Not Sure How Much To Contribute To Your 401 Try This

Here’s a closer look at a few approaches you can use to decide how much you want to contribute to your 401 going forward.

A good starting point: Get your full employer match

If you’re starting a new job and your employer asks how much you want to defer to your 401 from each paycheck, your answer should be at least enough to get your company’s full match. That assumes it offers one, of course. These funds are basically like a bonus for you, but you have to contribute to your retirement account in order to claim it.

Each company has its own matching structure that determines how much it will contribute to your 401. Usually, this involves a dollar-for-dollar match or a $0.50 on the dollar match up to a certain percentage of your income. If your company does a $0.50 on the dollar match up to 6% of your salary and you earn $50,000 per year, you would contribute 6% of your salary, or $3,000. Then, your employer would match half of this, contributing another $1,500 on your behalf. You’re free to contribute more if you want, but you’re on your own from there.

If you’re unsure how your company’s 401 match works, ask your HR department to find out. Then, make sure it’s feasible for you to contribute enough to get your full employer match. If doing so would make it difficult to pay your bills right now, scale your contributions back. The solution below may work better for you.

The bare minimum: Start with 1% of your salary

The ideal: Create a custom retirement plan

How Much Should You Have In Your 401 By 30

So how much should you have saved for retirement before your 30th birthday?

Assuming you have been working since you were 22 or 23, at 30, a great target is to have a 401 or IRA equal to about one years salary.

For example, if you make $40,000 a year, you could try to have $40,000 saved for retirement. .

Related: If you still dont believe in the power of compound interest, you have to see this

That said, dont freak out if your retirement saving isnt on this level yet. The sooner you start, the better. But if you start at 30 and dont plan on retiring until youre 65, that still gives your money plenty of time to earn interest.

Use this calculator to estimate what your 401 balance would be at retirement, based on your personal financial status:

No two investors are alike, especially beginning investors. Your starting salary range and the number of years you have been working are going to be much bigger factors in determining your retirement savings balance at 30 than they will be at 40 or 50, when you will have had additional years to make catch-up contributions or adjust your portfolio as necessary.

Should I Contribute To An Ira Instead Of A 401

In general, 401âs and IRAs act in very similar ways. With IRAs, you have the same two main options â traditional and Roth â that you have in 401 accounts, and they undergo the same tax advantages. So some people wonder whether they should bother opening an IRA in addition to their 401 or just contribute their full percentage to the 401.

One of the main reasons why people decide to open an IRA is for more control over their investments. With a 401, you typically have limited fund options that you can invest in based on what your employer is providing. In an IRA, youâre able to invest in anything that you want. So if you want to invest in specific companies or funds for retirement, the IRA may be worth looking into.

Secondly, you might want to open a Roth IRA and contribute to that alongside your traditional 401. This is a great way to take advantage of both sides of the tax advantages while youâre saving up for retirement. Whatever you do with an IRA, be sure youâre still contributing enough to your 401 to get the full match. Any amount left that youâre willing to contribute, putting it in a Roth IRA is not a bad idea!

Recommended Reading: How To Collect My 401k Money

When Should You Max Out Your 401

The most you can contribute to a 401 plan is $19,500 in 2021, increasing to $20,500 in 2022, or $26,000 in 2021 and $27,000 in 2022 if you’re age 50 or older. You might want to do so if you can easily afford to max out your contribution based on the yearly limits without it causing a large impact on your budget.

Some personal finance experts suggest saving at least 15% of your annual income for retirement throughout your working career. Chances are that you could max out comfortably at the $20,500 limit if you’re making at least $130,000 in 2022, and if you have a good handle on your current finances.

Think about when you might retire when you’re planning for your retirement, how much you’ve saved, what your lifestyle might look like during retirement, and how much money you’ll need each month to sustain that lifestyle. Once you have a rough target, work backward to figure out how much you should contribute to a retirement fund. What is your current budget like? Can you live comfortably if you contribute the max amount?

One other common best practice is to contribute at least the minimum required to capture your employer’s 401 match if one is provided. You’ll gain the full benefit of the match without losing a penny.

Should I Roll Over My Traditional 401 To A Roth 401

There isnt a one-size-fits-all answer when it comes to rolling over your retirement savings to a Roth account. If it makes sense for your situation, a Roth conversion is a great way to take advantage of tax-free growth on your accounts. But keep in mind that rolling over a traditional 401 means paying taxes on it now. And if youre converting a large sum all at once, it could bump you into a higher tax bracket . . . which means a bigger tax bill.

For example, if youre rolling over $100,000 and youre in the 22% tax bracket, that means you have to come up with $22,000 cash to cover the taxes. Dont pull that money out of the investment itself!

If you can pay cash for the taxes without taking money out of your nest egg and youre still several years away from retirement, it may make sense to roll it over. But before you roll over accounts, make sure to sit down with an experienced investment professional. Theyll help you understand the tax impact of rolling over your 401 and how you can be prepared for it.

Don’t Miss: How To Protect Your 401k In A Divorce

If Youre In Debt Focus On High

If your employer matches 401 contributions, put in enough to get that match, even if youre in debt.

