How Much Makes A Good Retirement Fund

Many experts believe that your retirement fund should be 80% of your pre-retirement income per year for the years you plan on being in retirement. Youd need $80,000 per year in retirement to live comfortably if you have a pre-retirement income of $100,000. You should have $1.6 million at the time of retirement if you plan on being in retirement for 20 years and you want to live comfortably throughout that time.

Charles Schwab: Best 401 Low

Charles Schwab offers both a full-service 401 plan customized to your company and the option to add investment advisory services to an existing 401. Charles Schwab has both a broker-dealer and banking subsidiary, so it can provide a full range of financial services. It also offers its own proprietary mutual funds and ETFs to plan participants, along with other investment options.

With zero dollar trading fees, Charles Schwab gets our nod for the best low-to-no fee provider. This is extremely attractive for 401 owners who want to trade stocks or bonds in their accounts.

Human Interest In The Media

| 401 Best Practices: 5 Things Growing Businesses Need to Know | Similar to health insurance and other employee benefit or wellness programs, if the employees need to jump through too many hoops or pay too much out of pocket to get the full advantage of the benefit, then its not truly a program that adds value to your HR teams goals. |

Recommended Reading: How To Diversify 401k Portfolio

Best For Large Business: T Rowe Price

T. Rowe Price has been in the business for over 80 years, and they offer excellent 401 plans for companies with up to 1,000 employees.

They boast access to over 5,400 low-cost funds, which on average have lower expense ratios than the rest of the industry. If you are in the nonprofit or tax-exempt space, T. Rowe Price offers a wide variety of 403 plans in addition to their 401 options.

Employers who sign on with T. Rowe Price gain access to mutual funds, bond funds, target-date funds, and stock funds, none of which charge sales fees.

Pros:

-

Abundance of mutual funds with no transaction fees

-

Options for nonprofit retirement and tax-exempt 403 plans

-

Robust retirement education resources for customers

Cons:

-

Not ideal for active investors

-

Fewer ETF options than competitors

Best For Flexibility: American Funds

The great thing about a 401 plan from American Funds is that you can tailor it to fit almost any type of business. Start-ups, mergers, and well-established firms can create retirement plans using its services.

It also has several retirement plans available, including growth funds and growth-and-income funds .

Other funds available are equity-income funds and balanced funds that look to conserve capital and create current and long-term growth. You can also invest in stocks, bonds, and other fixed-income securities.

The firm also offers access to bond funds, which seek to create fixed income with capital growth as a secondary goal.

Also Check: What Is The Minimum Withdrawal From 401k At Age 70.5

Sentinel Benefits & Financial Group

Sentinel Benefits & Financial Group is headquartered in Wakefield, Massachusetts, and it provides investment advisory, retirement plan administration, actuarial consulting, and other wealth planning and life planning services.

As a recordkeeper, Sentinel Benefits & Financial Group administers more than $9.25 in assets, and it serves more than 175,000 individuals. Notable employers who use Sentinel Benefits & Financial Group include Compass Medical, Harvard Management, Wood Mackenzie, Select Equity Group, and Village Care of New York.

