Re: Formula To Calculate A 401k Company Match

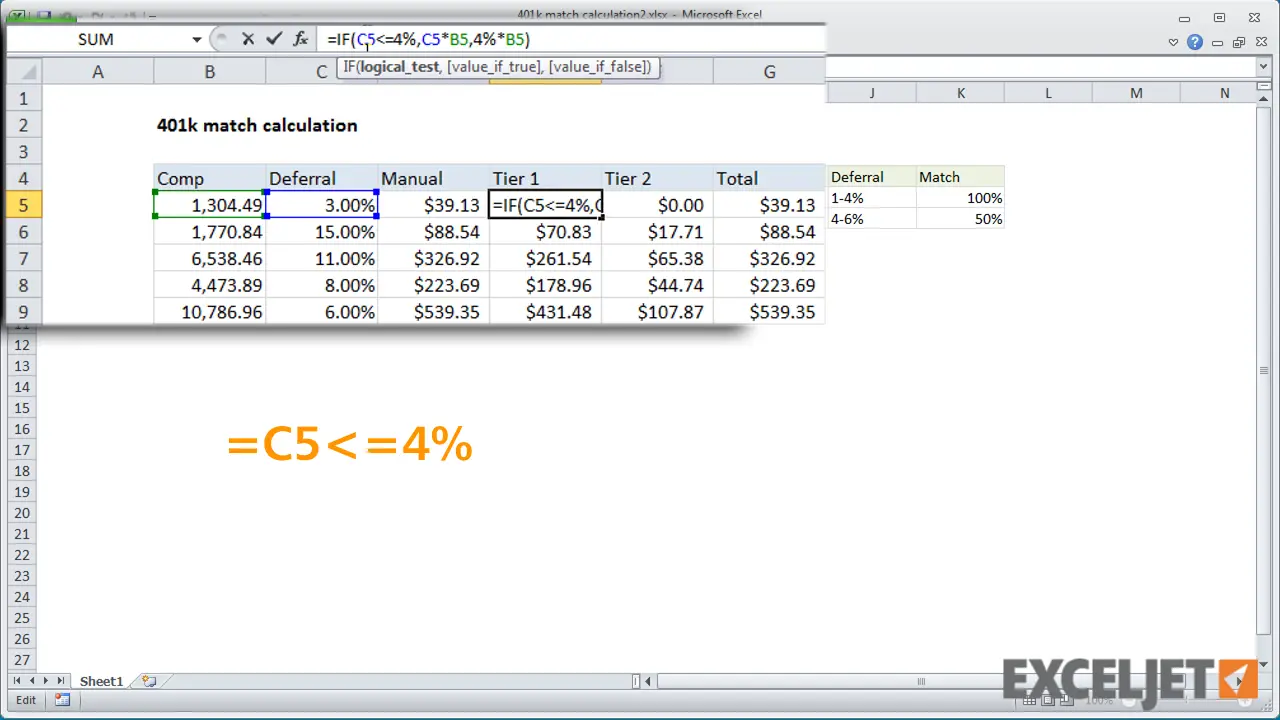

“Trish” wrote:> The company I work for will match employees 401K with the> following: The first 3% the company matches 100%, the 4th> and 5th % the company will match 50%. Does anyone know> a formula that will calculate this, I need to figure this> semi-monthly.I presume you mean that anything above 3% and less than orequal to 5% is matched at 50%. If the salary is A2 and thepercentage contribution is in B2:=A2*MIN + 50%*A2*MAX)or equivalently:=A2* + 50%*MAX))You probably want to put all that inside ROUNDDOWNor ROUNDDOWN to round down to dollars or cents.However, if you mean that anything under 4% is matched100% and anything between 4% and 5% inclusive is matchedat 50%, that is harder. Post again if this is your intent.