Next, if youre in credit card debt, stop. Put your extra money towards paying that off before making additional retirement contributions. Focus first on getting out of credit card debt and then come back.

Got student loans? Follow the above schedule anyway. Unless your private loans have double-digit interest rates, I dont recommend repaying student loans early.

A Look At The Benchmarks

Considering all this, here are some savings benchmarks for people in the following age groups:

Savings Benchmarks by AgeAs a Multiple of Income

Key Assumptions: Household income grows at 5% until age 45 and 3% thereafter. Investment returns before retirement are 7% before taxes, and savings grow tax-deferred. The person retires at age 65 and begins withdrawing 4% of assets . Savings benchmark ranges are based on individuals or couples with current household income approximately between $75,000 and $250,000.

Investor’s Age and Savings Benchmarks| Investor’s Age | |

|---|---|

| 6x to 11x salary saved today | |

| 65 | 7.5x to 14x salary saved today |

We assume the household starts saving 6% at age 25 and increases the savings rate by 1% annually until reaching the necessary savings rate. Benchmark ranges reflect the higher amounts calculated using federal tax rates as of January 1, 2020, or the tax rates as scheduled to revert to pre-2018 levels after 2025. Inflation adjustments to brackets effective in 2021 do not significantly affect the analysis and, therefore, are not reflected. Approximate midpoints for age 35 and older are rounded up to a whole number within the range. Target multiples at retirement reflect estimated spending needs in retirement Social Security benefits state taxes and federal taxes.

Recommended Reading: Can I Set Up My Own 401k Plan

How Does A Roth 401 Affect My Contribution Percentage

When youâre deciding what percentage of your income to contribute, you might want to take the type of 401 that youâre using into account. Letâs look at a quick example, where youâre making $100,000 per year and you want to contribute 15% of your income. This would be $15,000 per year.

In a traditional 401, $15,000 of your income would come out pre-tax and just go straight into your 401 account. This would mean youâre paying taxes on $85,000 this year. In a Roth 401, that $15,000 would have to come out of your after-tax money. Letâs say youâre paying 20% total in taxes, this means youâd technically be contributing $18,750. Thatâs because youâd first owe 20% in taxes before you can contribute that $15,000.

So as you can see, contributing the same percentage to a Roth 401 means that you effectively have to contribute more because of the taxes. But in the future, you wonât owe anything on any of your Roth withdrawals, which is going to be a huge savings. Just keep in that mind as youâre going over your finances, and consider adjusting the percentage slightly depending on the account type.

S To Take Now To Improve Your Retirement Readiness

While the average 401k balance at pre-retirement age is around $600K, that balance still falls far below even the no growth column of the savings potential chart for the same age. And while $600,000 is no chump change, its also probably not enough to retire comfortably for most people.

Needless to say, many people are falling way below their savings potential. But the good news is, its not too late to turn things around.

Recommended Reading: Should I Have A 401k And A Roth Ira

Who Is Eligible For A Roth 401

If your employer offers it, youre eligible. Unlike a Roth IRA, a Roth 401 has no income limits. Thats a fantastic feature of the Roth option. No matter how much money you earn, you can contribute to a Roth 401.

If you dont have access to a Roth option at work, you can still take advantage of the Roth benefits by working with your investing pro to open a Roth IRA. Just keep in mind that income limits do apply when you contribute to a Roth IRA.

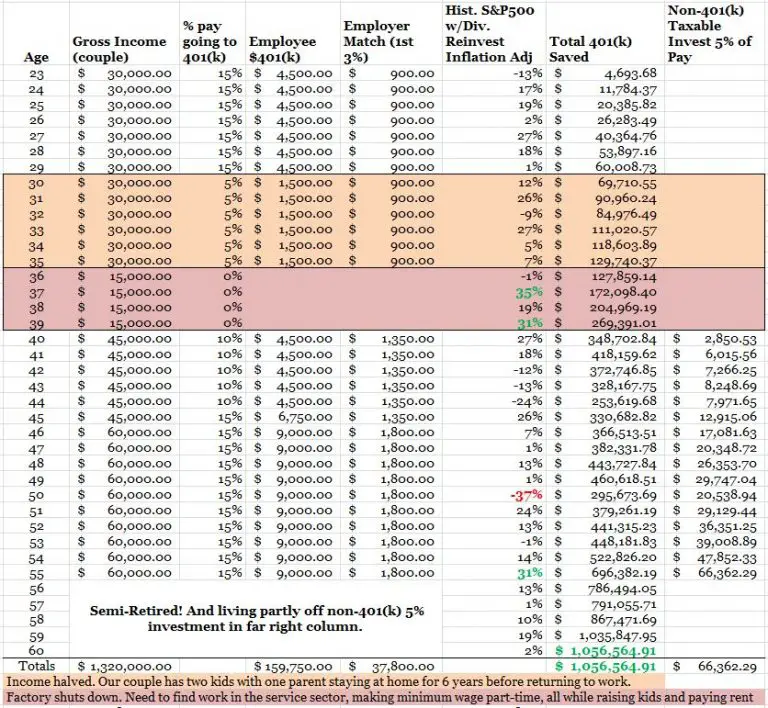

K Savings Potential By Age

The following chart depicts 401k savings potential by age, based on several assumptions. So this is how much you could have saved. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

| AGE | |

|---|---|

| $827,000.00 | $6,610,084.46 |

*Generally, financial planners say the expected rate of return for a 401k is between 8% and 10%.

