Take An Early Withdrawal

Perhaps youre met with an unplanned expense or an investment opportunity outside of your retirement plan. Whatever the reason for needing the money, withdrawing from your 401 before age 59.5 is an option, but consider it a last resort. Thats because early withdrawals incur a 10% penalty on top of normal income taxes.

While an early withdrawal will cost you an extra 10%, it will also diminish your 401s future returns. Consider the consequences of a 30-year-old withdrawing just $5,000 from his 401. Had the money been left in the account, it alone would have been worth over $33,000 by the time he turns 60. By withdrawing it early, the investor would forfeit the compound interest the money would accumulate in the years that follow.

How Do You Know What To Pick For Your 401 Plan

Getty

My finance background often makes me the recipient of random financial advice texts from friends and family. The most common by far is, What should I pick in my 401?

My head feels like its going to explode when I get this question. Its the equivalent of walking into a physicians office for the first time and asking, Doctor, do I need surgery? without providing them any further information.

To be clear: Your 401 plan is as unique as you are. Without knowing your plans fund offerings, your investments outside the plan, the type of job you have, your annual expenses, your goals and your risk tolerance, theres no way for a financial advisor to tell you which funds are the best for you. Having said that, there are general tips you can apply when making decisions related to your 401 plan.

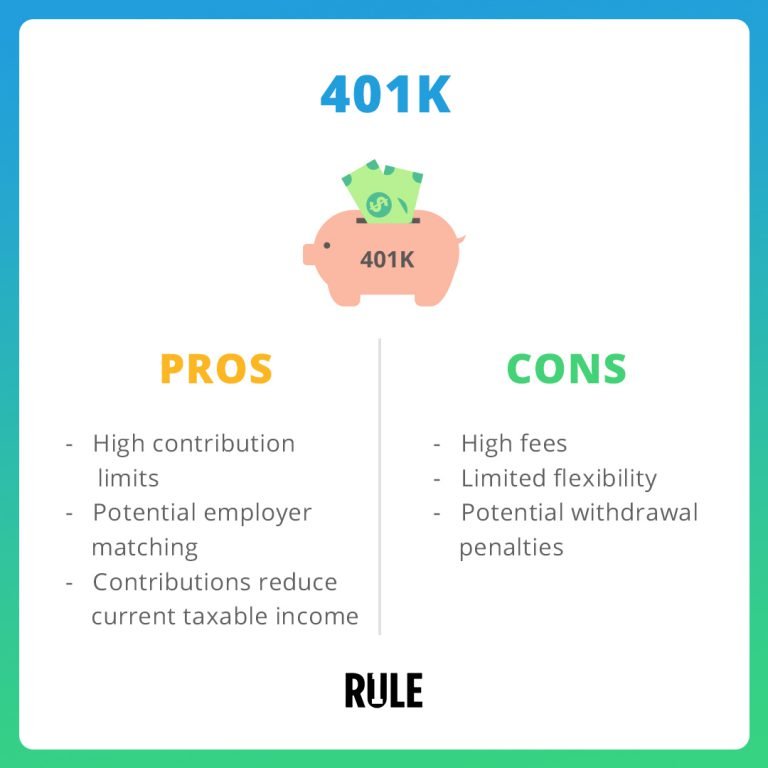

Fees, Fees, Fees

Asset Allocation Matters

Asset allocation, which sounds like it could be the title of a spy movie, simply explains the mix of stocks, bonds and cash in which you decide to invest. Research has found that this decision accounts for a significantly larger portion of your overall portfolio risk than the individual bonds or stocks that you might pick. Broadly speaking, the younger a person is, the larger the share of stocks they should have in their 401 plan. As you approach retirement, there should be a more balanced mix between stocks and bonds as you switch the focus from growing your money to preserving your money.

Calculate Your Risk Tolerance

All investing is risky and returns are never guaranteed, but it can actually be more risky to keep too much of your savings in cash, thanks to inflation.

Still, you don’t want to go all in on one stock or investment, particularly if a rocky market makes you uneasy and anxious, or likely to do something drastic, like pull your money out of your account.

You’ll want to determine an appropriate asset allocation, or how much of your investments will be in stocks and how much will be in “safer” investments, like bonds. Stocks have the potential for greater returns, but can be more volatile than bonds. Bonds are more stable, but offer potentially lower returns over time.

Financial advisors often recommend using the following formula to determine your asset allocation: 110 minus your age equals the percentage of your portfolio that should be invested in equities, while the rest should be in bonds.

