Should I Move My 401 To Bonds

Whether it makes sense to move assets in your 401 away from mutual funds, target-date funds or exchange-traded funds and toward bonds can depend on several factors. Specifically, those include:

- Years left to retirement

- Where else youve invested money

- How long you expect a stock market downturn to last

Real Estate And/or Reits

Buying a property often requires upfront costs like down payment and fees for closing, on top of any renovations you choose to make. There are also ongoing costs, like maintenance, repairs, dealing with tenants, and vacancies if you decide to rent out the property.

If homeownership isnt for you, you can still invest in real estate through real estate investment trusts . REITs allow you to buy shares of a real estate portfolio with properties located across the country. Theyre publicly traded and have the potential for high dividends and long-term gains.

REITs have done superbly well this year. They dont usually do well with a pandemic, but surprisingly, they have, says Luis Strohmeier, certified financial planner, partner, and advisor at . Part of the reason is you get access to properties, such as commercial real estate and multi-family apartment complexes, that could be out-of-reach for an individual investor.

More Financial Advising Help

Seeking professional help to manage your 401 is a smart move. In 2014, Financial Engines Inc. published a report that concluded professionally managed assets perform an average of 3.2% better than nonprofessionally-managed assets. However, many professional investment managers could charge up to 3%.

SmartAsset can help you find a profitable solution to finding a safe and affordable way to get professional 401 management.

Pricing

Donât Miss: How To Access Your 401k Account

Read Also: What Can You Do With Your 401k

Can A 401 Lose Money

Can your 401 lose money? It can. Not every type of investment available via your 401 plan is stable. Many investments like company stock, variable annuities and mutual funds are subject to market conditions.

For example, suppose you invest in company ABCs stock with a $8-per-share value, anticipating the company stock will perform well over time and you could sell them at $13 per share. However, at the time of withdrawal, due to a company embezzlement scandal, the shares fall to $2 per share.

In that case, if you had 1,000 shares of that company stock, you would have spent $8,000 at the time of purchase, and made $2,000 at the time of sale, losing $6,000 in the process. Plus, that doesnt take into account all transaction fees you may have to pay.

What Causes Bear Markets

There is no one cause for bear markets, which is why trying to predict them tends to be futile. Here are the general culprits that tend to unleash the bear.

- Rising interest rates. Lenders, whether they are giving you a home mortgage or financing a mega-million-dollar bond offering, like to get their money back. They also want a rate of return thats higher than inflation. If they think inflation will rise, lenders start raising their interest rates. After all, if you earn 3 percent on an investment and inflation averages 4 percent, youve lost a percentage point.

Why is that bad for stocks? Bonds are loans to corporations, municipalities and the U.S. government. If investors can get a relatively good rate on a bond, they will tend to move money out of stocks and into interest-bearing investments, such as government bonds. In addition, higher rates mean that businesses have to pay more for loans, which reduces corporate earnings.

- Sobriety. The stock market is a place for optimists: You buy stocks because you think corporate profits will increase, the economy will be healthy and prices will rise. Every so often, however, stock investors get too optimistic, making big bets on stocks that dont deserve all that money. In 2000, for example, investors made huge bets on online companies such as the now-defunct Pets.com. Eventually, investors wised up and realized that those companies were never going to make money, and that started the big bear market of 2000.

Read Also: What Are The Different 401k Plans

When Safer Assets Make Sense

Not all 401 investment menus offered by employers are the same. So you might not have all of these choices, particularly a stable value fund. It depends on whether your employer chooses to provide them.

Itâs also important to consider whether safer assets even make sense given your personal situation.

âIf youâre 25 years old and you have a long runway before you reach retirement at 65, I would say donât consider a stable value fund,â Pottichen said.

