A Roth Ira Can Benefit Heirs

Unlike traditional IRAswhich you must begin to tap at age 72Roth IRAs have no minimum distribution requirements for the original owner. So, if you don’t need the money, it can grow in the tax shelter until your death.

This is true for spousal heirs as well. A spouse who inherits your Roth IRA is never required to make withdrawals.

However, the SECURE Act recently changed the rules for nonspousal heirs. The 2019 legislation essentially prevents stretch IRAs, which allowed nonspousal beneficiaries to take required annual distributions on their life expectancy, not the original owners. Those that inherited a Roth IRA prior to Dec. 31, 2019, may still use this strategy.

Those who inherited an IRAeither a traditional or Rothafter that cutoff must now withdraw the money within a decade. There are a few exceptions to this, including if the heir is disabled, a minor child of the original owner or less than a decade younger than the original owner.

However, keep in mind that these withdrawals are tax-free. That means if you wait until the tenth year to withdraw all of the funds, you will benefit from almost 11 years of tax-free growth.

Ira Allowable Income Sources

Compensation you receive may be earned income, unearned income or a combination of the two sources. But only your earned income can contribute to an IRA, which is compensation you earn from working. Sources of allowable income include wages, salaries, tips, commissions and self-employment income. Unearned income, which is not IRA-allowable, includes pensions, dividends and interest income. Even though alimony and separate maintenance are unearned income, they are allowed by the IRS to count toward your IRA contributions.

Military Retirement Prior To World War Ii

In the years before the Second World War, the retirement systems of the United States military were highly varied between the different branches of service. In 1916, the military instituted new “up or out” policies, forcing the retirement of members who were not selected for promotion in a prescribed amount of time. In conjunction with these reforms, the military began using what has become the “standard” calculation for retirement compensation of 2.5% of base pay, multiplied by years of service, with a maximum payout of 75% of base pay in retirement. For example, a soldier retiring after 25 years of service would be eligible for a payment equal to 62.5% of his base pay at the time of his retirement. This method of calculation has remained ingrained in the military retirement system to present day.

You May Like: Can I Borrow Against My 401k

How To Max Out Your 401

If you’re hoping to build a giant nest egg for retirement, then you may be eager to max out your 401. But if you earn an average income, that’s not an easy thing to do. Still, there are steps you can take to ramp up your savings rate:

- Save your entire 2022 raise, or as much of it as you can

- Pick up a side hustle to score some extra income

- Put any bonus cash you get your hands on into savings

- Take budget vacations instead of bigger ones

- Cut back on spending as much as you can — even if it means ordering food delivery one time less per week

- Refinance your mortgage to lower your housing payments and stick the difference into your 401

These are just some examples. Take a look at your income and spending habits and see if there’s a better way for you to eke out more money for savings.

Now if you’re not able to max out your 401 in 2022, don’t beat yourself up. A lot of workers are in the same boat. At the same time, do your best to increase your savings rate as much as you can. That will help you not only grow more retirement wealth, but also reap as much tax savings as possible.

And no matter how close you get to maxing out your 401 next year, aim to contribute enough money to score your full employer match. Many companies that sponsor 401s match worker contributions to varying degrees. It’s important to set yourself up to claim that match in full, because if you don’t, you’ll effectively be leaving free money on the table.

Still A Work In Progress

The 401 has come a long way in the last 40 years. As it evolved, policy makers have introduced improvements that are becoming standard practices. Automatically enrolling employees dramatically increases participation. Selecting low-fee index funds as the default investment option lowered costs to consumers and improved diversification. These have made 401s more popular and more successful.

But problems remain. Only about 61% of Americans employees have access to a retirement benefit at work. Smaller employers are less likely to offer them because of high administrative costs and many part-time employees are not offered them at all. While its not clear that 100% of the population should be saving for retirementfor example, a worker earning low wages who will see a large income relative to their salary from Social Security may not need retirement savingsparticipation in 401s should be higher. A new bill introduced in Congress this year that would make it cheaper for small employers to offer retirement accounts could increase coverage.

You May Like: Where To Put My 401k

Fact Check: Were 401s Really An Accident Of History

Getty

401s are an accident of history: Thats the title of a 2017 article at the Economic Policy Institute, which goes on to say that 401s were never intended to replace pensions.

In a 2015 CNBC article with the shorthand title , The 401k is a failure, that news site cited another expert:

401s were never designed as the nations primary retirement system, said Anthony Webb, a research economist at the Center for Retirement Research. They came to be that as a historical accident.

And also at CNBC, in 2017, reporter Kathleen Elkins called it an accidental retirement revolution, citing a recent Wall Street Journal article interviewing the so-called father of the 401, Ted Benna. Here are Elkins excerpts:

The original proponents of the 401 plan, which has become the dominant source of retirement savings for most Americans, are rueful about the revolution they unintentionally began.

say it wasnt designed to be a primary retirement tool and acknowledge they used forecasts that were too optimistic to sell the plan in its early days, The Wall Street Journal reports. Others say the proliferation of 401 plans has exposed workers to big drops in the stock market and high fees from Wall Street money managers.

