Roth Or Traditional 401k

What’s the difference between a Roth and a traditional 401k? Traditional 401 Which is better? The difference between the traditional Roth 401 and the Roth 401 is the payment of taxes. While Roth accounts are generally recommended for young savers, Roth 401 may also offer older savers the opportunity to take advantage of the tax-free distribution. If your employer offers both, you don’t have to choose one or the other.

How Much Could Your 401 Grow If You Stop Contributing

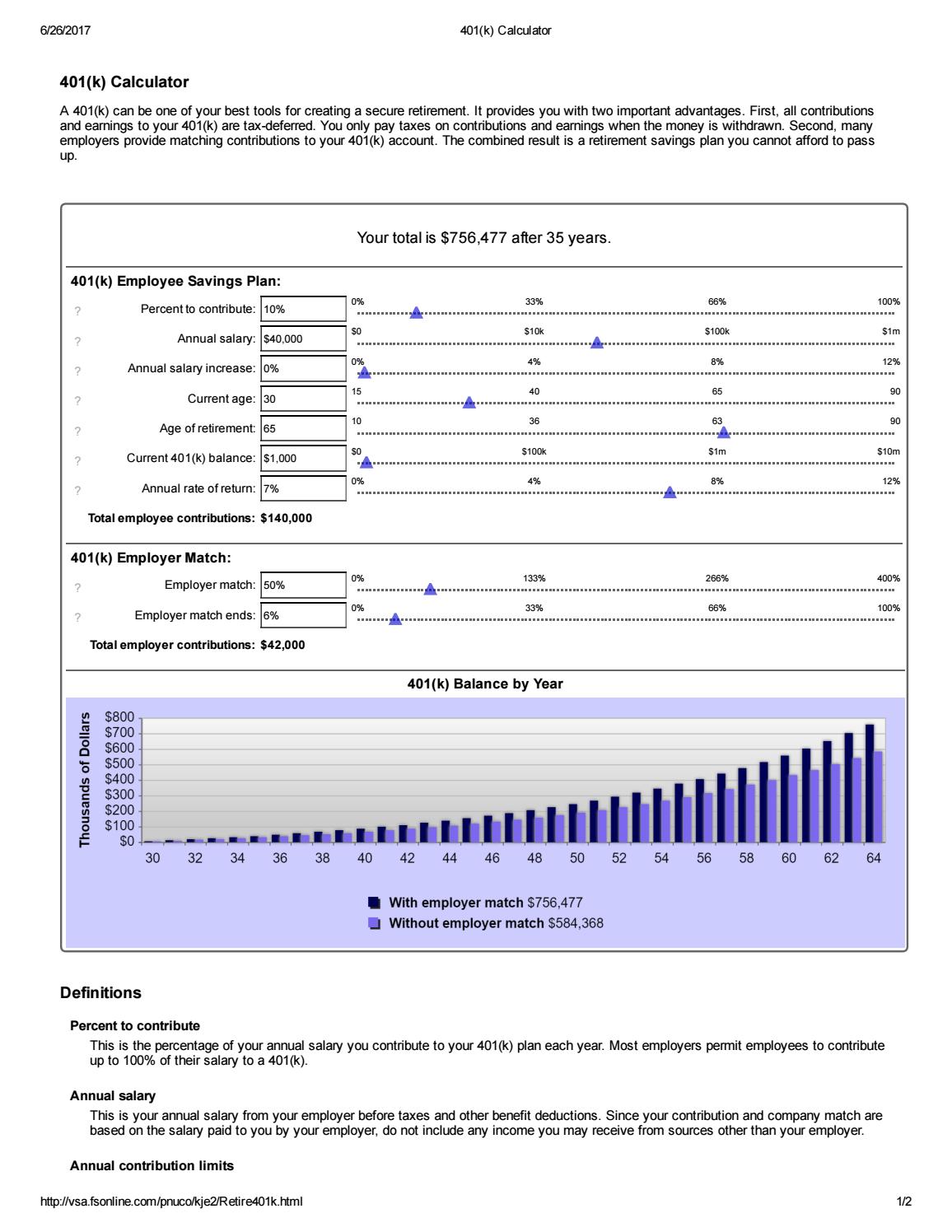

Now lets examine what happens to your 401 when you stop contributing and your employer does not make any matching contributions either. Using most of the same parameters as before, lets use our 401 Growth Calculator to see how much your 401 will be worth if you stop contributing at age 30, after you have already accumulated $10,000 in your account:

- You are 30 years old right now.