More from Personal Finance:

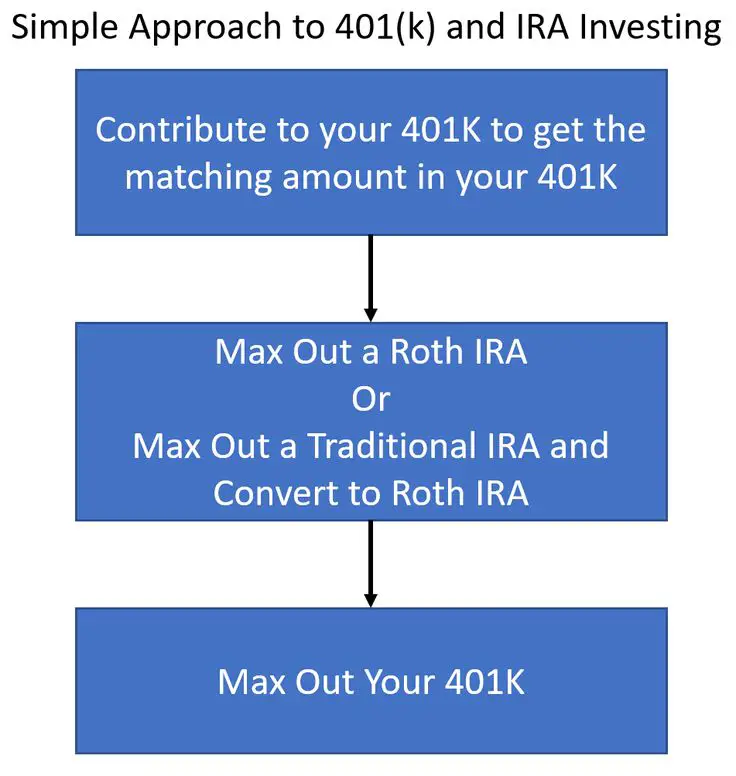

Diversify To Protect Your 401k From A Market Crash

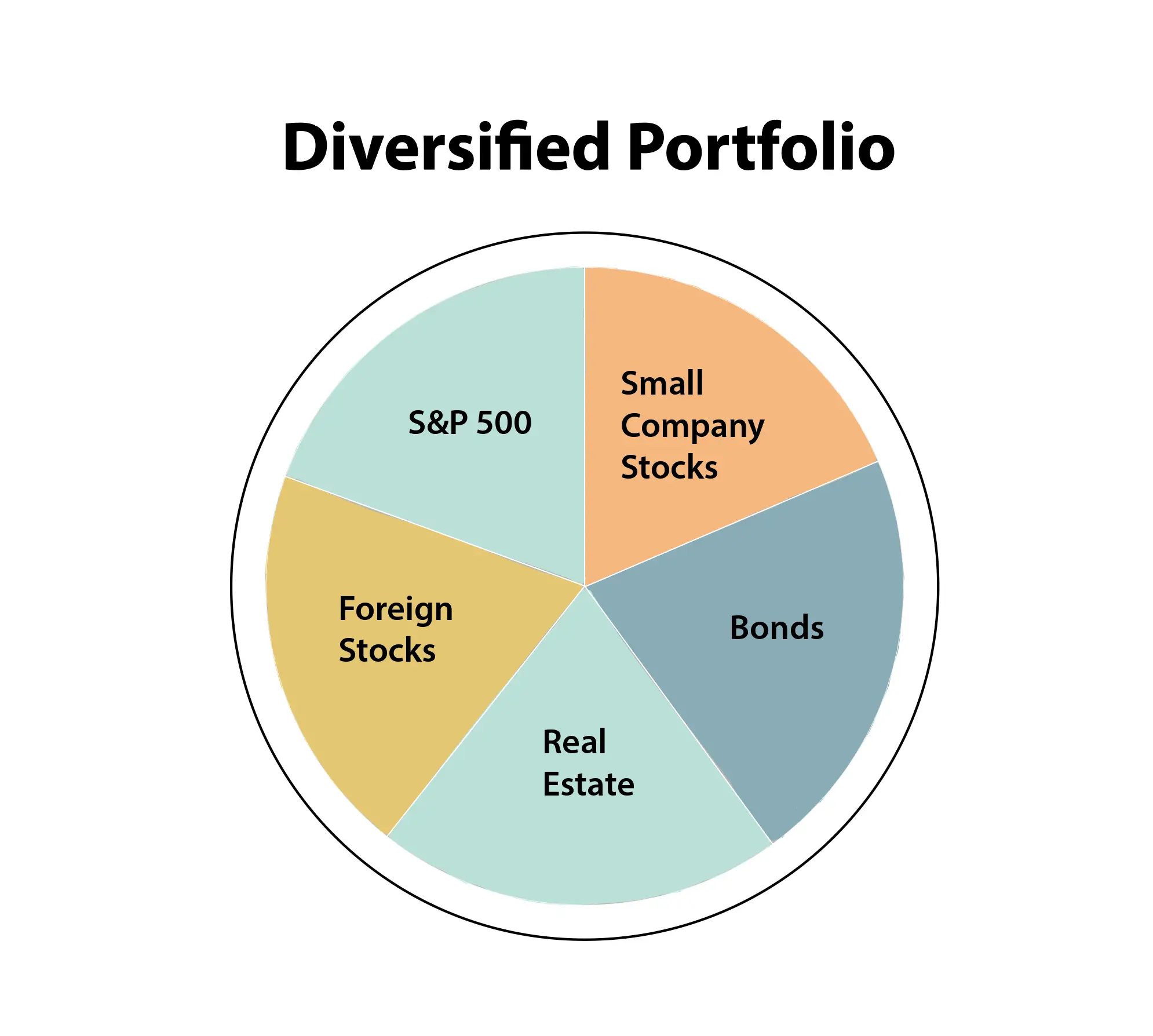

There is no foolproof strategy that will keep your portfolio safe. However, you can mitigate your risks with basic moves like diversification.

The first strategy for protecting your nest egg is diversification. To explain, put your money in several places, so you do not lose everything.

For instance, invest in different stocks and U.S. Treasury Bonds. An example of basic diversification is 20% tech stocks, 20% finance stocks, and 20% energy stocks.

In addition, invest in several good dividend stocks to have money coming in. A great rule is to have at least 50% of your 401K funds in dividend stocks.

Finally, having part of your funds outside of stocks will keep part of your money from a crash. Simply, having 20% of your funds in C.D.s or Bonds can ensure you will have cash.

Good diversification can be provided using the Portfolio Correlation Functionality in Stock Rover.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for: Growth Investing – With industry Leading Research Reports

Get Stock Rover Premium Plus Now or Read the In-Depth Stock Rover Review & Test.

Recommended Reading: Is It Worth Rolling Over A 401k

For Those Who Plan To Retire In The Next Few Years

If you plan to retire within five years, you should work to have enough funds to cover three to ten years worth of future withdrawals in safe investments. Safe accounts are those that might grow very slowly but with little risk of losing funds. They can be combined with others or used in methods to save and invest at the same time.

Transferring Your 401 To Your Bank Account

You can also skip the IRA and just transfer your 401 savings to a bank account. For example, you might prefer to move funds directly to a checking or savings account with your bank or credit union. Thats typically an option when you stop working, but be aware that moving money to your checking or savings account may be considered a taxable distribution. As a result, you could owe income taxes, additional penalty taxes, and other complications could arise.

IRA first? If you need to spend all of the money soon, transferring from your 401 to a bank account could make sense. But theres another option: Move the funds to an IRA, and then transfer only what you need to your bank account. The transfer to an IRA is generally not a taxable event, and banks often offer IRAs, although the investment options may be limited. If you only need to spend a portion of your savings, you can leave the rest of your retirement money in the IRA, and you only pay taxes on the amount you distribute .

Again, moving funds directly to a checking or savings account typically means you pay 20% mandatory tax withholding. That might be more than you need or want. Most IRAs, even if theyre not at your bank, allow you to establish an electronic link and transfer funds to your bank easily.

