The Risks Of A Rollover

Before people roll over their 401 funds to an IRA, however, they should consider the potential consequences. “Consider the costs inside the 401 funds versus the total cost of an IRA,” including advisor fees and commissions, urges Terry Prather, a financial planner in Evansville, Ind.

Prather raises another, noteworthy scenario. A 401 typically requires a spouse to be named as the primary beneficiary of a particular account unless the spouse signs a waiver provided by the plan administrator. An IRA doesn’t require spousal consent to name someone other than the spouse as the primary beneficiary.

“If a participant is planning to remarry soon and wants to name someone other than the new spouse as the beneficiarychildren form a prior marriage, perhapsa direct rollover to an IRA may be desirable,” Prather says.

When A 401 Hardship Withdrawal Makes Sense

Many workers count on their 401s for the lions share of their retirement savings. That’s why these employer-sponsored plans shouldn’t be the first place you go if you need to make a major expenditure or are having trouble keeping up with your bills.

But if better options are exhaustedfor example, an emergency fund or outside investmentstapping your 401 early may be worth considering.

Taking Money Out Of A Retirement Account May Have Financial Penalties

There are different rules on early withdrawals depending on the type of account. The type of account you want to take money out of will determine the penalties.

401

You maybe able to withdraw funds from your 401 via a loan or hardship withdrawal, but there may be plan limitations on these withdrawals. Note loans must be repaid, and hardship withdrawals are subject to a 10% penalty and income tax. If you have a 401 plan from a previous employer you may be able to access that savings with less restrictions but early withdrawals before age 59 1/2 are subject to the same 10% penalty and income taxes.

Traditional IRA

Traditional IRAs are subject to similar penalties and taxes on distributions as the 401 is, but the exceptions are a little more relaxed. For example, first time home buyers can take out $10,000 from their Traditional IRA without paying the 10% fees. You do still need to pay income tax on this withdrawal though. The same applies for qualified education expenses and health insurance premiums while unemployedyou wont pay the 10% fee, but you will pay income taxes.

Roth IRA

You May Like: What Is Max Amount To Contribute To 401k

Cares Act 401 Early Withdrawals

The CARES Act contains a provision allowing those who are under age 59 ½ to take a distribution from their retirement plan while working, waiving the 10% penalty that would normally be associated with this type of distribution.

The distributions are still subject to income taxes, but these taxes can be spread over a three-year period. You can re-contribute some or all of the money taken via this route over a three-year period and avoid some or all of these taxes.

These distributions require that you document that COVID-19 has impacted you or a family member. This means that you or a family member has contracted the virus or that you or a family member has been financially impacted by COVID-19 in ways that might include a job loss or reduced income. For a 401 plan, the ability to take these distributions is not automatic, your employer needs to adopt this as a provision of the plan.

Substantally Equal Period Payments

Substantially equal period payments may be another option for withdrawing funds without paying the early distribution penalty. SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

Don’t Miss: How To Get Money Out Of 401k Without Penalty

How To Get Money Out Of A 401

posted on

Youve done a good job of saving money, but nobody ever explained the process of taking money out of a 401. If youre like most people, the priority has been adding funds.

Your ability to get money out of a 401 depends largely on two factors:

You might want to pull your money out for several reasons, including:

- Youve stopped working at the company and youre going to roll your funds elsewhere

- Youre unhappy with the plan and the investments available

- You need the money for bills, medical expenses, or an emergency

- Youre going to use the funds elsewhere

Your reason for pulling money out of a 401 can be important. With certain optionslike the hardship distribution described belowyou may need to qualify. So keep that in mind as you read through the options.

Also Check: How Much Should I Have In My 401k At 55

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

Recommended Reading: Can I Borrow From My 401k

Things To Consider When Withdrawing From Your 401 At Age 55

A common question people ask is, When can I withdraw money from my 401? After all, you worked hard for many years, and its only natural to want to know when you can reap the benefits of that time and effort.

