dividends, or in some cases, a return of principal.

Each fund has a different objective: Some own stocks, others own bonds, and others use something called a dividend capture strategy. Be sure to do your research before buying.

Some closed-end funds use leveragemeaning they borrow against the securities in the fund to buy more income-producing securitiesand are thus able to pay a higher yield. Leverage means additional risk. Expect the principal value of all closed-end funds to be volatile.

Experienced investors may find closed-end funds to be an appropriate investment for a portion of their retirement money. Less experienced investors should avoid them or own them by using a portfolio manager who specializes in closed-end funds.

Don’t Miss: How To Increase 401k Contribution Fidelity

Take Fees Into Consideration

Heres a golden rule of investing: past performance does not guarantee future performance.

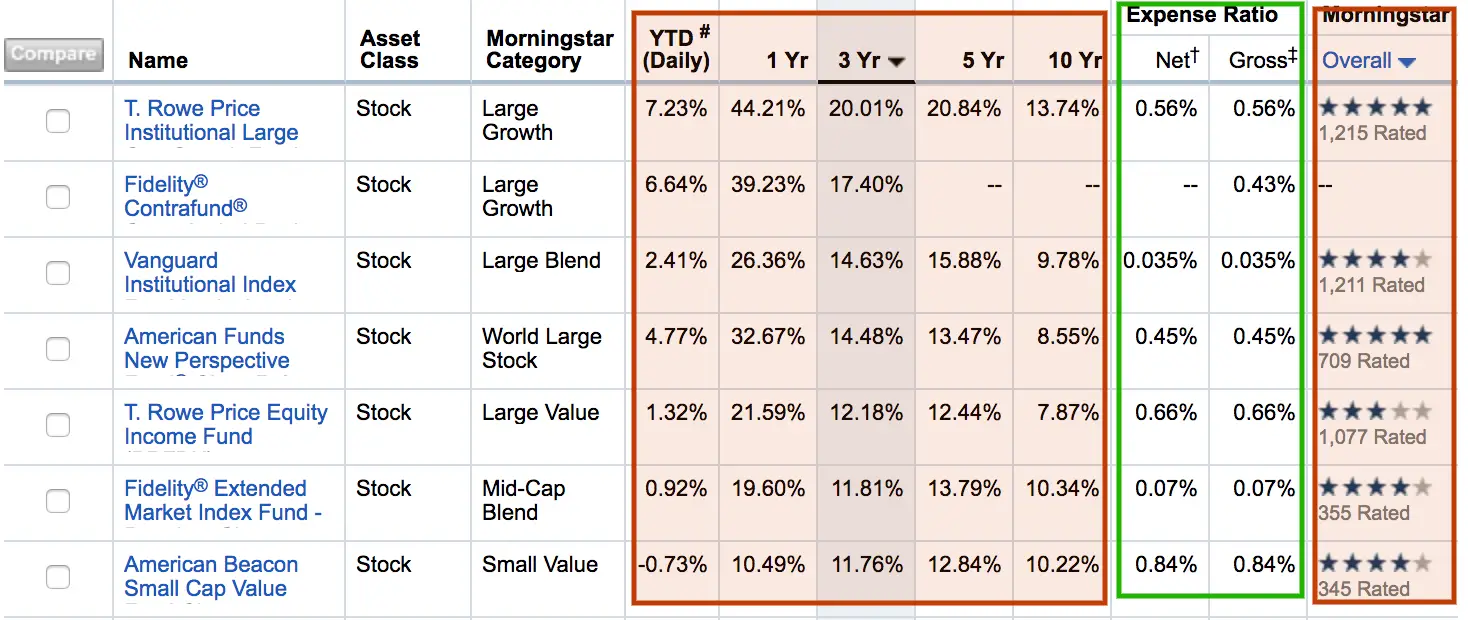

You cant control how well your investments will do, but you can control how much you pay to invest. Yes, it costs money to invest. You pay annual fees, an expense ratio, based on the percentage of the assets. This is why I ignore stats like past performance and ratings, and only pay attention to the Expense Ratio column .

Looking at the chart, paying a fee like 0.84% seems like nothing, and the most expensive option in the example, 1.02%, sounds totally reasonable. But fees can make a drastic difference in your returns.