Don’t Miss: How To Get Money From 401k After Retirement

What Can Happen To Your 401 In Case Of A Market Crash

When the stock market crashes, it means that there has been a sudden decline in stock prices for particular companies or investments. This can happen for many different reasons, including changes in interest rates, political instability, terrorism, and the onslaught of a pandemic, among other reasons.

But what does this have to do with your 401?

When you contribute to your 401, your money is invested to grow over time. You can select from a list of investment options, and, in most cases, those options include stocks, among other assets. The value of those stocks, and therefore, of your investment, is dependent on the stock markets performance.

If theres a crash in the market, then odds are the value of your retirement fund will decline as well, making you lose a part of the money that will provide your livelihood once you retire. Therefore, its perfectly understandable that many who are about to retire constantly worry about protecting their 401 against a market downturn.

In the following section, youll find a list of the top 7 ways to protect your savings against market crashes.

Should I Change My Asset Allocation

This could be a good time to talk with your financial adviser about your goals and to check whether your portfolio aligns with those objectives, experts say. That could result in an asset allocation shift if, for instance, you want to reduce your equity exposure to lower your risk or cut back on investments in certain sectors, like tech.

“For most investors, the best approach to long-term success is broad diversification that aligns with their risk tolerance,” Richardson said. “When you diversify your portfolio, you spread your money across different assets, understanding that all investments will go up and down at different times depending on different factors.”

People who are close to retirement or already retired may want to add Treasury Inflation-Protected Securities, or TIPS, to their portfolio, she added. Investors can buy TIPS directly through the Treasury Department, or via their bank or broker. But an investor can only buy $10,000 worth of TIPS annually for each account, which limits the amount of inflation protection they can offer.

“Commodities are also a good offset to inflation,” Richardson added.

Don’t Miss: How To Transfer 401k From Prudential To Fidelity

Final Thoughts On Moving Funds

You can move your 401 funds into a fixed-income account by contacting your plan administrators and requesting for a transfer or allocation form. However, you need to remember that even though fixed-income accounts often offer capital protection and stability, their interest rates are usually lower. So, you may make less money investing in these kinds of assets than you would in higher-risk ones.

References

Read Also: How To Invest In Toronto Stock Exchange

Stable Value Vs Bond Funds

For those who will need to make withdrawals soon, the advantage of stable value over a short- or intermediate-term bond fund is lower volatility. In other words, a good return on your investment is the return of your investment.

As you get closer to the time you will be taking withdrawals, protecting yourself from loss becomes more important. Stable value funds offer a way to safeguard your money as you approach the time in your life when you will need it the most.

Read Also: Can I Transfer Money From 401k To Roth Ira

Make Sure You Have Ample Cash

Having enough cash set aside for your near-term needs will make you better prepared to weather market shocks.

If you are near or already in retirement, make sure you have ample liquidity that will provide for one to two years of your spending needs, Reddy advised.

What you dont want to do is have a market correction and then you start withdrawing money out of the market, he said.

Investors of all ages should have three to six months of cash to cover essential expenses set aside in an emergency fund, Assaf said.

Get Involved And Learn The Ropes Of The Stock Market

Your 401 is basically an investment account, and to protect it from a market crash youll need to start by learning everything you can about investing and the stock market. Unfortunately, many people avoid learning how the market works because theyre scared of losing their money if they invest incorrectly. However, you shouldnt let this be your case.

If you want to retire with peace of mind and not have to worry about a new virus wiping out all of your savings without notice, learning the ropes is your first step. There are hundreds of books and resources you can choose from to learn the basics.

Once you have that down, you can move on to practicing trading using a good broker with a demo account that will help you understand things like asset classes, order types, and volatility.

The point is to read and learn about how the markets work to make educated decisions based on what you know.

