Learn Which Type Of Retirement Accounts Can Be Combined

The most common types of retirement accounts can be transferred into one IRA and one Roth IRA. For example, once you have left your employer, you can move your 401 to an IRA. This is called a rollover. When you move money from a 401 to an IRA using an IRA rollover, there are no taxes due, as it is considered a direct transfer from one type of retirement account to another. In your new IRA, youll pay taxes only as you take withdrawals. If you are between ages 55 and 59 1/2, make sure you understand the 401 retirement age rules before you decide to move money out of a 401 plan.

401s, 403s, SEP accounts, SIMPLE accounts, KEOGHs, individual 401s, and some 457 plans can all be transferred into one IRA account. Having everything in one account makes it easy to update and change beneficiaries, manage investments, and take withdrawals. When you reach age 72, you are required to take a minimum withdrawal amount, and that can be challenging to manage if your accounts are spread out.

If you have after-tax contributions in your 401 plan or other retirement accounts, those can usually be transferred into a Roth IRA account. Alternatively, you may find it advantageous to convert a portion of your pre-tax 401 contributions to a Roth IRA. Doing so will trigger an immediate tax bill, but future tax-free growth may position you better for the long term. A financial advisor and/or tax professional can provide some guidance on that front.

Recommended Reading: Who Qualifies For A Solo 401k

If You Qualify To Contribute To A Roth Ira You Can Enjoy A Higher Contribution Limit In 2023

Last month, the IRS announced the new Roth IRA contribution limits for 2023. For the first time in several years, the contribution cap is moving beyond $6,000 for people under 50. This is great news for people seeking to tuck away more money in a retirement account and receive tax-free income during retirement.

Below, we’ve summarized the new contribution and income limits so you can plan ahead for 2023. Before you add money to a Roth IRA, make sure you meet the requirements.

Image source: Getty Images.

Know The Rules For Roth 401 Rollovers

If you have moved jobs while holding a traditional 401, you are probably familiar with the rollover options for these ubiquitous retirement accounts. You may be less sure, though, of your options when you leave an employer with whom you hold a Roth 401, the newer and less prevalent cousin of the traditional 401.

The main difference between the traditional 401 and the Roth 401 is that the former is funded with pretax dollars, while Roth contributions are in post-tax dollars so there is no tax hit from a qualified withdrawal made in the future.

If your job is at stake, you are changing employers, or considering a career move, here are the Roth 401 rollover options you need to know.

Recommended Reading: How Do You Use Your 401k After Retirement

Should You Convert To A Roth Ira Now

Once youâve decided a Roth IRA is your best retirement choice, the decision to convert comes down to your current yearâs tax bill. Thatâs because when you move money from a pre-tax retirement account, such as a traditional IRA or 401, to a Roth, you have to pay taxes on that income. It makes sense: If you had put that money into a Roth originally, you would have paid taxes on it for the year when you contributed.

Democrats tried to put a moratorium on backdoor Roth conversions, primarily for the wealthy through the Build Back Better bill, which was first introduced by President Joe Biden in 2020. The bill aimed to create RMDs for accounts that exceeded $10 million while closing the door on additional contributions. This would, thus, close loopholes used by many wealthy individuals. The bill did not pass and was replaced by the Inflation Reduction Act of 2022.

-

Huge tax advantages, including tax-free growth and tax-free withdrawals in retirement

-

Withdrawals are allowed at any time, for any reason, tax-free

-

Doesn’t have required minimum distributions

-

You pay tax on the conversionâand it could be substantial

-

You may not benefit if your tax rate is lower in the future

-

You must wait five years to take tax-free withdrawals from the Roth after a rollover, even if youâre already age 59½

A Roth IRA rollover is most beneficial when:

How And Why To Transfer Your 401 To An Ira

posted on

By Justin Pritchard, CFP® in Montrose, CO

When you change jobs or retire, you have several options for the money in your 401. You can typically transfer that money to an IRA, leave it in the plan, move it to your new jobs retirement plan, or cash out. In many cases, its smart to move your savings into an IRA. Well cover the pros and cons here so you can decide whats best.

The process can be confusing and intimidating, so its easy to do nothing. But that might result in leaving your savings with an employer that you no longer have any connection to, and one you might even dislike or distrust.

Key takeaway:Read more below, or listen to the explanation .

