What Is Roth After Tax

Roth after-tax contributions are a method of transferring to your retirement account that you can use to withdraw tax-free money from your account, as long as you have made 59 tax contributions at least five years previously. In addition to pre-tax contributions, Roth contributions are also available after-tax.

Roth 401k vs 401kWhy is Roth 401k over traditional? The Roth 401k is likely to make you richer than the traditional 401k and is one of the best investment decisions you can make as a young investor in your 20s and 30s in an uncertain future due to the benefits of leaving the franchise. Roth 401ks pile up and grow over time without paying taxes.What is the difference between pre tax and Roth 401k?Traditional pre-tax deductions of

When Can You Withdraw From 401k Or What Is The Earliest 401 Withdrawl Age

As per the rule participant may begin to withdraw money from their 401 once he or she reaches the age of 59 1/2 without paying 10% early withdrawal penalty. If you dont need money, you can wait till 70 1/2. But, once you reach the age of 70 1/2, but you have no option, but to withdraw your money from your 401.

Learn more about the 401 withdrawl strategies in this post.

If you would like further information, please visit www.sdretirementplans.com or call us at 866 639 0066.

Cpp Deductions On Payroll

The amount of your CPP employee contributions and CPP employer contributions will depend on how much you earn. You start your CPP employee contributions when you earn above the minimum amount, which is known as the basic exemption.

Both your CPP employer contributions and CPP employee contributions stop when you reach the maximum CPP contribution limit . Below are the details of the basic exemption amount and the maximum CPP contribution amount for 2021:

- Maximum annual pensionable earnings: $61,600

- Basic exemption amount: $3,500

- CPP employee contribution rate: 5.45%

- CPP employer contribution rate: 5.45%

- Maximum CPP employer contribution: $3,166.45

- Maximum CPP employee contribution: $3,166.45

What is the CPP deduction if you earn less than $3,500 in any year? In this case, there will be no CPP deductions required. And once you earn over $61,600, you will have reached your maximum CPP contribution for that year and will have no further CPP deductions from your paycheque.

There are CPP income tax calculators available to help you calculate your CPP contributions, but the math is fairly simple:

x 0.0545

Below are some examples of CPP deductions for different income levels:

|

Income Level |

| 5.95% |

You May Like: Can I Have A 401k And An Ira

Capital Gains Tax Rates

Selling an investment held within a retirement account can trigger a capital gains tax if the difference between the sale price and the purchase price of the investment is positiveyou realized a profit. Capital gains are treated as taxable income in the year you incur them, and they’re sometimes subject to their own tax rates.

Short-term capital gains on investments held for a year or less are taxed at ordinary income tax rates along with your other income. But long-term capital gains on investments you’ve held for more than one year are taxed at lower rates. You’ll pay either a 0%, 15%, or 20% tax rate on long-term capital gains, depending on your income and filing status.

- The 0% tax rate applies to long-term capital gains of no more than $40,000 for single filers, or $80,000 for married couples.

- The 15% tax rate is imposed on capital gains for singles with incomes from $40,001 to $441,450, or couples with incomes from $80,001 to no more than $496,600.

- The 20% tax rate applies only to single taxpayers with incomes above $441,450, or $496,600 for married taxpayers.

A married couple with $50,000 in taxable income could realize $30,000 in long-term capital gains and pay no tax on the gain.

Realizing a capital gain in years where you pay no tax on the gain is one of a few ways to earn tax-free investment income.

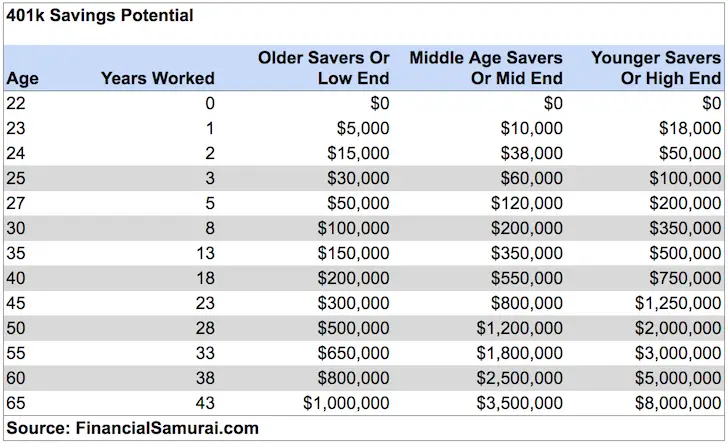

How Much Money Do You Need To Retire Comfortably At Age 65

Most experts say your retirement income should be around 80% of your final annual income before retirement. 1 This means that if you earn $ 100,000 per year in retirement, you need at least $ 80,000 per year to have a comfortable lifestyle after leaving the workforce.

