Provisions For Changing Jobs

Most 401 plans permit the employee who terminates employment the options of receiving the 401 balance in a lump sum or to receive periodic payments or to roll over the proceeds to an IRA or other employer-sponsored retirement plan. Additionally, some 401 plans permit the terminated employee to retain their 401 balance in their former employer’s plan. Amounts that are retained in a former employer’s 401 plan or transferred to another employer’s plan or IRA postpone the taxation until amounts are subsequently distributed from the plan or IRA the money was rolled into.

When receiving funds from a 401 with the intention to roll the amount to an IRA:

- The rollover must be completed in 60 days.

- Employers must withhold 20% of the proceeds as a withholding tax. It is up to the participant to make up this 20%, or it will be treated as a distribution. The money withheld will be used as a credit against any income tax liability.

- Neither the 60-day rule nor the 20% withholding apply to amounts directly transferred to an IRA or other qualified plan.

Other Benefits Of A 401

Even for employers who do not offer any matching program, every employer with a 401 plan is responsible for administering the plan. That may seem like its no big deal, but it actually saves quite a bit of trouble for the employees. As an employee in a 401 plan, you dont have to worry about the complicated rules and regulations that need to be followed, or about making arrangements with the funds in which you invest your moneyyour employer takes care of all of that for you. Thats quite a bit of saved paperwork.

At the same time, employees who participate in a 401 maintain control over their money. While employers provide a list of possible investment choices, most commonly different sorts of mutual funds, employees have quite a bit of freedom to decide their own strategy. Whether you are willing to take on a little more risk with your investments, or if you would rather play it safe, theres probably an option for you.

Is A 401 Worth It

You don’t have to master investing to allocate money in your 401 account in a way that meets your long-term goals. Here are three low-effort 401 allocation approaches and two additional strategies that might work if the first three options aren’t available or right for you.

Recommended Reading: How To Open A 401k Plan

Mistake #: Borrowing From Your Qrp

Many QRPs allow you to borrow from your account. Unless you need the money for an emergency, try not to. Borrowing can be an expensive choice, in two ways:

- Smaller retirement savings: When you take out a loan you are losing the potential for investment growth and that could leave you with a smaller retirement savings. How much smaller? This depends on a number of factors, including the size of the loan, the repayment period, whether you continue contributions during this period, the earnings on your account, and the loan interest rate. Also, if you stop contributing while you are paying back your loan, you wont receive any employer matching contributions.

- Repayment requirements: If you lose your job or take another one, youll have to repay the money quickly, usually within 30 to 60 days. However, if not repaid, the outstanding loan balance is generally subject to income tax and possibly an IRS 10% additional tax for early or pre-59 1/2 distributions. The 2020 Coronavirus, Aid, Relief and Economic Security Act includes provisions providing greater repayment flexibility for certain individuals affected by the coronavirus pandemic. If these apply to you, you should still consider the potential effects of borrowing from your QRP on your ability to reach your retirement goals.

In addition, cashing out of your 401 when you move to a new employer might be costly as well. Know your distribution options when changing jobs.

