Drawbacks To Using Your 401 To Buy A House

Even if it’s doable, tapping your retirement account for a house is problematic, no matter how you proceed. You diminish your retirement savingsnot only in terms of the immediate drop in the balance but in its future potential for growth.

For example, if you have $20,000 in your account and take out $10,000 for a home, that remaining $10,000 could potentially grow to $54,000 in 25 years with a 7% annualized return. But if you leave $20,000 in your 401 instead of using it for a home purchase, that $20,000 could grow to $108,000 in 25 years, earning the same 7% return.

How To Cash Out Your 401

Cashing out a 401 can help you get through a financial tough time. But its important to understand the penalties and taxes before you make that decision.

Stephanie Faris

- Cashing out a 401 plan should be considered a last resort.

- You can sometimes take a loan from your 401 instead of cashing it out.

- The IRS will charge you a 10% penalty for money taken out of your 401 early in most circumstances.

Having money saved for the future isnt much help when you have bills due today. While most experts advise leaving your 401 fully funded until you can take the money out without penalty, there are times when it makes sense. But its something that should only be done as a last resort, as youll lose the potential compounding returns on your investments youll get by leaving it in place. In fact, before you go forward, input your current balance into an online calculator and look at just how much money youll have if you leave it in place.

If you do decide to cash out our 401 plan, you should know it requires a little planning. Youll want to make sure you minimize tax penalties so that you get the most out of the money youve set aside. In this article, well break down what you need to do to prepare for cashing out your 401, including determining eligibility and understanding what youre giving up. As a result, youll be ready to make a fully-informed decision.

Drawbacks To 401 Loans

Assuming the loan and repayment process goes perfectly smoothly, there are several major reasons you should think twice before borrowing from your 401 fund:

- A 401 loan uses money that should be invested and helping accumulate wealth for your retirement. The funds you pull out of your 401 cannot gain investment value, and the interest payments you’re making to yourself are unlikely to come close to matching the gains you’d make in a moderately successful stock or index fund. contribution or invest elsewhere.)

- For most borrowers, retirement savings get put on hold until the 401 loan is repaid. Payroll deductions for 401 loan repayment typically eliminate or greatly reduce 401 payments for the five years it takes to pay off the loan. Losing five or so years of retirement savings, and likely forfeiting some or all of your employer’s matching contributions to your 401 in the process, is potentially a huge setback in your retirement savings process. The goal with 401 plans, as with all long-term savings programs, is to stash funds in small, steady amounts over long periods of time, and let money accumulate through the power of compound growth and reinvestment. A 401 loan disrupts that process in a major way, and most funds can never fully recover.

If your 401 loan process doesn’t go smoothly, you could face even worse consequences:

Recommended Reading: How Do I Get My 401k

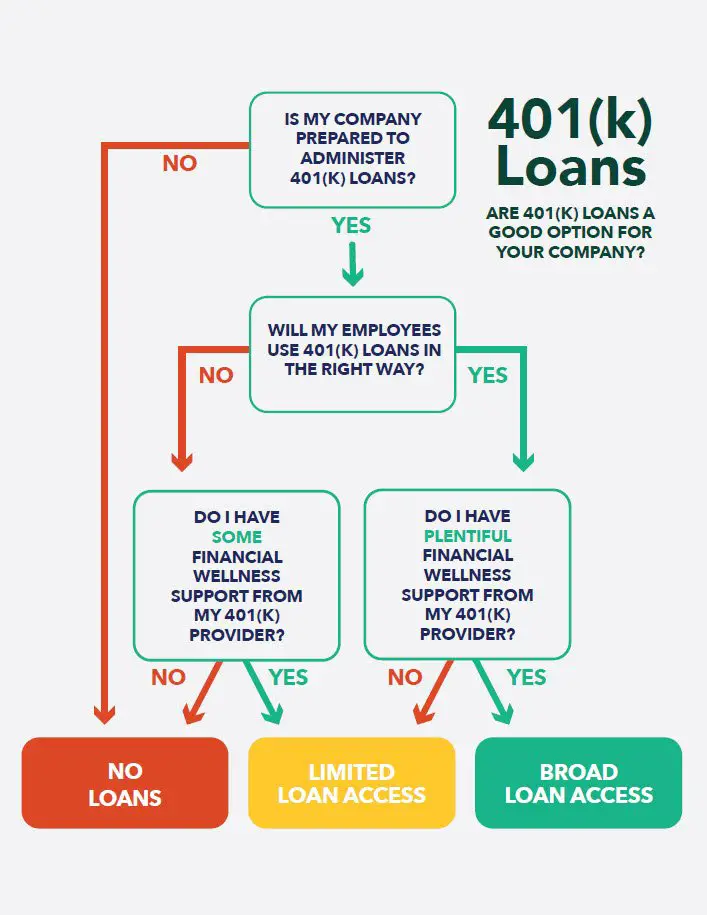

Questions To Ask If You’re Considering A 401 Loan

If youre thinking of borrowing from your 401, plan ahead by asking your 401 service provider about the borrowing process, such as:

- Are loans allowed? Ask about the types, terms, and costs.

