What Does Vesting Mean

Even if your employer makes a matching contribution to your 401, that money may not be yours. Many employers use their 401s to retain talent, so they include a vesting period for matching contributions. Once the vesting period ends, the money becomes fully yours.

Any money your employer contributes is kept separate from your contributions. Depending on your 401 plan, employer contributions can vest all at once or slowly over time. Once youve finished the vesting period, all previous and future contributions are vested and become yours immediately.

When considering a job change, take into account any money you may be leaving behind because it has not vested yet check your employers vesting schedule for more details.

For more on 401 vesting, check out our article detailing how 401 vesting works.

Impact Of Inflation On Retirement Savings

Inflation is the general increase in prices and a fall in the purchasing power of money over time. The average inflation rate in the United States for the past 30 years has been around 2.6% per year, which means that the purchasing power of one dollar now is not only less than one dollar 30 years ago but less than 50 cents! Inflation is one of the reasons why people tend to underestimate how much they need to save for retirement.

Although inflation does have an impact on retirement savings, it is unpredictable and mostly out of a person’s control. As a result, people generally do not center their retirement planning or investments around inflation and instead focus mainly on achieving as large and steady a total return on investment as possible. For people interested in mitigating inflation, there are investments in the U.S. that are specifically designed to counter inflation called Treasury Inflation-Protected Securities and similar investments in other countries that go by different names. Also, gold and other commodities are traditionally favored as protection against inflation, as are dividend-paying stocks as opposed to short-term bonds.

Our Retirement Calculator can help by considering inflation in several calculations. Please visit the Inflation Calculator for more information about inflation or to do calculations involving inflation.

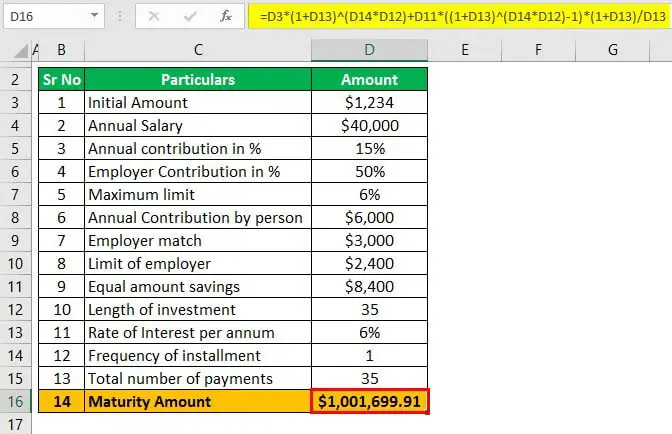

Maximize Employer 401 Match Calculator

Contribution percentages that are too low or too high may not take full advantage of employer matches. If the percentage is too high, contributions may reach the IRS limit before the end of the year. As a result, employers will not match for the rest of the year. This calculation can show the contribution percentage window in order to take full advantage of the employer’s matching contributions.

Also Check: Can I Rollover My 401k Into My Spouse’s Ira

Using This Simple 401 Calculator

Our 401 Growth Calculator is a simple and easy way to estimate the long-term growth of your 401 retirement account by the time you want to retire. Knowing how much your current 401 account may accumulate in the future can help you determine if you should adjust your annual 401 contributions to help reach your retirement goals. After answering a brief series of questions, you will get your results, including your estimated accumulated plan balance at retirement, total out-of-pocket costs, and a summary table and bar graph illustrating your retirement plan accumulation over time.

How Are The Solo 401k Contribution Limits Calculated

The 2020 Solo 401k contribution limits are $57,000 and $63,500 if age 50 or older . The annual Solo 401k contribution consists of 2 parts a salary deferral contribution and a profit sharing contribution. The total allowable contribution adds these 2 parts together to get to the maximum Solo 401k contribution limit.

Don’t Miss: What To Do With 401k When You Retire

Solo 401k Contribution Deadline 2021

The 2020 contribution deadline has passed for almost all businesses. The final 2020 tax returns were due October 15, 2020, unless you are in a FEMA identified disaster area and your tax filing deadline has been extended. The good news is that you have plenty of time to contribute for 2021. You can set up and fund your new Solo 401k plan all the way until you file your taxes in 2022. Depending on your business structure this could be either March 15 or April 15, 2022. If you have an S Corp or Partnership your deadline is March 15. With a Sole Proprietorship or C Corp your deadline is April 15th. If you file an extension, you could set up and fund your Solo 401k all the way until either September 15 or October 15 .

Maximize Your 401k Returns And Fees

Are you getting the most for your fees? Most people dont know what theyre paying in 401k fees. By some estimates, the average fees for 401k plans are between 1% and 2%, but some outliers can have up to 3.5%. Fees add upeven if your employer is potentially paying the fees, youll have to pay them if you leave the job and keep the 401k.

Essentially, if an investor has $100,000 in a 401 and pays $1,000 or more in fees, the fees could add up to thousands of dollars. Any fees you have to pay can chip away at your retirement savings and reduce your returns.