How To Find Affordable Small Company 401k Plans

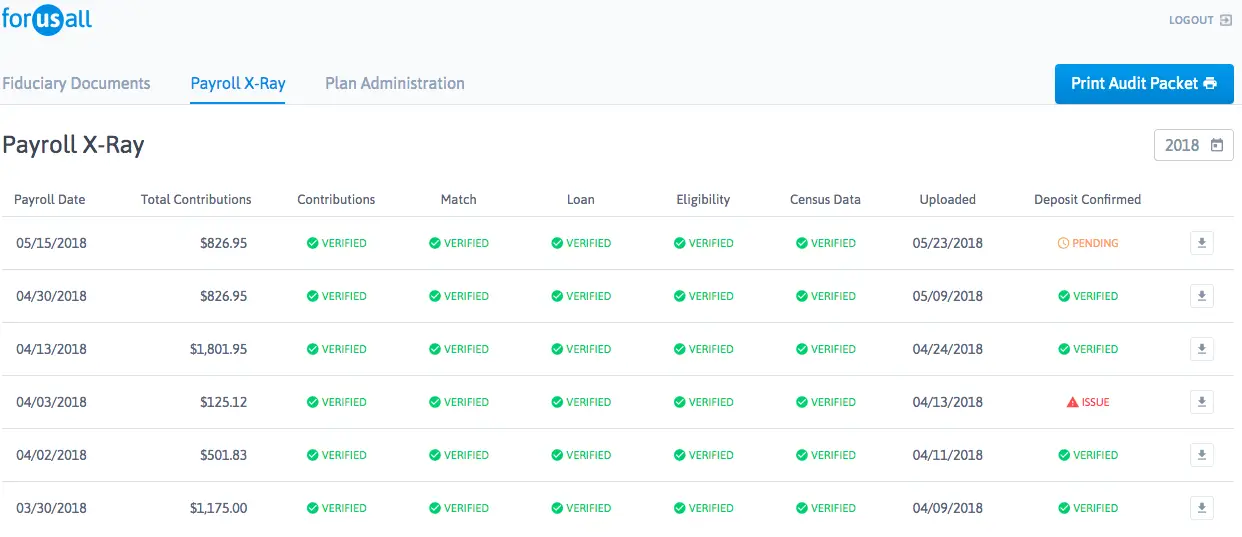

Self-employed people have long been able to create low-cost solo 401k plans. However, small businesses with more than one employee havent always had similar affordable options.Setting up a 401k requires legal documentation to set up the plan. It also requires ongoing maintenance to manage employee and employer contributions, pay fees, and file tax-related paperwork. The companies listed in this article have all created technology that limits the amount of human intervention required to set up and maintain retirement plans for small businesses.

Theyve created boilerplate forms to simplify the setup process. Once the plans are set up, the companies integrate plan maintenance with payroll technology , so small business owners dont need a new HR person just to manage the new plan. Typically, the plan providers also have websites setup, so employees can manage their accounts and contributions online.These technologies offer massive benefits to small business owners who want a simple, straightforward 401k plan for their employees. Some of the companies offer a few different plan versions so business owners can decide which suits their needs. The pricing listed in this article reflects the current pricing for these standard plans.

The companies may be able to offer customizations , but those were not listed on the sites. Small business owners looking for a white glove experience should expect to pay higher prices than those listed below.

Don’t Miss: Can I Transfer My 401k To Another Company

Best For Combined Services: Adp

ADP is another 401 provider that offers combined services for small employers. It offers 401 plans, payroll, insurance, human resources, tax filing, and other services. It specializes in small companies with up to 49 plan members and offers several 401 plans for businesses.

Advisor services are available to help you select the suite of products your company needs. Employers who switch to ADP from another firm have the option to transfer their plans over.

The 401 plans offer flexible options to invest in many mutual funds or other investment types. They offer three investment portfolio samples to help members choose:

- You can choose from a basic sample line-up for investors with little desire to manage their experience.

- A standard sample line-up helps investors who want to be somewhat involved in the experience.

- An advanced sample line-up helps you pick funds or investments that give you more options to tailor and manage your plan.

Investors can ask for help when choosing a plan or ask that a plan is chosen for them. Once enrolled, there is a useful mobile app that allows access to accounts from all devices.

Why A Solo 401k

You might be asking why I’m considering a solo 401k versus a SEP IRA or other self employed retirement savings options. Well, it all comes down to circumstance and how much you can save.

Let’s look at two scenarios that are similar to mine. First, in the past, I only saved in a because my income was lower and I was still maxing out my 401k at work, so I didn’t need any additional employee contributions.

With both a SEP and Solo 401k, on $30,000 of income, the employer contribution is $5,576.11. Since I was already doing the $18,000 at my primary employer, that amount didn’t make a difference.

However, fast forward to today, the business makes much more income, and my wife is now working for the business. As such, it can make a huge difference in savings and lowering our taxes. Let’s assume that the business is going to make $100,000 this year. That means that the business can contribute $18,587.05 to both my 401k and my wife’s 401k. Plus, my wife can contribute $18,000 of her salary to the 401k as well .

As such, the solo 401k provides much more savings options, and lower taxes today as a result.

