Tax Consequences Of A 401

As mentioned above, you generally wont have to pay any taxes on your 401-to-IRA rollover. The only time youll have to deal with taxes is if you have a traditional IRA and want to roll over to a Roth IRA.

One other tax consideration: You can choose to do a direct or indirect rollover. For a direct rollover, your old plan sends the money directly into your new IRA. In an indirect rollover, your old plan sends you a check with the cash and withholds 20% of your funds. These withheld funds are a taxable distribution unless you make up the difference out of pocket. Youll likely have to pay a 10% fine for the early withdrawal. This rule only applies if the check is sent directly to you, though. It doesnt matter if your old plan sends you a check to forward to your new IRA.

Larry Mcclanahan Financial Advisor

A rollover generally refersto “existing” retirement account funds being transferred while a contributiongenerally refers to “new” funds being deposited.

From a moretechnical standpoint, its a rollover when funds are transferred from aretirement plan to an IRA. Moving funds between similarplans is a “transfer.” Butthe term “rollover” has come to be loosely used for almost anymovement of funds between retirement plans/accounts.Finally, some 401 documents will refer to “rollover contributions” to identify retirement funds that were transferred in to the plan and which would, of course, not be subject to any of the plan’s vesting requirements.

And 2021 Contribution Limits

If youre an employee, in 2021, you may contribute up to $19,500 of your own money to a 401 and $26,000 if youre 50 or older.

These are the 2020 and 2021 limits for specific retirement plans, including 401, 403, 457, and a Thrift Savings Plan.

The limit on total contributions from both the employee and employer cant exceed the lesser of 100% of the employees salary or $58,000 for employees younger than age 50 and $64,500 for those age 50 or older.

Don’t Miss: What Is Ira And 401k

More Details On Ira Contributions

With Roth and traditional IRA contributions, limits are imposed per taxpayer, not per account. That means an individual may not contribute $6,000 to a Roth IRA and an additional $6,000 to a traditional IRA in 2021. Instead, one may contribute a total of $6,000 split across the different IRAs, say $4,000 to a Roth IRA, and the remaining $2,000 to a traditional IRA.

Spousal IRAs are regular IRAs that married couples who file jointly may participate in.

Married couples can also contribute the same amounts to a spousal IRA for a non-working spouse, as long as one spouse earns enough income to cover both contributions.

Which Types Of Distributions Can I Roll Over

IRAs: You can roll over all or part of any distribution from your IRA except:

Retirement plans: You can roll over all or part of any distribution of your retirement plan account except:

Distributions that can be rolled over are called “eligible rollover distributions.” Of course, to get a distribution from a retirement plan, you have to meet the plans conditions for a distribution, such as termination of employment.

Don’t Miss: How To Tell If You Have A 401k

How To Do A Rollover

The mechanics of rolling over 401 plan are easy. You pick a financial institution, such as a bank, brokerage, or online investing platform, to open an IRA with them. Let your 401 plan administrator know where you have opened the account.

There are two types of rollovers: direct and indirect. A direct rollover is when your money is transferred electronically from one account to another, or the plan administrator may cut you a check made out to your account, which you deposit. The direct rollover is the best approach.

In an indirect rollover, the funds come to you to re-deposit. If you take the money in cash instead of transferring it directly to the new account, you have only 60 days to deposit the funds into a new plan. If you miss the deadline, you will be subject to withholding taxes and penalties.

Some people do an indirect rollover if they want to take a 60-day loan from their retirement account.

Because of this deadline, direct rollovers are strongly recommended. Nowadays, in many cases, you can shift assets directly from one custodian to another, without selling anythinga trustee-to-trustee or in-kind transfer. If, for some reason, the plan administrator can’t transfer the funds directly into your IRA or new 401, have the check they send you made out in the name of the new account care of its custodian. This still counts as a direct rollover. However, to be safe, be sure to deposit the funds within 60 days.

Is A Roth 401k Worth It

The Roth 401k is likely to make you richer than the traditional 401k and is one of the best investment decisions you can make as a young investor in your twenties and thirties in an uncertain future due to the benefits of divesting the franchise. Why the Roth 401k is the best 401k system. Roth 401ks pile up and grow over time without paying taxes.

Dont Miss: How Do I Cash Out My 401k With Fidelity

Also Check: What Should I Do With My Old Company 401k

How Do I Complete A Rollover

Contact Your Old 401 Plan Administrator To Begin The Rollover Process

To transfer funds from your old 401, youll need to get in touch with your former employers plan administrator and indicate that you want to roll over your account.

There are two ways for administrators to transfer your funds to your rollover destination: direct and indirect rollover.

Direct rollover: A direct rollover is the easiest way to roll over your 401. If this is available to you, its the best option to avoid any pitfalls that could result in taxes and penalties.

With a direct rollover, you provide the administrator of the prior 401 plan with the information for the receiving account for your funds, and they transfer the funds to the new 401 account directly.