- How much can I borrow? This varies with your plan balance.

- What are the steps? Processes differ, and there may be paperwork if you want a home loan.

Keep in mind that loan checks are usually mailed, so they may take time to reach you.

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Read Also: What Is The Difference Between Roth 401k And Roth Ira

Why Do People Get 401 Loans

As long as a plan allows it, participants generally can borrow from their 401 for any reason. Some plans may only allow loans for specific reasons, so be sure to check your plans rules before trying to borrow.

Since youre borrowing your own money, and no credit check is involved, it may be easier to get approved for a 401 loan as long as you meet the plans requirements for borrowing. In some cases, a requirement may be getting approval from your spouse , because your spouse may be entitled to half of your retirement assets if you divorce.

Here are some potential uses for a 401 loan.

- Paying household bills and expenses

- Funding a down payment on a house

- Paying off high-interest debt

- Paying back taxes, or money owed to the IRS

- Funding necessary home repairs

- Paying education expenses

But that doesnt mean 401 loans are always a good idea. In fact, there are some major risks that come with borrowing from your retirement savings. Here are two.

What Are Some Alternatives To A 401 Loan

When cash is tight, borrowing from your 401 plan and paying yourself interest may seem like a good idea. But before you borrow, weigh all your options. Here are a few.

Don’t Miss: How To Lower 401k Contribution Fidelity

If You Default On Your 401 Loan You’ll Owe A Penalty

If you do not pay your 401 loan back as required, the defaulted loan is considered a withdrawal or distribution and thus subject to a 10% penalty applicable to early withdrawals made before age 59 1/2. That’s potentially a huge cost, especially when you also consider the loss of the potential gains your money would have made had you left it invested.

The penalty for defaulted loans still applies to COVID-19 related loans taken under the CARES Act’s special rules applicable in 2020. This can be confusing, as the CARES Act also altered the rules for withdrawals, enabling you to take a coronavirus-related distribution from your 401 in 2020 without incurring the customary 10% tax penalty. Unfortunately, if you default on your 401 loan, it doesn’t convert to a penalty-free withdrawal, even if you would have been entitled to one in 2020.

Making A Choice For Your 401

Maybe youve switched jobs to take on new challenges. Perhaps youre thinking about changing career paths for something more rewarding. Or maybe youre finally getting ready to retire.

We understand when your life changes, other things may change toolike your goals for retirement. Well help you consider your options for your 401 accounts from past jobs, so you can feel confident youre on track for the future you want.

You May Like: Should I Rollover My 401k When I Retire

What Happens When The Loan Defaults

When default is on the horizon you essentially have two options to avoid it. You can pay back all remaining principal on the loan to avoid it being considered a default, or you can let it default and deal with the consequences.

The consequences can be relatively steep. While this type of default will not be reported to the credit bureaus causing your credit rating to be damaged, the IRS plays its hand and collects the taxes and penalty due.

The remaining balance that is left unpaid is considered a distribution from your 401. Income taxes will be due on this distribution at your highest marginal tax bracket. This distribution has a double negative effect. First you will have to pay taxes on what is considered to be a lump sum of income. If this occurs in a year of high earnings you could see a substantial tax hit on funds that otherwise may have been removed a lower tax rates. Second, you have removed a sizable chunk of money from tax deferred retirement savings and will never be able to get this money back into its preferred tax deferred status.

Roth 401 Loan Interest

You will pay interest on the loan from your Roth 401 plan while it remains outstanding, even though you’re essentially borrowing your own money. The interest rate typically is slightly higher than prime, and it goes back into your account. The balance of your loan that remains outstanding isn’t invested, so you miss out on any gains. For example, if you have $10,000 outstanding and pay 4 percent interest, but the market increases 7 percent, you’re not earning as much as you would have if you’d left the money in the account.

You May Like: When Can I Set Up A Solo 401k

Loans Are Tied To Your Company

If you leave your job, youre still required to pay the balance of any 401 loans.

If you don’t repay, and you sever ties with your existing company for whatever reason, the IRS will deem the loan a distribution, and you will be taxed in that tax year, says Allan Katz, certified financial planner at Comprehensive Wealth Management Group in Staten Island, New York. And if youre younger than 59½, youll incur a 10% early withdrawal penalty.

You could be left in a deeper financial hole than the one caused by your credit card debt.

About 86% of people who leave their job with an outstanding 401 loan default on it, according to the National Bureau of Economic Research, compared with 10% of all 401 loan borrowers.

What Are The Advantages Of Borrowing Money From Your 401

- You won’t pay taxes and penalties on the amount you borrow, as long as the loan is repaid on time.

- Interest rates on 401 plan loans must be consistent with the rates charged by banks and other commercial institutions for similar loans.

