Can I Withdraw Money From My 401k At 55 Without Penalty

If you are between ages 55 and 59 1/2 and get laid off, fired, or quit your job, the IRS Rule of 55 lets you pull money out of your 401 or 403 plan without penalty. Once done, you can leave your current job before age 59 1/2 and withdraw the money using the Rule of 55.

Was this information helpful?

Does A 401 Loan Or Withdrawal Make More Sense

When you consider the potential tax consequences associated with an early withdrawal, a 401 loan may seem more attractive. Of course, there’s one drawback with both options: you’re diminishing your retirement savings.

With a 401 loan, you’d have the ability to replace that money over time. If you’re cashing out an old 401, however, there’s no way to put that money back. In both cases, you’re missing out on the power of compound interest to grow your retirement wealth over time.

One upside of deciding to borrow from a 401 for a housewhether you take a loan or make a withdrawalis that it may allow you to avoid paying private mortgage insurance if you offer the lender a large enough down payment. Private mortgage insurance protects the lender, and it’s typically required if you’re putting less than 20% down on a conventional mortgage. Private mortgage insurance can be eliminated when you reach 20% equity in the home, but it can add to the cost of homeownership in the early years of your mortgage.

Better Real Estate Agents At A Better Rate

Enter your zip code to see if Clever has a partner agent in your area.

If you don’t love your Clever partner agent, you can request to meet with another, or shake hands and go a different direction. We offer this because we’re confident you’re going to love working with a Clever Partner Agent.

Contact Us

Don’t Miss: Is There A Maximum You Can Contribute To A 401k

How To Use A 401 Loan To Buy A House

A 401 loan is the preferredmethod if you need to cash out some of your 401 retirementfunds tobuy a house. Thats because theres a much lower cost associated with a 401loan comparedto a 401 withdrawal.

You should also know:

- A 401 loan is usually not counted in your debt-to-income ratio, so it wont hurt your chances of mortgage qualifying

- 401 loans are not reported to credit bureaus, so applying for one wont harm your credit score

Can I use my 401k to buy a house without penalty?

Unlike a 401 withdrawal, a401 loan is not subject to a 10% early withdrawal penalty from the IRS. Andthe money you receive will not be taxed as income.

The rules for using a 401 loanto buy a house are as follows:

- Your employer must allow 401loans as part of its retirement plan

- The maximum loan amount is 50% ofyour 401svested balance or $50,000, whichever is less

- The loan must be paid back withinterest , on a schedule agreed to by youand your 401 provider

- Typically,you cannot make 401 contributions while you have an outstanding 401 loan

401 loans typically need to bepaid back over five years.

However, when the money is used topurchase a home, youre usually allowed to pay it back over a longer period oftime. Rules vary by 401 company, so check with yours to learn more.

Drawbacks to 401 loans for home buying

While youre paying back the 401 loan, you usually cant make new contributions to your retirement account. And that means your employer wont be matching contributions, either.

Retirement Account Withdrawal Comparison

So which is best? This depends on what accounts you have and how much you have contributed to them. But in general, youll be assessed fewer taxes and penalties if you withdraw money for your down payment from a Roth before a traditional IRA, and from either of those before a 401k. Whether a 401k loan is better than an IRA withdrawal depends on how large it is and whether it will affect your ability to qualify for the amount and type of mortgage you want.

- Contributions in Your Roth IRA: No income tax due, will not owe 10% penalty.

- Earnings in Your Roth IRA up to $10,000 for the Purchase of a First Home: No income tax due, will not owe 10% penalty.

- Small 401k Loan: Will not owe income tax or penalty. Monthly payments will be small and will have a minimal affect on mortgage qualification.

- Any Withdrawal From a Traditional IRA, SEP-IRA, or SIMPLE IRA up to $10,000 for the Purchase of a First Home: Income tax due, will not owe 10% penalty

- Earnings in Your Roth IRA Over $10,000 for the Purchase of a First Home: Income tax due, will owe 10% penalty.

- Any Withdrawal From a Traditional IRA, SEP-IRA, or SIMPLE IRA Over $10,000: Income tax due, will owe 10% penalty

- Large 401k Loan : Will not owe income tax or penalty. Monthly payments can be large and substantially affect mortgage qualification.

- 401k Withdrawal of Any Amount: Will owe income tax and 10% penalty.

Also Check: How Do I Find My Old 401k

A Better Way To Scrounge Up Your Down Payment

Withdrawing from retirement savings is not a great way to fund a home purchase. If you lack a down payment at present, delay homeownership for a year or two and cut back on spending during that time to free up additional money. You can also try getting a side job to drum up extra cash for homebuying purposes. It’s a far better bet than raiding your nest egg and struggling financially later on because of it.

Still Not Sure Ask A Financial Advisor

For most home buyers, withdrawing or borrowing from 401retirement funds to make a down payment on a house is short-sighted.

But your personal finances may create an exception. For somepeople, a hardship withdrawal or 401 loan could be a sensible solution.

