Your Retirement Is Portable With A 401

Pension benefits are based on your salary and tenure with the company. Pensions typically use either cliff vesting or graded vesting to determine access to your benefits . With cliff vesting, after you stay with the company a certain time , you earn 100% access to your pension benefits. With graded vesting, after you’ve been with the company for three years, you start gaining access to pension benefits at a rate of 20% per year. By the end of your seventh year, you’ll be 100% vested.

Unfortunately for this system, job-hopping is the norm these days, and people rarely stay with the same employer for more than three years, let alone seven. Worse, even if you stay long enough to fully vest, your pension benefits will be based on your earnings from that employer, so if you stay only a few years, the resulting benefits will be pretty minimal.

401 accounts work differently. Any contributions you make to your plan are always 100% vested, and when you leave your employer, your contributions still belong to you. You can leave them invested or choose to roll them over into your new employer’s 401 or into an IRA. While employer matching contributions may be subject to a vesting schedule similar to that of a pension, most of your retirement money comes with you when you switch jobs, even if you’ve been with your company for only a short time.

Average 401 Match: Everything You Need To Know

Average 401 match guidelines are fairly inconsistently applied across employers. Any employee who has worked at more than one company can likely discuss the differences in 401 matching guidelines experienced at each of their employers. An employee can certainly use their knowledge of a traditional 401 match program to help in their analysis of the employers total compensation offer. Generally, if an employer is known for offering an unfavorable 401 match, that employer is likely to offer other unfavorable benefits, as well. If an employee has an understanding of the typical range for 401 match offerings, that employee is in a better position to compare whether their prospective or current employer is offering a competitive 401 match. Lastly, employees should also consider the terms and length of a vesting schedule as it pertains to matching contributions.

The Bureau of Labor statistics indicate that the average employer 401 matching contribution is approximately 3.5 percent of the employees annual compensation the median matching contribution is approximately 3 percent. A breakdown of the statistics is as follows:

- 10 percent of employers provide a 401 matching contribution of greater or equal to 6 percent of annual compensation.

- 41 percent of employers provide a 401 matching contribution that falls in the range of 0 6 percent.

- 49 percent of employers do not provide employees with any 401 match.

Is Offering A 401 Employer Match Mandatory

Although offering a 401 employer match for your employees’ retirement plans may benefit your business, there are no laws requiring employer matching. However, if you do offer a 401 employer match contribution program, you are legally required to conduct nondiscrimination testing to ensure your program equally benefits all of your employees. These IRS-created tests, known as the Actual Deferral Percentage and Actual Contribution Percentage tests, ensure that your company’s most highly paid employees benefit as much from tax-deferred contributions as your other employees.

Key takeaway: Employers are not required to offer a 401 employee match, but those that do must regularly test for compliance with nondiscrimination standards that ensure employees of all incomes benefit equally from tax-deferred contributions.

Don’t Miss: How To Borrow Against 401k Fidelity

Worst: Mankind Vs The Rock

Triple H and Stephanie McMahon-Helmsley began to flex their muscles by calling the shots in WWE. On the December 27, 1999, edition of Raw, former three-time World Tag Team Champions The Rock and Mankind competed in a pink slip-on-the-pole match with the loser forced into retirement.

It was obvious that Rock was never going to lose this bout. He prevailed but since Mick Foley has his three faces of Foley, he returned into his Cactus Jack gimmick and clashed with Triple H over the WWE Championship for the next three months.

Check If Your Company Stacks Up

Companies with pension plans used to be the key to aging comfortably. But with the arrival of the 401k in 1978, workers took more control over their retirement savings and the best candidates began expecting more from their employers. Today, millions of Americans depend on their 401ks for security and independence in life after their earning years, and companies that lure the top talent are often the companies with the best retirement plans.

Andrew Lisa contributed to the reporting for this article.