Calculate The Employer Match 401

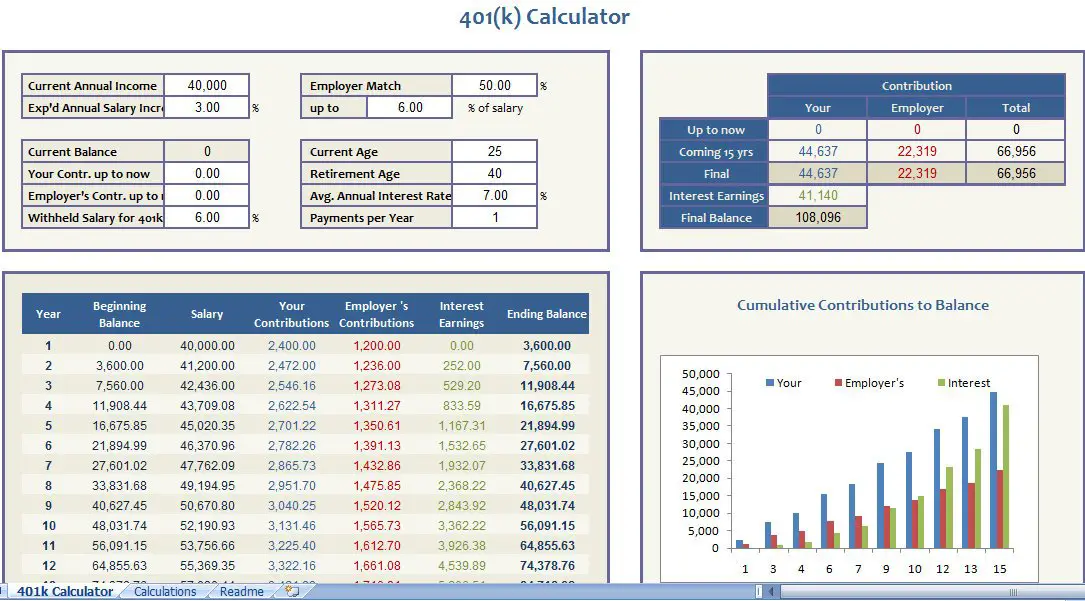

Calculating how much a matching policy would cost you isn’t idle number-crunching. It’s true that there are tax write-offs and credits for your contributions. Even so, money’s finite and a 6 percent dollar-for-dollar match for every employee might be more than you can afford.

An online 401 calculator is a simple solution, but you can figure the amount yourself easily enough. Say you have three employees making $50,000 each. If they each took a 6 percent contribution, that would be $3,000 apiece or $9,000 total. A full match would cost you $9,000, while a 50 percent partial match would cost you $4,500.

While you might flinch at the cost, particularly when you have 50 or 100 employees, the Betterment For Business website advises that it’s often a smart investment for the long term. Not only does it build employee loyalty, but it also makes it easier for older employees to step down and retire. That saves on your salary costs and health insurance coverage. That said, if you have to choose between offering a better match or a better salary, you have to judge what your business and workforce needs.

References

Scenario #: Contributing Your Entire Bonus In January

Upon learning you will be receiving a bonus, you decide to leave your monthly contribution rate at 19.5% and contribute your entire bonus to your 401 in January. Now, your first contribution of the year is $11,625, the next four are $1,625, and the last one is $1,375. You maximize your contributions by the end of June and are excited because starting in July you wont have to make any more contributions and your take-home pay will be much higher. That sounds great, but you find out at the end of the year that your employer only contributed $3,600. How could that be? Where is the other $3,000?

Heres where things get tricky. Many employers only match contributions on a per period basis. In these scenarios, the periods are monthly. This means that each month the employer looks at the compensation for that month and contributes up to 6% of that amount. Even though you contributed $11,625 in January, your employer could only contribute up to 6% of your pay for that period or $1,100. Your employer continued to match each of your other contributions , but after six months, you were no longer contributing therefore, the employer had nothing to match.

Scenario #4 | Salary: $100,000 January Bonus: $10,000| Month |

Recommended Reading: How To Find 401k From An Old Employer

Do Employers Really Match Contributions To 401s

Yes. And it has been the norm for several years now. In the 18th edition of its How America Saves report, Vanguard analyzed 1,900 defined contribution retirement plans plans) representing a total of 5 million participants and found that 95% of plans provide employer contributions, up from 91% in 2013.

Employers recognize the power of a 401 as a strong tool for attracting and retaining talent. 31% of employees value an employer-sponsored 401 over a salary raise, according to a Glassdoor poll. In addition, a 401 match contribution is tax-deductible for employers. Every dollar a company contributes to employees 401 plans is tax-deductible, providing ongoing tax benefits to companies.

Read Also: How To Get My 401k Early

How Does Employer 401 Matching Work

An employer 401 contribution match is one of the best perks going. An employer match is literally free money and with our good friend compound returns coming in clutch, it can make a serious difference in how much money youll have when you retire. Its kind of like being given magic beans without having to sell the cow.

Even better: This is no fairy tale. In fact, employer matches are pretty common. More than three-quarters of employers with fewer than 1,000 401 plan participants offer a match and that percentage only goes up the bigger the company and the plan.

