Does A 401 Loan Hurt Me

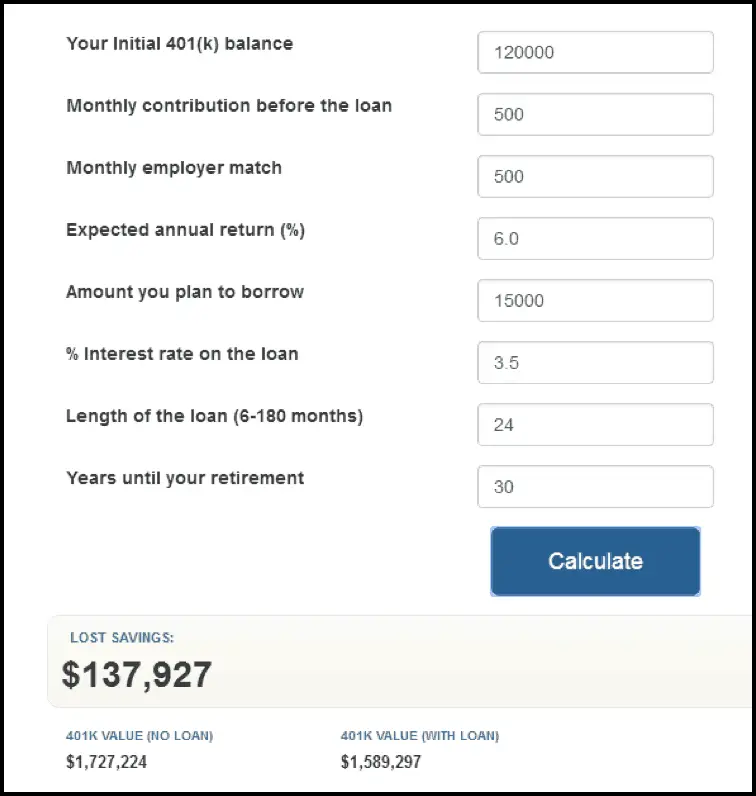

Taking out a 401 loan can negatively affect your future finances because it prevents you from making contributions to your account or taking advantage of employer-matching contributions for the life of the loan, which could last 5 years. Additionally, the interest you earn on the loan may be less than if youd just kept the money in your account.

How Service Providers Get Paid From Plan Assets

Most people dont know how 401 plan service providers get paid, and they may even assume their plan is free. Even with increased fee disclosure, its not always clear where the money comes from and where it goes. How does it happen? This page will give you a basic understanding of how 401 plan assets turn into revenue for service providers, and why its important to watch asset based fees over time.

Read Also: How Does A 401k Benefit The Employer

Should You Borrow A Loan From Your 401

Although a 401 loan may sound attractive, risks are involved with borrowing from your retirement savings. The biggest risk factor is that doing so will decrease the amount available to you when you retire, especially if youre unable to replenish your account over time. Even after you fully pay back the loan, this money still has less time to fully mature.

Also, if you cant repay the loan on time, your loan will be treated as a hardship withdrawal. You will be charged a 10% early withdrawal penalty fee on the balance if youre under the age threshold of 59½, or if youre younger than 55 and retired. Before taking out a 401 loan, its best to consider the implications this could have on your future.

Recommended Reading: Who Can Open A 401k Plan

Can You Take Multiple 401 Loans At A Time

Each 401 plan has its rules, and some plans may allow participants to take multiple 401 loans at the same time. Generally, if your 401 plan allows multiple loans, you can take a second loan while still repaying the first loan, but the total loan amount should not exceed the maximum loan limit.

For example, if you have $80,000 in your 401, you can only borrow up to $40,000. If the 401 plan allows multiple 401 loans at a time, and you had borrowed $30,000, you can take a second 401 loan of no more than $10,000.Ã Ã

Leaving Work With An Unpaid Loan

Suppose you take a plan loan and then lose your job. You will have to repay the loan in full. If you don’t, the full unpaid loan balance will be considered a taxable distribution, and you could also face a 10% federal tax penalty on the unpaid balance if you are under age 59½. While this scenario is an accurate description of tax law, it doesn’t always reflect reality.