- You have 37 years until you retire.

- You make $50,000/year and expect a 3% annual salary increase.

- Your current 401 balance is $10,000.

- You get paid biweekly.

- You expect your annual before-tax rate of return on your 401 to be 5%.

- Your employer match is 100% up to a maximum of 4%.

- Your current before-tax 401 plan contribution is now 0% per year.

What happens to your previous 401 balance of $795,517? It plummets to $63,485 $732,032 less than before. When you stop contributing to your 401 and have no employer matching contributions, your total 401 balance in year 37 is 92% less. Procrastinating with your retirement savings and your 401 contributions means you have to work much harder and save even more to catch up to where you need to be in order to reach your retirement goals. Learn more about the cost of waiting to save for your retirement.

Solo 401k Contribution Calculator

Self-employed individuals and businesses employing only the owner, partners and spouses have several options for tax-advantaged savings: a Solo 401 plan, a SEP IRA, a SIMPLE IRA, or a Profit Sharing plan. Each option has distinct features and amounts that can be contributed to the plan each year. Use the Solo 401 Contribution Comparison to estimate the potential contribution that can be made to a Solo 401 plan, compared to Profit Sharing, SIMPLE, or SEP plan.

Disclaimer: Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Ready to take control of your financial future?

Start where you are. Use what you have. Invest in what you want.

Read Also: What Is The Difference Between Roth 401k And Roth Ira

Where Did This Answer Come From

With a solo 401, you are allowed to make contributions in the role of employee and the role of employer. Specifically, you are allowed to make:

In this case, your net earnings from self-employment is defined as your businesss profit , minus the deduction for one half of your self-employment tax .

However, there are an assortment of limitations to the above contributions.

Important notes:

- Various amounts in this explanation may be off slightly due to rounding of cents.

- Solo 401 plans are complicated, so its likely a good idea to consult with your tax professional.

Welcome

to read more, or enter your email address in the blue form to the left to receive free updates.

My Latest Book

How To Calculate Using A 401 Contribution Calculator

One needs to follow the below steps in order to calculate the maturity amount for the 401 Contribution account.

Step #1 Determine the initial balance of the account, if any, and also, there will be a fixed periodical amount that will be invested in the 401 Contribution, which would be maximum to $19,000 per year.

Step #2 Figure out the rate of interest that would be earned on the 401 Contribution.

Step #3 Now, determine the duration which is left from current age till the age of retirement.

Step #4 Divide the rate of interest by the number of periods the interest or the 401 Contribution income is paid. For example, if the rate paid is 9% and it compounds annually, then the rate of interest would be 9%/1, which is 9.00%.

Step #5 Determine whether the contributions are made at the start of the period or at the end of the period.

Step #6 Figure out whether an employer is also contributing to match with the individuals contribution, and that figure plus value arrived in step 1 will be the total contribution in the 401 Contribution account.

Step #7 Now use the formula accordingly that was discussed above for calculating the maturity amount of the 401 Contribution, which is made at regular intervals.

Step #8 The resultant figure will be the maturity amount that would include the 401 Contribution income plus the amount contributed.

Recommended Reading: How To Collect My 401k Money

Solo 401k Contribution Calculator Walk Thru

February 24, 2020 by Editorial Team

The Solo 401k is the most powerful retirement account on the planet when it comes to contributions. This can add up to huge tax savings for you if you own your own business. When you run your own retirement account, you need access to the best tools. Fortunately, all Solo 401k account holders with Nabers Group have access to our contribution calculator. Lets walk through how to use the calculator, determine how much you can contribute to a Solo 401k plan.