Read Also: How Long To Transfer 401k To Ira

The 5 Most Popular 401 Contribution Features

Small business owners can have dramatically different goals for their 401 plan. While some want to maximize their personal contributions, others want to incentivize contributions from employees across the organization. The process of matching a small businesss goals to available 401 features is called plan design.

The five most popular contribution features that small businesses add to a 401 during the plan design process are:

Last year, we studied the plan designs of 3,975 small business 401 plans. Below is the adoption rate we found for each feature:

Well now walk you through each of these features and why you might want them.

What Should I Look For In A 401k Plan

Overall, you want to look for an employer that offers 401k matching and the higher the maximum amount your employer is willing to match, the better. And if youre comparing two plans that have the same maximum match amount, go for the dollar-for-dollar match over the partial match, since itll take you less contributions to get more money from your employer.

Another thing to watch out for is a vesting period. Similar to equity compensation, some employers will make you wait a certain time period to vest, or give you ownership over, the matching amount.

You May Like: How To Find 401k From Former Employer

Reasons To Add An Automatic Enrollment Feature

- For plans that struggle to pass nondiscrimination testing, automatic enrollment can be a way to increase in employee participation which often improves increases the amount HCEs can contribute annually with no testing issues.

- Following the passage of the SECURE Act, small businesses can earn a $500 tax credit by adding an automatic enrollment feature to a new or existing 401 plan. The credit is available for each of the first three years the feature is effective.

- A Qualified Automatic Contribution Arrangement can reduce the cost of a safe harbor plan. The QACA match is less costly than other safe harbor matches and QACA contributions can be subject to a vesting schedule.

Worst: Kurt Angle Vs Baron Corbin

Kurt Angle competed in a singles match at WrestleMania for the first time in 14 years but it would be the final time as he clashed with Baron Corbin in his retirement match at WrestleMania 35. Sadly, this was disappointing, and whilst, the former six-time WWE world champion was no longer functioning at the peak of his powers, he deserved to go out on a high.

RELATED: 10 Things About Kurt Angle’s WWE Career That Made No Sense

Fans were disinterested in this bout as Triple H put Batista into retirement in a brutal No Holds Barred match in the match prior. The bout plodded on, and Angle managed to execute the Angle Lock and Angle Slam but it wasn’t enough with Corbin earning the win over the WWE Hall of Famer.

Read Also: Should I Invest In 401k

First Off Whats A 401k Plan

401k plans are retirement accounts offered by many U.S. employers to their employees. To contribute to a 401k, youd typically ask your employer to deposit a certain amount of your paycheck into the account. Depending on the plan, youll either have that money invested for you or choose how to invest the funds yourself.

401k plans are tax-advantaged, which is a big benefit compared to a traditional investment account. Youll either only pay taxes on the amount you initially contribute or pay taxes once you withdraw funds from the account . In comparison, a traditional investment account. Not all employers offer a Roth 401k, so if youre earlier in your career and expect to earn more in the future, you should look for an employer that offers a Roth 401k to make the most of your money. And if you make more than the income limit for a Roth 401k , you might want to see if your company offers Roth conversions, also known as backdoor or mega backdoor Roth IRAs.

Goldman Sachs 401k Match

Goldman has an automatic enrollment feature for its 401 plan that allows employees to be enrolled into the plan immediately upon hire. Employees can contribute up to 50% of their eligible pay to the plan.

For an employee to qualify for the employerâs match, he/she must have completed 12 months of service. Goldman Sachs matches 100% of the employee’s 401 contributions each pay period up to 4% of the employeeâs base pay.

Matched contributions become fully vested immediately.