- In most cases, the interest you pay on borrowed funds is credited to your own plan account you pay interest to yourself, not to a bank or other lender.

Recommended Reading: How Do You Take Money Out Of 401k

Pros Of Borrowing From 401 To Pay Off Debt

As we mentioned above, taking out a loan from your 401 plan is essentially borrowing your own money. You wont need to go through an approval process with a lender to borrow the money. If you set up online access, theres likely an option on the website to do this quickly and conveniently. Thats both good and bad, but well keep it in the pro category. Other pros include:

- Flexible Repayment Options: Fund administrators want you to pay back your 401 loan quickly and painlessly, so they offer flexible repayment options. There are no early repayment fees, and you can set up direct debits to ensure you dont miss a payment.

- Low or Non-Existent Lending Costs: You may be charged a small origination fee and there might be an administrative charge, but 401 loans are the lowest cost lending vehicle youll find. If you must borrow to pay off debt, this is likely the best option.

- Neutral Impact on Retirement: A common misconception is that borrowing from your 401 will have a negative impact on your retirement fund. That only happens if you do it during a bull market. Otherwise, the impact is neutral because you pay the money back with interest. Well get into this in more detail below.

Will A 401 Loan Affect Your Mortgage Dti Ratio

March 5, 2017 By JMcHood

One of the hardest parts about buying a house is saving up for the down payment. Even when you have enough for the down payment, you have to consider the closing costs. Generally, closing costs span between 2 and 5 percent of the purchase price of the home. On a $200,000 home, this is as much as $10,000 in closing costs. If you are short on cash, but have a hefty 401 account, you might consider taking out a 401 loan. Of course, then you have to worry about your debt-to-income ratio. Any new debt often increases your debt ratio however, a loan from your 401 typically does not affect your DTI.

You May Like: Can I Sign Up For 401k Anytime

How Long Does It Take For Your 401 Withdrawal To Get To Your Bank

Moving money from a 401 to a bank account is simple enough, given you’re over the penalty-free minimum withdrawal age of 59 ½ years old. However, just how long it takes for the money to actually reach you varies. Depending on how your company’s 401 is structured, the reason for your withdrawal and several other factors, it could take up to a week or more to receive your 401 withdrawal.

Tip

It takes up to a week for your 401 withdrawal to process, and you could then get a direct deposit within one or two business days or wait longer for a check to come in the mail.

Repaying The 401 Loan

You should make payments at least quarterly, but commonly, this interval is manageable as you’ll repay your loan through payroll deductions. The longest repayment term allowed is five years, though there are exceptions. Some 401 plans do not allow you to contribute to the plan for a certain period after you take out a loan.

If you lose your job while you have an outstanding 401 loan, you may need to repay the balance in full or risk having it be categorized as an early distribution, which can result in both taxes owed and a penalty from the IRS.

Don’t Miss: How Much Does A 401k Cost A Small Business

Advantages Of Borrowing From A 401

Borrowing from your 401 isnt ideal, but it does have some advantages especially when compared to an early withdrawal.

A loan allows you to avoid paying the taxes and penalties that come with taking an early withdrawal. Additionally, the interest you pay on the loan will go back into your retirement account, although on a post-tax basis.

401 loans also wont require a credit check or be listed as debt on your credit report. If youre forced to default on the loan, you wont have to worry about it damaging your credit score because the default wont be reported to credit bureaus.

Retirement Savings Can Benefit

As you make loan repayments to your 401 account, they usually are allocated back into your portfolio’s investments. You will repay the account a bit more than you borrowed from it, and the difference is called “interest.” The loan produces no impact on your retirement if any lost investment earnings match the “interest” paid ini.e., earnings opportunities are offset dollar-for-dollar by interest payments.

If the interest paid exceeds any lost investment earnings, taking a 401 loan can actually increase your retirement savings progress. Keep in mind, however, that this will proportionally reduce your personal savings.

Recommended Reading: Can You Transfer An Ira Into A 401k

What To Do Before Withdrawing From Your 401

Even if you qualify for an early distribution, you should be wary of withdrawing from your 401.

So before borrowing from your 401, where should you look for money? The first and obvious place to look is liquid, cash savings, Levine says. Ideally, everyone would have an emergency fund for situations like this.

If you dont have enough saved up, then take a look at your current spending you may find areas where you can scale back to save money while times are tough.

Do you have a car payment or lease that you could reasonably get rid of by buying a cheaper or used car? Are you living in a rental that you could move out of and into something cheaper? Those are obviously serious steps, and just examples, but withdrawing from a 401 will permanently reduce your savings, says Renfro.

If you cant cut anything out of your budget, you could try to get discounts. Levine suggests calling providers, like your cable and insurance companies, and explaining that you need to cut back due to coronavirus-related cash flow issues. Theyll almost definitely offer a discount, he says.

You could also consider taking out a small loan, but be careful not to get yourself further behind with a high-interest debt payment, Renfro says.