Is Roth Better Than Traditional Ira/401

Is Roth Better Than Traditional IRA/401? Last week I was looking for an article on Roth 401 and came across T. Rowe Price’s Roth IRA study. In short, the study concludes that a Roth account is the best option for most investors. You’ll have more money if your tax rate doesn’t drop much after you retire.

Read Also: How Soon Can I Get My 401k After I Quit

Should I Choose A Roth Or A Traditional 401k Account

Your total income is not as important as your effective tax rate. However, higher income generally leads to a higher effective tax rate. As such, income is one of the first factors to consider when choosing between Roth or a traditional 401 plan. The higher the income, the more likely the traditional 401 will be.

Invest In Roth Or Traditional 401k

Roth 401 is an after-tax retirement savings account. This means that your contributions were taxed before you logged into your Roth account. On the other hand, a traditional 401 is a pre-tax savings account. When you invest in a traditional 401 plan, your pre-tax premiums are paid, reducing your taxable income.

Don’t Miss: What Happens To Your 401k When You Switch Jobs

How Aggressive Should I Be

The more aggressive your portfolio allocations, the higher the potential returns but investments can drastically peak and valley over short periods of time. The closer you are to retirement, the less aggressive you want to be with your assets. Over time, you may want to reduce the percentage of stocks in your plan in favor of bonds, cash, and other investments that are more stable over the short term.

Should You Switch To A Roth 401k Age

Thanks to the budget deal with Congress, Roth retirement account enthusiasts now have the option to convert their traditional 401K into a Roth 401K at any age. Ironically, this was part of the reduced cost recovery.

Spousal Ira,What is Spousal Ira?Generally, you will need income to participate in a traditional IRA or Roth. Mess in Convenient Quinney Travel Pet Joske’s partner has an income of 6 6,000, which the IRA earned in 2020 for the Convenient Quinnie Travel Pass. The limit of competition title is 7,000 if the title of the competition is at the end of 50 years or more.Literal Meanings of Spousal IraSpousal:Meanin

You May Like: What Happens To Your 401k When You Leave A Company

A 401 Is A Defined Contribution Plan

Unlike a defined benefit plan , also known as a pension plan, which is based on formulas for determining retirement withdrawals, defined contribution plans allow their participants to choose from a variety of investment options. DCPs, 401s in particular, have been gaining in popularity as compared to DBPs. Today, the 401 defined contribution pension plan is the most popular private-market retirement plan. The shift in the choice between DBPs and DCP can be attributed to a number of reasons, one of which is the projected length of time a person is likely to stay with a company. In the past, it was more common for a person to stay with a company for several decades, which made DBPs ideal since deriving the most value out of a DBP required a person to stay with their company for 25 years or more. However, this is no longer the case today, as the workforce turnover rate is much higher. DCPs are highly mobile in comparison to DBPs, and their values do not drop when a person switches companies. When an employee with a 401 plan changes employers, they generally have the option to:

Does Roth 401k Have Income Limits

Unlike traditional IRAs or Roth IRAs, there is no income cap above 401k to discourage your contribution. This makes it a very attractive option when you consider the benefits between IRA and 401k.

Roth ira 5 year ruleWhen does the five-year rule apply to Roth IRAs?The Legacy of the IRA. The 5-year rule applies to one of the many options available to beneficiaries when it comes to receiving distributions from an inherited IRA.Traditional ARI. Under the 5-year rule, the beneficiary of a traditional IRA is not subject to the usual 10% penalty on distribution, even if it occurs before the cut-off date.The mouth of

Don’t Miss: How To Invest My 401k In Stocks

Whats The 401k Contribution Deadline

What is the 401k contribution deadline? The 401k contribution deadline does land at the very end of the calendar year on December 31, 2021.

However, the IRS will allow you to contribute to your IRA account right up to the tax filing deadline of the coming year that is to say, April 15, 2022 of this next year.

Solo 401k Contribution Calculation For A Sole Proprietorship Partnership Or An Llc Taxed As A Sole Proprietorship

Salary Deferral ContributionAlthough the term salary deferral is used, these businesses do not provide a W-2 salary to the business owner. For businesses of this type, the salary deferral contribution is based on net adjusted business profit. Net adjusted business profit is calculated by taking gross self employment income and then subtracting business expenses and then subtracting 1/2 of the self employment tax. In 2020, 100% of net adjusted business profits income up to the maximum of $19,500 or $26,000 if age 50 or older can be contributed in salary deferrals into a Solo 401k .