A financial planner can help you weigh your current accountbalance against your long-term financial goals so you can better decide how toproceed.

Consider using a Roth IRA instead

If you decide to use retirement funds to help buy a home, considerusing money saved in a Roth IRA instead of a 401 or traditional IRA. BecauseRoth IRA contributions have already been taxed, youll have an easier timeaccessing this money.

Also, since money in your IRA isnt connected to your employer, youwont face a faster repayment period if you change jobs.

Don’t Miss: How To Transfer 401k From Old Job

How Much Can You Withdraw From Your 401k For A Home Purchase

December 16, 2018 By JMcHood

If you want to buy a house, you will need a down payment. If a lack of savings is the only thing holding you back, you may be able to tap into your 401K to get the funds you need.

Before you go and take out the funds youve saved up for your golden years, use the below tips to help you make it a profitable situation.

What Are Acceptable Reasons For A Hardship Withdrawal

The IRS considers the following list of items acceptable reasons for withdrawing money from your 401k under the hardship withdrawal.

The Pension Protection Act of 2006 extended your need for a hardship withdrawal to the needs of your beneficiary, even if the beneficiary is not your spouse or dependent.

- Medical expense: Un-reimbursed medical expenses for you, your spouse, or dependents

- Home purchase: Toward the purchase of your principal residence

- Foreclosure risk: To prevent foreclosure or eviction from your principal residence

- Educational expenses: College tuition and related educational expenses for you, your spouse, or children

- Funeral expenses: Offsetting the cost of final expenses

- Home repair: Certain expenses for the repair of damage to your principal residence

The IRS code will allow hardship withdrawals for the above-mentioned reasons only if you have no other funds or means to fulfill the need, and the withdrawal would be enough to satisfy the need .

You can, however, include the cost of withdrawal in the amount you need.

Thanks to the Bipartisan Budget Act of 2018, youre no longer required to take a loan from your 401k before being able to file for a hardship withdrawal.

Remember: You are not allowed to contribute to your 401k plan for six months after making a hardship withdrawal.

You May Like: Can A Sole Proprietor Have A 401k

The Costs Of Early 401k Withdrawals

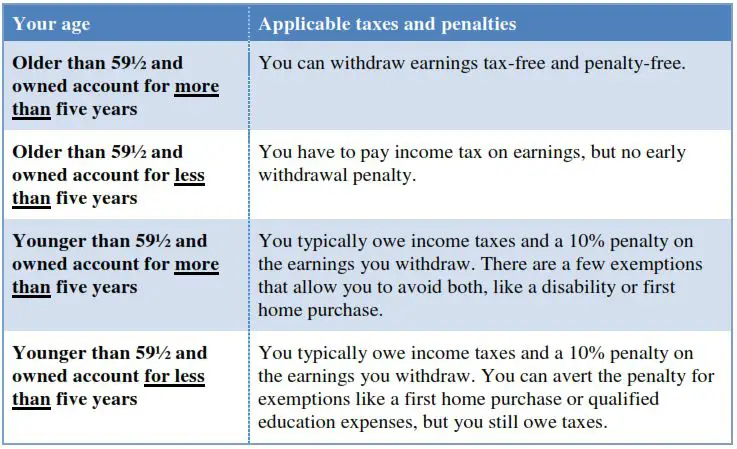

Early withdrawals from an IRA or 401k account can be an expensive proposition because of the hefty penalties they carry under many circumstances.

The IRS allows penalty-free withdrawals from retirement accounts after age 59 ½ and requires withdrawals after age 72 . There are some exceptions to these rules for 401ks and other qualified plans.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement. The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, you can use this calculator to determine how much other people your age have saved.

Contribution Limits For A 401

For the 2018 tax year, you cannot contribute more than $18,500 to your 401. If your employer also contributes to the 401, either through matching or through another type of program, those amounts don’t count toward the limit. In 2019, the contribution limit will increase to $19,000, and it will continue to increase over time to keep up with the cost of living.

Also Check: Should I Manage My Own 401k

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.

Using A 401k Loan To Buy A House:

If youre really considering using your 401k to buy a house, one of the best ways to do this will be to borrow from your own retirement savings. This is called a 401k loan.

The IRS limits 401k loans to the lesser of $50,000 or half the vested-plan balance . For example, lets say youve got a 401k plan worth $90,000. That means you could borrow up to $45,000 from your plan. If you had $120,000 in your 401k, then youd be limited to $50,000.

Remember that since your 401k plan is administered by your employer, your employer will first have to approve the loan. They are not required by law to let you do so. This is because in order for them to do so there may be special costs and administrative burdens that theyd rather not participate in. So all the loans are up to their discretion.

If you are allowed a 401k loan to buy a house, the loans must be paid back within five years and will carry an interest rate of the prime rate plus one percent. As long as the employee makes his payments and remains with the company the loan will not be taxed or subject to the early 10% withdrawal penalty. However if employment terminates, the loan is then considered a distribution and you will be subject to both taxes and penalties for the amount you withdrew.