How much money do I have at 65? At 65, you should have an amount of savings / net worth equivalent to 20X -25X your annual expenses. In other words, if you spend $ 50,000 a year, you should have around $ 1,000,000 to $ 1,250,000 in savings or equity to live a comfortable retirement life.

Recommended Reading: Do You Get Your 401k When You Quit

Series Of Substantially Equal Payments

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. It is named for the tax code which describes it and allows you to take a series of specified payments every year. The amount of these payments is based on a calculation involving your current age and the size of your retirement account. Visit the IRS website for more details.

The catch is that once you start, you have to continue taking the periodic payments for five years, or until you reach age 59 ½, whichever is longer. Also, you will not be allowed to take more or less than the calculated distribution, even if you no longer need the money. So be careful with this one!

Tax Treatment Of Lump Sum Benefits Paid By Retirement Funds

When you retire as a member of a pension fund, pension preservation fund or retirement annuity fund and you wish to take a portion of your retirement interest as a lump sum, you are allowed to take a lump sum equal to a maximum of one-third of the retirement interest in that fund. The remaining two-thirds will be paid out in the form of an annuity . However, if your total retirement interest in the fund does not exceed R247 500, you may take the full retirement interest as a lump sum.

Currently, when you retire and you are a member of a provident fund or provident preservation fund, your retirement interest is usually paid by way of a lump sum unless the rules of such a fund provide for the payment of an annuity on a members retirement. If you are already retired and in receipt of annuity income from a living annuity arrangement, you are allowed to commute the amount as a lump sum, if at any time the full remaining value of the assets becomes less than R125 000.

The retirement fund lump sum benefit for the 2020 tax year is taxed upon retirement using special tax rates, as indicated below:

| Taxable income from lump sum benefits | Rates of tax |

|

= 18% of = 18% of R132 000= R23 760 The normal tax on the lump sum of R682 000 therefore amounts to R23 760, and the net lump sum after tax would equal R658 240. |

Recommended Reading: Can Anyone Have A 401k

Avoid Taxes On Your 401 Rollover

Rolling over a 401 to an IRA or a new employer-sponsored retirement account isn’t considered a distribution as long as you do it properly. There are two ways you can go about it. The first is called a direct rollover. You provide your 401 provider with details about where you’d like your funds transferred, and they will automatically send the money to your new account. You may pay a one-time service fee for doing this. If you’re unsure how to get started, talk to your 401 plan administrator.

The other option is an indirect rollover. Here you withdraw all of the funds from your 401 yourself and then deposit them into your new account. As long as you deposit the funds into the new account within 60 days of the withdrawal, the government won’t consider it a distribution. But if you don’t deposit the money in time, or you fail to deposit the full amount you withdrew from your 401, the government is going to come around asking for its cut.

That’s why the direct rollover method is usually considered safer. You don’t touch the money at all, so you don’t have to worry about owing taxes right now. It is possible to do an indirect rollover without paying taxes as well, but make sure you deposit the new funds right away to avoid any issues.

Pre Tax Vs Roth Vs After Tax

Input Tax – Money is paid before tax and is taxed at the marginal tax rate when it is paid. Roth: The money is paid after taxes. Retirement benefits are generally tax deductible. Taxable: Money is paid after tax.

Etrade locationsWhat kind of bank is E * Trade Bank? The bank operates as a subsidiary of E*Trade Financial Corporation. According to the data from the Federal Deposit Insurance Corporation and depending on the type of constitutional institutions, E*TRADE Bank is classified as OTS, state or federal savings association.Where can I find E Trade in Florida?The current location is disabled. Learn more. There is currently no recent research, but

Don’t Miss: What Is The Best 401k Match

Spousal Rrsp Withdrawal Tax

You can contribute to a spouses RRSP until the final day of the calendar year they turn 71. When the money is withdrawn, the spousal RRSP holder is the one who is liable to pay the tax. However, if you contribute money and your spouse withdraws this money early, this is added to your taxable income, not theirs.

Early withdrawals include the year the withdrawal is made and the previous three years. You will have to report the subtotal of this amount as income.

Can I Withdraw Money From My Roth Ira And Put It Back

You can put funds back into a Roth IRA after you withdraw them, but only if you follow very specific rules. These rules include the return of funds within 60 days, which would be considered a rollover. Rollovers are only allowed once a year.

Can I withdraw money from my Traditional IRA and then return it? But you can make an IRA withdrawal and deposit the money back into the same account without penalty if youre careful. You have 60 days from the time you take a distribution from your IRA to replace it, either to the same account or to another qualified retirement account.