Also Check: How To Cash Out Your 401k Fidelity

First Off Whats A 401k Plan

401k plans are retirement accounts offered by many U.S. employers to their employees. To contribute to a 401k, youd typically ask your employer to deposit a certain amount of your paycheck into the account. Depending on the plan, youll either have that money invested for you or choose how to invest the funds yourself.

401k plans are tax-advantaged, which is a big benefit compared to a traditional investment account. Youll either only pay taxes on the amount you initially contribute or pay taxes once you withdraw funds from the account . In comparison, a traditional investment account. Not all employers offer a Roth 401k, so if youre earlier in your career and expect to earn more in the future, you should look for an employer that offers a Roth 401k to make the most of your money. And if you make more than the income limit for a Roth 401k , you might want to see if your company offers Roth conversions, also known as backdoor or mega backdoor Roth IRAs.

Top 401k Providers For Startups And Small Businesses

The best 401k solutions along with key features, benefits, recommendations, and more.

If you run a startup, offering a retirement plan as part of your employee benefits package is a good way to attract and retain top talent, especially in today’s increasingly challenging job market.

- 88% of employees say a 401 is a must-have benefit when looking for a job.â

- 76% of workers who are offered a 401 retirement plan participate in it.â

- 6 in 10 workers are likely to switch to a nearly identical job if it offers a âretirement plan/a better retirement plan.â Itâs important to note that this study found flight risk to be greatest among millennials as 71% of them shared that sentiment.

While the benefits of offering 401 plans to employees are many, administering those plans is fairly complex. Companies can easily set themselves up for penalties and audits if they donât follow all the rules and requirements set in place by the Internal Revenue Service and the Department of Labor .

To reduce your liability and streamline the administration of your retirement benefits, you may want to consider adding a 401k solution to your HR Tech stack. This guide is meant to help your team pick the right 401 solution for your business while avoiding the relevant pitfalls.

We put in the effort to make this guide awesome

28

Featured in

Also Check: What Is The Interest Rate On A 401k

Differences From A Sep

If you work for yourself, you may already have opened a Simplified Employee Pension.

Here are a few of the key differences to be aware of:

- A SEP-IRA can have more than one participant.

- A SEP-IRA does not offer a catch-up contribution for those who are 50 or over.

- Employee deferral contributions are not allowed with a SEP-RA.

Analyzing Your 401 Fees Compared To The Best 401 Plans

The best 401 plans for providers may not be the same as the best 401 plans for individuals. Your employer likely pays a hefty administration fee to your account administrator in addition to the fees you pay. But for now, we are more concerned about what you pay than what your employer pays.

To get the best analysis of your 401 fees, we recommend Personal Capitals fee analyzer tool.

Signing up for an account is 100% free and within minutes, and the built-in 401 fee analyzer that shows how much you are paying in fees and how you stack up compared to other 401 plans.

Don’t Miss: Should I Roll My 401k Into An Ira

What Are Your Choices For A Rollover

In general, once you leave a job you have three choices for how to deal with your employer-sponsored retirement plan:

- Leave it with your old employers 401 plan: This approach requires the least amount of work, but may require you to have a minimum amount if you plan to maintain the account there.

- Roll it over into your new employers 401 plan: This approach will require you to file some paperwork, but youll have all your 401 money in one place. This choice can make sense if you like your new employers plan.

- Roll it over into an IRA: This move will require you to file some paperwork, but then youll have the complete freedom to invest the money as you see fit. If you liked the investment options you held in a previous plan, you may still be able to access those via an IRA.

, thats another option for a rollover. But this option is not typical for most individuals.)

If you roll over your 401 into an IRA, youll also want to consider the kind of rollover you need.

- With a Roth 401, youll likely be more interested in a Roth IRA, so that you can maintain the substantial advantages of that plan.

- If you have a traditional 401, then youll probably opt for a traditional IRA.

Best For Mutual Funds: Vanguard

Vanguard

Vanguard is well known for its own mutual funds and ETFs. If you prefer investing in Vanguard funds, a Vanguard Individual 401 plan gives you easy access with no trade costs, making the company our review’s best choice for mutual funds.

