When A Withdrawal Penalty Applies

While you can take money out of your 401 without penalty for a few reasons, you’ll typically still pay income taxes on it. What if you just want to take the money out to do some shopping before you’ve reached age 59 1/2, or before age 55 if the Rule of 55 applies to you? Well, the IRS will hit you with a 10% penalty on top of taxes. That means that expenses such as a new car or a vacation don’t count as reasons to take out your 401 savings.

What To Do After Maxing Out Your 401 Plan

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Marcus Reeves is a writer, publisher, and journalist whose business and pop culture writings have appeared in several prominent publications, including The New York Times, The Washington Post, Rolling Stone, and the San Francisco Chronicle. He is an adjunct instructor of writing at New York University.

If you’ve already reached your 401 contributions limit for the yearor soon willthat’s a problem. You can’t afford to fall behind in the funding-retirement game. Also, losing the contribution’s reduction in your gross income isn’t going to help your tax bill next year, either. These pointers will help you decide how to handle maxing out your contributions and hopefully avoid a large tax burden.

Can I Put W2 Income In A Solo 401k

Therefore, you can make both your employee and profit sharing contributions to the solo 401k plan based on your W-2 wages since your self-employed business is and LLC taxed as an S-corp. and you dont employee any full-time W-2 employees without having to take into account the previous w-2 employee.

Recommended Reading: Can I Use My 401k To Buy Investment Property

Contributions: How Much Is Enough

Please fill out all required fields

Email addresses provided will be used only to let the recipient know who sent the web content. The information will not be used for any other purpose by Securian Financial.

Thank you for sharing

Your message has been sent.

When you land your first full-time job, chances are your employer will offer you the chance to contribute to a 401. Should you participate? And, if so, how much should you contribute?

If youre lucky enough to work for a company that offers a 401, most financial experts will recommend that you participate in the plan and that you do so as soon as possible. Heres why.

Contributing To Your 401 Plan

As part of enrolling in a 401, you must decide how much you are going to contribute to the plan each year. There are some limits on the upper end, and your employer may require a minimum contribution if you want to join the plan.

But you may find that the critical question is what percentage of your earnings you are willing to commit to retirement savings. Many experts in the retirement field believe a ballpark amount is somewhere around 10 percent of your earnings. But it can be more or less, depending on your personal circumstances. If your company offers a match, you should contribute at least enough to get the full benefit of the match, otherwise you are leaving money on the table. And keep in mind that even if you are automatically enrolled at a certain level , this is often a minimum amount to save for a secure retirement. Consider increasing this amount, perhaps significantly, to give yourself a better shot at accumulating a robust retirement nest egg.

