When A Problem Occurs

The vast majority of 401 plans operate fairly, efficiently and in a manner that satisfies everyone involved. But problems can arise. The Department of Labor lists signs that might alert you to potential problems with your plan including:

- consistently late or irregular account statements

- late or irregular investment of your contributions

- inaccurate account balance

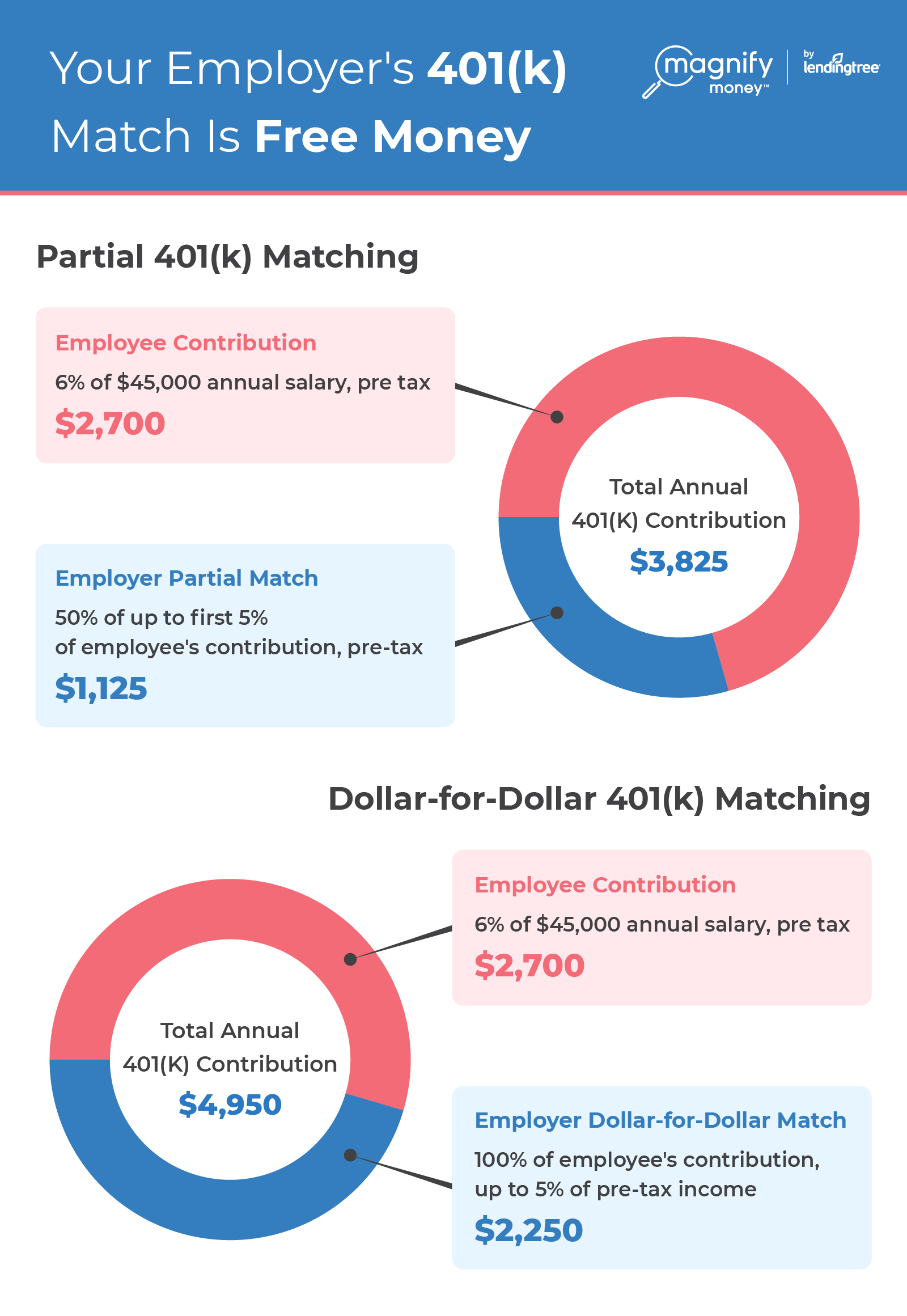

What Is 401 Matching

401 matching occurs when an employer matches a certain amount of your contributions to your retirement account. As we’ll detail below, there are a few different ways employers can offer matching funds.

Nothing states that a company match program is required. Employer 401 matching is a perk on top of your employee salary. Read your company handbook or speak with a supervisor to understand how matching contributions work at your company.

