Understand The Limits On How Much You Can Borrow

Just because you have a large balance in your 401 and your plan allows loans doesnt mean you can borrow the whole amount. Loans from a 401 are limited to one-half the vested value of your account or a maximum of $50,000whichever is less. If the vested amount is $10,000 or less, you can borrow up to the vested amount.

For the record, youre always 100 percent vested in the contributions you make to your 401 as well as any earnings on your contributions. Thats your money. For a company match, that may not be the case. Even if your company puts the matching amount in your account each year, that money may vest over time, meaning that it may not be completely yours until youve worked for the company for a certain number of years.

Example: Lets say youve worked for a company for four years and contributed $10,000 a year to your 401. Each year, your company has matched 5% of your contribution for an additional $500 per year. Your 401 balance would be $42,000. However, the companys vesting schedule states that after four years of service, youre only 60% vested. So your vested balance would be $41,200 . This means you could borrow up to 50% of that balance, or $20,600.

Now lets say that after ten years of service, youre fully vested and your balance has grown to $120,000. The maximum you could borrow is $50,000.

The government sets these loan limits, but plans can set stricter limitations, and some may have lower loan maximums. Again, be sure to check your plan policy.

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

How Do You Repay

Since youre borrowing from your 401 plan, you have to repay the loan. This is typically done by taking a portion of each paycheck and applying it toward your loan. In most cases, you can borrow for a term of up to five years, but longer-term loans may be allowed if youll use the money to buy your home. Again, borrowing is risky, and longer-term loans are riskier than shorter-term loans .

When you repay money that youve borrowed from your 401 plan, you dont get any tax benefits. That money is treated as normal taxable income to you, so it wont be like any pre-tax contributions that youve been making to the plan. You can still contribute to the plan with pre-tax dollars contributions if your plan allows) but you dont get to double-dip and get a tax break on loan repayments. Remember: You werent taxed on the money you received when you took the loan.

If you leave your job before you repay the loan, you should have an opportunity to repay any money you borrowed from the 401. But thats not always easy. You probably took the loan because you needed cash, and its therefore unlikely that you have a lot of extra money sitting around. Try to repay if possible, otherwise, you may face income taxes and tax penalties as described below. If youve been recruited to a new job, you might be able to get some help from your new employer .

Read Also: What Happens To 401k When You Die

Those Who Can Stomach The Loss In Stock Value

Because a 401 is an investment account, you should also consider the trade-off of missing the market rebound if you withdraw funds right now. Any money that you borrow from your 401 now wont be there when the market turns around, Renfro says. This would compound the adverse effects of an early 401 withdrawal if you dont truly need one.

Echoing that, Levine says many 401 balances have been hit hard, and taking a loan while theyre down essentially locks in the losses.

Taking an early withdrawal from your 401 can have long-term adverse effects on your financial health. However, so can the ramifications of COVID-19, especially if youve been particularly affected by the disease. The CARES Act gives options to those who need it most. Theres no right answer, but in times of uncertainty and struggle, those options can be a life raft.

Accessibility Of 401 Funds

The 401 plan has some great features, such as tax-deferred status, matching contributions and catch-up provisions for older savers. That said, one of their drawbacks is lack of accessibility. The structure of a 401 account is different from that of a traditional individual retirement account .

While an IRA is held in the name of the account holder, a 401 account is held in the name of an individual’s employer on the individual’s behalf. The specific 401 plan offered through the employer governs the circumstances under which individuals can withdraw money from the account, and many employers only allow early withdrawals in the event of severe financial hardship. This basic structural fact regarding 401 accounts is one of the main factors that present obstacles to using account funds as collateral for a loan.

One of the other primary reasons stems from the fact that these accounts are specifically protected from creditors by the Employee Retirement Income Security Act, or ERISA. Therefore, if a 401 were used as collateral for a loan, the creditor would have no means of collecting from the account in the event the borrower defaulted on the loan payments.

Don’t Miss: How To Find Old 401k Money

Risks Of Taking Out A 401 Loan

Before deciding to borrow money from your 401, keep in mind that doing so has its drawbacks.

You may not get one. Having the option to get a 401 loan depends on your employer and the plan they have set up. A 2020 study from retirement data firm BrightScope and the Investment Company Institute says that 78 percent of plans gave participants the option to borrow based on 2017 data. So you may need to seek funds elsewhere.

You have limits. You might not be able to access as much cash as you need. The maximum loan amount is $50,000 or 50 percent of your vested account balance, whichever is less.