If your employer offers a 401 match, heres what you need to know.

Also Check: How Often Can I Rollover 401k To Ira

What Are 401 Matching Contributions

If your employer offers 401 matching contributions, that means they deposit money in your 401 account to match the contributions you make, up to a certain threshold. Depending on the terms of the 401 plan, an employer may choose to match your contributions dollar-for-dollar or offer a partial match. Some employers may also make non-matching 401 contributions.

Matching contributions arent required by law, and not all employers offer them as part of their 401 plans. But according to Katie Taylor, vice president of thought leadership at Fidelity Investments, a 401 match can be a core employee benefit that helps an organization retain talent and build strong teams.

About 85% of the employers we work with offer some sort of matching contribution, said Taylor. The average employer contribution dollar amount into 401s in 2019 was $4,100, which equates to a little bit more than $1,000 per quarter.

Some 401 plans vest employer contributions over the course of several years. This means you must remain at the company for a set period of time before you fully take ownership of your employers matching contributions. Employers use vesting to incentivize employees to remain at the company. When you complete the schedule, you are said to be fully vested.

Matching Roth 401k Contributions

Some employers offer what is referred to as a Roth 401k in addition to a traditional 401k. Contributions to a Roth 401k are made with after-tax money, or in other words, money that youve already paid taxes on. Traditional 401k contributions are made with pre-tax money, or money that you havent paid taxes on yet.

What this means from a practical standpoint is that you can withdraw money from a Roth 401k tax-free after you retire. With a traditional 401k, youll have to pay income tax on withdrawals in retirement. However, traditional 401k contributions reduce your current taxable income, which reduces your current taxes Roth 401k contributions dont do this.

The contribution limits for Roth 401ks are the same as for traditional 401ks: up to $20,500 in 2022, or $27,000 if youre 50 years of age or over. Unlike Roth IRAs, there is not an income limit for participating in a Roth 401k. Note that employer matches to Roth 401k accounts are made into a traditional 401k.

Don’t Miss: What Is The Tax Rate On 401k After 65

Are There Rules For 401 Matches

Employees can make pre-tax contributions to a 401 plan up to the $20,500 maximum for 2020 and 2022 . Employer contributions may lead to a total contribution in excess of $20,500* that is, theyre outside the annual contribution limit applied to employees.

An employer is typically the one to set rules around their maximum contributions. Its largely driven by the matching formula and rules that the employer lays out.

One more caveat to know here: If the employee is also the employer, e.g., if they are self-employed, then an employee can contribute up to $57,000 for 2020 *, or 100% of their compensation, whichever is less.

*$20,500 if theyre under age 50 $27,000 is the annual contribution limit for employees if the employee is age 50 or older. $57,000 is the total if youre under age 50. If youre age 50 or older, the $6,500 catch-up contribution can be added on top.

How To Calculate The Employer Match In A 401

Employer 401k matching programs are smart employee investments because you have the option to maximize your retirement plan contributions for free. Some employers match your own plan contributions dollar-for-dollar, up to a certain percentage. The most common matching percentage a company authorizes is 3 percent of your gross income, although some companies authorize a matching portion on up to 5 percent of your gross income. Once you determine the amount your employer matches on your behalf, you can quickly calculate the amount of free money invested into your 401k plan.

Determine your elective contribution percentage. You may elect to defer any amount of your salary as a 401k contribution, up to the annual limit established by the IRS. As of the time of publication, the annual contribution limit for most employees is $16,500, but most employees select a flat percentage of gross income to contribute each paycheck.

Determine your employers match percentage. Your employer may select a matching percentage based on the type of 401k plan maintained by the company and the matching contribution limits. Your employers contribution percentage is disclosed on your 401k plan documents.

Pay attention to the maximum amount your employer contributes. For example, if your employer contributes a maximum of 3 percent of your compensation and you elect to contribute 6 percent of your compensation, your employer matching portion is still only 3 percent.

References

Recommended Reading: Can I Use My 401k To Buy Stocks

How Do I Maximize My Employer 401 Match

Many employees are not taking full advantage of their employer’s matching contributions. If, for example, your contribution percentage is so high that you obtain the $20,500 limit or $27,000 limit for those 50 years or older in the first few months of the year then you have probably maximized your contribution but minimized your employer’s matching contribution.

This information may help you analyze your financial needs. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy. Hypothetical illustrations may provide historical or current performance information. Past performance does not guarantee nor indicate future results.