Leave Your Retirement Savings In Your Former Qrp If The Qrp Allows

While this approach requires nothing of you in the short term, managing multiple retirement accounts can be cumbersome and confusing in the long run. And, you will continue to be subject to the QRPs rules regarding investment choices, distribution options, and loan availability. If you choose to leave your savings with your former employer, remember to periodically review your investments and carefully track associated account documents and information.

Features

- Your former employer may not allow you to keep your assets in the plan.

- You must maintain a relationship with your former employer, possibly for decades.

- You generally are allowed to repay an outstanding loan within a short period of time.

- Additional contributions are generally not allowed. In addition to ordinary income tax, distributions prior to age 59½ may be subject to a 10% additional tax.

- RMDs, from your former employers plan, begin April 1 following the year you reach age 72 and continue annually thereafter, to avoid IRS penalties.

- RMDs must be taken from each QRP including designated Roth accounts aggregation is not allowed.

- Not all employer-sponsored plans have bankruptcy and creditor protection under ERISA.

If you choose this option, remember to periodically review your investments, carefully track associated paperwork and documents, and take RMDs from each of your retirement accounts.

Also Check: How To Transfer 401k From Old Job

Definition And Examples Of Eligible Rollover Distributions

An eligible rollover distribution is a way to move assets between retirement accounts. It involves taking the money in a retirement account such as a 401 or an individual retirement account and moving it into another eligible retirement plan or account. This must happen within 60 days of the distribution. If you take care of it within 60 days, the distribution wont be considered a taxable withdrawal.

You might need to make eligible rollover distributions to consolidate your retirement accounts. For example, if you change jobs, you may want to move assets from your old employers 401 into your new employers 401, rather than having two accounts. If your new employer doesnt allow rollovers, you might decide to make an eligible rollover distribution from your previous employers plan into your own IRA.

Another reason you might need to make eligible rollover distributions is to change providers. For example, you may have an IRA account through a brokerage firm, but youre unhappy with the investment options within that account. You could make an eligible rollover distribution to a new IRA provider who offers the investment choices youre looking for.

Withdrawal Rules Frequently Asked Questions

- 401 Distributions

- 401 Withdrawal Rules Frequently Asked Questions

If you participate in a 401 plan, you should understand the rules around separation of service, and the rules for withdrawing money from your account otherwise known as taking a withdrawal. 401 plans have restrictive withdrawal rules that are tied to your age and employment status. If you dont understand your plans rules, or misinterpret them, you can pay unnecessary taxes or miss withdrawal opportunities.

We get a lot of questions about withdrawals from 401 participants. Below is a FAQ with answers to the most common questions we receive. If you are a 401 participant, you can use our FAQ to understand when you can take a withdrawal from your account and how to avoid penalties.

Don’t Miss: How To Pull Out Of 401k

Move Your Retirement Savings Directly Into Your Current Or New Qrp If The Qrp Allows

If you are at a new company, moving your retirement savings to this employers QRP may be an option. This option may be appropriate if youd like to keep your retirement savings in one account, and if youre satisfied with investment choices offered by this plan. This alternative shares many of the same features and considerations of leaving your money with your former employer.

Features

- Option not available to everyone .

- Waiting period for enrolling in new employers plan may apply.

- New employers plan will determine:

- When and how you access your retirement savings.

- Which investment options are available to you.

Note: If you choose this option, make sure your new employer will accept a transfer from your old plan, and then contact the new plan provider to get the process started. Also, remember to periodically review your investments, and carefully track associated paperwork and documents. There may be no RMDs from your QRP where you are currently employed, as long as the plan allows and you are not a 5% or more owner of that company.

You End Up Paying Taxes On Your Loan Repaymentstwice

Normally, contributing to your 401 comes with some great tax benefits. If you have a traditional 401, for example, your contributions are tax-deferredwhich means youll pay less in taxes now . A Roth 401 is the opposite: You pay taxes on the money you put in now so you can enjoy tax-free growth and withdrawals later.

Your 401 loan repayments, on the other hand, get no special tax treatment. In fact, youll be taxed not once, but twice on those payments. First, the loan repayments are made with after-tax dollars . And then youll pay taxes on that money again when you make withdrawals in retirement.

Whats worse than getting taxed by Uncle Sam? Getting taxed twice by Uncle Sam.