At retirement or separation from employment, many people often choose to take part of their 401 money as a taxable distribution, especially if they are cash-strapped. Having an unpaid loan balance has similar tax consequences to making this choice. Most plans do not require plan distributions at retirement or separation from service.

People who want to avoid negative tax consequences can tap other sources to repay their 401 loans before taking a distribution. If they do so, the full plan balance can qualify for a tax-advantaged transfer or rollover. If an unpaid loan balance is included in the participant’s taxable income and the loan is subsequently repaid, the 10% penalty does not apply.

The more serious problem is to take 401 loans while working without having the intent or ability to repay them on schedule. In this case, the unpaid loan balance is treated similarly to a hardship withdrawal, with negative tax consequences and perhaps also an unfavorable impact on plan participation rights.

Also Check: Can You Pull Money Out Of 401k For House

How To Avoid 401 Early Withdrawal Penalties

There are certain exceptions that allow you to take early withdrawals from your 401 and avoid the 10% early withdrawal tax penalty if you arent yet age 59 ½. Some of these include:

- Medical expenses that exceed 10% of your adjusted gross income

- Permanent disability

- If you leave your employer at age 55 or older

- A Qualified Domestic Retirement Order issued as part of a divorce or court-approved separation

Even if you can escape the additional 10% tax penalty, you still have to pay taxes on your withdrawal from a traditional 401. owner owes no income tax and the recipient can defer taxes by rolling the distribution into an IRA.)

Roll Your 401 Balance Into Ira

Another possibility is for you to roll the balance over into an IRA. When moving the money, make sure you initiate a trustee-to-trustee transfer rather than withdrawing the funds and then depositing them into a new IRA. Many IRA custodians allow you to open a new account and designate it as a rollover IRA so you dont have to worry about contribution limits or taxes. When rolling your 401 balance into an IRA, make sure you place traditional 401 funds in a traditional IRA, and Roth funds in a Roth IRA.

Looking For A Financial Advisor?

Get In Touch With A Pre-screened Financial Advisor In 3 Minutes

Don’t Miss: How Can You Get Money From Your 401k

Is It A Good Idea To Take Early Withdrawals From Your 401

There are few advantages to taking an early withdrawal from a 401 plan. If you take withdrawals before age 59½, you will face a 10% penalty in addition to any taxes you owe. However, some employers allow hardship withdrawals for sudden financial needs, such as medical costs, funeral costs, or buying a home. This can help you avoid the early withdrawal penalty but you will still have to pay taxes on the withdrawal.

How A 401 Loan Works

For critical short-term needs, borrowing from a 401 account can be a better choice than a hardship withdrawal, which is allowed in certain circumstances, or a high-interest bank loan. Any money borrowed from a 401 account is tax-exempt, as long as you pay back the loan on time. And you’re paying the interest to yourself, not to a bank.

You do not have to claim a 401 loan on your tax return. As long as the loan is paid back in a timely manner, the interest attached to certain plans is the only tax consequence. The term “interest” is a bit misleading because the funds go back into the participant’s own account.

The borrower must use after-tax dollars to repay the loan, including interest. This means the government taxes a portion of it twiceâincome tax is paid on the amount again when the borrower taps the account in retirement. However, 401 interest rates are typically modest so double taxation has a negligible impact. It is only significant when the amount borrowed is large and is repaid over several years.

The IRS allows loans of $50,000 or 50% of your vested balance, whichever is less. An exception is when the vested balance is less than $10,000. In that case, you may be allowed to borrow as much as $10,000, provided the vested account value is at least $10,000. Each plan has its own limits for loans and is not required to offer them at all, so check with your employer for specifics.

