Reasons You Should Not Convert A 401 To A Roth Ira

There are a few reasons you shouldnt convert your 401 to a Roth IRA. If you dont have the cash on hand to pay the estimated tax due, then you should consider rolling over to a traditional IRA instead. Using money from your Roth IRA to pay the tax has been shown to make workers worse off in the long run.

Again, the main reason to convert to a Roth is the assumption that your tax rate will be higher in retirement. If you are in the highest marginal tax bracket now, theres a good chance your tax rate will be lower in retirement.

Paying Taxes On Your Contributions

The point of a Roth IRA is that the money gets taxed as income upfront, then grows tax-free. But the money in your 401 was shielded from taxes. So youll now need to pay income tax on that money so that it qualifies for a Roth.

The funds you roll over are added to your taxable income for the year you do the rollover. Income taxes you owe will be calculated from that new total. Since the income from your IRA isnt coming from a paycheck, though, the tax you owe on it wont be withheld. Itll have to come out of your pocket, and to avoid a penalty, you may need to make an estimated tax payment before filing your taxes for the year.

Youll need to make an estimated tax payment if the taxes withheld from your paycheck arent enough to cover at least a) 90% of the taxes youll owe for the tax year of your rollover or b) 100% of the taxes you paid for the previous tax year . Once you know your estimated payment, you can either pay it all at once or split the amount between the quarters remaining in the tax year. Quarterly estimated tax payments are due on or before April 15, June 15, Sept. 15 and Jan. 15 of the next year.

If you overestimate how much your tax bill is going up and overpay your estimated tax payments, thats OK. Youll get a refund if you end up paying more than you owe.

Find Out If Youll Be Able To Convert Your 401

According to the IRS, in order to be eligible for a 401 conversion, the money must be vested .3 All the money you put into your 401 is immediately vested, but your employers contributions are usually vested over time. Depending on the vesting schedule set up by the company and how long youve been there, your existing 401 might not be fully vested yet.

Companies sometimes have their own additional restrictions on who can convert their 401, so ask your employer if you are eligible.

Don’t Miss: How Do I Find An Old 401k

What Are The Benefits Of A Roth Ira

A major benefit of a Roth IRA is, unlike traditional IRAs, withdrawals are tax free when you reach age 59½. You can also withdraw any contributions, but not earnings, at any time regardless of your age.

In addition, IRAs typically offer a much wider variety of investment options than most 401 plans. Also, with a Roth IRA, you dont have to take required minimum distributions when you reach age 72.

Signs It Makes Sense To Roll Your 401 Into A Roth Ira

If youre thinking of rolling your 401 into a Roth IRA instead of a traditional IRA, you have plenty of reasons to do so. Not only do Roth IRAs let you invest your dollars in the same investments as traditional IRAs, but they offer additional perks that can help you save money down the line. Here are four signs that a Roth IRA might actually be your best bet.

Read Also: What Is The Max Percentage For 401k

You Want To Increase Your Tax Diversification

Contributions to traditional IRAs are tax-advantaged, meaning you wont pay taxes on your invested funds until you begin taking withdrawals at retirement. Roth IRAs, on the other hand, are taxed up front but offer tax-free withdrawals after age 59 ½. If youre unsure how your tax and income situation might pan out in the future, having both types of accounts a traditional IRA and a Roth IRA is a smart move in terms of diversifying your future tax exposure.

What If You Deposit The Funds In The Wrong Account

When you receive a rollover check, you have 60 days to deposit it into the appropriate account. If you miss the 60-day deadline, your rollover will not count as a rollover and will thus become taxable.

Exceptions to the 60 day rollover time frame are hard to come by unless your financial services company made a gross error. That’s why it’s important to have a clear plan for where your rollover funds are going and to make sure your financial advisor or plan administrator knows exactly where to put the money.

If you do miss your 60-day window, you can look at other ways to get money into a Roth IRA by converting an IRA to a Roth or contributing other eligible earned income to a Roth IRA.

Recommended Reading: How To Change 401k Investments

Will Taxes Be Withheld From My Distribution

- IRAs: An IRA distribution paid to you is subject to 10% withholding unless you elect out of withholding or choose to have a different amount withheld. You can avoid withholding taxes if you choose to do a trustee-to-trustee transfer to another IRA.