Even the father of the 401, Ted Benna, tells The Journal with some regret that he helped open the door for Wall Street to make even more money than they were already making.

But this new conventional wisdom is missing several key points:

You Can Save More In 2022

Currently, 401s max out at $19,500 a year for workers under the age of 50 and $26,000 a year for those 50 and over. That’s because older workers get the option to make a catch-up contribution of up to $6,500.

Next year, that $19,500 limit is increasing to $20,500, so younger savers will get to sock away more money in their 401s. That $6,500 catch-up limit, however, isn’t changing. Workers 50 and over will be able to put up to $27,000 into their 401 plans.

But still, workers who max out their retirement plan contributions in 2022 could enjoy some really big tax savings. Traditional 401 plans are funded with pre-tax dollars, so the more you’re able to contribute, the less income the IRS gets to tax you on. And if you’re in a higher tax bracket, that extra $1,000 could really make a difference.

Read Also: How Does 401k Work When You Quit

Use A Roth Ira Before Retirement For Other Purposes

The ability to tap money in a Roth IRA without penalty before age 59 1/2 allows for flexibility to use the Roth IRA for other purposes. In essence, this account can act as an emergency fund and could be used to pay off significant unexpected medical bills or cover the cost of a child’s education.

But it’s best to only tap into these funds if it’s absolutely necessary. And if you must withdraw any money from a Roth IRA before retirement, you should limit it to contributions and avoid taking out any earnings. If you withdraw the earnings, then you could face taxes and penalties.

Two: How Are Older Americans Faring In Retirement

Charts in this section focus on the income of people 65 and older and are based on data from the U.S. Census Bureaus Current Population Survey Annual Social and Economic Supplement . Unlike the Survey of Consumer Finances, the CPS focuses primarily on individuals rather than families. Though the goal is to assess retirement outcomes, some people in this age group are still working.

Until recently, the CPS did a poor job of capturing distributions from retirement accounts and other types of asset income, making it a problematic source for assessing retirement income. A 2014 survey redesign to correct this problem resulted in large percentage increases in these income measures . But as charts in this section will show, income from retirement accounts remains modest in dollar terms.

Because many families withdraw retirement account savings in lump sums, the size of these distributions for any family in a given year, whether a large sum or nothing at all, does not tell us how important this income source is for that family. But the mean value of these distributions across families does give a sense of the importance of retirement account savings relative to other sources of income. Going forward, it will be possible to assess how much these distributions are affected by economic conditionsfor example, people tapping retirement funds when they lose jobs in recessions.

Key findings of the following charts include:

Read Also: Can An Individual Open A 401k Account

Erisa Brought Sweeping Changes

In 1875, the American Express Co. created the first employee-based pension plan. It was almost 100 years later in 1974 when Congress enacted ERISA. Between 1875 and 1974, most workers depended on their company pensions to sustain them financially in their retirement years. But the passage of ERISA changed this status quo. ERISA not only regulated pension plans, retirement plans and health care plans, but it also allowed workers who were not covered by employee pension plans to contribute to an IRA.

What Your 401 Could Look Like In The Next 20 Years

For building retirement savings, 401 savings plans have become one of the better deals. Traditional 401s allow you to save pre-tax dollarsbefore you get your paycheckto build a retirement nest egg. The Roth 401 has been added to many workplace plans it allows you to build savings that you can withdraw tax-free in retirement as long as you meet certain prerequisites. Many employers provide matching contributions to employee plans, making them an even better deal.

There are many 401 savings calculators available, and all of them demonstrate how your retirement account balance can grow over time. Even a modest level of savings that is allowed to grow over a period of many years can grow into a significant sum of money.

You May Like: How To Cash Out 401k After Leaving Job

Protect Your Retirement Against Future Healthcare Costs

Saving for future healthcare costs can be daunting, and uncertainty about coverage and rising Medicare premiums can add to the complexity. But you can take steps today that will help you live the life you want in retirement. From health savings accounts to supplemental coverage, we are here to bring clarity to your retirement strategy and help you find what you need to live your best and healthiest life.

Medicare is the government health care program for people 65 and over, and for younger people with disabilities. Medicare coverage plays an important role in containing medical costs as you age. But its benefits may not pay for everythingsuch as most dental care, eye exams and eyeglasses, and hearing aids.****

Whole life insurance is an option to consider for hedging against healthcare costs in retirement. It can provide guaranteed coverage for life, with the potential to accumulate cash value, which is money you can apply to healthcare costs.

If you are an employee with benefits, an HSA helps you cover healthcare expenses with tax-deductible funds you set aside from your paycheck. They are on the rise as employees look for ways to manage the costs of high-deductible health plans plans in which people pay more out-of-pocket costs before insurance kicks in. Ask your insurance company or HR department if you can open an HSA.