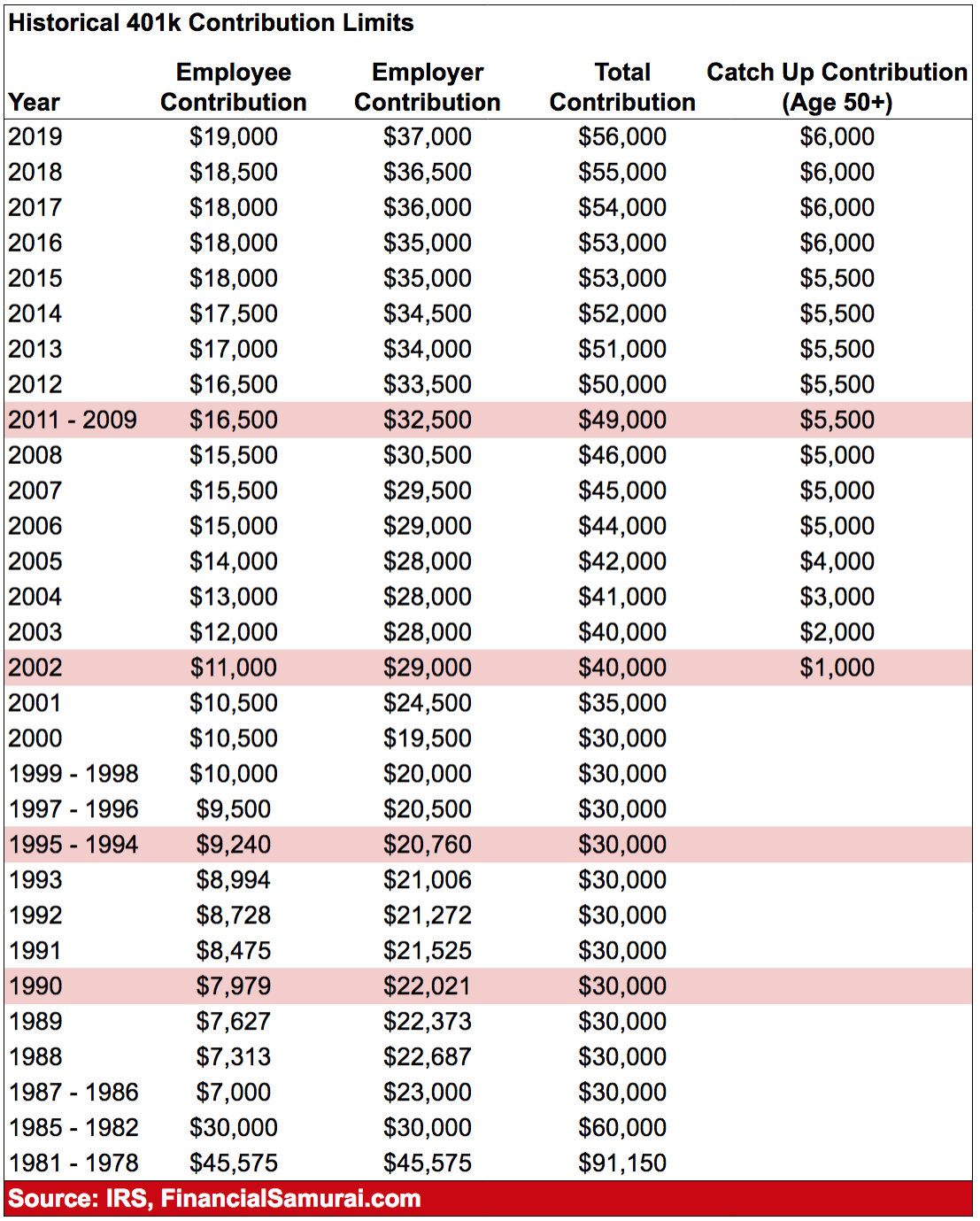

Top Contribution Method: Max Your 401k Percentage

If you want maximum funding for your 401k plan, then determining the contribution percentage is straightforward, even without a 401k max contribution calculator. The maximum contribution per year is age based and changes depending on whether you’re age 50 and over, or whether you’re under the age of 50, as set forth below. To calculate the correct percentage to contribute, divide the annual limit by the number of total yearly paychecks. The result should then be divided by your gross salary per paycheck to learn the contribution percentage.

Recommended Reading: Where To Put 401k After Retirement

Contribute Up To The Employer Match

You have enough saved up to cover your expenses. You emergency fund is there in case you need it. Now youre starting to think about 401 contributions. Where do you you start?

The first thing you should figure out is if you have an employer matching program with your 401. With an employer match, your employer will match your 401 contributions up to a certain percentage of your gross salary. Say your employer offers 100% match on the first 5% you contribute. That means if you contribute 5% of your gross salary to your 401, your employer will contribute an amount equal to 5% of your gross salary. The total contribution to your 401 would then equal 10% of your gross salary.

An employer match allows you to increase your contribution, and you should always take advantage of matching programs. Unfortunately, many people pass up free money by not contributing up to their employer match.

The Boring Glory Of Index Funds

Your best bet is to buy something called an index fund and keep it forever. Index funds buy every stock or bond in a particular category or market. The advantage is that you know youll be capturing all of the returns available in, say, big American stocks or bonds in emerging markets.

And yes, buying index funds is boring: You usually wont see enormous day-to-day swings in prices the same way you may if you owned Apple stock. But those big swings come with powerful feelings of greed, fear and regret, and those feelings may cause you to buy or sell your investments at the worst possible time. So best to avoid the emotional tumult by touching your investments

Don’t Miss: How Do I Access My 401k Account

How Much Interest Will 2 Million Dollars Earn

At the end of 20 years, your savings will have grown to $6,414,271. You will have earned in $4,414,271 in interest. How much will savings of $2,000,000 grow over time with interest?Interest Calculator for $2,000,000.RateAfter 10 YearsAfter 30 Years0.00%2,000,0002,000,0000.25%2,050,5662,155,5670.50%2,102,2802,322,8000.75%2,155,1652,502,54454 more rows

Invest In Real Estate

Returns in the real estate market can massive. However, the risk and cost to invest in this market have disenfranchised numerous investors from engaging in this space.