Also Check: How Often Can I Change My 401k Investments Fidelity

Transfer Or Rollover Options

You may be able to defer tax on all or part of a lump-sum distribution by requesting the payer to directly roll over the taxable portion into an individual retirement arrangement or to an eligible retirement plan. You may also be able to defer tax on a distribution paid to you by rolling over the taxable amount to an IRA within 60 days after receipt of the distribution. If you do a rollover, the regular IRA distribution rules will apply to any later distributions, and you can’t use the special tax treatment rules for lump-sums . For more information on rollovers, refer to Topic No. 413 and visit Do I Need to Report the Transfer or Rollover of an IRA or Retirement Plan on My Tax Return?

Basics Of Federal Income Tax Brackets

The U.S. uses a progressive tax system that consists of several tax brackets. Each of the brackets is associated with a span of income that’s taxed at that percentage. The brackets apply only to the amount of taxable income that remains after you subtract your standard deduction or itemized deductions and any exemptions you’re entitled to claim.

High-income individuals pay more in taxes as a percentage of their taxable incomes than low-income earners.

Your taxable income would be $72,000 if you’re a single filer with an income of $84,400, and if you take the 2020 standard deduction of $12,400. But the full $72,000 isn’t taxed at the same rate. A different tax rate is applied to different portions of that amount according to seven different tax brackets that are based on filing status.

Tax brackets range from 10% to 37% as of 2020. The 37% tax bracket might seem high, but it only applies to the highest earners.

