Roth Ira Income Limit

The income limit for contributing the maximum to a Roth IRA will go up by $4,000 for singles from $125,000 in 2021 to $129,000 in 2022. It will go up by $6,000 for married filing jointly from $198,000 in 2021 to $204,000 in 2022.

You cant contribute anything directly to a Roth IRA when your income goes above $140,000 in 2021 and $144,000 in 2022 for singles, and $208,000 in 2021 and $214,000 in 2022 for married filing jointly, up by $4,000 and $6,000 respectively in 2022. 2021 may be the last year you can do a backdoor Roth.

Why It’s Worth Meeting The Higher 401 Contribution Limit

If you can already afford to max out your 401 account, you should take advantage of the increased contribution limit in the new year and plan on saving an additional $1,000 to make your total contribution for the year $20,500.

It’s sort of a no-brainer option, thanks to these tax breaks that come with 401 contributions:

What Is The Irs Limit For 401k Contributions In 2021 Over 50

Elective differences up to 100% of compensation up to the annual contribution limit: $ 20,500 in 2022 , or $ 27,000 in 2022 . 2021) if age 50 or older more.

What are the 2021 401 K limits? New Contribution Limits for Employees with a 401 Plan The news is that by 2022, employees of a company with a 401 plan will be allowed to contribute up to $ 20,500 per year. This is an increase of $ 1,000 over the 401 contribution limit of $ 19,500 by 2021.

Recommended Reading: Can An Individual Open A 401k Account

Increased 2022 Hsa Contribution Limits

If youre already maxing out your 401 or other retirement contributions, consider putting pre-tax dollars toward an HSA , if you have one. An HSA helps those with high-deductible health plans save taxes on money earmarked for medical expenses not covered by the plan.

Unlike a flexible spending account , which has a use it or lose it provision, the assets you contribute to an HSA are yours for the long term and can be rolled over each year. Plus, an HSA offers a triple tax advantage: Money put in isnt taxed, it grows tax-free, and youre not taxed when you take money out to pay for qualified medical expenses.

| $7,300 |

How Does The Increased 401 Limit Affect Me

If you hit the $19,500 contribution cap in 2021, this limit increase is good news for you, as you can choose to increase your contributions up to the limit to continue fully funding your account.

If you contribute a lower amount to your account each year, the new limits may not affect you. In fact, only 8.5% of taxpayers who contribute to direct contribution plans like a 401 contributed the maximum amount, according to Congressional Research Data from 2021. According to investment firm Fidelity, the average 401 contribution as a percent of salary was 9.4% in 2021. So, to hit the $19,500 cutoff in 2021 while saving the average income percentage, a worker would have made $207,447.

If you do qualify to contribute more in 2022 than in 2021 and want to do so, it’s time to make a plan.

“Budgeting is the key,” Hargrove says. “Prepare for the transition by building the funds you’ll withhold into your budget.”

Don’t Miss: How To Convert A 401k To Roth Ira

Traditional Vs Roth 401

Some employers offer both a traditional 401 and a Roth 401. With a traditional 401 plan, you can defer paying income tax on the amount you contribute. In other words, if you earn $80,000 a year and contribute the maximum $20,500, your taxable earnings for the 2022 tax year would be $59,500.

With a Roth 401 plan, you dont get an upfront tax break, but when its time to withdraw that money in retirement, you wont owe any tax on it. All your accumulated contributions and earnings come out tax free.

Investing in both types of plans provides you with tax diversification, which can come in handy during retirement.

If you have access to both a Roth and a traditional 401 plan, you can contribute to both, as long as your total contribution to both as an employee doesnt exceed $20,500.

In addition to the Roth and traditional 401, some employers also offer an after-tax plan, allowing you to save up to the total annual limit of $61,000. With this account you can put away money after-tax and it can grow tax-deferred in your 401 account until withdrawal, at which point any withdrawn earnings become taxable.

Contribution Limits For Employer Matching And Highly Compensated Employees

Some employers will match contributions to a 401 account, up to a certain point. For instance, your employer may match 50% of your contributions up to 5% of your total salary. These matching contributions dont factor into the $20,500 standard contribution or $6,500 catch-up contribution limits, though. However, there is an overall limit for matching contributions. In 2022, that ceiling is the lesser of $61,000 or 100% of the employees salary.

The IRS has a specific tax status called highly compensated employee, or HCE. According to the IRS website, the 2022 requirements for an HCE go as follows:

- Over the previous year, the employee earned $135,000 or more OR

- The employee owns more than 5% of the interest in the business at any point during the current or preceding year, regardless of compensation

While there are no explicit differences in the way the IRS limits the 401 contributions of HCEs, the 401 plan they utilize must meet some standards. The IRS determines this by testing the plan to ensure that it does not favor HCEs in any way. Should this process uncover that the plan is, in fact, treating HCEs and non-HCEs differently, there may be limits placed on the contributions of those HCEs.

