How Does A Roth Ira Work

Roth IRAs are individually-owned retirement funds that anyone can open as long as they meet the income requirements. In 2019, single individuals making $122,000 or less can contribute to a Roth IRA. However, if they make $137,000 or more, they cannot contribute at all. A reduced contribution rate applies if they make more than $122,000 but less than $137,000. Couples who file jointly can’t contribute if they make more than $193,000 combined.

Like a 401, there are limits to how much you can invest annually in your Roth IRA. You cannot contribute more than your taxable compensation for the year, and the maximum contribution for 2019 is $6,000 if you’re age 50 or over, it’s $7,000. And whether you can put in the full amount depends on your tax filing status and how much you earn annually.

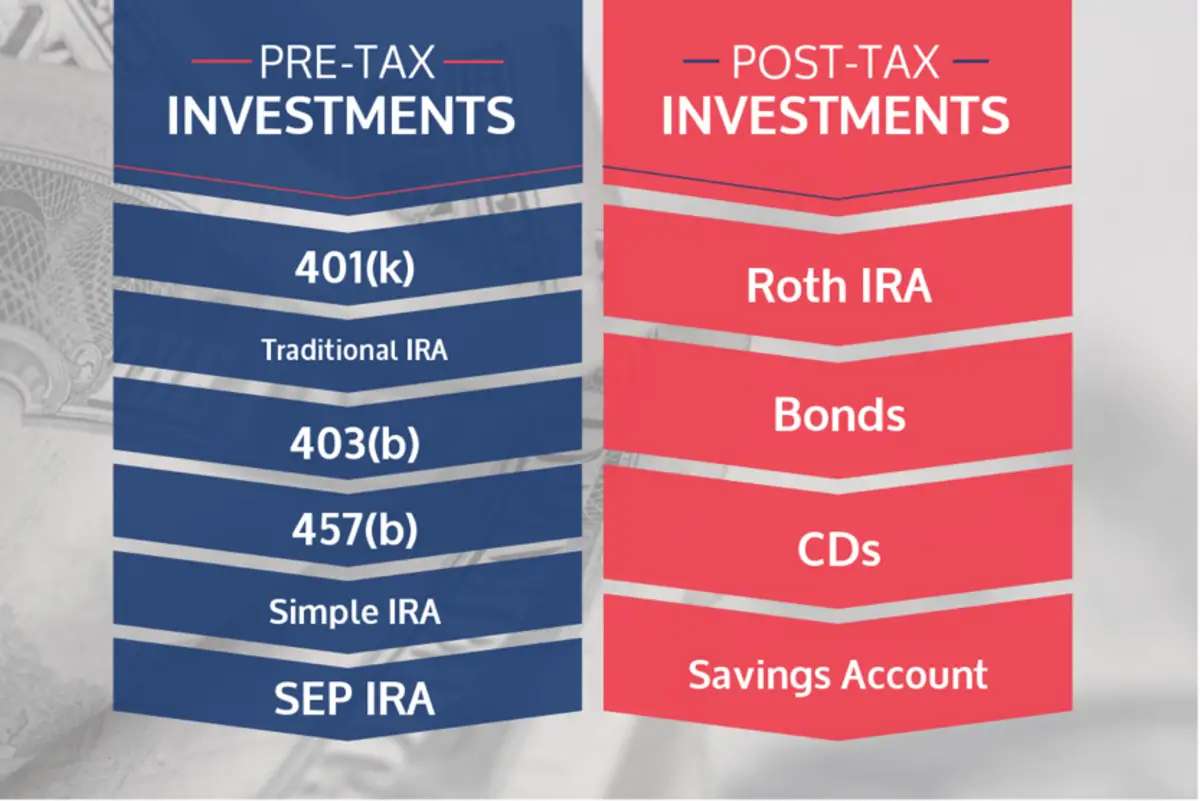

Roth IRA contributions are made using after-tax dollars and, as a result, are not taxed when you withdraw the money, as long as your account has been active for five years.

While you can withdraw any Roth IRA contributions at any time, regardless of the reason, without receiving a penalty, you will be penalized if you withdraw any investment earnings from your Roth IRA prior to the age of 59½, unless it’s for a qualifying reason.