- Retirement plans: A retirement plan distribution paid to you is subject to mandatory withholding of 20%, even if you intend to roll it over later. Withholding does not apply if you roll over the amount directly to another retirement plan or to an IRA. A distribution sent to you in the form of a check payable to the receiving plan or IRA is not subject to withholding.

Access More Investment Choices

In a 401 plan, youre limited to the investment choices picked by your employer, usually a selection of mutual funds. If you roll over your 401 to an IRA, you may be able to expand your investment choices to include a broader range of funds, exchange traded funds or even individual stocks and bonds. Youll get more control over your portfolio, especially if you use a self-directed IRA, which allows you to invest money into more unorthodox assets like real estate.

Recommended Reading: How Much Does 401k Cost Per Month

How To Roll Over A Roth 401 To A Roth Ira

Saving through a Roth 401 can help you grow a nest egg that you can then tap into in retirement without having to pay taxes. If you leave your job or youre ready to retire, you may be wondering what to do with the funds in your 401. Rolling your Roth 401 over to a Roth IRA is just one possibility. But make sure you know how this process works to avoid triggering an IRS tax penalty. A financial advisor can walk you through a rollover if youre new to it.

You Expect To Pay Higher Taxes In The Future

Since Roth IRAs use after-tax dollars, youll have to pay taxes upfront on any funds you roll over. However, you wont have to pay taxes on your distributions, which could be extremely beneficial if youre taxed at a higher rate when you reach retirement. Youll pay taxes either way now or later. But with a Roth IRA, you can rest assured your withdrawals will be tax-free.

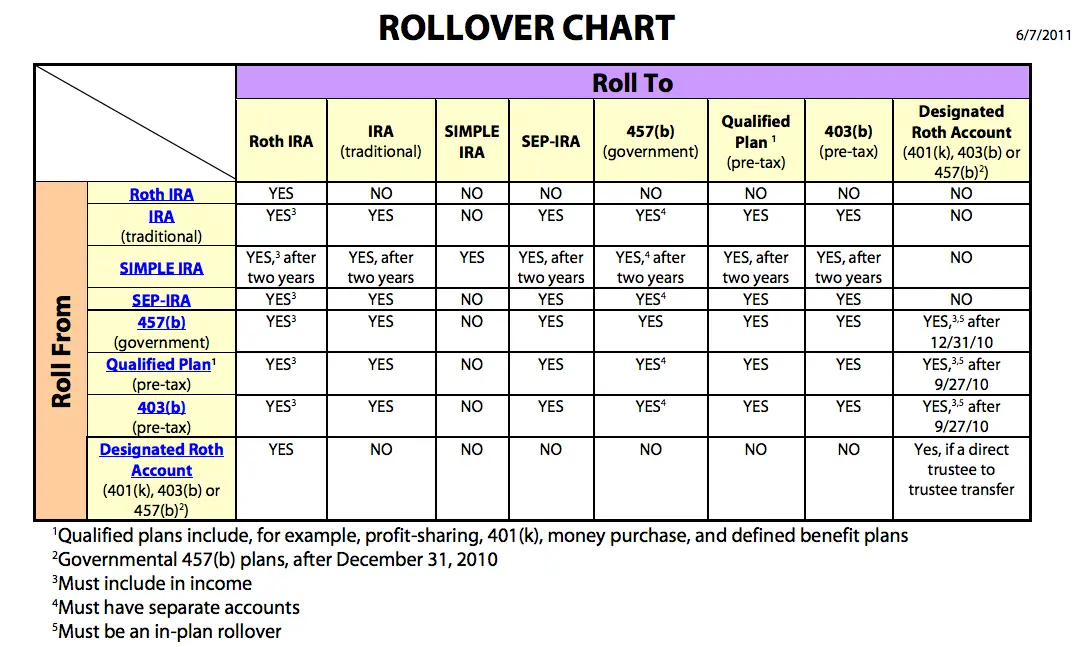

Also Check: Can I Transfer My Ira To My 401k

Open Your New Ira Account

You generally have two options for where to get an IRA: an online broker or a robo-advisor. The option you choose depends on whether you’re a “manage it for me” type or a DIY type.

-

If you’re not interested in picking individual investments, a robo-advisor can do that for you. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, all for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments and has a reputation for good customer service.