But think about your investing horizon. If you have decades until you’re going to retire , then you can afford a bit more risk. You might choose an 80-20 stock mix for now. When you’re older, you’ll start scaling that back, depending on your goals and, again, your appetite for risk. Experts suggest checking that your investments are properly aligned with your risk tolerance each year and rebalancing as necessary, though how often you actually do will vary based on personal preference.

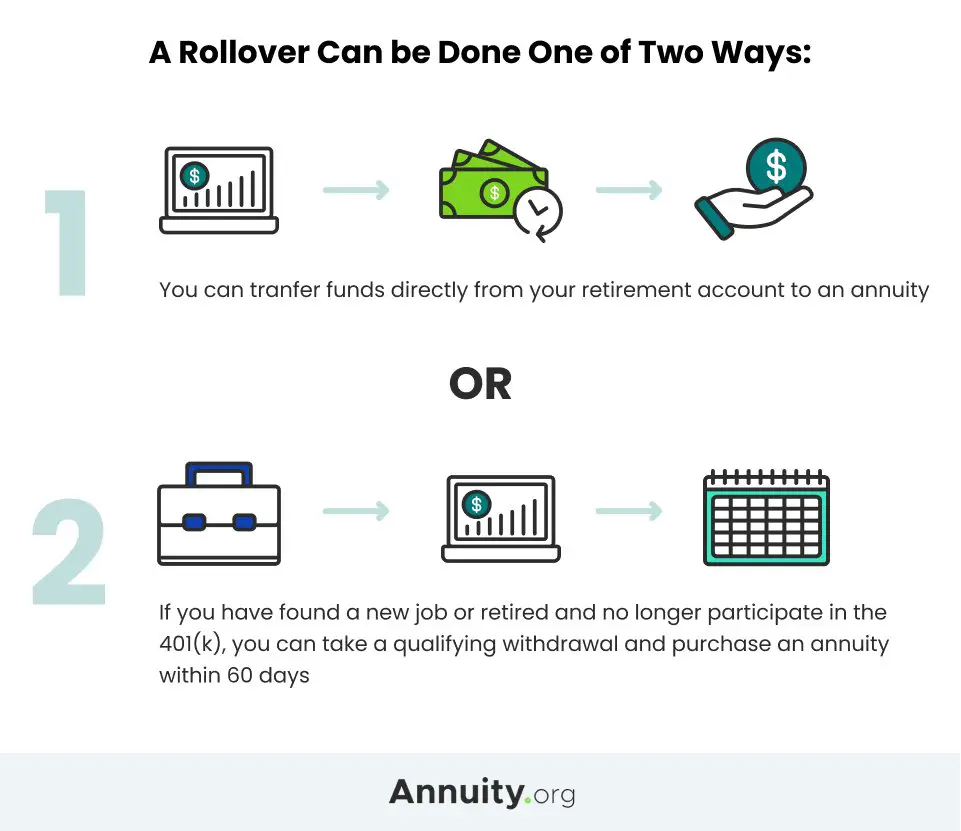

You May Like: How To Rollover Old 401k To New 401k

Pick The Right Funds For Your 401

Without a thorough understanding of your mutual fund options, its easy to make bad investing choices. For instance, lets say a sample companys 401 materials have 19 investment choices that arent target date funds: six growth funds, four growth and income funds, two equity income funds, two balanced funds, four bond funds, and one cash-equivalent money market fund.

If youre trying to invest according to our advice by splitting your 401 portfolio evenly between growth, growth and income, aggressive growth, and international funds, youre already in trouble. According to the brochure, you dont have any aggressive growth or international options! You meet with an investment professional and they let you know that of the six options the brochure has listed as growth funds, two are actually international funds and one is an aggressive growth fund. Thats exactly the kind of insight you need to help you make smart investment selections.

A lot of people dont know you can work with an outside professional to select your 401 investments, but you can!

Other investors worry that working with their own investing pro will be expensive. Your investing professional may charge a one-time fee for a 401 consultation, and thats a reasonable cost for the time they spend to help you make smart 401 selections. Just make sure you know what to expect before your appointment so there are no surprises.

How Much Should I Save

Many advisors recommend saving 10% to 15% of your income, but some savers may fall outside that target range. If you have doubts on your trajectory, consult our retirement calculator to pressure-test your approach. We are going to assume here that you already have some sense of how much you should be setting aside to reach your retirement goals.