Don’t Miss: What Is Ira And 401k

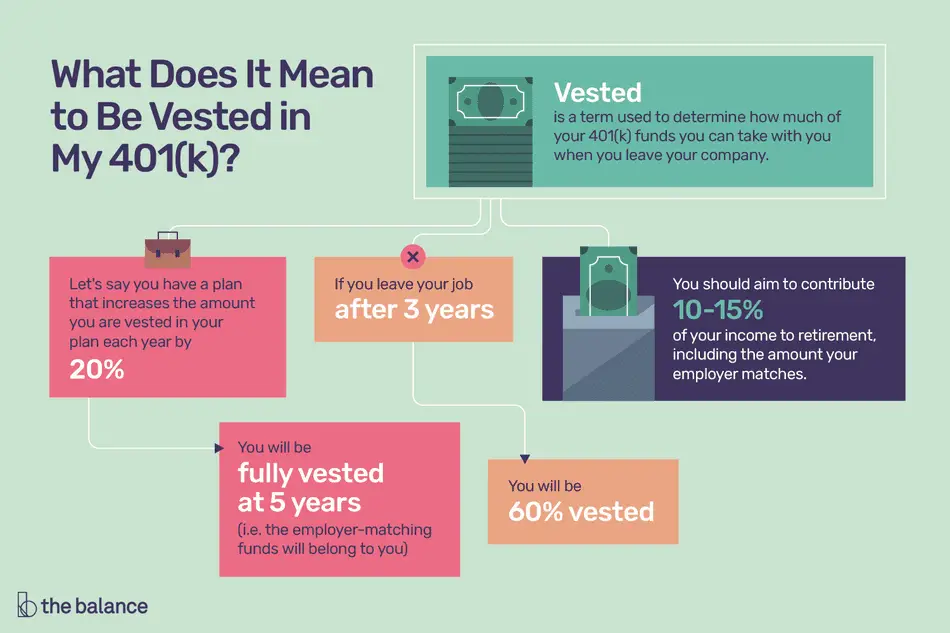

What Does Vesting Mean

Even if your employer makes a matching contribution to your 401, that money may not be yours. Many employers use their 401s to retain talent, so they include a vesting period for matching contributions. Once the vesting period ends, the money becomes fully yours.

Any money your employer contributes is kept separate from your contributions. Depending on your 401 plan, employer contributions can vest all at once or slowly over time. Once youve finished the vesting period, all previous and future contributions are vested and become yours immediately.

When considering a job change, take into account any money you may be leaving behind because it has not vested yet check your employers vesting schedule for more details.

For more on 401 vesting, check out our article detailing how 401 vesting works.

How Employers Offer A 401k Match

Employers offer different 401K match options its not a one-size-fits-all approach. Some may offer a 3 percent contribution regardless if you contribute or not. If you make $50,000 per year, that means your employer will add $1,500 to your 401K each year.

Others offer a more hybrid approach. It may look like 100 percent of the first 4 percent of your salary that you contribute and 50 percent on the additional 2 percent of your salary that you contribute. Each company has a different structure, so make sure you understand whats being offered to you and how it works out financially.

Don’t Miss: Where Can I Find My 401k Balance

If The Company Fails Your Money Is Safe In A 401

Remember Enron? Its spectacular crash not only wiped out thousands of jobs but also destroyed the company’s $2 billion in pension plans. And it wasn’t just current employees who lost their retirement benefits many former employees who’d already retired found themselves suddenly without their major source of income.

Even if your employer is in perfect financial health today, there’s no predicting how it will be doing decades down the line. The Pension Benefit Guaranty Corporation insures private pensions and will step in if your pension fails, but the agency has only so much money to hand out. If your pension fails, there’s a good chance you won’t get your full benefits — and in some cases you may not get a penny.

On the other hand, employers can’t touch your 401 money. Those funds are in the hands of a 401 trustee precisely so they’ll be safe if something bad happens. Even if your employer is the next Enron, you may lose your job, but your 401 funds will be fine.

In theory, pensions are the ultimate retirement savings tool. In practice they have many pitfalls — and as a result they present an awful risk to anyone counting on those pensions for retirement income. So instead of bemoaning the fact that your company doesn’t offer a pension, be thankful you have a 401 instead.

Northrop Grumman 401k Match

Northrop Grumman provides automatic enrollment of new employees in its savings plan.