You May Like: What Happens To Your 401k If You Leave Your Job

Early Withdrawals Less Attractive Than Loans

One alternative to a 401 loan is a hardship distribution as part of an early withdrawal, but that comes with all kinds of taxes and penalties. If you withdraw the funds before retirement age youll typically be hit with income taxes on any gains and may be assessed a 10 percent bonus penalty, depending on the nature of the hardship.

You can also claim a hardship distribution with an early withdrawal.

The IRS defines a hardship distribution as an immediate and heavy financial need of the employee, adding that the amount must be necessary to satisfy the financial need. This type of early withdrawal doesnt require you to pay it back, nor does it come with any penalties.

A hardship distribution through an early withdrawal covers a few different circumstances, including:

- Certain medical expenses

- Some costs for buying a principal home

- Tuition, fees and education expenses

- Costs to prevent getting evicted or foreclosed

- Funeral or burial expenses

Weighing Pros And Cons

Before you determine whether to borrow from your 401 account, consider the following advantages and drawbacks to this decision.

On the plus side:

- You usually dont have to explain why you need the money or how you intend to spend it.

- You may qualify for a lower interest rate than you would at a bank or other lender, especially if you have a low credit score.

- The interest you repay is paid back into your account.

- Since youre borrowing rather than withdrawing money, no income tax or potential early withdrawal penalty is due.

On the negative side:

- The money you withdraw will not grow if it isnt invested.

- Repayments are made with after-tax dollars that will be taxed again when you eventually withdraw them from your account.

- The fees you pay to arrange the loan may be higher than on a conventional loan, depending on the way they are calculated.

- The interest is never deductible even if you use the money to buy or renovate your home.

CAUTION: Perhaps the biggest risk you run is leaving your job while you have an outstanding loan balance. If thats the case, youll probably have to repay the entire balance within 90 days of your departure. If you dont repay, youre in default, and the remaining loan balance is considered a withdrawal. Income taxes are due on the full amount. And if youre younger than 59½, you may owe the 10 percent early withdrawal penalty as well. If this should happen, you could find your retirement savings substantially drained.

You May Like: Can I Move My 401k To A Self Directed Ira

Will Your Employer Know If You Take Out A 401 Loan

Yes, its likely your employer will know about any loan from their own sponsored plan. You may need to go through the human resources department to request the loan and youd pay it back through payroll deduction, which theyd also be aware of. Loans arent guaranteed to be approved either or your plan may not offer them at all. If youre concerned about a manager or executive finding out about the loan request, consider asking HR to keep your request confidential.

Start Making Loan Payments

You will be required to make loan payments starting from the next pay period. The loan payments will include the principal and interest components of the loan, and they will be deducted automatically from your paycheck.

As long as you are an employee of the company, the employer will deduct the loan payments every pay period until you pay off the loan. If you leave the job and you have an unpaid loan, you will be required to make loan payments via check before the next tax due date.

Also Check: Can I Borrow Against My 401k

Impact Of A 401 Loan Vs Hardship Withdrawal

A 401participant with a $38,000 account balance who borrows $15,000 will have $23,000 left in their account. If that same participant takes a hardship withdrawal for $15,000 instead, they would have to take out $23,810 to cover taxes and penalties, leaving only $14,190 in their account, according to a scenario developed by 401 plan sponsor Fidelity. Also, due to the time value of money and the loss of compounding opportunities, taking out $23,810 now could result in tens of thousands less at retirement, maybe even hundreds of thousands, depending on how long you could let the money compound.

Pros And Cons Of 401 Loans

Pros

- No credit check. Your credit score isnt a factor in eligibility.

- Low rates. 401 loans typically come with lower interest rates than other borrowing methods, such as credit cards and unsecured loans.

Cons

- Risky if you lose your job. If you get laid off or quit your job, you have two to three months to pay back your entire loan before you default.

- Lose protection from bankruptcy. Funds in your 401 are protected from bankruptcy as long as theyre still in the account. But once theyre borrowed in the form of a loan, your funds are no longer protected.