Recommended Reading: What Can I Contribute To My 401k

Impact Of A 401 Loan Vs Hardship Withdrawal

A 401participant with a $38,000 account balance who borrows $15,000 will have $23,000 left in their account. If that same participant takes a hardship withdrawal for $15,000 instead, they would have to take out $23,810 to cover taxes and penalties, leaving only $14,190 in their account, according to a scenario developed by 401 plan sponsor Fidelity. Also, due to the time value of money and the loss of compounding opportunities, taking out $23,810 now could result in tens of thousands less at retirement, maybe even hundreds of thousands, depending on how long you could let the money compound.

Similar Employer Sponsored Retirement Plans

If you are employed by a public school, state college, religious organization, non-profit or another tax-exempt organization, you may be allowed to participate in a 403 plan. If you are a state or local government employee , you may be eligible to participate in a 457 plan.

These types of plans are generally similar to a 401 in terms of contribution limits and investment opportunities.

Read Also: Where Can I Open A 401k

How Much You Need

As a general rule of thumb, many financial advisors recommend having enough saved in retirement funds plus other sources of income, such as social security or a pension, to replace 80% of your income before retirement. If you have determined how much you will receive from other sources of income, you can use a conservative estimate of roughly 56% in annual returns from your 401 to figure out what sort of balance you will need to generate the additional income to achieve 80%.

Another quick and simple way to estimate the amount you will need to have saved is to take your pre-retirement income and multiply it by 12. So, for example, if you were making $50,000 a year and were considering retirement, you should have about $600,000 saved in your 401.

A more comprehensive approach would be to use a “retirement calculator.” Many financial institutions that manage 401 plans offer online, interactive retirement calculator tools that will allow you to use different assumptions and automatically calculate the required savings amount needed to achieve your goals. They typically also have knowledgeable representatives that will walk you through the process. You should take advantage of these resources if they are available, assuming you don’t already have a financial advisor.

You Have More Choices And Potential But Greater Risks Of Messing Up

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Participants in 401 plans might feel restricted by the narrow slate of mutual fund offerings available to them. And within individual funds, investors have zero control to choose the underlying stocks, which are selected by the mutual fund managers, who regularly underperform the market.

Fortunately, many company’s offer self-directed or brokerage window functions that give investors the option to seize the reigns over their own financial destinies by managing their 401 plans for themselves. But there are both pros and cons to taking the do-it-yourself route.

Recommended Reading: Can You Move An Ira To A 401k

How Does My 401 Plan Use Mutual Funds

Generally, in your shopping cart, or investment portfolio, you will choose to include a variety of assets spread across different asset classes in order to avoid putting yourself at risk of losing too much value when shifts in the marketplace occur . However, instead of creating a recipe completely from scratch, you may choose to fill your 401 shopping cart with pre-made ingredients to cut down on complication or risk. For example, you may choose to buy pre-made pizza sauce instead of buying all the separate ingredients to make your own sauce . The following fund types may make it simpler to diversify your 401 portfolio:

Balanced Fund: A type of mutual fund, sometimes called a hybrid or blended fund, which includes both stocks and bonds providing diversification and thus earning the reputation of being less vulnerable to volatility in the marketplace.

Equity Fund: A type of mutual fund which invests primarily in stocks to generate returns, but as a result, tend to be higher risk.

Index Fund: A type of mutual fund whose goal is to match the performance of the overall market based on a particular index, like the S& P 500.

Stable Value Fund: A collection of low-risk fixed income investments which are insured, offering protection for investors who are concerned about losing money.

Learn more about: Reasons to review your 401 portfolio on a regular basis

Know Your Investment Risk Tolerance

Whats the difference between investment types and asset classes? A lot centers around risk vs. return.

In general, the higher the potential for return the higher the potential for risk of lossand vice versa.

Risk tolerance is how much you can keep the emotion out of investing. Healthy markets typically go up and down, but those short-term market changes can stir both excitement and regret.

Some people are more comfortable knowing they could lose money in the short run if there are possible gains in the long run. Others are more conservative, preferring less risk.

To learn about coping with market volatility, watch our video.

Also Check: How To Cash Out A Fidelity 401k

What Is The Difference Between Risk Tolerance And Risk Capacity

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

Risk tolerance and risk capacity are two concepts that need to be understood clearly before making investment decisions. Together, the two help to determine the amount of risk that should be taken in a portfolio of investments. That risk determination is combined with a target rate of return to help construct an investment plan or asset allocation.

Risk capacity and risk tolerance may sound similar but they are not the same things.

The Supportive Ally Your Retirement Plan Deserves

When considering a retirement benefit for your employees, its important to understand what youll be expected to provide as a plan sponsor.