-

No fee to establish an account

-

Trade the Vanguard family of funds with no commissions or load fees

-

Roth contributions allowed

-

$20 annual fee for each Vanguard fund held in this type of account

-

401 loans are not supported

If youre looking to stick with a well-respected list of mutual funds from Vanguard, choose the Vanguard Individual 401. The account doesnt have an annual fee on its own for accounts with at least $10,000 in Vanguard funds. It charges a $20 annual fee below that balance plus a $20 annual fee for each Vanguard fund held in the account. Depending on how you invest, this fee can add up fast and could be a reason to consider buying those Vanguard funds elsewhere. You can also trade stocks and ETFs with no commission, in addition to options and fixed-income investments.

Vanguards founder, the late John Bogle, is credited as a pioneer in index investing, bringing the first index fund to market in 1976. Vanguard remains a leader in investment funds as the second-largest asset manager in the world with $6.2 trillion under management.

Read our full Vanguard review.

Recommended Reading: What Do I Need To Rollover My 401k

Charles Schwab Solo 401k

Schwab is another discount brokerage that offers a prototype solo 401k plan for free. Since Schwab is continually working to improve their image in the low-cost brokerage space, I was interested to see what they offered.

I was disappointed to learn that Schwab only offers traditional 401k contributions – they do not have a Roth option on their plan. They also do not offer loans under their plan.

It appears that you can rollover a 401k into your Schwab solo 401k, but you cannot do an IRA rollover.

Schwab does offer a lot of investing options, including Vanguard mutual funds and commission free ETFs.

There are no fees to open the solo 401k, and there are no yearly maintenance fees. Inside the 401k, traditional Schwab pricing applies – $0 per stock trade, with $0 on Schwab funds and ETFs.

Learn more about Charles Schwab in our Charles Schwab Review.