Its important to ensure youre getting the most for your money in order to maximize your retirement savings. If you are currently working for the company, you could discuss high fees with your HR team. One of the easiest ways to lower your costs is to find more affordable investment options. Typically, the biggest bargains can be index funds, which often charge just 0.3% to 0.5 %

If your employers plan offers an assortment of low-cost index funds or institutional funds, you can invest in these funds to build a diversified portfolio.

If you have a 401 account from a previous employer, you might consider moving your old 401k into a lower fee plan. Its also worth examining what kind of fund youre invested in and if its meeting your financial goals and risk tolerance.

Don’t Miss: Can I Move My 401k Into A Roth Ira

How Much Can I Contribute Into A Solo 401k Sep Ira Defined Benefit Plan Or Simple Ira

Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. Enter your name, age and income and then click Calculate.

The result will show a comparison of how much could be contributed into a Solo 401k, SEP IRA, Defined Benefit Plan or SIMPLE IRA based on your income and age.

Note: If you are taxed as a sole proprietorship use your NET income when using the calculator. If you are incorporated, then only use your W-2 wages when using the calculator. For example, S corporation K-1 distributions are not included when making the contribution limit calculation.

Nership Or Multi Member Llc

Now lets say that Kyle converts his business from an S-corp to a multi member LLC, and earns $65,000. He has several business partners but no employees.

He may still defer $19,500 as an employee and $6,500 as a catch up contribution. But since he no longer has W-2 wages, he bases his profit sharing contribution on the K-1 income attributable to self-employment earnings. His total contribution limit would be $19,500 + $6,500 + $16,250 = $42,250.

You May Like: Can You Have A Solo 401k And An Employer 401k

Rrif + Oas + Cpp + Etsy = Retirement Income

Suppose your Etsy store does really well todays young people are crazy about the clothes their grandparents wore back in the 2010s. It could be the case that your income adds up to an even bigger paycheque than you were earning before you retired, pushing you back into a higher tax bracket. Suddenly, your tax savings are nil.

This is why its helpful to talk to our office about your options for retirement, to find out how you may be able to maximize your tax savings. There are a lot of factors to take into account for instance, minimum annual withdrawal amounts from your RRIF, and OAS clawback. We can help you project this into the future and plan where to put your savings.

Reset Your Automatic 401k Contributions

When was the last time you reviewed your 401k? It may be time to check in and make sure your retirement savings goals are still on track. Is the amount you originally set to contribute each paycheck still the correct amount to help you reach those goals?

With the increase in contribution limits this year, it may be worth reviewing your budget to see if you can up your contribution amount to max out your 401k. If you dont have automatic payroll contributions set up, you could set them up.

Its generally easier to save money when its automatically deducted a person is less likely to spend the cash when it never hits their checking account in the first place.

If youre able to max out the full 401 limit but fear the sting of a large decrease in take-home pay, consider a gradual increase such as 1%how often you increase it will depend on your plan rules as well as your budget.

Recommended Reading: Why Is A 401k Good

Solo 401k Contribution Calculator Walk Thru

February 24, 2020 by Editorial Team

The Solo 401k is the most powerful retirement account on the planet when it comes to contributions. This can add up to huge tax savings for you if you own your own business. When you run your own retirement account, you need access to the best tools. Fortunately, all Solo 401k account holders with Nabers Group have access to our contribution calculator. Lets walk through how to use the calculator, determine how much you can contribute to a Solo 401k plan.

How Much Should You Contribute To Your Rrsp

When you contribute to an RRSP, youre investing towards a better quality of life for your future self. So if you have money to contribute, its almost always a good idea to do so.

Generally speaking, you should aim to contribute at least 10% of your gross income each year to your retirement savings.

Start contributing in your early 20s, and that 10% per year could add up to a sizeable savings and a comfortable retirement. Start later in life say, your late 30s and 10% a year may not cut it.

To see how much money you can expect in the future from your invested contributions, check out this RRSP tax savings calculator.

Recommended Reading: Should I Do 401k Or Roth Ira

How A 401 Match Works

Employees usually contribute a percentage of their salaries to their 401s, and most employers who offer matching also contribute a percentage of employees’ income. Some companies offer dollar-for-dollar matches, whereby the employer contributes $1 for every $1 the employee contributes to their 401, but more common are partial matching percentages. This means the company matches a portion of what the employee contributes, such as $0.50 for every $1 the employee puts into their 401.

Regardless of the matching structure, your employer will likely cap your match at a certain percentage of your income. For example, your employer may pay $0.50 for every $1 you contribute up to 6% of your salary. So if you make $50,000 per year, 6% of your salary is $3,000. If you contribute that much to your 401, your employer contributes half the amount $1,500 of free money as a match. If the company offered a dollar-for-dollar match instead of a partial match, it would give you $3,000 for the year. You’re free to contribute more than $3,000 if you want to, but you won’t get any additional match from your company.

Every company has its own matching methodology and vesting schedule, so talk to your employer if you’re not sure how your 401 match works.