Profit Sharing ContributionA profit sharing contribution can be made up to 20% of net adjusted businesses profits. Net adjusted business profit is calculated by taking gross self employment income and then subtracting business expenses and then subtracting 1/2 of the self employment tax. You will want to ask your tax professional for assistance with this calculation.

Don’t Miss: Can I Roll My 401k Into A Brokerage Account

Best Places For Employee Benefits

SmartAssets interactive map highlights the counties across the country that are best for employee benefits. Zoom between states and the national map to see data points for each region, or look specifically at one of four factors driving our analysis: unemployment rate, percentage of residents contributing to retirement accounts, cost of living and percentage of the population with health insurance.

Why Is Roth 401k

Why Your 401 Should Have a Roth 401 Tax Option to Diversify Your Retirement Savings. Various cubes. Save more for your retirement with the Roth 401k. Forced saving. Younger members benefit the most from the Roth 401k. Time is on your side. You can inherit your family’s Roth IRAs. Roth 401k Tax Strategy for Contributors to a Cash Settlement Plan. Eat your cake and eat it too.

You May Like: How Do You Transfer 401k

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

How Much Can I Contribute Into A Solo 401k Sep Ira Defined Benefit Plan Or Simple Ira

Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. Enter your name, age and income and then click Calculate.

The result will show a comparison of how much could be contributed into a Solo 401k, SEP IRA, Defined Benefit Plan or SIMPLE IRA based on your income and age.

Note: If you are taxed as a sole proprietorship use your NET income when using the calculator. If you are incorporated, then only use your W-2 wages when using the calculator. For example, S corporation K-1 distributions are not included when making the contribution limit calculation.

Don’t Miss: How Much Should I Put In My 401k Calculator

Can You Put Money In Both A Roth Ira And A Traditional Ira

While you don’t pay taxes on your traditional IRA contributions, but are responsible for paying taxes on withdrawals in retirement, the opposite is true with the Roth IRA. All the money you deposit into the Roth IRA is tax-free, but your account will be tax-free and you will not have to pay tax on withdrawals.

Can I Switch My Roth 401k To A Traditional 401k Plan

You cannot convert a Roth IRA to a traditional IRA, as the Roth is not a conversion, but rather a replacement for the existing Roth 401. Since Roth is after-tax money, it is not possible or allowed to convert it into pre-tax money.

Roth meaning Rosa makes sense to you?The sooner you start a Roth IRA, the better, but when you’re going to receive a Roth IRA can still make sense In any case A Roth IRA is an individual retirement account that allows fixed distributions or withdrawals to be free under certain conditions.Why is Ross better than the Irish Republican army?If you are not eligible for a deduction, the best option to contribute to a Roth IRA is if you are eligible for assis

Don’t Miss: How To Collect Your 401k From Previous Employer

Can You Contribute To Both A Roth 401 And A Traditional 401

You can deposit into either the Roth 401 or the traditional 401, as long as your accrued contributions do not exceed the annual contribution limit of 401. Deciding whether it makes sense to save on taxes now or later is an important consideration when choosing between Roth or a traditional 401 plan.

Traditional ira vs roth iraWhat are the advantages and disadvantages of a Roth IRA? Here are the main advantages and disadvantages of accounts and how they differ from traditional IRAs. Withdrawals from a Roth IRA are tax-free if the account has been open for at least five years and you are 59½ or older. In contrast, withdrawals from a traditional IRA are tax-deductible.How do you calculate a Roth IRA?Divide the b

Should I Choose A Roth Or A Traditional 401k

Your total income is not as important as your effective tax rate. However, higher income generally leads to a higher effective tax rate. As such, income is one of the first factors to consider when choosing between Roth or a traditional 401 plan. The higher the income, the more likely the traditional 401 will be.

You May Like: Can I Use My 401k To Start A Business

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.