Disadvantages Of A Roth Ira

Just like a 401, a Roth IRA has its downsides:

- Contribution limit. You can only invest up to $6,000 in a Roth IRA each year or $7,000 if youre age 50 or older.3 Thats a lot less than the 401 contribution limit.

- Income limits. If youre single or the head of a household, your modified adjusted gross income has to be less than $125,000 to contribute the full amount to a Roth IRA. If youre married and file your taxes jointly with your spouse, your MAGI must be less than $198,000. If your income is above these limits, the amount you can invest is reduced. And if you make $140,000 or more as a single individual or $208,000 or more as a married couple filing jointly, youre not eligible for a Roth IRA.4 However, the traditional IRA would still be an option.

How Does A 401 Work

While both accounts are tax-advantaged and intended to help individuals save for retirement, there are some big differences between them.

A 401 is employer-sponsored, which means you can only open an account if it’s offered by the company you work for. You typically can’t sign up for one independently. Any contributions to a 401 account are made using pretax dollars that come straight out of your paycheck.

With a 401, or other employer-sponsored account like a 403, you don’t pay taxes on the money until you begin taking out distributions for retirement. How much that money gets taxed depends on the tax bracket you’re in at the time of the withdrawal, and pulling from your 401 prior to the age of 59½ could result in a penalty.

A major perk with 401 plans is that employers often offer a “contribution match.” This is also sometimes referred to as an “employer match” or “company match,” but typically it means your company contributes the same amount to your 401 as you do, up to a certain percent.

For example, if you earn $55,000 a year plus a 4% match, you’ll need to contribute 4% in order to get the full employer match of $2,200. If you only put in $1,000, your employer will as well, which means you’re missing out on $1,200 of essentially free money that could be growing in the market.

In the U.S., the average company 401 match is 4.7%, according to retirement plan provider Fidelity.

You May Like: Should I Move 401k To Ira

Whats Better Roth 401 Or Pre

Then the question is, well whats better for you? Should it be pre-tax or should it be Roth?

So lets take a look at those things. And again, just to drive home the foundation here, your contributions with the Roth are made with after-tax dollars. With the pre-tax 401, it is pre-tax.

Now your limits here, your contribution limits, this is currently 2020, very end of 2020. This may change. But your limits right now are $19,500, if youre 49 years of age or younger and contributing. And if youre age 50 or older, you get that catch-up contribution which is super-cool. The IRS allows you to put an additional $6,500 into your 401 retirement plan. So those are your contribution limits.

I get asked an awful lot, Well, how much should I put into my 401? And the number one thing I tell people is, you should put in at least 10%. I know its very hard for a lot of people to do that, but when we talk about retirement and shaping what your future golden years are going to look like, the 10% today is going to be a lot better off than waiting. The longer you go, it takes longer to catch up, the less youll have in retirement and so on and so forth.

The other thing to think about here is growth. And the growth in that account, once you get the money in there, whether its pre-tax or whether its Roth, that growth is going to be tax-deferred. And eventually, when you pull the money out of a pre-tax account, thats going to be taxable at your ordinary income rates.

Have Questions About Investing Funds From Your Ira Or 401k Into Our Multifamily Fund Contact Us For The Pros And Cons

If youre reading this, you likely know that there is enormous value for investors in property investing. Real estate, particularly in multifamily and commercial properties, offers some of the highest ROI. But doing so takes a large investment of funds. What many prospective investors dont know is they may have those resources in their IRA and/or 401K. There are ways to use either of these to invest in multifamily and commercial properties.

With the stock market at record highs, many investors are looking to buy an investment property as a way of diversifying their portfolios. But with real estate also at record highs, it has created a dilemma for some investors: should they be saving for and investing in real estate, or should they stay the course and continue maxing out their retirement accounts?

Most people dont realize that it isnt an either-or situation.

In fact, it is possible to use both your 401k and individual retirement accounts to invest in real estate. And contrary to popular belief, it is possible to do so without suffering from steep withdrawal penalties.

There are some key differences between how to invest with either an IRA or 401k, which well cover in this article. This guide is intended to be an investors go-to resource for learning about how to leverage their retirement plans to buy an investment property, including the pros and cons of using this approach and alternative investment strategies to consider.

Don’t Miss: How To Figure Out 401k Contribution

Roth Ira Or : Which Should You Fund First

Plus six more strategic moves to a successful financial end game.