Don’t Miss: How To Figure Out Your 401k Contribution

Changes To Roth Ira Phase

While you can’t deduct contributions to a Roth IRA on your taxes, the IRS still applies phase-out ranges to contribution amounts based on income. Roth phase-out ranges determine how much you’re eligible to contribute, with some earners only eligible to contribute a reduced amount, and the highest-income earners ineligible to contribute at all.

Roth IRA contribution phase-out income ranges have also increased in 2022:

- Singles and heads of household: The income phase-out range is increased to $129,000 to $144,000. That’s up from $125,000 to $140,000 in 2021.

- The income phase-out range is increased to $204,000 to $214,000. That’s up from $198,000 to $208,000 in 2021.

- The income phase-out range remains the same at $0 to $10,000.

Traditional And Roth Ira Contribution Limit

The Traditional or Roth IRA contribution limit will stay the same at $6,000 in 2022 as in 2021. The age 50 catch-up limit is fixed by law at $1,000 in all years.

The IRA contribution limit and the 401k/403b/TSP or SIMPLE contribution limit are separate. You can contribute the respective maximum to both a 401k/403b/TSP/SIMPLE plan and a traditional or Roth IRA.

Recommended Reading: How To Close Your 401k Early

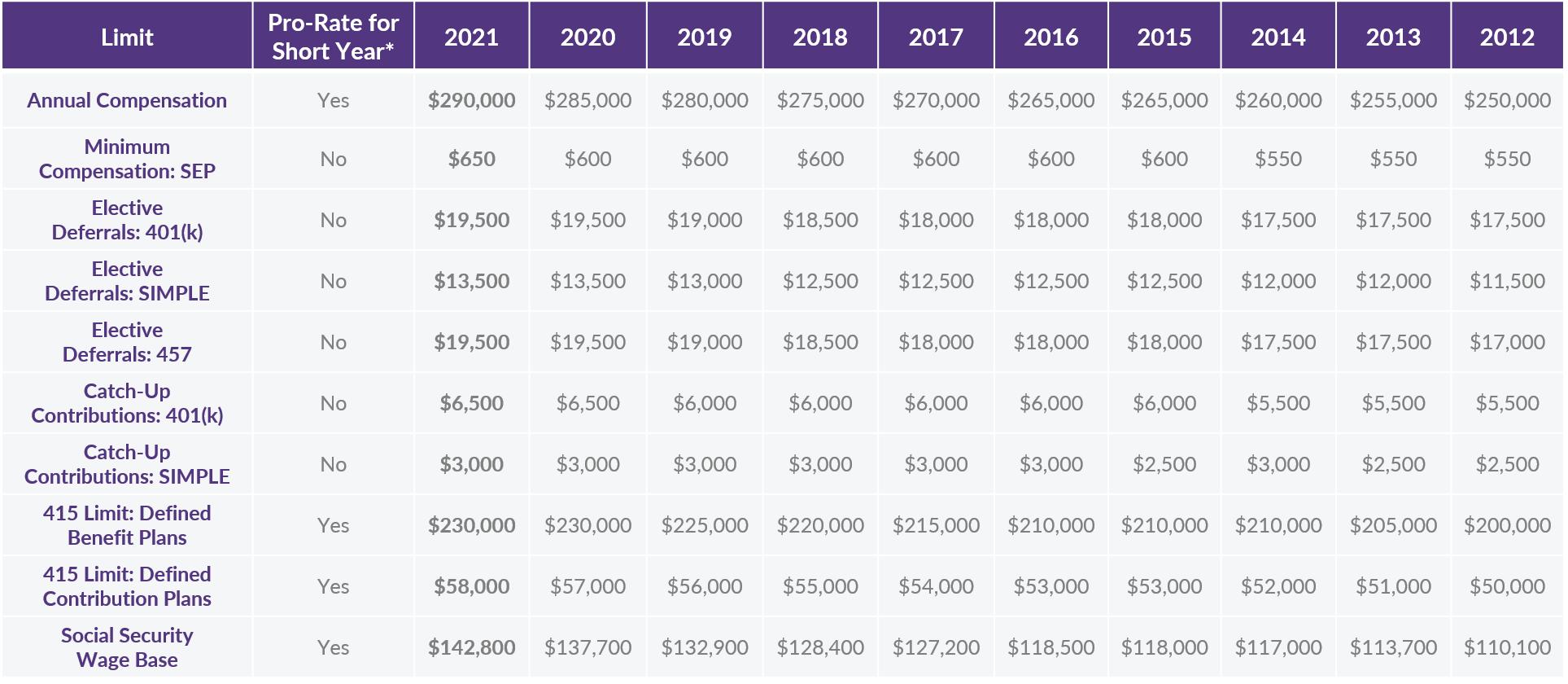

Contribution Limits For 2021 And 2022

When most people think of 401 contribution limits, they are thinking of the elective deferral limit, which is $19,500 in 2021 and $20,500 for 2022. This is the maximum amount you are allowed to voluntarily defer to your 401 for the year. Adults 50 and older are also allowed $6,500 in catch-up contributions, which are additional elective deferrals, in 2021 and 2022. This brings the maximum amount they can contribute to their 401s to $26,000 in 2021 or $27,000 in 2022.