How To Match Employee Retirement Contributions

A great benefit to offer your employees is a group retirement plan that allows them to save for their future. In Canada, most people are a part of a group registered retirement savings plan . This plan has its own set of advantages and disadvantages over other retirement plans, but it does allow employers to match their employees contributions. This extra benefit helps attract and keep employees, and it also gives your business a tax deduction for the years you match contributions.

Recommended Reading: What Is A Pension Vs 401k

What Do Small Employers Do

-

Some dont match. According to Vanguard, 25% of 401 plans at small businesses do not provide an employer contribution. Matching is not mandatory but many employers provide this benefit because it helps with recruiting and retaining talented employees and shows theyre investing in their employees future.

-

Some match right away some have a wait. Among small businesses that offer employees a 401 match, 19% of plans provide immediate employer-matching contributions 40% require one year of service before employer-matching contributions kick in.

-

The majority offer immediate vesting: 69% of plans offered by smaller businesses provide immediate vesting for employer-matching contributions .

Why Do Employers Match 401s Anyways

401s and other defined contribution plans are more cost-effective for the employer than managing a traditional pension plan funded entirely by the company, and are also preferred by most private-sector employees.

While an employer match is not required by the IRS, this company match can be a selling point for recruiting employees particularly if competing firms are offering a generous 401 matching plan.

Employers also get tax benefits for contributing to 401 accounts employer matches can be deducted on their federal corporate income tax returns, and theyre often exempt from payroll taxes and state taxes as well.

Read Also: How To Transfer 401k From Old Job

What Kind Of Investments Are In A 401

401 accounts often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your company match, and then direct any additional retirement savings contributions for the year into an IRA.

K Company Match Calculation

When an employee has a set dollar amount they contribute to each week and the company default is 3%, QuickBooks is not recognizing when the employee contribution is under that 3%. So the employer “match” is calculating at 3% which is often OVER the employee contribution. Thoughts?

Hi there, ShelleChristmasCPA.

Thanks for stopping by the Community for assistance. Your best bet at this point would be to reach out to our Support team for further assistance, this is because it sounds like there may be an error in the employee profile setup and our support team can dive into the account with you and see exactly where that error is occurring. To reach them, follow these steps.

Check our support hours and contact us. If you have any other questions or concerns, feel free to post them below. Thank you for your time and have a nice evening.

Also Check: How Much Will I Have When I Retire 401k

Suggested Next Steps For You

If you are not able to max out your 401k contributions, then the best strategy may be to contribute the minimum amount required to take advantage of your employers contributions.

Here are some steps you can take now, and for free, to help you manage and evaluate your 401k:

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

When To Use Matching Contributions

Employers commonly use matching contributions to meet the following 401 goals:

- Incentivize employees to make salary deferrals themselves.

- Meet safe harbor 401 contribution requirements with the least possible expense possible when low plan participation by employees makes a safe harbor matching contribution less expensive than the 3% safe harbor nonelective contribution.

However, nonelective contributions may be the superior alternative when trying to meet the following 401 goals:

- Provide a base retirement benefit to low wage workers that cant afford to save themselves

- Maximize business owner contributions with the least possible expense often, a new comparability profit sharing contribution is less expensive than a matching contribution in meeting this goal.

You May Like: How To Open Up A 401k

What Is 401k Matching

For most employees, a defined contribution plan is one of the primary benefits offered by their employer, with a 401k being the standard employer-sponsored retirement plan used by for-profit businesses. Employer matching of your 401k contributions means that your employer contributes a certain amount to your retirement savings plan based on the amount of your annual contribution.

Similarly, some employers use 403b or 457b plans. While there are some minor differences between these plans, they are generally treated in a similar manner, and they usually have the same maximum contribution limits.

The type of plan is based on the type of entity:

- 403b plans are used by tax-exempt groups, such as schools or hospitals.

- 457b plans are for government workers, although there are some non-governmental organizations that also qualify to use these plans.

Whether youre on your first job or are thinking about retirement, here are a few considerations to keep in mind when offered an employer match to your 401k contributions.

Can You Match Within A Roth 401

A Roth 401 is an employer-sponsored retirement plan in which contributions are taxed upfront, rather than at the time of withdrawal as in a traditional 401. Not every employer offers a Roth option. For those that do offer a match within a traditional 401, theyll likely offer the same matching formula within a Roth 401 they offer though regardless of whether you use a traditional or Roth 401 or both employer match contributions go into a traditional 401 account. Learn more about Roth 401s here.

Recommended Reading: How Do You Take A Loan Out Of Your 401k