So, how do you stack up? Are you on the high end? The low end? Do you think these numbers are realistic?

Read Also: Can I Transfer My 403b To A 401k

Benefits Of Tax Diversification

In addition to shifting the load tax-wise as you pay into your retirement funds, and allowing for flexibility when you’re withdrawing, there are other benefits to a traditional/Roth 401 split.

“More sophisticated tax strategies come into play when you have these options,” says Golladay.

If you’re moving into retirement and up against the mandatory withdrawal age of 70½, you have some room to maneuver. Sure, you’ll have to take required minimum distributions from both kinds of accounts after you turn 70½, but your Roth 401 withdrawals will be tax free.

Closer to retirement, you may want to roll both over to Roth IRAs to avoid required minimum distributions. You don’t need to take required minimum distributions on a Roth IRA until after the death of its owner. Or, you could roll the traditional 401 into a traditional IRA and the Roth 401 into a Roth IRA to keep some tax diversification.

“In years that an individual has a big expense, to pull the additional amount of money out of the tax-free source out of the Roth is a huge benefit,” says Golladay.

The other thing that she sees people doing is using the two funds to manage their marginal income tax bracket, she says. They may pull some money out of the tax-deferred fund, and anything needed beyond a certain amount they’ll pull out of their Roth to avoid moving up to the next income bracket.

How Much You Invest Makes A Huge Difference

The U.S. Census Bureau says the median household income is around $69,000.1 Fifteen percent of that would be $10,350 a year, or $862.50 a month. Over 30 years, that could grow to over $1.9 million, assuming a 1012% return. Sounds awesome, right? Who doesnt want to be a millionaire?

But what if you only invested 10% of that gross income? That would be $6,900 a year, or roughly $575 a month. Invested over 30 years at the same rate of return, that percentage could get you to about $1.3 million. Youve lost out on $600,000 you could be using to fund your retirement dream.

Just as an example, what about if you dropped that 15% down to 5.5%the average personal savings rate in the U.S., including retirement savings and emergency funds? At that percentage, youre investing $3,795 a year, or around $315 a month. Over 30 years, assuming that same rate of return, you could be looking at about $715,000.

We know thats a lot of numbers. If youre a little more visual, heres a breakdown for you:

Don’t Miss: How To Do A 401k Rollover

Contribute As Much As You Can

You have emergency savings. You met your employers 401 match and then you maxed out a Roth IRA . Then what? How much should you really contribute to your 401 now?

Your goal at this point should be to save as much as you can for retirement while still living comfortably now. For some people, that will mean another 1% of their salary into their 401. For others it will mean maxing out their 401.

The key is to put as much as you can toward retirement. Some people spend their money frivolously and save only a little bit. If youre spending thousands of dollars every month on unnecessary purchases, you should find a way to cut that spending and put it toward retirement instead. It might not sound fun, but remember that the goal is to have financial security when you retire.

How Much Should Be In Your 401 At 30

Modified date: Dec. 1, 2021

How much should be in your 401 at 30, 40, 50, etc? What about other retirement accounts? These are good questions.

Ill try to answer them in this article, but I should warn you: Personal finance is personal.

The more you can contribute to your 401, and the sooner you can start, the better. But everybodys situation is different. Dont beat yourself up if you feel behind in the retirement game remember, you cant change yesterday but you can take action today and change tomorrow.

Whats Ahead:

Recommended Reading: How Is 401k Paid Out

How Much Should I Put Into My 401 Out Of Each Paycheck

Aiming to put at least 15% of each paycheck into your 401 as long as you can still comfortably afford your living expenses is an excellent start on your way to saving for retirement. It’s suggested that if you can’t meet this amount, aim for the minimum amount to where your employer will match your 401 investment.

How To Calculate Your Monthly 401 Contribution

In 2021, the 401 contribution limit is $19,500 for those under age 50 this increases to $20,500 for 2022. Workers age 50 or older can make an additional catch-up contribution of $6,500 in both 2021 and 2022. You and your employers combined contributions cant exceed $58,000 in 2021 or $61,000 in 2022, excluding catch-up contributions.

However, few people actually contribute these amounts. Only 12% of plan participants made the maximum contribution in 2020, when the limit was $19,500, according to Vanguard’s 2021 How America Saves report.

To determine how much you should be saving, you can use Social Securitys retirement estimator and see what monthly benefit you can expect from that fund. You also can use a retirement calculator to estimate how much youll need each month on top of Social Security. Choose a calculator that allows you to personalize as many factors as possible, including your current age and account balance, anticipated contributions, other sources of income, and expected rates of return.

Don’t Miss: Can You Use 401k To Buy Stocks