Recommended Reading: Which 401k Plan Is Best For Me

When Leaving Your Job You Can Typically Cash Out Your 401 Or Roll It Over Into A Different Retirement Account

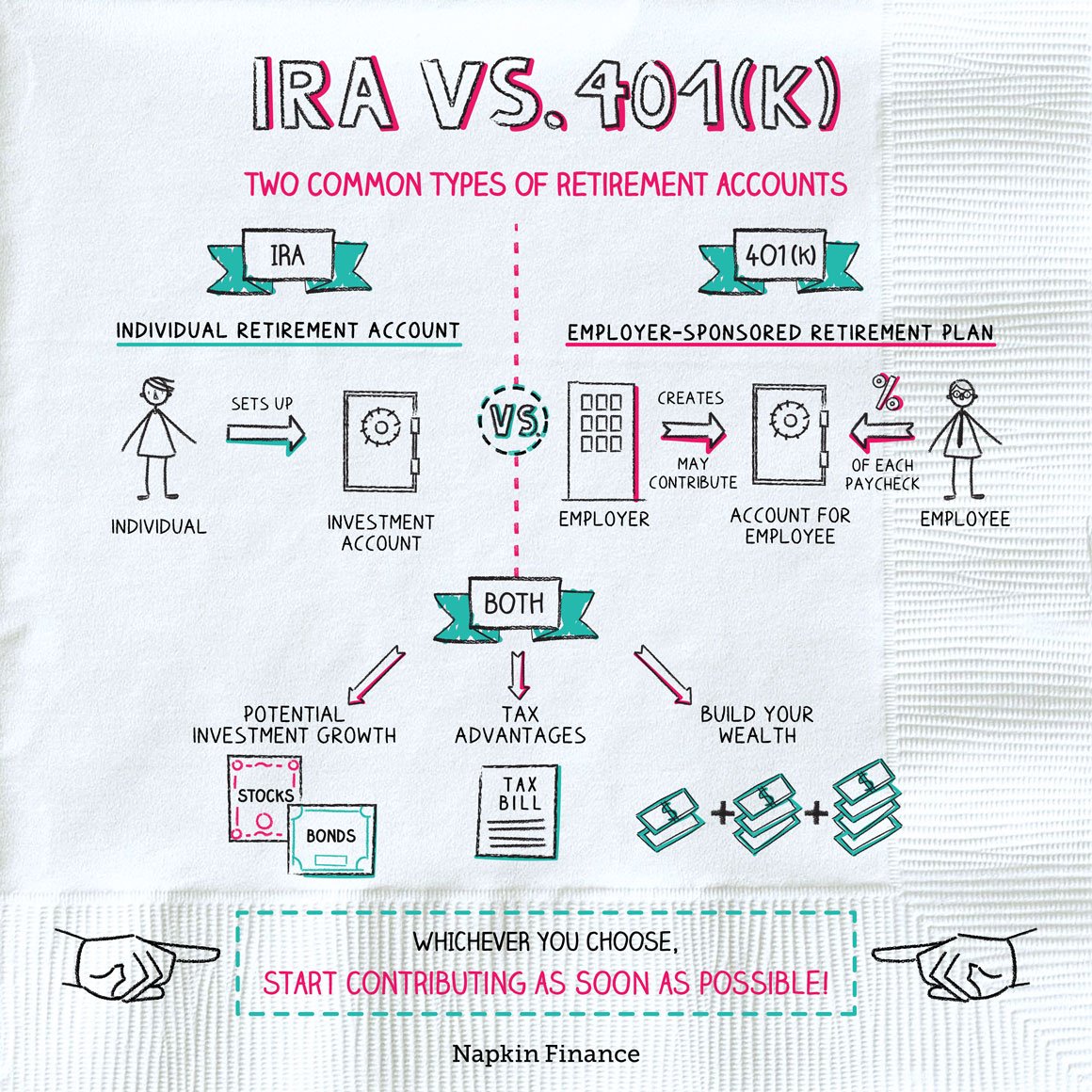

Both a 401 and IRA are tax-advantaged retirement accounts, but they work differently. 401s are sponsored by employers and often offer limited investment options. IRAs arent linked to employment. They can be opened with any brokerage firm or other financial institutions and have a wider variety of investment selections, but require more hands-on management.

Because 401s are offered through employers, youll need to determine what to do with yours when you leave your job. Your options include:

- Leave it invested

- Rollover to a new 401

- Rollover to an IRA

There are plenty of pros and cons to these options, but lets take a close look at when rolling your workplace 401 into an IRA may make sense for you.

Roth Ira Conversion Ladder

A Roth IRA conversion ladder is a series of Roth IRA conversions made year after year. Its a way for people to tap their retirement savings early without penalty. The government lets you withdraw your Roth IRA conversions tax- and penalty-free after theyve been in your account for five years, and Roth IRA conversion ladders leverage this to get around the governments 10% early-withdrawal penalty on tax-deferred savings for those under 59 1/2.