Read Also: How To Find My 401k Balance

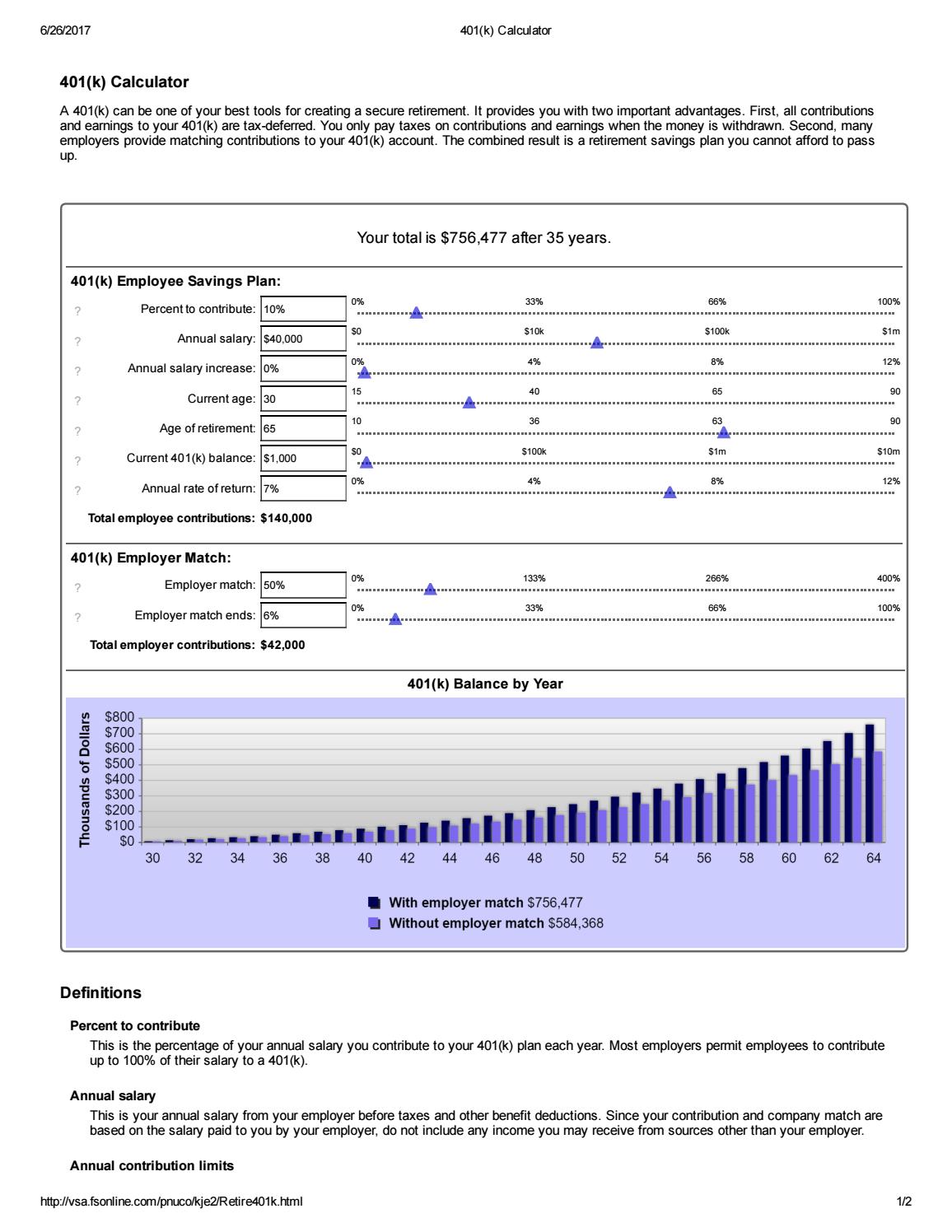

Taxes On Employer Contributions To Your 401

In addition to your contributions, an employer may also put money into your 401. Once that money is in your account, the IRS treats it the same as your contributions. You wont pay any taxes while the money is in your account, but you will pay income taxes when you withdraw it. Unlike your own contributions, you dont pay any payroll taxes when your employer contributes to your account. Its truly free money. It doesnt even count toward the $19,500 contribution limit for 2021.

A Note On Individual Retirement Accounts

If your employer doesnt offer a 401 and you decide to contribute to a traditional IRA instead, your taxes will work very similarly. However, your employer doesnt manage your IRA. You are responsible for making contributions, so your employer wont consider any of those contributions when reporting your earnings at the end of the year. Because your employer isnt excluding IRA money from your earnings, you will need to deduct your contributions on your tax return if you want to get the tax benefits. One big difference with 401 plans and IRAs is that IRAs have a much lower contribution limit. You can only deduct $6,000 in IRA contributions for the 2021 tax year. There are also income limits above which you cant contribute this full amount.

You May Like: Should I Do Roth Or Traditional 401k

What Are The Rules For A 401 Distribution

You can withdraw money from your 401 penalty-free once you turn 59-1/2. The withdrawals will be subject to ordinary income tax, based on your tax bracket. For those under 59-1/2 seeking to make an early 401 withdrawal, a 10% penalty is normally assessed unless you are facing financial hardship, buying a first home, or needing to cover costs associated with a birth or adoption. Under the 2020 Coronavirus Aid, Relief, and Economic Security Act, a hardship 401 distribution of as much as $100,000 was allowed, without the 10% penalty. However, the 10% penalty is back in 2021, and income on withdrawals will count as income for the 2021 tax year.

Topic No 558 Additional Tax On Early Distributions From Retirement Plans Other Than Iras

To discourage the use of retirement funds for purposes other than normal retirement, the law imposes an additional 10% tax on certain early distributions from certain retirement plans. The additional tax is equal to 10% of the portion of the distribution that’s includible in gross income. Generally, early distributions are those you receive from a qualified retirement plan or deferred annuity contract before reaching age 59½. The term qualified retirement plan means:

- A qualified employee plan under section 401, such as a section 401 plan

- A qualified employee annuity plan under section 403

- A tax-sheltered annuity plan under section 403 for employees of public schools or tax-exempt organizations, or

- An individual retirement account under section 408 or an individual retirement annuity under section 408

In general, an eligible state or local government section 457 deferred compensation plan isn’t a qualified retirement plan and any distribution from such plan isn’t subject to the additional 10% tax on early distributions. However, any distribution attributable to amounts the section 457 plan received in a direct transfer or rollover from one of the qualified retirement plans listed above would be subject to the additional 10% tax.

You May Like: How Much Is 401k Taxed

Are You Older Than 70 And Still Working Do A Reverse Rollover

According to Pew Research, Americans over 70 are working at higher rates than ever before. If this is you, then you might benefit from a reverse rollover.

A reverse rollover transferring funds from an IRA into your company 401k or 403b program is an interesting tax strategy if you:

- Have money in an IRA account that will be subject to Required Minimum Distributions

- Do not NEED or want to withdraw funds from your IRA accounts

- Have access to a 401k or 403b program where you are currently working

Learn more about other ways to reduce the impact of Required Minimum Distributions.

How Much Does Average 65 Year Old Have Saved

According to Federal Reserve data, the average amount of retirement savings for those 65 to 74 is just north of $ 426,000. While this is an interesting data point, your specific retirement savings may be different from someone elses.

What is the average 401K balance for a 65 year old?

| AGE |

|---|

| $ 64,548 |

How much money does the average person have in their 401k when they retire?

Average 401 balance: $ 11,800. Median 401 balance: $ 4,300. Many of the participants in this age group are starting to work and save for retirement.

What is a good 401k balance at age 60?

The goal is for you to live a good retirement life and not have to worry about money. Those 60 above the average should have at least $ 800,000 in their 401k if theyve saved and invested diligently. However, the average 60-year-old has over $ 170,000 in their 401k.

You May Like: How Much Should You Put In Your 401k