Don’t Miss: Can You Leave Money In 401k At Your Old Job

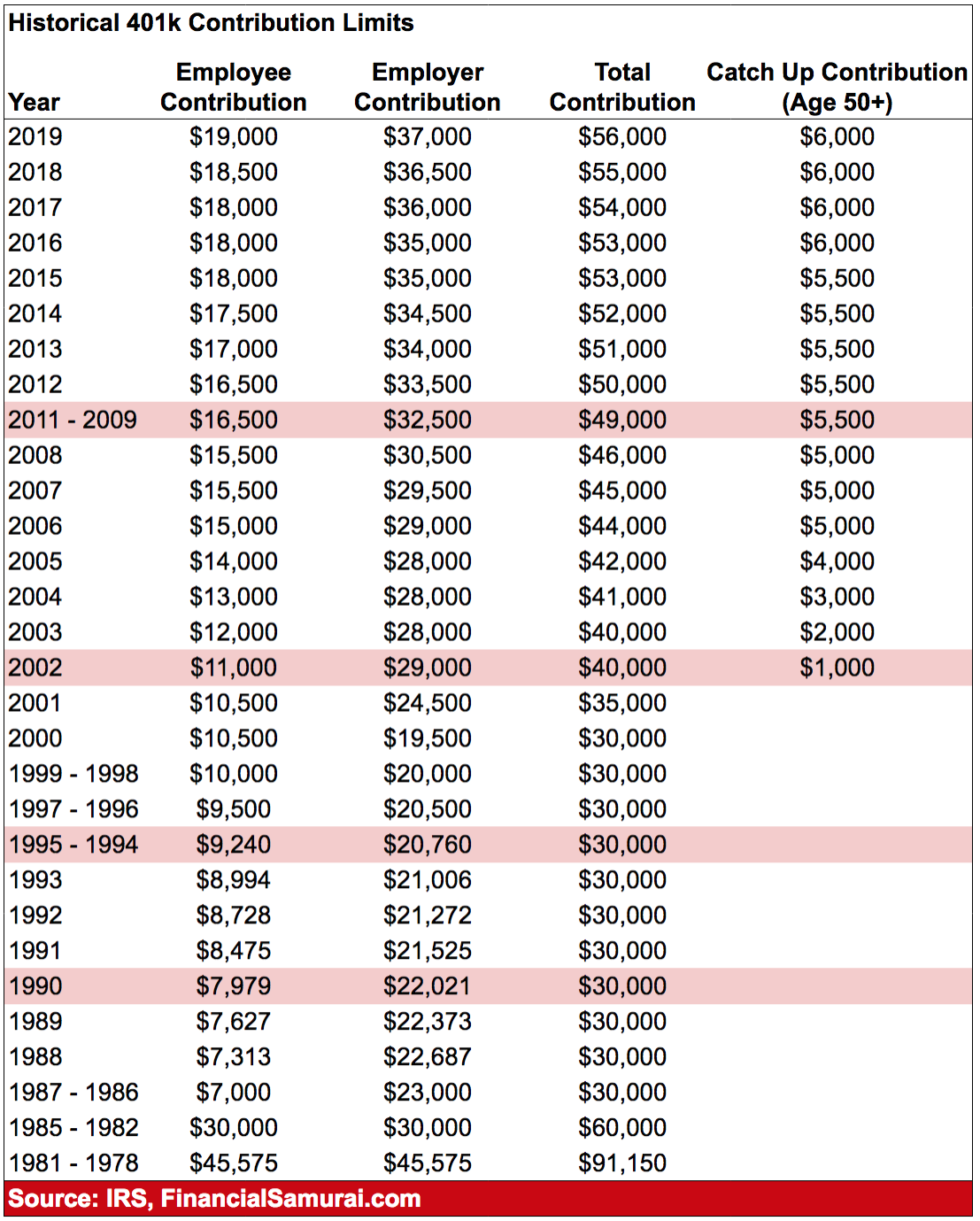

Contribution Limits Rules And More

Your 401 contribution limits are made up of three factors:

- Salary-deferral contributions are the funds you elect to invest out of your paycheck.

- Catch-up contributions are additional money you may pay into the plan if you are age 50 or older by the end of the calendar year.

- Employer contributions consist of funds your company contributes to the plan also known as the “company match” or “matching contribution,” they may be subject to a vesting schedule.

There are two types of limits. One is a limit on the maximum amount you can contribute as a salary deferral. The other limit is on the amount of total contributions, which includes both your and your employer’s contributions.

Retirement Savings Plan Contribution Limits

The information below summarizes the retirement plan contribution limits for 2021.

| Plan |

|---|

More details on the retirement plan limits are available from the IRS.

457 Plans

The normal contribution limit for elective deferrals to a 457 deferred compensation plan is unchanged at $19,500 in 2021. Employees age 50 or older may contribute up to an additional $6,500 for a total of $26,000. Employees taking advantage of the special pre-retirement catch-up may be eligible to contribute up to double the normal limit, for a total of $39,000.

401 Plans

The total contribution limit for 401 defined contribution plans under section 415 increased from $57,000 to $58,000 for 2021. This includes both employer and employee contributions.

401 Plans

The annual elective deferral limit for 401 plan employee contributions is unchanged at $19,500 in 2021. Employees age 50 or older may contribute up to an additional $6,500 for a total of $26,000.

The total contribution limit for both employee and employer contributions to 401 defined contribution plans under section 415 increased from $57,000 to $58,000 .

403 Plans

The annual elective deferral limit for 403 plan employee contributions is unchanged at $19,500 in 2021. Employees age 50 or older may contribute up to an additional $6,500 for a total of $26,000.

The total contribution limit for both employee and employer contributions to 403 plans under section 415 increased from $57,000 to $58,000 .

IRAs

Recommended Reading: How To Make More Money With My 401k

Don’t Leave Your 401 Match On The Table

You should always begin saving in your 401 if your company offers you a matching contribution. This is additional money your employer gives to you to help you pay for your retirement, but you only get it if you put money into your 401 first.