When comparing expense ratios, also be sure to note the decimal points. At a quick glance, 0.7% and 0.07% can easily look the same.

Lets compare how those fees can play out over time. If you started with $10,000, and invested $5,000 each year for 30 years with a 6% return, heres how much each will cost you.

A 0.63% difference can end up costing you almost $50,000 more over a span of 30 years. To me, anything over 1% is expensive. Generally, my benchmark for funds are ones that cost less than 0.5%, but it all depends on what options you have in your 401k plan. If many of them are expensive, then you may have a crappy 401k plan.

Besides expense ratios, there are other fees you can incur, like load fees and redemption fees, but they arent in this specific example. Anyway, I avoid those, too.

Back To The 401k Basics

When I asked Mr. Mechanic what he knew about 401ks, he said:

Yes, you should enroll in your 401k. It is a great vehicle for saving for retirement because money can grow tax-free. You get a 401k through your employer many companies auto-enroll their employees, but some people will need to opt in.

There are other employer-sponsored retirement accounts such as 403 plans for the public sector and non-profits, 457 plans for government employees, and the Thrift Savings Plan for federal employees, but the 401k is more ubiquitous.

The max contribution limit for a 401k is $18,500, higher than a personal IRA at $5,500. Many companies offer contribution matching, which is not counted towards the limit. The exact amount will vary company to company, but the end result is the same: extra money funding that sweet retirement life.

Personally I max out my 401k every year, but of course whether or not this is achievable depends on your salary and expenses. Reference the ultimate flowchart for the order of contributions to debt, 401k, IRA, HSA, etc.

Now that weve covered the basics of what a 401k is and how it works, there are 4 steps to simplify the process of choosing your funds.

Don’t Miss: How Do You Know If You Have An Old 401k

Investing In Your 401

The variety of investments available in your 401 will depend on who your plan provider is and the choices your plan sponsor makes. Getting to know the different types of investments will help you create a portfolio that best suits your long-term financial needs.

Among the most importantand perhaps intimidatingdecisions you must make when you participate in a 401 plan is how to invest the money you’re contributing to your account. The investment portfolio you choose determines the rate at which your account has the potential to grow, and the income that you’ll be able to withdraw after you retire.

So Whats Right For You

Use this chart to help see which options match your wants and needs.

Investment and Insurance Products are:

- Not insured by the Federal Deposit Insurance Corporation or Any Federal Government Agency.

- Not a Deposit, Obligation of, or Guaranteed by any Bank or Banking Affiliate.

- May Lose Value, Including Possible Loss of the Principal Amount Invested.

The subject matter in this communication is educational only and provided with the understanding that Principal® is not rendering legal, accounting, or tax advice. You should consult with appropriate counsel or other advisors on all matters pertaining to legal, tax, or accounting obligations and requirements.

Financial professionals are sales representatives for the members of Principal Financial Group®. They do not represent, offer, or compare products and services of other financial services organizations.

Insurance products and plan administrative services provided through Principal Life Insurance Co. Securities offered through Principal Securities, Inc., 800-547-7754, member SIPC. Principal Life and Principal Securities are members of Principal Financial Group®, Des Moines, IA 50392.

You May Like: How To Invest In 401k Without Employer

Managing Your 401 For Maximum Returns

Investing in a 401 plan is one of many popular methods that can help you build a secure retirement. Many have enjoyed long and comfortable retirements by starting to save early in their lives and maximizing their employer match.

Here are some tips for maximizing your 401 investment results by managing the plan over time.

More Financial Advising Help

Seeking professional help to manage your 401 is a smart move. In 2014, Financial Engines Inc. published a report that concluded professionally managed assets perform an average of 3.2% better than nonprofessionally-managed assets. However, many professional investment managers could charge up to 3%.

SmartAsset can help you find a profitable solution to finding a safe and affordable way to get professional 401 management.

Pricing

Don’t Miss: Can I Roll An Old 401k Into A New One

S To Get Started When You’re Ready To Invest

This is the year youre getting your money in order. Youve set goals, have a spending and savings strategy, built an emergency fund, and youre saving for retirement.

A savings account is good for your short-term goalsthe money youll need in the next three years.

For mid- and long-term goals, youre going to need something with an engine. Thats what investing doestakes your saving strategy and puts an engine behind it.