The IRS also imposes a limit on all 401 contributions made during the year. In 2021, it rises to $58,000 and $64,500, respectively. In 2022, it rises to $61,000 and $67,500, respectively. This includes all your personal contributions and any money your employer contributes to your 401 on your behalf.

Highly paid employees have some additional limitations to keep in mind. Companies can elect to stop a participant’s salary deferrals once that person has earned $290,000 in 2021 or $305,000 in 2022, and companies use only that first amount to calculate employer matching contributions.

For example, say your company matches up to 6% of your salary and you earn $300,000 in 2021. Six percent of $300,000 is $18,000 however, your company can only match you up to 6% of $290,000, the maximum employee compensation limit for 2021. So rather than up to $18,000, you’d get up to $17,400 as an employer match.

Here’s a useful reference chart to help you remember these important limits and thresholds:

|

Type of Contribution |

|---|

Good News Higher 401 Contribution Limits Announced By Irs For 2022

Time to pop the champagne, new higher contribution limits announced for 401 plans in 2022. … ATLANTA, GA – SEPTEMBER 22: Nick Markakis #22 of the Atlanta Braves celebrates with champagne after clinching the NL East Division against the Philadelphia Phillies at SunTrust Park on September 22, 2018 in Atlanta, Georgia.

There is some good news from the IRS for retirement savers they have announced an increase to the contributions limits for workers with a 401, 403 and 457 defined contribution plans for 2022. Larger contributions will allow you to defer more income from taxation. This will be great for high-income Americans who are facing potentially higher taxes next year under tax proposals from President Bidens Build Back Better plan.

You May Like: How To Turn 401k Into Ira

Remind Yourself A 401k Is Only One Leg Of The Retirement Stool That Is Already Broken

The other two legs of the retirement stool are a pension and Social Security. According to the Bureau of Labor Statistics about 22% of full-time private industry workers have a defined pension benefit compared to 42% in 1990.

Although most public sector employees still get pensions, public sector employees account for only around 10% of the population. In other words, most people dont have pensions anymore.

As for Social Security, the realistic calculation is that we will still all receive Social Security checks in our mid-60s, but at 70% of what is promised if nothing is done.

Given most people dont have pensions and Social Security wont be paid in full, the 401k is the baseline defense for retirement. Thus, we must build upon our after-tax investments and alternative income streams to develop financial buffers for maximum financial security.

The new three-legged retirement stool consists of You, You, and You. Mentally forget about Social Security or a pension taking care of you in retirement. If you can get either, consider yourself blessed.

New Solo 401 Contributions Announced For 2022

There is also good news for business owners who have a 401 plan for their employees or small business owners who take advantage of the tax benefits from a solo 401. The total contribution limits to a 401 plan have increased to $61,000 in 2022. Catch-up contribution aside, that is a $3,000 increase over the $58,000 401 contribution limit from 2021.

This $61,000 contribution limit for a solo 401 in 2022 includes both the employee and employer contributions. So, between profit sharing, employee deferral, and company match, the maximum that could go into a 401 for one person in 2022 is $61,000. Or $67,500 for business owners over the age of 50.

While this adjustment to 401 contribution limits for 2022 probably wont be life-changing, it can help business owners save some money on taxes. For example, 50-year-old California business owners in the top federal and state tax brackets could be hit with a tax rate above 50%. In this scenario, maxing out a solo 401 at the 2022 limits level could save a business owner $337,000 in income taxes over the next decade. Not to mention the value of deferred gains on the value of investments within the 401. Of course, taxes will be due on eventual withdrawals from the 401 plan. There are many tax planning strategies to help reduce the taxes paid on retirement income.

Recommended Reading: How To Invest With Your 401k

Irs Announces Changes To Retirement Plans For 2022

IRS Tax Tip 2021-170, November 17, 2021

Next year taxpayers can put an extra $1,000 into their 401 plans. The IRS recently announced that the 2022 contribution limit for 401 plans will increase to $20,500. The agency also announced costofliving adjustments that may affect pension plan and other retirement-related savings next year.