Read Also: How To Find My Fidelity 401k Account Number

Using A 401 Withdrawal To Buy A House

401 withdrawals are generallynot recommended as a means to buy a house because theyresubject to steep fees and penalties that dont apply to 401 loans.

If you take a 401 withdrawalbefore age 59½, youll have to pay:

- A 10% early withdrawal penaltyon the funds removed

- Incometax on the amount withdrawn

For example, say you withdraw$20,000 from your 401 to cover your down payment and closing costs.

- Youll be charged a $2,000 earlywithdrawal penalty

- Andyoull have to pay income tax on the $20K, which likely comes out to around$4,000-$6,000

Thats up to $8,000gone from your retirement savings, on top of the initial withdrawal.

The standard rules for 401withdrawals are as follows:

- Most 401 plans allow withdrawals only in cases of financial hardship

- However, using the money to buy a primary residence often qualifies as a hardship withdrawal

- You can withdraw only the money required to cover your immediate need

- The money does not have to be repaid

Since the IRS considers 401 withdrawals income,withdrawing 401 money could bump some home buyers into a higher tax bracket.This could add even more to the cost of the early withdrawal.

Coronavirus update:

The CARES Act provision allowingfor tax-free withdrawals from a 401 expired on Dec. 31, 2020. The IRSsnormal 10% penalty is being enforced on hardship withdrawals in 2021.

When Borrowing From Your 401k Is A Bad Idea

Borrowing from your retirement plan for any reason is a risky proposition. There are several pitfalls to borrowing from your 401k or IRA account to buy a house.

If your debt-to-income ratio is high and youre already cutting your monthly budget pretty thin by getting a mortgage, then having a separate loan payment may make using your 401k to buy a house a terrible idea.

And even if you have plenty of money left over after paying your bills, tapping into your 401k should still be a last resort.

Your Retirement could be Harmed in the Long-Term

When borrowing from your 401k, you may not be able to contribute additional funds to your account while repaying the loan.

If your employer offers any retirement contribution matches, you will not be able to take full advantage of it.

When looking at your retirement savings in the long-term, the total amount will be less than it could because you cannot contribute for years.

Tax Penalties

When you withdraw funds from your retirement plan, you are subject to a 10% income tax penalty. The fund that money is in may also have an early-withdrawal fee.

The tax penalty is waived if you are getting a 401k loan and are repaying the amount borrowed.

However, if you leave your current employer for any reason, you may have to repay any loans within 60 days. If youre unable to repay within the window of time, you could face a 10% tax penalty.

Recommended Reading: When Can You Start Drawing From Your 401k

Borrow Against Your 401

Borrowing from your 401 is generally the more advantageous option if you want to tap your plan for a down payment.

If your employers plan allows employees to take out loans against their 401 accounts, youll typically be able to borrow up to 50% of your vested account balance or $50,000, whichever is less.

Tip:

Youll then have to make more or less equal payments at least quarterly, with interest until youve repaid the loan. Youll typically need to repay it within five years.

Upsides

- Wont affect your credit

Downsides

Learn More: 401 Loans: Should You Borrow Against Your Retirement?

Mortgage Interest Tax Strategy

Keep in mind that youll be deducting mortgage interest on your taxes after you purchase your home. This may actually wash with some or all of the income you report from a retirement account withdrawal.

For example, lets say you withdrew $25,000 from your 401k and paid $25,000 in mortgage interest the same year. The $25,000 youll report in additional income will wash with the $25,000 mortgage interest deduction. In other words, your taxable income wont be increased by the withdrawal, and you will effectively pay no tax on it.

However, you will still be liable for the 10% penalty, which is $2,500 in this case. This type of strategy can work for IRA, SIMPLE, and SEP withdrawals as well, but you wont be liable for the 10% penalty unless you withdraw more than $10,000.

You May Like: Where Can I Find My 401k Balance

Other Types Of Down Payment Assistance

For home buyers who are ineligible for no-down payment loans, there are a few more alternatives to turn to instead of using a 401 to purchase a house:

Down Payment Assistance programs offer eligible borrowers financial assistance in paying the required down payment and closing costs associated with purchasing a home. They come in the form of grants and second mortgages, are available nationwide, can be interest-free, and sometimes have lower rates than the initial mortgage loan. Certain mortgage lenders provide financial assistance by offering credits to cover all or some of the closing costs and down payment. Gifted money from friends or family members can be used to cover a down payment or closing costs on certain home loans.

What Is A 401 Retirement Account

A 401 retirement account is an account set up by your employer to help you save for retirement. Under a 401 plan, you can take money directly from your paycheck, before the taxes come out, and deposit the funds into an investment account, where it will earn interest over time. Because the contributions you make are made before your taxes come out, they also reduce the amount of taxable income you have for the year, allowing you to defer the taxes until you retire. Once you start receiving distributions at retirement, you pay taxes on them, just as if they were ordinary income.

Read Also: How To Recover 401k From Old Job