- For money you need in three to five years, you have more time to weather market volatility, but youre still likely sticking to more conservative, fixed income investments like bonds.

- For savings you wont need for five or more years, you may consider other investments to help spread risk and grow your money, like mutual funds, stocks, exchange traded funds , and annuitiesdepending on your risk tolerance.

Youre already an investor if you contribute to your 401. But when youre ready to venture beyond saving/investing in a retirement plan, here are three steps to get started.

Tip: How will you know youre ready to invest? Read about the four signs to find out.

Whats Your Risk Tolerance

Every investor can consider their risk tolerance when choosing an investment fund. This represents how aggressive, or careful, the investor wants to be with those investments while no investment return is ever guaranteed, aggressive 401 investments often have a higher potential for returns compared to safer investments.

An investor with a higher risk tolerance may choose an aggressive, and therefore riskier, 401 strategy, like a fund that is heavy in equities such as company stocks traded on the S& P 500. A more conservative investor may opt for a plan that is heavy in mutual funds and bonds, or even one that allows for âsafeâ investment growth, such as money-market instruments.

You May Like: How To Put 401k Into Ira

Learn About Your Investment Options

Youll also use your plan enrollment form to select your investments for your 401 portfolio. This is where a lot of people get lost. Many folks feel like theyre not doing enough to prepare for retirement or simply dont know how to get started.1

Remember that brochure or booklet that came with your enrollment packet? Its from your 401 plan manager. It should provide fairly detailed descriptions of all your 401 selection options. Some companies do a better job at this than others, but no brochure is going to give you the complete lowdown on all your investing choices.

Another problem with these materials is that they make a big push for target date funds. Target date funds have predetermined investment mixes depending on the date you plan to retire. If youre young and have 30 or more years to retire, youll start out with a decent mix of growth stock mutual funds, but, as your retirement date gets closer, the mix will become more and more conservative.

As your investments move to less and less risk, there is less and less return. When you reach retirement age, your 401 will be heavily invested in bonds and money markets that wont provide the growth you need to support you through 30-plus years of retirement.

Your Action Step: Ignore the target date funds so you can build your own 401 portfolio from individual funds.

Picking Your 401 Investments

A 401 plan typically offers at least 10 or 12 investment funds, though some plans may offer a few dozen choices, including target-date funds. How do you choose among these options?

For many, the limited selection of funds in a 401 may be more of a benefit than a drawback, helping to simplify the process. For experienced investors, a limited fund choice is, well, limiting. These investors might prefer the unlimited selection available in an IRA. But most 401 participants want a good solution rather than a perfect solution .

There are two broad factors that 401 participants should look at:

- Long-term returns: These are the returns on the fund over five- and 10-year periods, as well as since inception.

- Expense ratio: Basically, this is the cost to hold the fund for a year as a percent of the money invested in the fund.

Participants should search for the best returns at the lowest costs, all else equal. Youll have to make a trade-off between the performance and the funds expenses sometimes, too. But it may be worth paying a higher fee for the prospect of much better long-term returns.

Youll want to be careful about buying any fund thats had a good recent performance, such as one- or two-year returns, but has delivered a mediocre performance over longer periods. Many investors make the mistake of chasing a hot fund, only to see its performance drop in the future.

Also Check: When Can You Access 401k

How To Choose Investments For Your 401 Plan

While target date funds are often chosen as investment options in a 401 plan, there are myriad options to choose from, including alternative investment strategies. In addition, if you plan to go the do-it-yourself route, you may want to consider what kind of retirement portfolio would best suit your needs.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: How To Manage 401k Investments

We Believe Theres A Better Way When It Comes To 401 Investments It Starts With Us Providing The Highest Level Of Investment Fiduciary Protection Available

You know how important it is to offer a 401 plan in todays marketplace. Having a competitive retirement plan can help your organization attract and retain talent and be a key component to an overall financial wellness program. Your employees may be years away from retirement, but a 401 plan, and the educational resources that often come with it, can help them feel more confident about their futures and especially if your organization offers a 401 match and/or profit-sharing contribution, balances in employee retirement accounts can really add up quickly.

Whether you are starting up a 401 plan for the first time or your organization already has a 401 plan, its important to keep current with market trends. This is especially critical if your company has a high percentage of positions in competitive fields, where an attractive 401 plan can be a deciding factor for people .