» Ready to get started? Explore best IRA accounts for 2021

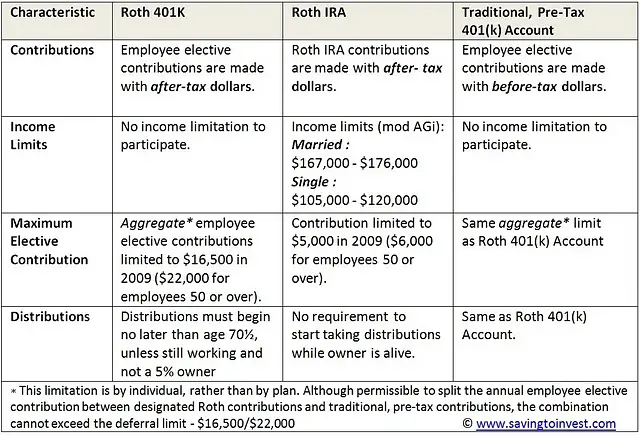

Should You Convert Your Traditional 401 Into A Roth 401

7 Minute Read | September 27, 2021

Over the past few years, you might have received an email from your companys human resources department introducing a new retirement savings plan option: the Roth 401.

More and more companiesespecially large onesare adding Roth options to their 401 plans. In fact, seven out of 10 employers now offer this option to their employees.1 If the Roth 401 is on the table at your workplace, thats great news for you!

But if you now have a Roth 401 option, youre probably wondering what to do with your existing 401. Is converting an existing 401 to a Roth the way to go? Or should you just leave it alone?

There are some things to keep in mind before you make this decision, so lets dive in.

Recommended Reading: Should I Rollover My 401k From A Previous Employer

Cons Of Rolling Your Roth 401 Funds Into A Roth Ira

When it comes to Roth IRAs, the most important thing to keep in mind is the five-year rule. The clock starts ticking when you make your first contribution into your Roth IRA, not when you open the account. So even if youve had a Roth IRA for more than five years, you may still have to hold off withdrawals if it took you a few years to start contributing. Any Roth 401 contributions youve made dont make any difference in relation to this timeline.

If you need the money and dont plan to change jobs any time soon, remember that you may be able to get a Roth 401 loan from your plan administrator. To clarify, you could borrow up to $50,000 or 50% of your vested account balance, whichever is less, though the loan must be repaid within five years or immediately upon leaving your employers service to avoid it being treated as a taxable distribution. Roth IRAs dont offer this kind of flexibility, so a rollover would eliminate this option.

You should consider the investment options and fees of a Roth IRA before definitively deciding on a rollover. It may be that your Roth 401 program offers a better selection of possible investments or charges fewer fees than a Roth IRA would.

Why You Might Not Want To Combine Your Ira With Your 401

On the flip side, there are plenty of areas where a traditional IRA has a leg up on a 401 that is, of course, why so many people roll a 401 into an IRA. Here are the biggest you should know:

-

Wider investment selection: Within an IRA, you can invest in nearly anything under the sun not just the mutual funds, index funds and exchange-traded funds that show up in 401 plans, but also individual stocks and even options . You can also shop around for the absolutely lowest-cost funds, which can save you money. As noted above, you should look closely at your 401 plan and its investments to see if youd save money by leaving your funds in your IRA.

-

More loopholes for early withdrawals: Aside from the aforementioned loans, a 401 may allow hardship withdrawals in certain situations the IRS defines hardship as an immediate and heavy need, which means things like unreimbursed medical expenses, funeral expenses or disability. Those will waive the 10% penalty on early distributions youll still owe income taxes on the withdrawal. But a traditional IRA casts a wider net, allowing early distributions without penalty but with taxes still owed for higher education expenses and a first-time home purchase .

-

Low-cost options for investment management: If your 401 plan doesnt come with anything in the way of investment advice, and you want that sort of thing, youll have more options for getting it on the cheap within an IRA if youre open to a robo-advisor. .)

Also Check: How To Find My 401k Money

Tax Consequences Of The One

Beginning in 2015, if you receive a distribution from an IRA of previously untaxed amounts:

- you must include the amounts in gross income if you made an IRA-to-IRA rollover in the preceding 12 months , and

- you may be subject to the 10% early withdrawal tax on the amounts you include in gross income.