You start by converting the sum you expect to spend in your first year of retirement from your 401 or other tax-deferred account to a Roth IRA at least five years beforehand so you can access it penalty-free when you retire. Then, four years before youre ready to retire, you convert another sum you can use in your second year of retirement. You continue doing this until you have enough to last you until youre 59 1/2, at which point you can use all your savings penalty-free.

It requires a lot of retirement savings to pull off, and it could result in a larger tax bill, but its a strategy worth considering if you plan to retire before youre 59 1/2.

There are quite a few rules to keep in mind when youre doing a 401 to Roth IRA conversion, but as long as you check your plans restrictions and prepare yourself for the accompanying tax bill, you shouldnt run into any problems.

Read Also: How Do I Find Out Where My Old 401k Is

Read Also: Where Can I Cash A 401k Check

Taxpayers Can Now Take Tax Free Jump From 401k To Roth Ira

Moving your retirement money around is now easier than ever. In a conciliatory move for taxpayers, the IRS has issued new rules that allow you to minimize your tax liability when you move 401 funds into a Roth IRA or into another qualified employer plan. The situation arises when you have a retirement account through your employer that includes both pre-tax and after-tax funds. However, allocating your retirement funds to new plans becomes tricky upon leaving the company.

The new allocation rules took effect in 2015, but taxpayers chose to apply them to distributions as early as September 18, 2014, the date the new rules were released by the IRS.

Under the old rules, you would have to pro-rate distributions and rollovers separately between pre-tax and after-tax amounts according to a set formula, resulting in payment of tax on a pro rata share of pre-tax funds. The new rules allow you to do the allocations yourself within certain limits. You can now choose to move pre-tax money into a traditional IRA and after-tax money into a Roth IRA. If you moved pre-tax amounts into a Roth IRA, you would have to pay tax on the rollover because Roths can only be funded with after-tax money. Now you can direct pre-tax dollars to one account and after-tax dollars to another to avoid tax liability.

Lets look at an example.

Smart Planning

Choose Your 401 Rollover Destination

Consider whether a traditional IRA or Roth IRA makes the most sense for your 401 rollover.

401 Rollover to Traditional IRA: If you want to maintain the same tax treatment, this can be a good choice, Henderson says. You avoid extra hassle, and you just see the same RMD and tax treatment as you would with your current 401.

401 Rollover to Roth IRA: For those with high incomes, the 401 rollover to a Roth IRA can serve as a backdoor into a Roth tax treatment. But dont forget about the taxes, Henderson says. In addition, remember the five-year rule when it comes to Roth accounts: Even at 59 ½, you cannot take tax-free withdrawals of earnings unless your first contribution to a Roth account was at least five years before. Those close to retirement, therefore, may not benefit from this type of conversion. Talk to a tax professional if youre rolling into an account with different treatment, says Henderson.

Read Also: How To Find Your 401k Account Number

A Tax Loophole Lets High Earners Contribute Indirectly To A Roth Ira

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

High-income earners cant contribute directly to a Roth IRA. But thanks to a tax loophole, they can still make contributions indirectly. If you take advantage and maximize your retirement savings, you can save tens or even hundreds of thousands of dollars on taxes over the years. Let’s delve deeper into this loophole and the benefits of setting up a backdoor Roth IRA.

Roth Ira Rollover Methods

The simplest way to convert to a Roth is a trustee-to-trustee or direct rollover from one financial institution to another. Tell your traditional IRA provider that youd like to transfer the money directly to your Roth IRA provider.

If both IRAs are at the same firm, you can ask your financial institution to transfer a specific amount from your traditional IRA to your Roth. This method is called a same trustee transfer.

With an indirect rollover, you receive a distribution from your traditional IRA. You then have 60 days to deposit it into your Roth IRA.

Also Check: How To Get A Personal 401k

How Does A 401 To Roth Ira Conversion Work

Converting a 401 into a Roth IRA gives you greater ownership and direction over your money. A 401 is a tax-advantaged retirement account that is managed by an employer, while a Roth IRA is a tax-advantaged retirement account that is managed by you.

In practice, this means youll open a Roth IRA account at an online brokerage firm and then roll any money in your 401 into your new account.

Beware: this will likely be a taxable event. Most, but not all, 401 accounts are tax-deferred. This means that youve never paid any taxes on the money within. Roth IRAs, on the other hand, are post-tax, meaning that they must contain only money that has already been taxed. If you have a tax-deferred 401, also known as a traditional 401, you will owe ordinary income taxes on the amount of money you convert into a Roth IRA.