Sometimes you might receive a check made out to your new IRA or 401 plan, and its your responsibility to forward the check to the appropriate party. If you have any questions about where to send the check, you can contact your new 401 plan administrator or your IRA brokerage for clarification.

Indirect rollover: The other option is an indirect rollover. Instead of transferring funds directly from your old 401 to your rollover destination, the plan administrator sends the funds to you. You are then responsible for depositing the funds in the amount of your old 401 into your rollover account.

You May Like: Can You Use Your 401k To Buy Real Estate

How Much Can I Roll Over If Taxes Were Withheld From My Distribution

If you have not elected a direct rollover, in the case of a distribution from a retirement plan, or you have not elected out of withholding in the case of a distribution from an IRA, your plan administrator or IRA trustee will withhold taxes from your distribution. If you later roll the distribution over within 60 days, you must use other funds to make up for the amount withheld.

Example: Jordan, age 42, received a $10,000 eligible rollover distribution from her 401 plan. Her employer withheld $2,000 from her distribution.

If you roll over the full amount of any eligible rollover distribution you receive :

- Your entire distribution would be tax-free, and

- You would avoid the 10% additional tax on early distributions.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: Where Is My 401k Money Invested

Ira Contribution Limits For 2021 And 2022

9 Minute Read | November 12, 2021

The past couple years have been a wild ride! Even with all the crazy going on, you have to stay focused on your retirement goals. And an important part of making sure those goals are on track is knowing how much IRA contribution limits are in 2021. Theres still time left in the year to max out your contributions, if you havent already.

When we talk about contribution limits for a Roth or traditional IRA, were just talking about how much money you can legally put into the account each year.

So, what are the 2021 IRA contribution limits, and what factors affect those limits? We’ll break it down for you.

What Is A 401

A 401 is a retirement savings plan offered by employers that allows workers to defer a portion of their paycheck into a long-term investment account. Some employers match a portion of contributions, while others just provide the 401 accounts themselves. By investing your money, you let it grow through the power of compound interest. A 401 is just a handful of tax-advantaged retirement savings vehicles available. Other options include an IRA for self-managed retirement savings, a 403 for public school employees and tax-exempt organizations, a 457 for state and local government employees and some non-profit employees, and a TSP for federal government employees.

Recommended Reading: How Do I Know If I Have Money In 401k

A Roth 401 Rolled Into Another Roth 401

If you roll your old Roth 401 to a new Roth 401, the specific distribution rules from the new account will vary by the plan itself your new employer’s human resources department should be able to assist with this.

However, some basic conditions apply. If you decide to roll over the funds from your old Roth 401 to your new Roth 401 through a trustee-to-trustee transfer , the number of years the funds were in the old plan should count toward the five-year period for qualified distributions. However, the previous employer must contact the new employer concerning the amount of employee contributions that are being rolled over and must confirm the first year they were made.

Note, too, that the rollover generally must be complete in order for the new funds to enjoy the carryover of the time period from the old Roth 401. If an employee did only a partial rollover to the new Roth 401, the five-year period would start again. That is, you do not get credit for the period the funds were in your old Roth 401.

Before making a decision, speak to your tax or financial advisor about what may be best for you. One option could even be leaving the Roth 401 in your previous employer’s plan, depending on the circumstances and that plan’s rules.