Also Check: Can I Rollover My 401k To A Mutual Fund

How Does 401 Matching Work

A few different scenarios could occur if your employer offers 401 matching. Some of the matching formulas that your employer may use include:

-

A single-tier formula: The employer pays 50% or 100% of every dollar up to the first X% of your contributions. This is known as partial matching.

-

A multi-tier formula: The employer pays 100% of every dollar up to the first X% of contributions. Then the employer pays 50% on the next Y% of contributions.

-

A dollar cap: Employers match dollar-for-dollar up to a certain amount.

In addition to the above, there are matching scenarios based on things like age, job position or tenure.

You need to make the minimum contributions to get the most of your employer match. Let’s say that your employer will match 100% of your contributions up to 6% of your salary. If you elect only to contribute 4% of your annual income, your employer will likely only match up to 4%. To get the most out of your employer match, your minimum annual salary contributions should be the maximum threshold set by your company .

Additionally, you should be mindful of your employer’s vesting schedule, which defines the period of time it takes for you to have complete control over your employer contributions. This is a tool that employers use to retain employees.

You should also be aware of when your employer contributes to your account. They could pay:

-

Every pay period

-

Quarterly

-

Monthly

How Do You Withdraw Money From A 401 When You Retire

After retirement, one of the common questions that people ask is âhow do you withdraw money from a 401 when you retire?â. Find out the options you have.

As you plan your retirement, you should think about how you are going to live off your retirement savings once you are out of employment. You will need to figure out how to withdraw your retirement savings in your 401 post-retirement, and the best withdrawal strategies so that you donât exhaust your retirement savings.

When withdrawing your retirement savings from a 401, you can decide to take a lump-sum distribution, take a periodic distribution , buy an annuity, or rollover the retirement savings into an IRA.

Usually, once youâve attained 59 ½, you can start withdrawing money from your 401 without paying a 10% penalty tax for early withdrawals. Still, if you decide to retire at 55, you can take a distribution without being subjected to the penalty. However, any distribution you take after retirement is taxed, and you must include the distribution as an income when filing your annual tax return.

Don’t Miss: How Can I Use 401k To Buy A House

How Are 401 Withdrawals Taxed

If a rollover-eligible withdrawal is made to you in cash, the taxable amount will be reduced by 20% Federal income tax withholding. Non-rollover eligible withdrawals are subject to 10% withholding unless you elect a lower amount. State tax withholding may also apply depending upon your state of residence.

However, your ultimate tax liability on a 401 withdrawal will be based on your Federal income and state tax rates. That means you will receive a tax refund if your actual tax rate is lower than the withholding rate or owe more taxes if its higher.

If a 401 withdrawal is made to you before you reach age 59½, the taxable amount will be subject to a 10% premature withdrawal penalty unless an exception applies. This penalty is meant to discourage you from withdrawing your 401 savings before you need it for retirement. You can avoid the 10% penalty under the following circumstances:

- You terminate service with your employer during or after the calendar year in which you reach age 55

- You are the beneficiary of the death distribution

- You have a qualifying disability

- You are the beneficiary of a Qualified Domestic Relations Order

- Your distribution is due to a plan testing failure

A full list of the exceptions to the 10% premature distribution penalty can be found on the IRS website.

Exceptions To 401 Early

Several exceptions to the 10% penalty are intended to limit some of the financial loss in certain situations. Some 401 withdrawals made before you reach age 59 1/2 are exempt from the additional penalty under these circumstances:

- You die, and the account is paid to your beneficiary.

- You become disabled.

- You terminate employment and are at least 55 years old.

- You have unreimbursed medical expenses exceeding 7.5% of your adjusted gross income . This could potentially increase to 10% in tax year 2022.

- You begin substantially equal periodic payments. .)

- Your withdrawal is related to a Qualified Domestic Relations Order pursuant to divorce.

- You took a qualified coronavirus-related early 401 withdrawal under the Coronavirus Aid, Relief, and Economic Security Act between January 1 and December 30, 2020.

- You take a qualified disaster-related early 401 withdrawal under the Taxpayer Certainty and Disaster Tax Relief Act of 2020 between January 1, 2020, and June 24, 2021.

Withdrawals in each of these last three scenarios would only be subject to ordinary income taxes, not the additional 10% penalty. But the withdrawals must be made according to plan rules and with appropriate documentation.

Read Also: How To Cash In Your 401k Early

Can You Reverse Your Decision To Start Benefits

Yes, but your options for reversing your Social Security decision are extremely limited: If its been less than a year since you started benefits, you can withdraw your application and repay all your benefits, including Medicare premiums, taxes you opted to withhold and benefits your family received on your behalf.