Employees can contribute 1% to 75% of their eligible pay to their 401 plan, and receive 4% to 7% matching depending on the date when they were hired. Employees hired before April 1, 2016, get up to a 4% match of their eligible compensation. Employees hired after April 1, 2016, are eligible for 401 matching up to 7%.

Employees must complete three years of service to be 100% vested in the matching contributions.

Also Check: How To Manage Your 401k Yourself

An Ira Might Be A Better Option

If you are already contributing up to your employer match, another way to invest additional cash is through a traditional or Roth individual retirement account. The IRA contribution limit is much lower $6,000 in 2021 so if you max that out but want to continue saving, go back to your 401.

Some 401 plans, typically at large companies, have access to investments with very low expense ratios. That means youll pay less through your 401 than you might through an IRA for the very same investment. In other cases, the opposite is true small companies generally cant negotiate for low-fee funds the way large companies may be able to. And because 401 plans offer a small selection of investments, youre limited to what’s available.

Lets be clear: While fees are a bummer, matching dollars from your employer outweigh any fee you might be charged. But once youve contributed enough to earn the full match or if youre in a plan with no match at all the decision of whether to continue contributions to your 401 is all about those fees. fee analyzer.) If the fees are high, direct additional dollars over the match to a traditional or Roth IRA.

Taxes And Employer 401 Matching Contributions

You dont have to pay any income taxes on employer 401 matching contributions until you start making withdrawals.

Gross income includes wages, salaries, bonuses, tips, sick pay and vacation pay. Your own 401 contributions are pre-tax, but still count as part of your gross pay. However, your employers matching contributions do not count as income, said Joshua Zimmelman, president of Westwood Tax & Consulting.

Your employers matching contribution grows tax-deferred in a traditional 401, boosting your compounding returns over the years. You dont have to pay any taxes on the employer match until you start making withdrawals, said Zimmelman. Traditional 401 withdrawals are taxed as ordinary income at whatever tax bracket youre in when you make those withdrawals..

Read Also: How Do I Look At My 401k

Theres Little Reason Not To Offer Roth

Honestly, theres little reason not to offer this contribution feature. It requires a little extra work when setting up your payroll for contributions, but this isnt terribly time-consuming or complex. If youve yet to set up your plan or are thinking of changing it, this is an excellent box to check.

How Does An Employer Match Work

Some employers will match a portion of your retirement contributions, up to a certain limit. For example, they might put 50 cents into your account for every dollar you put in, up to 6% of your salary. If you contribute at least 6% of each paycheck, youll get the full match.

Some employers also set up a default contribution to help employees get the full match automatically.

Heres an example of how this could look over a year:

Also Check: Can I Take Money Out Of My Fidelity 401k

Best For Flexibility: American Funds

The great thing about a 401 plan from American Funds is that you can tailor it to fit almost any type of business. Start-ups, mergers, and well-established firms can create retirement plans using its services.

It also has several retirement plans available, including growth funds and growth-and-income funds .

Other funds available are equity-income funds and balanced funds that look to conserve capital and create current and long-term growth. You can also invest in stocks, bonds, and other fixed-income securities.

The firm also offers access to bond funds, which seek to create fixed income with capital growth as a secondary goal.

What Is A Top

A plan is top-heavy when the owners and most highly paid employees own more than 60% of the value of the plan assets. This ratio is tested every year based on the account balances on the last day of the prior plan year. The employer must generally pay a minimum 3% benefit to the accounts of the lower paid employees if the top-heavy ratio exceeds 60%.

Key employee accounts

All employee accounts

You May Like: How Do I Open A 401k Account

Resist The Temptation To Tap Your 401

When youre contributing funds to your 401 account month after month, there will be times when the market flags and you see the value of your investments steadily decline. You may face the urge to withdraw money from the market during downturns, its essential that you resist the temptation.

Especially for young investors, its important to remind people to stay the course even when the market is volatile, said Taylor. People who are younger have time to ride out market swings.