What Is A 401

A 401 is a retirement plan offered by some employers. These plans allow you to contribute directly from your paycheck, so theyre an easy and effective way to save and invest for retirement. There are two main types of 401s:

-

A traditional 401: This is the most common type of 401. Your contributions are made pre-tax, and they and your investment earnings grow tax-deferred. Youll be taxed on distributions in retirement.

-

A Roth 401: About half of employers who offer a 401 offer this variation. Your contributions are made after taxes, but distributions in retirement are not taxed as income. That means your investment earnings grow federally tax-free.

Read Also: How To Get Your 401k Out

General Pros And Cons Of A 401

Pros

Cons

- Few investment optionsGenerally speaking, 401s have few investment options because they normally originate from employers, they are limited to what is offered through employers’ 401 plans, as compared to a typical, taxable brokerage account.

- High feesCompared to other forms of retirement savings, 401 plans charge higher fees, sometimes as a percentage of funds. This is mainly due to administration costs. Plan participants have little or no control over this, except to choose low-cost index funds or exchange-traded funds to compensate.

- Illiquid 401 funds can only be withdrawn without penalty in rare cases before 59 ½. This includes all contributions and any earnings over time.

- Vesting periodsEmployers may utilize vesting periods, meaning that employer contributions don’t fully belong to employees until after a set point in time. For instance, if an employee were to part ways with their employer and a 401 plan that they were 50% vested in, they can only take half of the value of the assets contributed by their employer.

- Waiting periodsSome employers don’t allow participation in their 401s until after a waiting period is over, usually to reduce employee turnover. 6 month waiting periods are fairly common, while a one-year waiting period is the longest waiting period permitted by law.

Just One Year May Be Enough But It’s Quite Risky

If you’re early enough in your career, you might be able to reach millionaire status by just maxing out your 401 for one year — and then waiting for compounding to work its magic. In 2022, employees under 50 will be generally able to contribute up to $20,500 to their 401 style retirement plans. If you sacrifice to sock away that much for just one year, then around 41 years later, you might wake up to find out you’re a millionaire.

While that path might work, it’s an incredibly risky path to get to millionaire status. There are three key reasons why it’s so risky.

First, it assumes you earn 10% per year on the money. Although that’s more or less in line with the , there are no guarantees that stocks will deliver near that level in the future.

Second, it requires that you start really early in your career. If you’re past the beginning of your career, have lower income, or are facing high life start-up costs, you might not have enough money early enough to make that plan work.

Third, it exposes you to a huge sequence of returns risk. If you happen to make that single, huge investment just before a market crash, you first have to wait for the market to recover before compounding really starts working on your behalf.

Also Check: How To Get My 401k Money From Walmart

Reporting Your 401k Contributions

Although you will not be required to report your 401k contribution on IRS Form 1040, you may qualify for a Retirement Saving Contribution Credit which can be found on Form 8880.

Tips

- Section 125 or cafeteria plans, such as pretax medical, dental and group-term life insurance are not subject to federal income tax, Medicare tax, Social Security tax, and in many cases, state and local income tax. Deduct the premiums from gross wages before calculating those taxes.

- Your pretax 401 contributions are subject to federal income tax when you withdraw from the plan state and local taxes apply if they were not paid at the time of contribution. However, you do not pay Medicare and Social Security taxes or any other taxes that you paid at the time of the contribution. If your employer matches your contributions, the matching amounts are made in pretax dollars and are subject to applicable taxes when you withdraw from the plan.

Writer Bio

Grace Ferguson has been writing professionally since 2009. With 10 years of experience in employee benefits and payroll administration, Ferguson has written extensively on topics relating to employment and finance. A research writer as well, she has been published in The Sage Encyclopedia and Mission Bell Media.

How Do I Maximize My Employer 401 Match

Many employees are not taking full advantage of their employer’s matching contributions. If, for example, your contribution percentage is so high that you obtain the $20,500 limit or $27,000 limit for those 50 years or older in the first few months of the year then you have probably maximized your contribution but minimized your employer’s matching contribution.

This information may help you analyze your financial needs. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy. Hypothetical illustrations may provide historical or current performance information. Past performance does not guarantee nor indicate future results.

Read Also: How Often Can I Change My 401k Investments Fidelity

Should You Max Out Your 401 Contributions

If you have the means, contributing the full amount to your 401 could have major benefits. Some experts, though, would urge you to think about filling other needs before you max out your 401. For starters, certain non-retirement needs may come first. These might include paying off high-interest debts or loans, stocking your emergency fund accounts, maintaining solid health insurance and investing in long-term care insurance if youre over 50.

There are also other options for saving for retirement. Perhaps the most notable partner of a 401 is the individual retirement account . So if you want to contribute more than the 401 limit allows you to, consider opening an IRA too. The 2022 IRA contribution limit remains unchanged since 2019 at $6,000. The catch-up contribution limit is $1,000, which is again the same as it was in 2019.

A Roth IRA might be a particularly good destination for your extra retirement funds. Since a Roth account offers tax-free growth and distributions, it might be a good complement to your tax-deferred 401. Note that even if you do favor an IRA, you should still contribute enough to your 401 to secure any employer matching perks.