Several companies, such as Fundrise, have emerged over the past few years that have given individual investors who previously were not able to take advantage of this market to invest in commercial real estate developments through Real Estate Investment Trusts .

Fundrise allows individual investors to pool together their money to collectively invest in commercial real estate. This eliminates the need for a large sum of cash and spreads out the risk. Its no wonder Fundrise has grown to over half-a-million members.

You May Like: When Can I Take Out My 401k

Contribute Up The 401k Max To Save On Taxes:

Another popular theory on how much to save in your 401k is to do this one simple thing save all the way up to the maximum limit! .

Why would anyone suggest that? For one single reason taxes. Every dollar you contribute to your 401k is tax-deferred. When you compare this to the amount of money you would have had if you had just cashed in your paycheck, its quite a bit more!

How much more? The math is pretty simple. Lets assume youre in the 25% tax bracket. That means for every dollar you make, by the time you cash your paycheck you really only get to keep 75 cents.

BUT with a 401k, you keep that whole $1 because it didnt get taxed. Therefore youre saving:

= = +33%

Wow, you get to save 33% more because you used your 401k to save for retirement instead of saving with your taxable income.

And thats where saving all the way up to the maximum contribution limit comes in. By saving all the way up to that $18,000 mark, youre keeping $4,500 of your money for yourself instead of giving it away to Uncle Sam!

Lesson Learned: The more you save in your 401k account, the more you keep for yourself and the less you give away to taxes. Figure out what percentage of your income it will take to save $18,000 in your 401k every year and make an effort to achieve it.

The Matching Contribution Bonus

For people who start saving early and take advantage of employer-sponsored plans, such as 401s, hitting savings goals isnt as daunting as it may sound. Employer matching contributions could significantly reduce what you need to save per month. These contributions are made pre-tax and it’s the equivalent of “free money.”

Say you save 3% of your income during a year and your company matches that 3% in your 401, “you will make a 100% return on the amount you saved that year,” says Kirk Chisholm, wealth manager at Innovative Advisory Group in Lexington, Mass.

Don’t Miss: Is Rolling Over 401k To Ira Taxable

How Much Should I Contribute To My 401 If No Match

Before the economic downturn that occurred in 2008, it was a no-brainer to invest in your companys 401k program because your employer would typically match your contribution, possibly dollar for dollar or 50 cents on the dollar for the first 3 percent to 6 percent. As a way to stay competitive or to stay in business, matching your 401k contributions is one of the first programs employers cut. Contributing to your 401k might be your best bet, but it doesnt hurt to explore your other options.

Contribute As Much As You Can

You have emergency savings. You met your employers 401 match and then you maxed out a Roth IRA . Then what? How much should you really contribute to your 401 now?

Your goal at this point should be to save as much as you can for retirement while still living comfortably now. For some people, that will mean another 1% of their salary into their 401. For others it will mean maxing out their 401.

The key is to put as much as you can toward retirement. Some people spend their money frivolously and save only a little bit. If youre spending thousands of dollars every month on unnecessary purchases, you should find a way to cut that spending and put it toward retirement instead. It might not sound fun, but remember that the goal is to have financial security when you retire.

Don’t Miss: Can I Have 2 401k Plans

When Is An Ira A Better Option

An IRA and a 401 are both retirement saving vehicles and the two share commonalities. But there are a few important differences that make IRAs the better choice in some situations.

A 401 is only available through your employer. If you work at a company that doesnt offer a 401, you cant get one. People in work situations where the employer does not offer 401 accounts can still get retirement savings accounts with tax benefits thats where the IRAs come in.

IRAs are another type of retirement savings account. Unlike a 401, an IRA is not tied to your employer. You can sign up for an IRA at online brokerage like E*Trade, Vanguard, or Fidelity and open an account.

Another reason why someone might choose an IRA is for the investment options. IRAs are generally known to have a wider selection of investment opportunities than what youll find with a 401. But keep in mind that the contribution limits with an IRA account is much lower than the limits with a 401.

How Much Will You Need In Retirement

The sum youll need to retire is a highly personal question but needs careful consideration.