If youve reached full retirement age, you can suspend your benefits so that you can take advantage of the extra 8% Social Security gives you for every year you delay beyond your full retirement age. Once you hit 70, your benefits will automatically restart.

Robin Hartill is a certified financial planner and a senior writer at The Penny Hoarder. She writes the Dear Penny personal finance advice column. Send your tricky money questions to

Final Thoughts On How Does A 401k Grow

401ks are the best way to accumulate wealth and allow your hard-earned money to grow tax-free. Whether youve just started your career or are nearing retirement, contributing to a 401k account is a no brainer that you cant afford to skip out on.

Want to learn more about the stock market? Read my Beginners Guide to Investing in the Stock Market here or check my Investing Terms & Slang to help you understand all of the investing jargon.

Don’t worry we hate spam too. Unsubscribe at any time.

Also Check: Can I Roll Over A 403b To A 401k

Can You Take Benefits Based On Your Spouses Record

Yes. You can collect benefits based on the work record of your current spouse, a deceased spouse and even an ex-spouse in some cases. However, you cant claim for both yourself and a current or former spouse. You have to decide whether youll get more based on their work record or your own.

You can collect on your current spouses record if:

- Youve been married for at least a year.

- Your spouse is already taking their benefits.

- Youre at least 62, or youre caring for a child whos under 16 or disabled.

Benefit amount: 32.5% to 50% of your spouses benefit.

You can collect on the record of a spouse who died if:

- Youre at least 60 or youre age 50 and disabled. You can also qualify if youre caring for the deceased spouses child.

- You were married for at least nine months, unless the death was accidental or occurred in the line of military duty.

- You didnt remarry before age 60, or age 50 if youre disabled. If you remarry later, you can still collect on your late spouses record.

Benefit amount: 71.5% to 100% of your late spouses benefit.

You can collect on your ex-spouses record if:

- You were married for at least 10 years and havent remarried.

- Youve been divorced for at least two years.

- Youre at least 62.

- Your former spouse is eligible for benefits, though you can still claim based on their record even if they havent started taking benefits yet.

Benefit amount: 50% of your ex-spouses benefit.

How Do I Join And How Does It Work

If you’re keen to save in a 401k plan, the first thing to do is to find out if you’re eligible by asking your HR department.

The plans are typically available to workers aged at least 21 who have worked at the company for one year or more.

However, some employers will allow new workers to join one straight away.

If your employer is offering one, you’ll likely have to fill in some paperwork, and decide how much money you plan to contribute.

Your employer will then set aside the cash from your salary before you’re taxed on it.

You also need to choose the appropriate investment options for your contributions.

For example, if your planned retirement is still many years away, it could be worth choosing a higher investment risk – as the rewards may be better.

However, if you plan to retire soon, it could be better with a lower risk.

As always with any investment, keep in mind you’re not guaranteed to make money and could actually make a loss.

While you sign up for a 401k through your employer, it’s typically managed by a financial firm such as Vanguard, Fidelity or Principal.

You can begin withdrawing money penalty-free at the age of 59 ½ in most cases.

If you withdraw money before that age, you will be hit with a 10% early withdrawal penalty and pay income taxes on the cash.

Recommended Reading: Am I Able To Withdraw Money From My 401k

How The Roth 401 Came To Be

The Roth 401 began in 2006 as a provision of the Economic Growth and Tax Relief Reconciliation Act of 2001 . It was based on the already-existing Roth IRA, allowing investors to stash their after-tax money in a safe place, for later use.

Contribute to a Roth 401 and you wont be able to claim it as a tax deduction, but you also wont owe any taxes on any qualified distributions. If you participate in a 403 plan, youre also eligible to participate in a Roth fund.

How Long Does Retirement Fund Take To Pay Out

It typically takes between 4 and 12 weeks to process a pension fund payout , from the time your last contribution is invested or the required instructions are received from the administrator .

How long does it take to withdraw from the pension fund? Depending on who manages your 401 account , it may take between 3 and 10 business days to receive a check after you have paid out your 401 . To see also : How much do retirement homes cost.

How long does it take to get a payout of 401k? You can typically expect to receive funds from your 401 in seven to 10 days, although extended circumstances extend the time frame.

How is the pension paid out? An annuity, or stream payout, is the traditional way to get income from a defined benefit retirement plan. Your employer calculates the amount based on a number of factors, including your retirement age, your salary and the number of years you worked. You know before you retire how much income you will receive.

Don’t Miss: What Are Terms Of Withdrawal 401k