You can technically withdraw money out of your 401 at any age. But if you take out money before youre at least age 59 ½, then your withdrawal will incur a 10% penalty in addition to the income taxes you must already pay.

However, you do have an opportunity to dig into your 401 starting at age 55 and not pay penalties on that withdrawalprovided you meet two criteria:

- You are no longer employed by the company with whom the 401 is affiliated

- You left that employer during or after the calendar year in which you reached age 55

Keep these four things in mind if youre thinking about taking 401 withdrawals from an old employer planbetween the ages of 55 and 59 ½:

Medical Expenses Or Insurance

If you incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you are able to pay for them out of an IRA without incurring a penalty.

For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year then the penalty will likely be waived.

You May Like: Does A 401k Rollover Count As A Contribution

Disadvantages Of Closing Your 401k

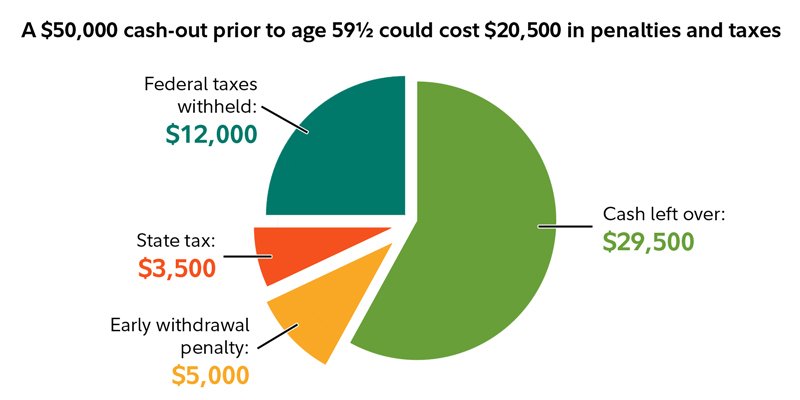

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

Withdrawing Money From A 401 After Retirement

Once you have retired, you will no longer contribute to the 401 plan, and the plan administrator is required to maintain the account if it has more than a $5000 balance. If the account has less than $5000, it will trigger a lump-sum distribution, and the plan administrator will mail you a check with your full 401 balance minus 20% withholding tax.

Before you can start taking distributions, you should contact the plan administrator about the specific rules of the 401 plan. The plan sponsor must get your consent before initiating the distribution of your retirement savings. In some 401 plans, the plan administrator may require the consent of your spouse before sending a distribution. You can choose to receive non-periodic or periodic distributions from the 401 plan.

For required minimum distributions, the plan administrator calculates the amount of distribution for the qualified plans in each calendar year. The 401 may provide that you either receive the entire benefits in the 401 by the required beginning date or receive periodic distributions from the required date in amounts calculated to distribute the entire benefits over your life expectancy.

Read Also: How To Increase 401k Contribution Fidelity

Penalties For Home And Tuition Withdrawals

Under U.S. tax law, there are several other scenarios where an employer has a right, but not an obligation, to allow hardship withdrawals. These include the purchase of a principal residence, payment of tuition and other educational expenses, prevention of an eviction or foreclosure, and funeral costs.

However, in each of these situations, even if the employer does allow the withdrawal, the 401 participant who hasn’t reached age 59½ will be stuck with a sizable 10% penalty on top of paying ordinary taxes on any income. Generally, youll want to exhaust all other options before taking that kind of hit.

“In the case of education, student loans can be a better option, especially if they’re subsidized,” says Dominique Henderson, Sr., owner of DJH Capital Management, LLC, a registered investment advisory firm in Cedar Hill, Texas.

How Does A Cares Act 401k Withdrawal Work

Plan participants should speak to their plan administrator to ask about the process for requesting a 401k or IRA withdrawal. The participant may need to complete a withdrawal form and provide documentation to substantiate the nature of their hardship.