Check with your company’s HR department if you’re unsure how its matching system works. Find out how much you have to contribute in order to get the full match. Then figure out how many pay periods it will take you to set aside enough money based on your monthly savings goal.

The Daily Money: Get our latest personal finance stories in your inbox

If you have to contribute $3,000 of your own money to get the full match and you’re setting aside $150 per pay period, it will take you 20 pay periods to claim your employer 401 match. That’s where your retirement savings should go, for the first part of the year at least.

The exception to this rule is if you aren’t fully vested in your 401 plan and you plan to leave your job soon. Quitting before you’re fully vested could cost you your 401 match, so you may not gain anything by putting your money here versus another retirement account. Check with your HR department to learn more about its vesting schedule.

Retirement: See how 2022 changes to 401Ks, IRAs will benefit you

Provisions For Changing Jobs

Most 401 plans permit the employee who terminates employment the options of receiving the 401 balance in a lump sum or to receive periodic payments or to roll over the proceeds to an IRA or other employer-sponsored retirement plan. Additionally, some 401 plans permit the terminated employee to retain their 401 balance in their former employer’s plan. Amounts that are retained in a former employer’s 401 plan or transferred to another employer’s plan or IRA postpone the taxation until amounts are subsequently distributed from the plan or IRA the money was rolled into.

When receiving funds from a 401 with the intention to roll the amount to an IRA:

- The rollover must be completed in 60 days.

- Employers must withhold 20% of the proceeds as a withholding tax. It is up to the participant to make up this 20%, or it will be treated as a distribution. The money withheld will be used as a credit against any income tax liability.

- Neither the 60-day rule nor the 20% withholding apply to amounts directly transferred to an IRA or other qualified plan.

Don’t Miss: What Is 401k In Usa

The Results Can Be Pretty Incredible

Of course, many self-employed people don’t have the ability to contribute the maximum amount allowed to a solo 401. However, even modest contributions add up over time.

For example, let’s say that you’re self-employed and that you’ll have $80,000 in net self-employment income for 2021. You decide to set aside a total of 10% of your net self-employment income in a solo 401. Not only could this reduce your taxable income by $8,000 for the year, but if you repeat the process every year, you could end up with a retirement nest egg of more than $928,000 after 30 years — and that assumes just 2% annual income increases and a historically conservative 7% annual rate of return.

Imagine if you decided to invest even more. With a solo 401, you can dramatically reduce your taxable income while building up a million-dollar nest egg.

How Much Can You Contribute To A 401

The most you can contribute to a 401 is $19,500 for 2021 . Employer contributions are on top of that limit. These limits are set by the IRS and subject to adjustment each year.

That limit dictates how much you can contribute, but it doesnt tell you how much you should contribute. To figure that out, consider the following.

Recommended Reading: How To Manage Your 401k Yourself

What Is Considered A Good 401 Matching Contribution

Many employers and employees consider a good 401 match to be an employer contribution of 50 cents for each dollar an employee contributes for up to 6% of the employees pay, which is why this is the most common 401 matching contribution. This is typically considered a generous matching contribution since the average matching contribution is 4.3% of an employees salary.

Overall Limit On Contributions

Total annual contributions to all of your accounts in plans maintained by one employer are limited. The limit applies to the total of:

- elective deferrals

The annual additions paid to a participants account cannot exceed the lesser of:

However, an employers deduction for contributions to a defined contribution plan cannot be more than 25% of the compensation paid during the year to eligible employees participating in the plan .

There are separate, smaller limits for SIMPLE 401 plans.

Example 1: In 2020, Greg, 46, is employed by an employer with a 401 plan, and he also works as an independent contractor for an unrelated business and sets up a solo 401. Greg contributes the maximum amount to his employers 401 plan for 2020, $19,500. He would also like to contribute the maximum amount to his solo 401 plan. He is not able to make further elective deferrals to his solo 401 plan because he has already contributed his personal maximum, $19,500. He would also like to contribute the maximum amount to his solo 401 plan.

Also Check: How To Transfer 401k From Old Job

Working With Your Financial And Tax Professionals

A 401 plan can become the cornerstone of a personal retirement savings program, providing the foundation for future financial security. Consult your financial and tax professionals to help you determine how your employer’s 401 and other savings and investment plans could help make your financial future more secure.