Pensions Don’t Allow You To Make Investment Choices

Chronic underfunding gets worse when paired with bad investment decisions, and history shows you can’t assume the person managing your pension will invest wisely. Unfortunately, the Center for Retirement Research reports the return on investment earned by public sector pension plans has fallen far short of actuarial estimates throughout the 2000s.

One reason pension plans have fallen short is that many plan managers overinvested in alternative investments, particularly hedge funds — 31% of pension plans have at least 30% of their assets in alternative investments. These investments have been hugely underperforming the stock market since 2010, in part because hedge funds charge relatively high fees that reduce returns.

401 accounts generally don’t offer the option to invest in hedge funds. Even if they do, you have the option to select your own investments, so you can steer clear. Most 401s offer multiple investment options for you to pick from, including index funds or target date funds that make it easy to maintain an appropriate asset allocation as you age. Since you have the option to choose your own investments, you can determine how much risk you want to take on and choose investments that are a good fit for you personally, whereas a pension invests for all company employees.

Recommended Reading: How To Manage 401k In Retirement

The Benefits Of Starting Early

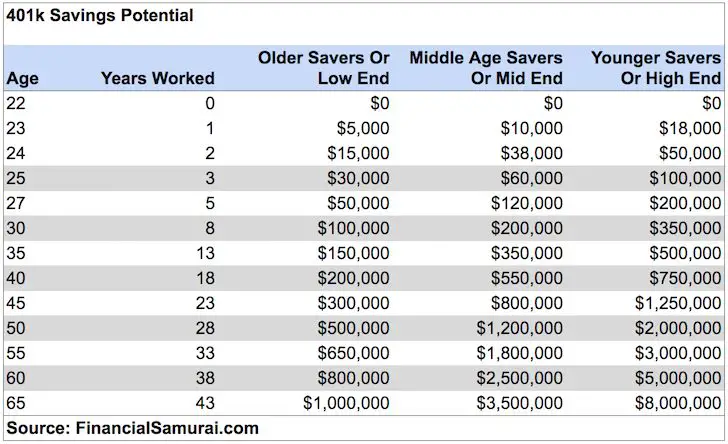

One of the greatest assets any investor has is time. The longer your account balance has to grow, the greater your chance of achieving your savings goals. The amount you save is, of course, important to how much you have in the end, but when you start saving may be more important.

Here’s a look at two different investors. Investor A saves $5,000 a year between ages 25 and 35, then stops saving altogether. Investor B saves $5,000 a year between ages 35 and 65. Investor B has saved three times as much as Investor A.

However, Investor A will have a larger balance at age 65. The reason that Investor A comes out ahead is the effect of compounded earnings over time. Investor A has given her account an extra 10 years to grow, and the compounded returns that the account experiences actually outweigh any future contributions that are given less time to grow. Starting early gives you the best chance to save for a secure retirement.

Or consider this example from Peter J. Creedon CFP®, ChFC®, CLU®, chief executive officer of Crystal Brook Advisors, New York, NY:

Retirement Advice From The Man Who Created The 401

Ted Benna designed and put in place the first 401 savings plan back in 1978. That historic first earned him the title father of the 401 even though Benna had his doubts it would work.

You know I was a little hesitant embracing it, Benna told Yahoo Finance Presents. It was a little flukey thing ) stuck in an end of year tax bill, that Benna realized allowed companies and employees to increase tax-deferred savings.

Today, the 401 juggernaut Benna launched 42 years ago accounts for $7.4 trillion in assets, according to a just released analysis from the Center for Retirement Research at Boston College. Only IRAs, at $11 trillion, surpass 401 assets and Benna points out some of that IRA money was rolled over from 401 accounts as people retired.

Yet despite those massive amounts, Benna warns having enough retirement income will be a major issue in the years ahead for millions of Americans, with every retirement system in existence severely tested, as he writes in his book 401 Forty Years Later.

The Federal Reserves 2019 Survey of Consumer Finances shows an increase in 401 balances from $135,000 in 2016 to $144,000 in 2019 for households approaching retirement. That will kick off roughly $570 a month.

No question. It was never intended to be the primary vehicle for saving for retirement, Benna reminds people. All these plans are subject to the ups and downs of the stock market. And it’s very obvious with 401s.

You May Like: How To Make 401k Grow Faster

Rise Of Defined Contributions

But a funny thing happened as 401 plans began to multiply: defined benefit plans started disappearing. In 1985, the year there were 30,000 401 plans, defined benefit plans numbered 170,000, according to the Investment Company Institute. By 2005, there were just 41,000 defined benefit plansand 417,000 401 plans.

The reasons for the shift are complex, but Ghilarducci argued that in the early years, “workers overvalued the promise of a 401” and the prospect of amassing investment wealth, so they accepted the change. Meanwhile, companies found that providing a defined contribution, or DC, plan cost them less.

But the new plans had two key differences. Participation in 401 plans is optional and, while pensions provided lifetime income, 401 plans offer no such certainty.

“I’m not saying defined benefit plans are flawless, but they certainly didn’t put as much of the risk and responsibility on the individual,” said Terrance Odean, a professor of finance at the University of California, Berkeley’s Haas School of Business.