Additionally, if you pay the distributed amounts into another IRA, the amounts may be:

- taxed at 6% per year as long as they remain in the IRA.

What If I Have Employer Stock In My Employer

You can choose to roll company stock into an IRA or a taxable brokerage account. If you decide to roll the stock to an IRA, its full value will be taxed as income at your regular rate if you move the stock to a taxable brokerage account, you might be able to save money by paying capital gains taxes on the difference between the stocks value and the price you paid for it. There are tax benefits to each, so consult your tax advisor and ask about the net unrealized appreciation strategy.

You May Like: Can I Invest My 401k In Gold

Dave Anthony President And Portfolio Manager

ROTH–ROTH–ROTH. Look, if you have any substantial amount of money saved up , then you need to convert your monies over to tax free accounts while you still can.

Our country is $19 trillion in debt—Baby Boomers are retiring at 10,000/day and are putting an enormous strain on Social security and Medicare plans. The government has already passed the legislation to come ofter those “affluent” boomers–those that make over $44k/year in retirement, and they will be the ones paying for these out of control programs. You’ll be one of them as well unless you strategically allocate your money into the five accounts that don’t count toward SS taxation and Medicare surcharge penalties.

Both of these programs are means based, if you follow the old-school train of though and defer, defer, defer your retirement income into all IRA/401 plans, you’ll be in for a world of hurt once you hit 70 1/2 and are required to take distributions.This will cause a triple whammy of ordinary income tax, Social security tax, and probably Medicare penalty premium tax. OUCH!

Pay taxes now, at some of the lowest rates in a long time, and go tax free.

Concerned about your tax hit? Work with a Wallet Hub advisor to run to numbers to eliminate or reduce your ROTH conversion tax through strategic deductions that you can take to off-set this ordinary income.

Kirk

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

Recommended Reading: Can I Open A 401k Without An Employer

Taxpayers Can Now Take Tax Free Jump From 401k To Roth Ira

Moving your retirement money around just got easier. In a conciliatory move for taxpayers, the IRS has issued new rules that allow you to minimize your tax liability when you move 401 funds into a Roth IRA or into another qualified employer plan. The situation arises when you have a retirement account through your employer that includes both pre-tax and after-tax funds. When you leave the company and want to move your money, allocating these retirement funds to new plans becomes tricky.

The new allocation rules take effect beginning in 2015, but taxpayers can choose to apply them to distributions beginning on September 18, 2014, the date the new rules were released by the IRS.

Under the old rules, you would have to pro-rate distributions and rollovers separately between pre-tax and after-tax amounts according to a set formula. This resulted in payment of tax on a pro rata share of pre-tax funds. The new rules allow you to do the allocations yourself within certain limits. You now can choose to move pre-tax money into a traditional IRA and after-tax money into a Roth IRA. If you moved pre-tax amounts into a Roth IRA, you would have to pay tax on the rollover because Roths can only be funded with after-tax money. Now you can direct pre-tax dollars to one account and after-tax dollars to another to avoid tax liability.

Lets look at an example.

Smart Planning

Direct And Indirect 401 Rollovers

Before you roll over your 401, youll need to open an IRA account. You can do this at virtually any major brokerage firm, mutual fund company or robo-advisor. Do some research, then head to your financial institutions website to open your account. At some point, youll want to talk to a customer representative to find out whether the rollover and conversion can be done at once or if they are done sequentially. If its the former case, youll just have to pick your investments once. If its the latter, youll want to keep the money liquid in the IRA before converting to a Roth.

Once youve opened the IRA, you can contact the company managing your 401 account to begin the rollover process. You can do this online or over the phone. Your 401 plan administrator will then transfer your funds into your new IRA account. This is called a trustee-to-trustee or direct rollover, and its the easiest way to do it.

Another path is an indirect rollover. In this case, the balance of the account is distributed directly to you, typically as a check. Youll have 60 days from the date you receive the funds to transfer the money to your custodian or IRA company. If you dont deposit the funds within the 60 days, the IRS will treat it as a taxable withdrawal, and youll face a 10% penalty if youre younger than 59.5. This risk is why most people choose the direct option.

Recommended Reading: How To Open A Solo 401k