Important NoteEquitable believes that education is a key step toward addressing your financial goals, and we’ve designed this material to serve simply as an informational and educational resource. Accordingly, this article does not offer or constitute investment advice and makes no direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your needs, goals and circumstances are unique, and they require the individualized attention of your financial professional. But for now, take some time just to learn more.

Please be advised that this material is not intended as legal or tax advice. Accordingly, any tax information provided in this material is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transactions or matter addressed and you should seek advice based on your particular circumstances from an independent advisor.

What’s the next step for you?

A financial professional can help you decide. Let’s talk.

How Much Can You Contribute To A 401k If You Are Over 50

For 2021, your 401 individual contribution limit is $ 19,500 or $ 26,000 if youre 50 or older.

What happens if you contribute more than 57000 to 401k?

If the excess contribution is returned to you, any earnings included in the returned amount should be added to your taxable income on your tax return for that year. Excess contributions are taxed at 6% per annum for each year excess amounts remain in the IRA. Any income earned on the excess contribution.

How much can a 50 year old individual themselves contribute to their 401 K plan?

If you are 50 or older, your maximum 401 contribution is $ 26,000 in 2021 , because you are granted $ 6,500 in payback contributions.

What is the maximum age for 401k contributions?

Employees 50 years of age or older can make 401 recovery contributions up to $ 6,500 for a maximum possible 401 contribution of $ 26,000 in 2021. Those aged 50 and over can also deposit an extra $ 1,000 into an IRA or $ 7,000 total for 2021.

Prev Post

Read Also: Should You Move Your 401k To An Ira

Understanding 401 Plan Contribution Limits

The 401 plan and the variations mentioned above are all long-term savings plans designed to help people build their retirement savings. They are all qualified plans, in IRS speak. That means they have certain tax benefits for the employee, the employer, or both.

The tax advantage for employees, in most cases, is that their contributions are deducted from gross income, not net income. That reduces take-home pay. Less take-home pay means lower taxes, softening the blow, and the money goes into an investment account week after week, building long-term net worth.

For some 401 plans, employers can match some percentage of their employees contributions, but its strictly voluntary. Among employers who offer a match, the average was about 4.7% of the employees gross salary at the end of the first quarter of 2020, according to Fidelity Investments. This is effectively a 4.7% salary bonus, and any personal financial advisor will tell you that its nuts not to take full advantage of it.

Contributions to 401s and other retirement plans are limited by the IRS to prevent highly paid workers from benefiting more than the average worker from the tax advantages they provide.

Sit Back And Celebrate

Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value.

Consumer and commercial deposit and lending products and services are provided by TIAA Bank®, a division of TIAA, FSB. Member FDIC. Equal Housing Lender.

The TIAA group of companies does not provide legal or tax advice. Please consult your tax or legal advisor to address your specific circumstances.

TIAA-CREF Individual & Institutional Services, LLC, Member FINRA and SIPC , distributes securities products. SIPC only protects customers securities and cash held in brokerage accounts. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association of America and College Retirement Equities Fund , New York, NY. Each is solely responsible for its own financial condition and contractual obligations.

Teachers Insurance and Annuity Association of America is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 3092.

TIAA-CREF Life Insurance Company is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 6992.

Read Also: Can You Contribute To 401k And Roth Ira

Can Both Spouses Contribute To 401k

Can you and your spouse contribute to a 401? Find out what IRS rules say, and the various options you have as a married couple.

When saving for retirement, married couples often have an advantage over single people due to the power of numbers. However, it can be challenging for married couples to decide where and how much to contribute when one spouse is the breadwinner or both spouses are working. The IRS provides various guidelines to guide how retirement savers can contribute to their retirement accounts to maximize their savings.

The IRS requires that 401 accounts must remain in each personâs name, and you cannot combine two 401s belonging to two spouses. Each spouse can have a 401 of their own and in their name. If both spouses are working, they can participate and contribute to the employerâs 401 plan. Married couples filing jointly must decide how much they will contribute to their respective retirement accounts to avoid exceeding the IRS contribution limit. For 2021, the IRS 401 contribution limit is $19,500 or $26,000 if you are age 50 or older. If the employer provides a match, the IRS limit is $58,000, or 64,500 if you are age 50 or older.