Dont Be Overwhelmed When Shopping For A 401k Provider

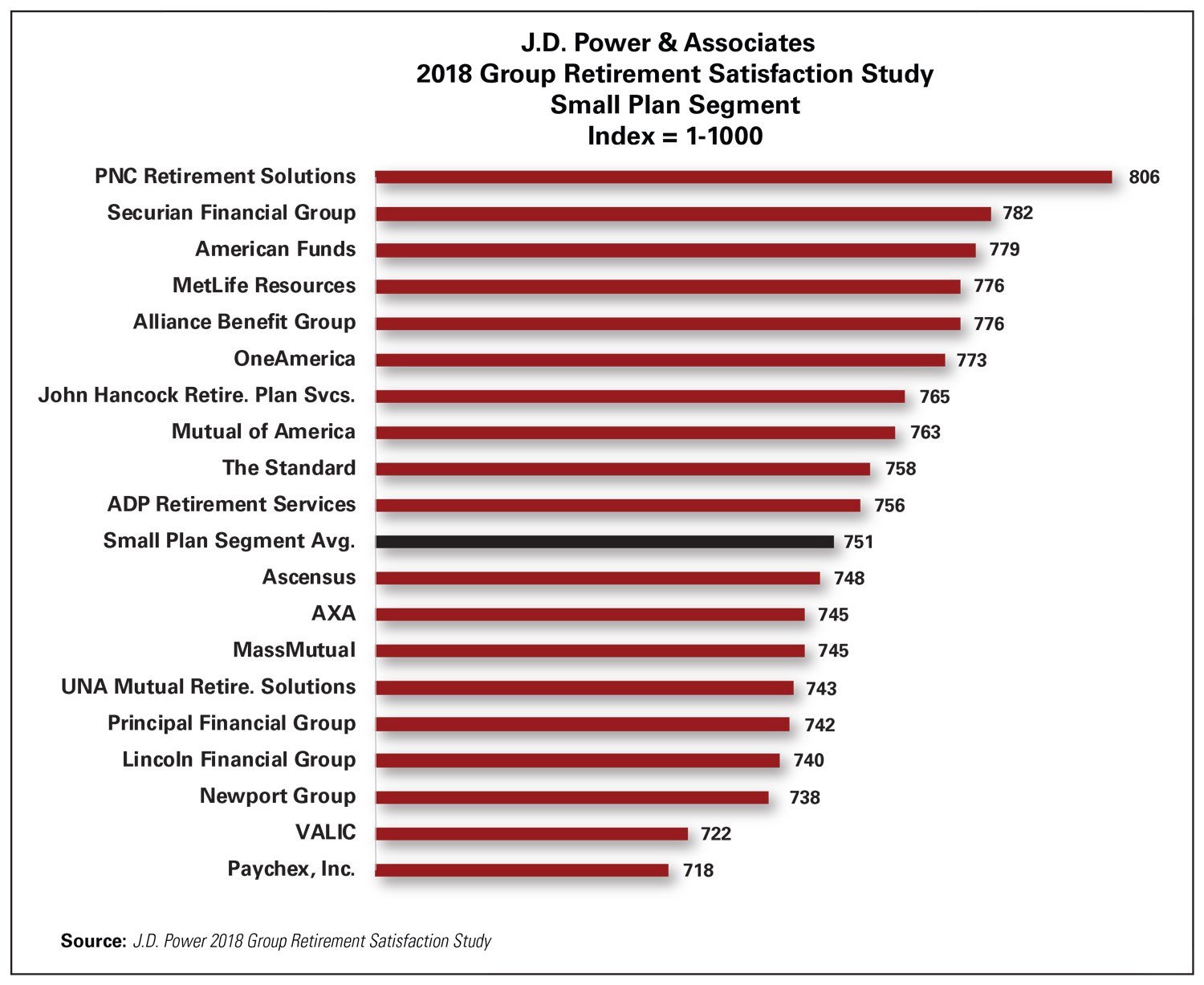

Shopping for a new 401k provider can be a challenge for 401k fiduciaries, given the thousands of providers in the U.S. – each with different fees, services, and expertise. Making matters worse is the technical nature of 401k services, which can make it hard for fiduciaries to pick a provider they can trust.

To keep shopping simple, I recommend 401k fiduciaries use a 3-step process to evaluate quantitative provider attributes while looking for the 4 key traits of the best small business 401k providers.

Don’t Miss: How To Invest 401k With Fidelity

What Is A 401 Advisor Vs A 401 Provider Vs A Recordkeeper

At ForUsAll, when we think about small and mid-sized businesses, we tend to think less about the assets that a company has and more about the employee base. A company with 25 employees is usually pretty different than a company with 250 employees, and a business owner at a successful, 20 person consulting firm thinks about her 401 differently than the HR manager at a 400 person manufacturing company. The HR infrastructure, workforce composition, etc. are likely very different if not unique at each of those businesses. While the assets at each of these companies is likely correlated with the employee count, using assets is a rather crude way to determine if a plan is associated with a small business or a mid-sized business.

The ability to think about each company as an individual entity, with specific needs, is where a 401 advisor like ForUsAll can help. As an independent 401 advisor, ForUsAll is focused on helping small and mid-sized businesses get the most out of their 401. Some of the responsibilities of a 401 advisor include:

Setup & Plan Administration

While Bank of America and Merrill Edge provided several different financial services, Merrill Edge is predominantly a discount brokerage arm and trading platform. As a 401 provider, Merrill handles many services seamlessly, including:

- Plan administration

- Trading

- Account reporting

While Merrill is not a payroll provider, it does make it easy to coordinate contributions to your plan by setting up automatic contributions for employees as well as cash sweeps for employer matching and any profit sharing.

Also Check: When Can I Move My 401k To An Ira

Biggest 401k Companies In America

The 10 biggest 401k companies in America, such as Charles Schwab Corp , are likely responsible for handling that nest egg youre trying to grow on your way to a comfortable retirement.

Everyone wants to retire comfortably and with money to spend on vacations and hobbies, not to mention the medicine and treatments theyll likely need as they get older. Hence, a retirement plan is an important consideration when it comes to the compensation of the average American employee. Hence, if a company wants to keep its best employees with a good compensation package, it is good for the company to select a reputable 401k plan provider. Because while the 401k package will ultimately depend on the company, a good 401k company can also help with keeping track of benefits and assets tied with the plan.

JCStudio/Shutterstock.com

Plansponsor, an online information source on Americas retirement benefit providers, has conducted an annual survey on the monetary and operational performance of the 55 retirement plan providers for the past 19 years. For its latest survey, Plansponsor looked into figures for the providers statements regarding their retirement plan services. These 55 providers of defined contribution recordkeeping services account for more than $6 trillion in assets and are estimated to represent approximately 85% of the total defined contribution market. The figures in the latest survey were as of December 31, 2016.