Judging from the many responses I received to my column about whether you should invest in the market or pay down your mortgage, a lot of you are strategizing about how best to allocate your financial resources. That’s smart. Managing your personal finances is a lot like running a business, and the best businesspeople are those who make the best decisions about how to allocate their capital.

Grappling with whether to invest in the market or pay down your mortgage isn’t the only decision you have to make when determining how to allocate your personal financial resources, though–not by a long shot. For instance, you also have to pick and choose among the different investment-account types available to you. Should funding your 401 be your top priority, given that your money goes in on a pretax basis? How do Roth or traditional IRAs fit into the picture?

What Is A Roth Ira

A Roth IRA is a retirement savings account you can open yourself. Unlike a 401, you contribute to a Roth IRA with after-tax money. When you hear the word Roth, think happybecause a Roth IRA allows your savings to grow tax-free. And when you celebrate turning 59 1/2, you can withdraw money from your account tax-free!

An IRA is a great option for people who are self-employed or who work for small businesses that dont offer a 401 plan. And if you do have a 401, you could save extra money and diversify your investments by opening an IRA.

Recommended Reading: Can You Use Your 401k For A House Down Payment

Your 401 Is The Best Way To Save For Retirement

The very first thing that you need to know is, the 401 that you have at work is absolutely one of the best ways that you can possibly save for retirement. That being said, it can also be a little bit confusing.

There are a lot of moving parts. There are investments. Theres possibly employer matches. There are rules on contributions. There are model portfolios. And theres our topic of the day, which is, should you put your money into pre-tax or after-tax Roth 401 contributions?

So, were going to dig deep into that right now.

There Are Roth Ira Contribution Limits

To be able to contribute to a Roth, you must have earned income. You are also limited to stashing up to $6,000 in a Roth IRA and an extra $1,000 if you’re 50 or older for 2021. Those amounts are staying the same for 2022. You can contribute to both Roth and traditional IRAs, but the total cannot exceed this annual limit.

But higher-income taxpayers are barred from contributing to a Roth IRA. For 2021, the ability to contribute to a Roth phases out if your adjusted gross income is between $198,000 and $208,000 for joint filers and between $125,000 and $140,000 for single filers. For 2022, your ability to contribute will phase out between $204,000 and $214,000 for joint filers and $$129,000 and $144,000 for single filers.

You can make a 2021 Roth IRA contribution as late as April 18, 2022.

Read Also: Should I Roll Over 401k From Previous Employer

What’s The Difference Between A Roth Ira And A Traditional Ira

Both types of IRAs allow you to save for retirement. A Roth IRA allows you to save after-tax funds, and you must meet income requirements to contribute to one. You can withdraw those funds tax-free in retirement. A traditional IRA allows you to save pre-tax funds, and you may be able to deduct your contributions, depending on your income and whether you and/or your spouse have retirement plans at work. You pay taxes on withdrawals in retirement.

What Is A 401k

A 401k is an employer-sponsored retirement plan that many, but not all, companies establish for their employees and often contribute some amount too. Upon enrollment in the plan, you can choose how much youd like to contribute either a set dollar amount or a percentage of your salary. That amount is then deducted from your paycheck and goes into your 401k investment plan on a pre-tax basis. As of 2019, people can invest up to $19,000 in their 401k each year.

Each plan has its own limited list of available investment options for you to choose from. If you do not select a specific plan, you will be auto-enrolled into a default investment selected by your plan provider.

The big thing to understand about a 401k is that you will be taxed upon withdrawing money from your account in retirement. It doesnt matter if the funds you withdraw came from your own contribution or the earnings from your investment in either case, the funds will be considered part of your gross income on your tax return and taxed accordingly.

Read Also: When Can I Withdraw From My 401k

What Is A Roth 401

The Roth 401 is a type of retirement savings plan that allows you to make contributions after taxes have been taken out. Then, you receive tax-free withdrawals when you retire.

The Roth 401 was introduced in 2006 and was designed to combine features from the traditional 401 and the Roth IRA. With a Roth account, you can take advantage of the company match on your contributions, if your employer offers one, just like a traditional 401. And the Roth component of a Roth 401 gives you the benefit of tax-free withdrawals.