The request will need to be approved by either a committee or a designated person responsible for making hardship-withdrawal decisions. If the participant qualifies for a hardship withdrawal based on IRS regulations, the plan administrator will process the request. Depending on the plan administrator, approving and processing the hardship request can take several weeks. For that reason, a hardship withdrawal may not be a great option for the most time-sensitive financial needs.

If the participant doesnt qualify for the distribution, the administrator will deny the request and notify the participant.

Prior to the CARES Act, plans would automatically withhold 20% of early withdrawals for tax purposes. The CARES Act eliminated the 20% automatic withholding on 401k withdrawals. However, participants may want to avoid spending the full amount withdrawn in order to have funds available to cover the tax bill later.

Also Check: How To Find Your 401k Account Number

Taxes For Making An Early Withdrawal From A 401

The minimum age when you can withdraw money from a 401 is 59.5. Withdrawing money before that age results in a penalty worth 10% of the amount you withdraw. This is in addition to the federal and state income taxes you pay on this withdrawal.

There are exceptions to this early withdrawal penalty, though.

If you want to remove money from a 401 account without paying taxes, you will need to meet certain criteria. According to the IRS, you generally dont have to pay income tax or an early withdrawal penalty if you experience an immediate and heavy financial need. One situation where this may apply is when you have medical expenses that arent reimbursed by your insurance and which exceed 7.5% of your adjusted gross income . If this happens, you dont have to pay taxes on the money you withdraw to cover that financial need. There are also other exceptions, such as for disabled taxpayers. The IRS provides a more complete list of situations where you wont pay tax on early withdrawals.

The big caveat here is that the amount you can withdraw tax-free is exactly enough to cover the cost of this financial need. And youll still pay the full income tax on your withdrawal only the 10% penalty is waived.

Do You Pay Tax On 401 Contributions

A 401 is a tax-deferred account. That means you do not pay income taxes when you contribute money. Instead, your employer withholds your contribution from your paycheck before the money can be subjected to income tax. As you choose investments within your 401 and as those investments grow, you also do not need to pay income taxes on the growth. Instead, you defer paying those taxes until you withdraw the money.

Keep in mind that while you do not have to pay income taxes on money you contribute to a 401, you still pay FICA taxes, which go toward Social Security and Medicare. That means that the FICA taxes are still calculated based on the full paycheck amount, including your 401 contribution.

You May Like: Should I Get A 401k

Would Pulling Your Money Out Keep It Safer

Although market downturns are relatively common, it still may seem like a smart idea to pull your money out before prices fall. While that strategy makes sense, its much tougher to pull off than it may seem.

Its easy to look back in hindsight and wish youd pulled your money out of the market right before it crashed. But in the moment, its nearly impossible to know when, exactly, prices will drop. Market crashes can be unpredictable and unexpected, and even the experts dont always know when theyll happen.

If you withdraw your money at the wrong time, it could be a costly mistake. Say youre worried the market will crash soon, so you pull all your money out today. But the market doesnt crash, and instead, stock prices continue going up. You decide to reinvest your money, but because prices have increased, you end up paying more for your investments than what you sold them for.

Or, say you pull your money out of the market but choose not to reinvest because youre worried prices will fall soon. When your money isnt invested, its not growing as much as it could. And the longer you wait to get started investing again, the more youre limiting your earning potential.

Read Also: How Do I Take Money Out Of My Voya 401k

Understanding Early Withdrawal From A 401

The method and process of withdrawing money from your 401 will depend on your employer and the type of withdrawal you choose. Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It’s really a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available. If it is, then you should check the fine print of your plan to determine the type of withdrawals that are allowed or available.

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay normal income taxes on the withdrawn funds. For a $10,000 withdrawal, once all taxes and penalties are paid, you will only receive approximately $6,300. There are some non-penalty options to consider, however.

Before deciding upon taking an early withdrawal from your 401, find out if your plan allows you to take a loan against it, as this allows you to eventually replace the funds. You may also want to consider alternative options for securing financing that could hurt you less in the long run, such as a small personal loan.

Also Check: What Is A 401k For Dummies

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.