How Much Money Do I Need To Open A Vanguard Ira

At Vanguard, you can open an account with a $0 balance. But there are a few minimums to keep in mind as you begin to invest.

- Vanguard ETFs: You only need enough money to cover the price of 1 share, which can generally range from $50 to a few hundred dollars.

- Vanguard mutual funds: Some Vanguard mutual funds have a $1,000 minimum . Most of our other Vanguard mutual funds have a $3,000 minimum.

Read Also: What Age Is Retirement For 401k

Can I Use A Traditional Or Roth Ira To Invest In Crypto

Yes, you can use a self-directed traditional or Roth IRA to invest in crypto. The primary difference between traditional and Roth IRAs lies in the timing of their tax advantages. In traditional IRAs, you contribute your gross or pretax income and then pay tax on distributions taken at retirement age. However, in Roth IRAs, you contribute your net or after-tax income and typically do not pay tax on distributions taken at retirement age.

Roth Ira Rollover Rules From 401k

As a reminder, you must generally be separated from your employer to roll your 401k into a Roth IRA. However, some employers do permit an in-service rollover, where you can do the rollover while still employed. Its permitted by the IRS, but not all employers participate.

Before January 1, 2008, you werent able to roll your 401 into a Roth IRA directly at all. If you wanted to do so you had to complete a two-step process.

However, the law changed shortly after and this option became available. Still, just because the law has made this option available doesnt mean you can definitely roll your old 401 into a Roth IRA no matter what. Unfortunately, it all depends on your plan administrator.

For example, recently I had two clients who intended to roll their old retirement plans into a Roth IRA.

One client had an old military retirement plan- Thrift Savings Plan and the other had an old state retirement plan. After helping each of them complete the required paperwork, I came across an interesting discovery.

The TSP rollover paperwork had a box you could mark if you wanted to roll over the plan into a Roth IRA . However, the state retirement plan did not give that option.

The only option was to open a traditional IRA to accept the rollover then immediately convert it to a Roth IRA. That certainly seemed like a hassle at the time, and it definitely was.

Read Also: How Do I Sign Up For 401k

Don’t Miss: Can I Rollover My 401k Into An Existing Ira

Direct And Indirect 401 Rollovers

Before you roll over your 401, youll need to open an IRA account. You can do this at virtually any major brokerage firm, mutual fund company or robo-advisor. Do some research, then head to your financial institutions website to open your account. At some point, youll want to talk to a customer representative to find out whether the rollover and conversion can be done at once or if they are done sequentially. If its the former case, youll just have to pick your investments once. If its the latter, youll want to keep the money liquid in the IRA before converting to a Roth.

Once youve opened the IRA, you can contact the company managing your 401 account to begin the rollover process. You can do this online or over the phone. Your 401 plan administrator will then transfer your funds into your new IRA account. This is called a trustee-to-trustee or direct rollover, and its the easiest way to do it.

Another path is an indirect rollover. In this case, the balance of the account is distributed directly to you, typically as a check. Youll have 60 days from the date you receive the funds to transfer the money to your custodian or IRA company. If you dont deposit the funds within the 60 days, the IRS will treat it as a taxable withdrawal, and youll face a 10% penalty if youre younger than 59.5. This risk is why most people choose the direct option.

Tips For Managing Your Retirement Accounts

- Taking care of your retirement plans on your own is harder than it might seem. Luckily, finding the right financial advisor that fits your needs doesnt have to be hard. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Check your 401 contributions each year to make sure youre taking full advantage of your employers plan when it comes to matching contributions. Run the numbers through our 401 calculator annually to make sure youre contributing enough to reach your target retirement savings goal.

Also Check: How To Transfer 401k To Fidelity

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

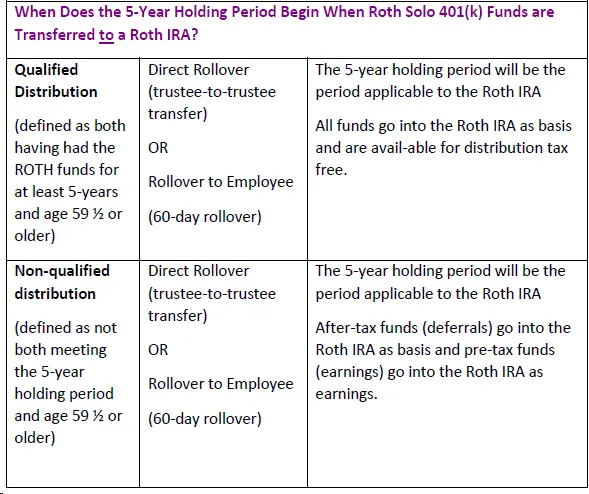

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.