Can You Invest In Reit Through Ira

Is it wise to invest in a REIT via your IRA if it is tax-shielded and REITs are tax-shielded?? It is very often the answer that is yes.. Financial journalist Reuben Gregg Brewer says that if you own REITs in a traditional IRA, you wont have to pay taxes on that income until you withdraw the money.

Read Also: Can You Withdraw From Fidelity 401k

Extra Mortgage Payments Vs Investing

Assume you have a 30-year mortgage of $150,000 with a fixed 4.5% interest rate. You’ll pay $123,609 in interest over the life of the loan, assuming you make only the minimum payment of $760 each month. Pay $948 a month$188 moreand youll pay off the mortgage in 20 years, and youd save $46,000 in interest.

Now, lets say you invested that extra $188 every month instead, and you averaged a 7% annual return. In 20 years, youd have earned $51,000$5,000 ahead of the sum you saved in intereston the funds you contributed. Keep on depositing that monthly $188, though, for 10 more years, and youd end up with $153,420 in earnings.

So while it may not make a huge difference over the short term, over the long term, youll likely come out far ahead by investing in your retirement account.

The Boring Glory Of Index Funds

Your best bet is to buy something called an index fund and keep it forever. Index funds buy every stock or bond in a particular category or market. The advantage is that you know youll be capturing all of the returns available in, say, big American stocks or bonds in emerging markets.

And yes, buying index funds is boring: You usually wont see enormous day-to-day swings in prices the same way you may if you owned Apple stock. But those big swings come with powerful feelings of greed, fear and regret, and those feelings may cause you to buy or sell your investments at the worst possible time. So best to avoid the emotional tumult by touching your investments

You May Like: How To Transfer 401k From Vanguard To Fidelity

Is 401k And Roth Ira The Same

The primary distinction between a Roth IRA and a 401 is how they are taxed. You invest pretax cash in a 401, lowering your taxable income for the year. A Roth IRA, on the other hand, allows you to invest after-tax cash, which means your money will grow tax-free.

Is anyone else feeling like theyve been drinking from a firehose? That was quite a bit of data! Lets go over the key distinctions between a Roth IRA and a 401 so you can compare their benefits:

Employer-sponsored programs are the only way to get it. Before enrolling, there may be a waiting time.

Earned income is required, although restrictions apply after a certain amount of income, depending on your filing status.

$20,500 per year in 2022 . Highly compensated employees may be subject to additional contribution limits .

To avoid fines, you must begin drawing out a specific amount each year at the age of 72.

A third-party administrator manages investment opportunities for the account.

Donât Miss: Can I Roll My Wifeâs 401k Into My Ira

Are 401k And Roth 401k Limits Combined

This is an after-tax contribution, which means you wont be able to deduct the contribution from your taxable income. Keep in mind that the maximum contribution is the aggregate limit across all your 401 plans You cant save $19,500 in a traditional 401 and another $19,500 in a Roth 401.

Can you contribute to a 401k and a Roth 401k? If your employer offers a 401 plan, there may still be room in your retirement savings for a Roth IRA. Yes, you can contribute to 401 and Roth IRAs, but there are certain limitations you should consider. This article will cover how to determine your eligibility for a Roth IRA.

You May Like: How To Borrow From Your 401k

Compromise Position: Funding Both At Once

Between these two options lies a compromisefund your retirement savings while making small additional contributions toward paying down your mortgage. This can be an especially attractive option in the early phases of the mortgage when small contributions can reduce the interest you’ll ultimately pay. Or, if the market is being extremely volatile or spiraling downward, it might make more sense to pay down your mortgage instead of risking the loss of investment funds.

Since individual circumstances vary widely, theres no one answer as to whether its better to pay down a mortgage or to save for retirement. In each case, you have to run your own numbers. Overall, however, dont sacrifice the long-term savings goals of your retirement plan by focusing too much on your mortgage. By prioritizing your retirement-savings goals first, you can then decide if any additional savings are best spent on further contributions to your mortgage or on other investments.

In fact, you should balance paying down a mortgage against the return prospects of other, non-retirement savings options. For example, if your mortgage interest rate is far above what you can reasonably expect to earn, getting rid of it can be advantageous . Also, if you have an unusually high interest rate on your mortgage, it makes financial sense to pay down the debt firstor look into refinancing.