I believe retirement is a financial number versus a retirement age. Assess how much you need in your retirement account to live at least 20 years in retirement without having to go back to work to pay your bills, says Shaquana Watson-Harkness, personal finance coach and founder of Dollars Makes Cents, an online debt management and investing training course.

Rita-Soledad Fernández Paulino, a NextAdvisor contributor and creator of Wealth Para Todos, told us how she calculates her financial independence number using Trinity Studys 4% rule. According to the 4% rule, you can estimate how much money youll need to live on during retirement using this quick calculation:

Annual Expenses x 25 = Nest Egg .

For example, if your annual expenses are $40,000, multiply that by 25 for a total of $1M the amount youd need to retire, based on the 4% rule above.

If youre already freezing up thinking about million-dollar sums, remember youre not solely responsible for saving up this much on your own. The market, through compound interest, will do most of the heavy lifting for you, especially if you invest early and let your portfolio grow for decades.

Thats why starting early is so important.

Recommended Reading: How Much Should I Have In 401k

How Much Should You Have In Your 401 By 30

So how much should you have saved for retirement before your 30th birthday?

Assuming you have been working since you were 22 or 23, at 30, a great target is to have a 401 or IRA equal to about one years salary.

For example, if you make $40,000 a year, you could try to have $40,000 saved for retirement. .

Related: If you still dont believe in the power of compound interest, you have to see this

That said, dont freak out if your retirement saving isnt on this level yet. The sooner you start, the better. But if you start at 30 and dont plan on retiring until youre 65, that still gives your money plenty of time to earn interest.

Use this calculator to estimate what your 401 balance would be at retirement, based on your personal financial status:

No two investors are alike, especially beginning investors. Your starting salary range and the number of years you have been working are going to be much bigger factors in determining your retirement savings balance at 30 than they will be at 40 or 50, when you will have had additional years to make catch-up contributions or adjust your portfolio as necessary.

Meet Employers Match At Minimum

When employers match your 401 contribution, it serves as the companys pension plan. Some look at it like free money, but its actually a benefit you earn by working for your employer. At the very least, you should contribute the maximum amount to your 401 that your employer is willing to match. If, for example, your company matches the first 5 percent of the money you contribute, defer 5 percent of your salary to your retirement account. And, dont leave money on the table when you leave the job or retire.

You May Like: Is 401k The Best Way To Save For Retirement

Perks For Older Investors

If you happen to be at least 50 years old, youre entitled to make catch-up contributions by adding an additional $6,500 for a total contribution of $27,000 in 2022. The total maximum that can be tucked away in your 401 plan, including employer contributions and allocations of forfeiture, is $67,500 in 2022, or $6,500 more than the $61,000 maximum for everyone else. Forfeitures come from an account in which company contributions accumulate from departing employees who werent vested in the plan.

What Percent Of Your Salary Should Go Toward Retirement

How much money you need to live financially comfortable during retirement varies widely depending on the individual. There are plenty of proposals on how much retirement savings you should have. Meanwhile, many of the free online calculators will show little agreement with one another. And while its difficult to forecast exactly what youll need during retirement there are benchmarks to aim for.

The ideal savings rate varies by expert or study because making plans for the future depends on many unknown variables, such as not knowing how long youll be working, how well your investments will do, or how long you will live, among other factors.

Also Check: Should I Transfer 401k From Previous Employer

How To Calculate Your Monthly 401 Contribution

In 2021, the 401 contribution limit is $19,500 for those under age 50 this increases to $20,500 for 2022. Workers age 50 or older can make an additional catch-up contribution of $6,500 in both 2021 and 2022. You and your employers combined contributions cant exceed $58,000 in 2021 or $61,000 in 2022, excluding catch-up contributions.

However, few people actually contribute these amounts. Only 12% of plan participants made the maximum contribution in 2020, when the limit was $19,500, according to Vanguard’s 2021 How America Saves report.

To determine how much you should be saving, you can use Social Securitys retirement estimator and see what monthly benefit you can expect from that fund. You also can use a retirement calculator to estimate how much youll need each month on top of Social Security. Choose a calculator that allows you to personalize as many factors as possible, including your current age and account balance, anticipated contributions, other sources of income, and expected rates of return.

Should I Contribute More Than The Match To My 401k

If you have a 401 at work and your employer offers a match, you should always invest enough in the 401 to claim the full match. If you dont, youre giving up free money. You cant afford to give up free money and should take advantage of the help your employer provides to ensure you save enough for retirement.

Don’t Miss: How Do I Find My 401k Plan