Old 401s dont count. If youre planning on tapping into a 401 from a company you no longer work for, youre out of luck. Unless youve rolled that money into your current 401 plan, you wont be able to use it.

You could pay taxes and penalties on it. If you dont repay your loan on time, the loan could turn into a distribution, which means you may end up paying taxes and bonus penalties on it.

Youll have to pay it back more quickly if you leave your job. If you change jobs, quit or get fired by your current employer, youll have to repay your outstanding 401 balance sooner than five years. Under the new tax law, 401 borrowers have until the due date of their federal income tax return to repay in such circumstances.

Getting A 401 Loan For A Home

If you’d like to use your 401 to cover your down payment or closing costs, there are two ways to do it: a 401 loan or a withdrawal. It’s important to understand the distinction between the two and the financial implications of each option.

When you take a loan from your 401, it must be repaid with interest. Granted, you’re repaying the loan back to yourself and the interest rate may be low, but it’s not free money. Something else to note about 401 loans is that not all plans permit them. If your plan does, be aware of how much you can borrow. The IRS limits 401 loans to either the greater of $10,000 or 50% of your vested account balance, or $50,000, whichever is less. For example, if your account balance is $50,000, the maximum amount you’d be able to borrow is $25,000, assuming you’re fully vested.

In terms of repayment, a 401 loan must be repaid within five years. Your payments must be made at least quarterly and include both principal and interest. One important caveat to note: loan payments are not treated as contributions to your plan. In fact, your employer may opt to temporarily suspend any new contributions to the plan until the loan has been repaid. That’s significant because 401 contributions lower your taxable income. If you’re not making any new contributions during your loan repayment period, that could push your tax liability higher in the interim.

You May Like: Can I Rollover My 401k Into My Spouse’s Ira

Consider Other Options First

An effective debt consolidation plan should allow you to pay off your credit cards within five years.

If you cant pay off the consolidated debt within five years, or if your total debt equals more than half your income, you might have too much debt to consolidate. Your best option is to consult an attorney or credit counselor about debt relief options, including debt management or bankruptcy.

Chapter 13 bankruptcy and debt management plans require five years of payments at most. After that, your remaining consumer debt is wiped out. Chapter 7 bankruptcy discharges consumer debt immediately.

Unlike consumer debt, a 401 loan isnt forgiven in bankruptcy. If you cant repay, the loan is considered a withdrawal, and youll owe the IRS income taxes and a penalty on the money youve already spent trying to pay down credit cards.

Better consolidation options for smaller debt loads include a:

-

0% balance transfer card: If you have good or excellent credit, look into a balance transfer credit card with an introductory no-interest period. These typically range from six months to two years. This is usually the cheapest option for those who qualify.

-

Personal loan: Interest rates on debt consolidation loans are lower for most borrowers than rates on regular credit cards. Your rate depends on your credit history and income.

Reasons To Borrow From Your 401

Although general financial wisdom tells us we shouldnt borrow against our future, there are some benefits to borrowing from your 401.

- With a loan from a commercial lender such as a bank, the interest on the loan is the price you pay to borrow the banks money. With a 401 loan, you pay the interest on the loan out of your own pocket and into your own 401 account.

- The interest rate on a 401 loan may be lower than what you could obtain through a commercial lender, a line of credit, or a credit card, making the loan payments more affordable.

- There are generally no qualifying requirements for taking a 401 loan, which can help employees who may not qualify for a commercial loan based on their credit history or current financial status.

- The 401 loan application process is generally easier and faster than going through a commercial lender and does not go on your credit report.

- If you are taking a loan to buy a home, you can have up to 10 years to repay the loan with interest.

- Loan payments are generally deducted from your paycheck, making repayment easy and consistent.

- If you are in the armed forces, your loan repayments may be suspended while you are on active duty and your loan term may be extended.

You May Like: How Is 401k Paid Out

K Withdrawal Rules: How To Avoid Penalties

401k plans, IRAs and other tax-advantaged retirement savings accounts are common ways to save for retirement, and millions of Americans pour money into them every year. Its generally wise to avoid withdrawing money from your 401k, as there are often hefty penalties and taxes to consider for early withdrawals.

Sometimes, however, unplanned circumstances force people to withdraw funds from their 401k early. So if you find yourself in a place where you need to tap your retirement funds early, here are some rules to be aware of and some options to consider.

Other Alternatives To A 401 Loan

Borrowing from yourself may be a simple option, but its probably not your only option. Here are a few other places to find money.