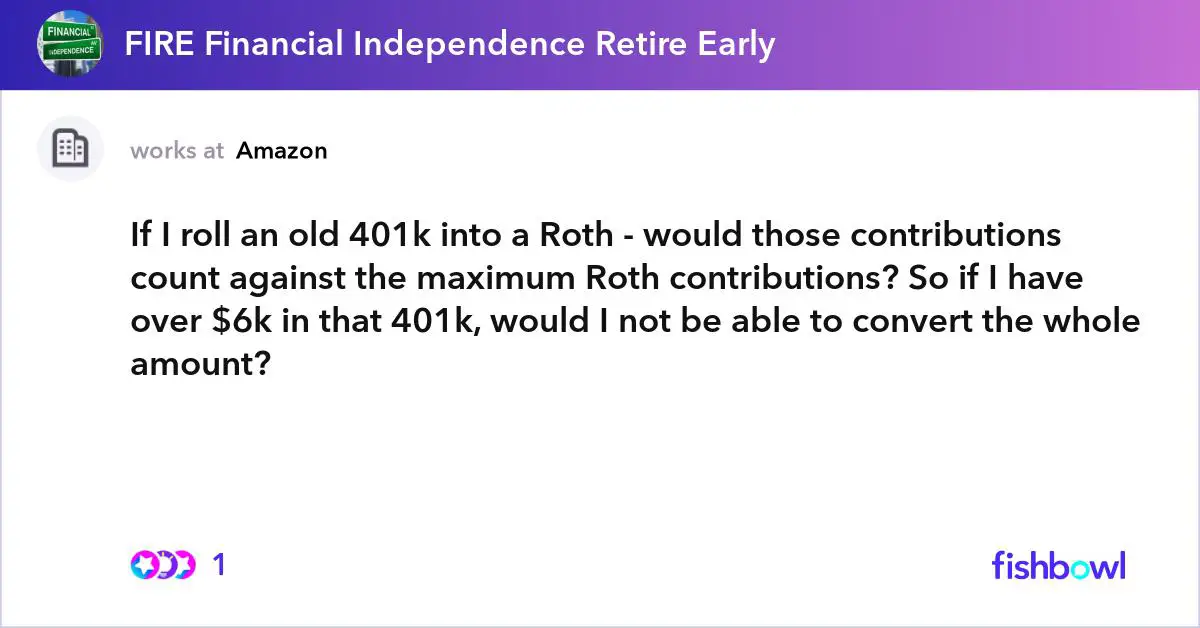

Rollovers Dont Count Against Limits

If you have money in other qualified retirement accounts, such as a traditional IRA, 401, 403 or even another Roth IRA, youre allowed to move the money to a Roth IRA. These rollovers dont count as contributions, so they dont reduce the amount that you can contribute each year. For example, if you roll over $15,000 from another qualified retirement plan to a Roth IRA, you can still make your annual contribution to your Roth IRA.

You May Like: How Do I Take Out My 401k

How To Fix Excess Ira Contributions

If you realize youve contributed too much money to a single IRA account, or a combination of accounts, there are several ways to reverse the excess contributions. But it’s important to act fast because failure to meet deadlines can trigger stiff penalties.

Those who contribute too much to an IRA will annually face a 6% penalty until they correct the mistake.

If you discover your mistake after filing income taxes for the year, you can remove the excess contribution within six months and file an amended return by October 15. Alternatively, you can reduce the following years contribution by the excess amount. For example, if you errantly contributed $8,000 one year, you can reduce your contribution by $2,000 the following year. But remember that carrying forward the excess this way subjects you to that 6% penalty until the excess is absorbed.

Transferring Your 401 To Your Bank Account

You can also skip the IRA and just transfer your 401 savings to a bank account. For example, you might prefer to move funds directly to a checking or savings account with your bank or credit union. Thats typically an option when you stop working, but be aware that moving money to your checking or savings account may be considered a taxable distribution. As a result, you could owe income taxes, additional penalty taxes, and other complications could arise.

IRA first? If you need to spend all of the money soon, transferring from your 401 to a bank account could make sense. But theres another option: Move the funds to an IRA, and then transfer only what you need to your bank account. The transfer to an IRA is generally not a taxable event, and banks often offer IRAs, although the investment options may be limited. If you only need to spend a portion of your savings, you can leave the rest of your retirement money in the IRA, and you only pay taxes on the amount you distribute .

Again, moving funds directly to a checking or savings account typically means you pay 20% mandatory tax withholding. That might be more than you need or want. Most IRAs, even if theyre not at your bank, allow you to establish an electronic link and transfer funds to your bank easily.

Recommended Reading: How To Rollover My Fidelity 401k

Also Check: How To Roll 401k Into Roth Ira

Traditional 401 Vs Roth 401 Contributions

If you have a traditional 401 and Roth 401, these retirement accounts have different tax treatments. With a traditional 401, you will get a tax break on your income when you contribute to the retirement account. For example, if your annual salary is $50,000, and you contribute to a 401 up to the allowed limit of $19,500, your taxable income will be $30,500.

In contrast, if you contribute to a Roth 401, you will not get a tax break. This is because a Roth 401 is funded with after-tax money, meaning that you contribute money on which taxes have been taken out. If you take a distribution from a Roth 401 after attaining retirement age, you wonât pay any income taxes on the distribution. Also, if your employer offers a 401 match, the matching contributions cannot be added to a Roth 401. Instead, the employer contributions are added to a traditional 401.

Reasons To Roll Your Money Into An Ira

When you have a lot of retirement accounts in a lot of different places, its hard to a) wrap your mind around where you actually stand and b) make sure that everything you own is properly diversified. If you have all your retirement accounts in an IRA, on the other hand, balancing your investments and forecasting whether youre on track to hit your goals, like we do for you at Ellevest is a lot easier.

Another big reason why many people choose to roll an old 401 into an IRA is to have more choice. When you can decide for yourself which company youll open your IRA with , you often have greater control over things like how much you pay in fees and the types of businesses your money is supporting. With a 401, youre stuck with whatever investment provider and investment options your employer picks for you .

Also, if youre trying to make certain special purchases, the government lets you take money out of an IRA before retirement without facing the 10% early withdrawal penalty. These include things like college costs and your first home. Not so with a 401.

Don’t Miss: Can I Use My 401k To Start A Business