Don’t Miss: Can You Use 401k To Buy A House

Retirement Investments For 10 Years To Retirement

Reaching within a decade of your planned retirement means getting more cautious with your investments. The minimum annual return on stocks over any 10-year period going back to 1950 has been a loss of 5.1% with a maximum annualized return of 16.8% over the period.

You read that right. Investors in February 2009 had lost 5% a year on stocks over the preceding decade.

For investors within a decade of retiring, you may want to cut your investment in stocks to 50% or less. You may still need some growth potential to meet retirement goals and protection against inflation but you cant afford to take too much risk at this point.

Precious metals and other hard assets like real estate should make up a larger proportion of your retirement investments, upwards of 35% or more. These real assets offer the ultimate protection against inflation and can provide upside return as well.

While bonds will not offer much return, you will also want to increase your holding of fixed income investments as you head the decade before your planned retirement date. Most investors should still limit their portfolio to about 35% or less in bonds, in favor of real assets that can provide inflation protection.

Extra Benefits For Lower

The federal government offers another benefit to lower-income people. Called the Saverâs Tax Credit, it can raise your refund or reduce the taxes owed by offsetting a percentage of the first $2,000 that you contribute to your 401, IRA, or similar tax-advantaged retirement plan.

This offset is in addition to the usual tax benefits of these plans. The size of the percentage depends on the taxpayerâs adjusted gross income for the year and tax-filing status. The income limits to qualify for the minimum percentage offset under the Saverâs Tax Credit are as follows:

- For single taxpayers , the income limit is $33,000 in 2021 and $34,000 in 2022.

- For married couples filing jointly, itâs $66,000 in 2021 and $68,000 in 2022.

- For heads of household, it maxes out at $49,500 in 2021 and $51,000 in 2022.

Also Check: What Can You Rollover A 401k Into

Don’t Try To Time The Market

There’s a reason why you may have heard this many times: Investment professionals show that timing the market or trying to guess when stocks are at their top or bottom is nearly impossible. Research has shown that people who dump stocks during a market downturn are likely to miss the days when the market rises sharply, and that can make a dent in long-term returns.

For instance, one study published by the investment organization CAIA found that a buy-and-hold investor would have an annual return of almost 10% from 1961 to 2015. But an investor who tried to time the market and missed the 25 best days during that period would have an annual return of less than 6%.

To be sure, if an investor managed to avoid the worst 25 days during that period, their annualized return would have been more than 15%. But predicting both the worst and best days of the market is notoriously difficult, which is why investment pros recommend sticking with the “buy and hold” strategy.

Use An Etf Strategy Designed To Avoid Crashes

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you avoid or minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens, so you can protect your portfolio. You will also know when the bear market is over, so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments 3 Index ETF Strategies Outperforms the NASDAQ 100, S& P500& Russell 3000 Beats the DAX, CAC40 & EURO STOXX Indices Buy & Sell Signals Generated

You May Like: How Do I Start A 401k For Myself

Set Your Contributions As A Percentage Of Your Salary

There are two general ways 401 plans allow people to manage their contributions — either as a specific dollar amount per paycheck or as a percentage of their salaries. If you have the option to enter your contribution based on a percentage of your salary, it’s a good idea to go that route.

If you choose to contribute a percentage of your salary, your contributions will increase automatically as your salary rises over time with yearly adjustments and raises. This can help to scale up your retirement savings goals over the course of your career with minimal intervention on your part.

Keep Contributing To Your 401 And Other Retirement Accounts

Steadily contributing to your 401 is another way to protect it from future market volatility. Cutting back on your contributions during a downturn may cost you the opportunity to invest in assets at discount prices. Meanwhile, maintaining your 401 contributions during a period of growth when your investments have exceeded expectations is equally important. The temptation to scale back your contributions may creep in. However, staying the course can bolster your retirement savings and help you weather future volatility.

Donât Miss: How To Self Manage Your 401k

Don’t Miss: How Long Do You Have To Roll Over Your 401k