Use your savings. Your emergency cash or other savings can be crucial right now and why you have emergency savings in the first place. Always try to find the best rate on an online savings account so that youre earning the highest amount on your funds.

Take out a personal loan. Personal loan terms could be easier for you to repay without having to jeopardize your retirement funds. Depending on your lender, you can get your money within a day or so. 401 loans might not be as immediate.

Try a HELOC. A home equity line of credit, or HELOC, is a good option if you own your home and have enough equity to borrow against. You can take out what you need, when you need it, up to the limit youre approved for. As revolving credit, its similar to a credit card and the cash is there when you need it.

Get a home equity loan. This type of loan can usually get you a lower interest rate, but keep in mind that your home is used as collateral. This is an installment loan, not revolving credit like a HELOC, so its good if you know exactly how much you need and what it will be used for. While easier to get, make sure you can pay this loan back or risk going into default on your home.

You May Like: Is A 401k A Defined Benefit Plan

Does A 401 Loan Or Withdrawal Make More Sense

When you consider the potential tax consequences associated with an early withdrawal, a 401 loan may seem more attractive. Of course, there’s one drawback with both options: you’re diminishing your retirement savings.

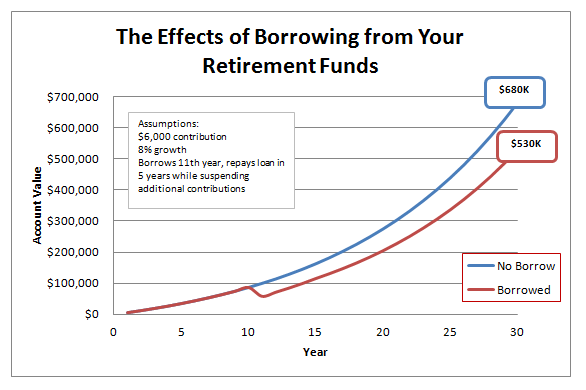

With a 401 loan, you’d have the ability to replace that money over time. If you’re cashing out an old 401, however, there’s no way to put that money back. In both cases, you’re missing out on the power of compound interest to grow your retirement wealth over time.

One upside of deciding to borrow from a 401 for a housewhether you take a loan or make a withdrawalis that it may allow you to avoid paying private mortgage insurance if you offer the lender a large enough down payment. Private mortgage insurance protects the lender, and it’s typically required if you’re putting less than 20% down on a conventional mortgage. Private mortgage insurance can be eliminated when you reach 20% equity in the home, but it can add to the cost of homeownership in the early years of your mortgage.

Our Take: When Can You Withdraw From Your 401k Or Ira Penalty

There are a number of ways you can withdraw from your 401k or IRA penalty-free. Still, we recommend not touching your retirement savings until you are actually retired. Compounding is a huge help when it comes to maximizing your retirement savings and extending the life of your portfolio. You lose out on that when you take early distributions. To see how much compounding can affect your 401k account balance, check out our article on the average 401k balance by age.

We understand that its always possible for unforeseen circumstances to arise before you reach retirement. Being aware of the exceptions allows you to make informed decisions and possibly avoid paying extra fees and taxes.

To take control of your finances, a good place to start is by stepping back, getting organized, and looking at your money holistically. Personal Capitals free financial dashboard will allow you to:

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Recommended Reading: How To Open A Solo 401k

Paying Yourself Back May Be The Least Of Your Worries

How much worse will the cash crunch get?

- Print icon

- Resize icon

Congress has just passed the CARES Act, allowing people to borrow more from their retirement portfolio if theyve been hit economically by the crisis.

Its basically doubled, says Robert Neis, tax and benefits lawyer at the law firm Eversheds Sutherland, of the permitted loan limit. Generally, you can only borrow up to 50% of your vested plan balance or $50,000, whichever is less, for a plan participant who has been affected by COVID-19, the limit is increased to the lesser of 100% of the vested account balance or $100,000, he says.

Meanwhile, the new law also waives the 10% early withdrawal penalty for those who take money out for good, although theyll still have to pay income tax.

There are plenty of wrinkles. You have to apply during the next six months, Neis says. And only certain people can benefit from the new rules. They are not available to everybody, he says. You have to be effected by COVID-19. That includes being laid off, furloughed, or working reduced hours for reduced pay, he says. It also includes those who cant work because they cant get child care for their children.

But if you face an emergency cash crunch, should you borrow from you 401? Or is it a disastrous mistake?

Ironically, Congress has made it easier to borrow from your retirement account just as it has become more dangerous.

Even in normal times, there are hidden costs to borrowing from your plan, financial advisers note.