Fiduciary responsibility can feel overwhelming, but by working with a Morgan Stanley Financial Advisor, you can adopt an investment fund lineup for your plan thats guided by Morgan Stanleys rigorous research process and standards.

With more than 85 years of investment experience, we can help deliver the retirement plan oversight, advice, research and selection you need to meet your fiduciary obligationwithout having to sacrifice any focus on your business.

Whats more, well make sure you fully understand and feel comfortable with our investment decision-making process, so you can rest easy knowing youre making thoughtful choices for the people who rely on you.

Learn more about Morgan Stanley at Works comprehensive range of retirement services and solutions, and talk to a Morgan Stanley Financial Advisor about your corporate retirement plan today.

Read Also: Can You Have A 401k Without An Employer

Christopher Gething Certified Financial Planner

@ChristopherGething12/12/16 This answer was first published on 07/02/15 and it was last updated on 12/12/16.For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

You need to come up with an asset allocation which is appropriate for your risk tolerance, time horizon, and investment objectives. I would recommend consulting with a financial adviser for a more detailed analysis of your situation and assistance in implementing an appropriate investment strategy.

Which Assets Should You Draw From First

You may have assets in accounts that are taxable , tax-deferred s, and tax-free . Given a choice, which type of account should you withdraw from first?

The answer isâit depends.

- For retirees who dont care about leaving an estate to beneficiaries, the answer is simple in theory: withdraw money from taxable accounts first, then tax-deferred accounts, and lastly, tax-free accounts. By using your tax-favored accounts last, and avoiding taxes as long as possible, youll keep more of your retirement dollars working for you.

- For retirees who intend to leave assets to beneficiaries, the analysis is more complicated. You need to coordinate your retirement planning with your estate plan. For example, if you have appreciated or rapidly appreciating assets, it may be more advantageous for you to withdraw from tax-deferred and tax-free accounts first. This is because these accounts will not receive a step-up in basis at your death, as many of your other assets will. A step-up in basis is used to calculate tax liabilities for your beneficiaries.

Also Check: How Long Will My 401k Last

What Are The 401 Contribution Limits

For 2022, the maximum contribution limit for employees to individually contribute pre-tax to their 401 is $20,500. If you are above the age of 50, you can have a catch-up limit of an additional $6,500 to contribute . To compare, you are allowed to contribute $6,000 per year to an IRA or Roth IRA .

Contributing To A Roth Ira And 401 Can Be Tax Efficient

Roth IRAs have income limits based on your modified adjusted gross income .

- For 2023, you may contribute to a Roth IRA if your MAGI is less than $138,000 or less than $218,000 .

- For 2022, you may contribute to a Roth IRA if your MAGI is less than $129,000 or less than $204,000 .

If you meet the income requirements, contributing to a 401 and Roth IRA simultaneously can help diversify your tax liability. Here’s why: Investments generally trigger taxes, but the timing of the tax bill varies. You can think of investments as being in three buckets: “tax now,” “tax later” and “tax never.”

Traditional IRAs and 401s typically fall into the “tax later” bucket. You can reduce your taxable income by the amount you contribute to the retirement accounts every year, and any taxes you pay are generally deferred until you begin withdrawals.

Roth IRAs belong to the “tax never” bucket, in which assets generally have preferential income-tax treatment on their accumulated value and distribution. If you follow the IRS’s rules for Roth IRAs, your withdrawals are tax-free.

You can use these tax differences between a 401 and Roth IRA to your advantage to potentially save more of your money over the long term.

Don’t Miss: How Do I Check My 401k Account Online

What To Look For

Among your choices, avoid funds that charge the biggest management fees and sales charges. Actively managed funds are those that hire analysts to conduct securities research. This research is expensive and drives up management fees.

Index funds generally have the lowest fees because they require little or no hands-on management by a professional. These funds are automatically invested in shares of the companies that make up a stock index, like the S& P 500 or the Russell 2000, and change only when those indexes change. If you opt for well-run index funds, you should look to pay no more than 0.25% in annual fees. By comparison, a relatively frugal actively-managed fund could charge you 1% a year.

What Is A 401 How Does A 401 Work

A 401 is an employer-sponsored retirement savings plan that offers significant tax benefits while helping you plan for the future.

With a 401, an employee sets a percentage of their income to be automatically taken out of each paycheck and invested in their account. Participants can choose how to allocate their funds among the investment choices offered by the plan, which usually include a variety of mutual funds.

Recommended Reading: What Happened To My 401k When I Quit A Job