Always Take Advantage Of The Maximum 401k Contribution Limit

I always recommend maxing out your 401k as fast as you can. Once you get into a max habit, youll rack up some big bucks in no time.

Maxing out your 401k is a learned habit that gets easier over time. Given the contributions are pre-tax, you wont feel as much pain compared to saving with after-tax dollars. In other words, at a 25% effective tax rate, contributing $20,500 will feel more like youre contributing $15,375.

So many people dont even bother to try maxing out their 401k because they dont feel like its possible. But once they try, they kick themselves for wondering why they didnt max out their 401k sooner.

Below is a simple chart to see how much you can accumulate in your 401k by age or years worked if you contribute $19,000 a year starting today.

The chart is obviously more helpful for younger folks, given older folks had lower maximum contribution limits in the past. For example, when I first started maxing out my 401k in 2000, the historical 401 contribution limit was only $10,500.

Ive also included my high-end 401k target amount by age. It is based off continued maximum contributions plus a constant 4-8% annual return. My high-end 401k savings target can also be considered your overall total savings target. It can include after tax savings as well.

The numbers are for ideal conditions. We all know that life, recessions, and buying things we dont need gets in the way of savings and returns all the time.

You May Like: Is Tiaa Cref A 401k

Simple 401k And Simple Ira Contribution Limit

SIMPLE 401k and SIMPLE IRA plans have a lower limit than standard 401k plans. The contribution limit for SIMPLE 401k and SIMPLE IRA plans will go up by $500 from $13,500 in 2021 to $14,000 in 2022.

If you are age 50 or over, the catch-up contribution limit will stay the same at $3,000 in 2022 as in 2021.

Employer contributions arent included in these limits.

Contributions In Excess Of 2021 Limits

Evaluating your estimated contributions for the year ahead and analyzing your contributions at the end of a calendar year can be very important. If you find that you have contributions in excess of the 2020 limits, the IRS requires notification by March 1 and excess deferrals should be returned to you by April 15.

You May Like: How Do You Take Money From Your 401k

Maximum 401 Contribution Limits For 2021 And 2022

Many employers offer 401 matching contributions as part of their benefits package. With a 401 match, your employer agrees to duplicate a portion of your contributions, up to a certain percentage of your salary. In addition to matching contributions, some employers may share a percentage of their profits with employees in the form of non-matching 401 contributions.

While an employers 401 match and non-matching contributions dont count toward your $19,500 employee deductible contribution limit , they are capped by total contribution limits.

Total 401 plan contributions by both an employee and an employer cannot exceed $58,000 in 2021 or $61,000 in 2022. Catch-up contributions for employees 50 or older bump the 2021 maximum to $64,500, or a total of $67,500 in 2022. Total contributions cannot exceed 100% of an employees annual compensation.

Other Irs Retirement Account Changes For 2022

In addition to contribution increases to 457, 403, and 401 plans, the IRS has additional 2022 updates:

-

Traditional and Roth IRA contribution limits remain the same at $6,000, with traditional and Roth IRA catch-up contribution limits staying at $1,000.

-

Income ranges for determining eligibility to make deductible contributions to traditional IRAs, to contribute to Roth IRAs, and to claim the Saver’s Credit all were raised for 2022.

Recommended Reading: Can I Withdraw My 401k If I Quit My Job

Irs Raises 401 Contribution Limits For 2022 By $1000

- In early November 2021, the IRS boosted annual contribution limits for 2022 for 401, 403, and most 457 plans.

- Plan participants can contribute up to $20,500 for 2022, which is up from $19,500 for 2021.

- This is a good time to consider adding a retirement savings program to your benefits menu, if your business doesn’t yet have one.

General Pros And Cons Of A 401

Pros

Cons

- Few investment optionsGenerally speaking, 401s have few investment options because they normally originate from employers, they are limited to what is offered through employers’ 401 plans, as compared to a typical, taxable brokerage account.

- High feesCompared to other forms of retirement savings, 401 plans charge higher fees, sometimes as a percentage of funds. This is mainly due to administration costs. Plan participants have little or no control over this, except to choose low-cost index funds or exchange-traded funds to compensate.

- Illiquid 401 funds can only be withdrawn without penalty in rare cases before 59 ½. This includes all contributions and any earnings over time.

- Vesting periodsEmployers may utilize vesting periods, meaning that employer contributions don’t fully belong to employees until after a set point in time. For instance, if an employee were to part ways with their employer and a 401 plan that they were 50% vested in, they can only take half of the value of the assets contributed by their employer.

- Waiting periodsSome employers don’t allow participation in their 401s until after a waiting period is over, usually to reduce employee turnover. 6 month waiting periods are fairly common, while a one-year waiting period is the longest waiting period permitted by law.

Also Check: How To Start A 401k For Employees