- Youll pay taxes. 401 funds are tax-deferred until you withdraw from it. When repaying the loan, your employer deducts taxes first before withdrawing your repayment from your paycheck. And you still have to pay taxes later when you retire.

- Loss on investment returns. The less money you have in your 401 balance, the less youll get in returns. Even if you repay your 401 loan on time, you wont have gained as much from interest as you would if you left your account alone.

- Contribute less or not at all. You can still contribute to your 401 while youre repaying the loan, but you might not have the funds to do so. This can cost you thousands in retirement savings if you dont repay the loan quickly.

You May Like: How To Access My 401k Plan

You Have Given The Notice To Resign/quit

If you have given the notice to resign from the company, you may be denied a 401 loan. Depending on the amount of the loan and the repayment duration, the repayment period may stretch beyond the time you will be working in the company, and you could be responsible for loan repayment. This opens doors for default, and the employer may deny you a 401 loan to protect itself from loss.

Tags

Think About What Would Happen If You Lost Your Job

This is really important. If you lose your job, or change jobs, you cant take your 401 loan with you. In most cases you have to pay back the loan at termination or within sixty days of leaving your job. This is a big consideration. If you need the loan in the first place, how will you have the money to pay it back on short notice? And if you fail to pay back the loan within the specified time period, the outstanding balance will likely be considered a distribution, again subject to income taxes and penalties, as I discussed above. So while you may feel secure in your job right now, youd be wise to at least factor this possibility into your decision to borrow.

Smart Move: To lessen the odds of having to take a 401 loan, try to keep cash available to cover three to six months of essential living expenses in case of an emergency.

Don’t Miss: Can You Take Out Your 401k Early

What Is A Roth 401

Some employers offer a Roth 401 option. Employees make contributions from after-tax income. Like a Roth IRA, you pay no income taxes on qualified distributions, such as those made after the age of 59 ½assuming your first contribution was made five years prior.

Choosing a Roth 401 can make sense if you believe you will be in a higher tax bracket when you retire than you are today. For many young earners who are just beginning their careers, lower income levels and tax brackets could make a Roth 401 a great choice.

There is nothing forcing you to choose between either a traditional 401 or a Roth 401you can make contributions to both kinds of 401 plan, if your employer offers them. Consider speaking with a tax professional or a financial advisor when deciding between a traditional or a Roth 401, or dividing your contributions between both types.

Access to thousands of financial advisors.

Expertise ranging from retirement to estate planning.

Match with a pre-screened financial advisor that is right for you.

Answer 20 questions and get matched today.

Connect with your match for a free, no-obligation call.

Does A 401 Loan Hurt You

A 2020 report from the Transamerica Center for Retirement Studies found that millennials are already taking out loans against their retirement savings at almost double the rate of older generations. Even so, a 2021 study from the same organization shows that other generations arent faring much better. So if youve been trying to beat the odds and put aside adequate savings for retirement, taking out a 401 loan can be a triple whammy.

First, some plans dont allow participants to make plan contributions while they have an outstanding loan. If it takes five years for you to repay your loan, that could mean five years without adding to your 401 account. During that time, you may be failing to grow your nest egg and youll miss out on the tax benefits of contributing to a 401.

Next, if your employer offers matching contributions, youll miss out on those during any years you arent contributing to the plan. Loan repayments arent considered contributions, so if the employer contribution is dependent upon your participation in the plan, you may be out of luck if you cant make contributions while you repay the loan.

And finally, your account will miss out on investment returns on the money youve borrowed. Although you do earn interest on the loan, in a low-interest-rate environment you could potentially earn a much better rate of return if the money was invested in your 401.

What are the tax benefits of 401s?

Recommended Reading: Can Fidelity Manage My 401k

Move Your 401 To A New Employer

You can usually move your 401 balance to your new employer’s plan. As with an IRA rollover, this maintains the account’s tax-deferred status and avoids immediate taxes.

It could be a wise move if you aren’t comfortable with making the investment decisions involved in managing a rollover IRA and would rather leave some of that work to the new plan’s administrator.