Ira Vs 401what Is The Difference

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Update: The deadline for making IRA contributions for tax year 2020 has been extended to May 17, 2021.

Retirement isnt what it used to be. The days when you worked for a company for 40 years, then got a pension, Social Security, and a gold watch are long gone.

If you want to retire someday, you need to make it happen yourself.

Today, nobody expects to work for the same firm their whole career, most companies dont have pensionsand who needs a watch anyway? Whats more, most of us know that Social Security alone is not going to give us the retirement income we needif its even still around 40 years from now.

If you want to retire someday, it may be time to take matters into your own hands and fund a individual retirement account, such as an IRA or a 401.

Vs Roth : Which One Is Better

11 Minute Read | November 12, 2021

If youve heard of a Roth 401, you may be wondering how different it really is from a traditional 401. We get it, 401s can be confusing! While these two types of 401 accounts have some similarities, they also have some pretty huge differences.

Access to a Roth option is becoming more and more common, so youre in the majority if you have this option at work. Just over the last five years, the number of plans offering a Roth 401 option has increased by 32%. As of 2021, about 3 out of 4 workplace retirement plans now offer a Roth optionwhich is great news for you!1

And guess what? Younger savers are starting to take advantage of this new option. Millennials are the most likely group to contribute to their Roth 401 at work.2

If you can contribute to a Roth and traditional 401 at work, which one should you choose? Lets dig into some of the differences between these options so you can make the best decision.

The Benefits Of A 401 Vs A Traditional Ira Roth Ira Or Myra

Some people erroneously think that, without a match, there is no point to contributing to a 401. However, there are many benefits to a 401, even without employers matching contributions.

-

Pretax deductions: The deductions taken from your paycheck to go toward your 401 is pretax money, so your contributions essentially lower your taxable income at the end of the year.

-

Compound interest: The money you invest compounds every year until you are ready to retire. As this Business Insider chart demonstrates, the earlier you start saving for retirement, the more potential you have to gain in compound interest.

-

Easy for both workers and employers: Contributing to your 401 is a painless process to maintain once youve established your plan. In addition, Human Interest allows you the option of effortlessly managing your 401 online. For employers, are completely streamlined or automated, making the onboarding and administration seamless for all parties.

-

Higher contribution limits: If youve already maxed out with your IRA, you may be looking for additional tax-friendly places to invest, and a 401 has significantly higher contribution limits.

And of course, for employees of companies offering matching contributions, there are many advantages to having free money added into their retirement plans.

Don’t Miss: How To Open 401k For Individuals

If Your Employer Offers A 401 Match

1. Contribute enough to earn the full match. Check your employee benefits handbook. If you see that your employer matches any portion of the money you contribute to the company 401 plan, do not bypass this opportunity to collect your free money.

A company matching program is one of the biggest benefits of a 401. It means that your employer contributes money to your account based on the amount of money you save, up to a limit. A common arrangement is for an employer to match a portion of the amount you save up to the first 6% of your earnings.

Even if a 401 has limited investment choices or higher-than-average fees, carve out enough money from your paycheck to get the full company match, as its effectively a guaranteed return on those dollars. Also note that employer contributions dont count toward the 401 annual contribution limit.

2. Next, contribute as much as youre allowed to an IRA. Depending on which type of IRA you choose Roth or traditional you can get your tax break now or down the road when you start withdrawing funds for retirement.

-

A traditional IRA is ideal for those who favor an immediate tax break. Contributions may be deductible that means your taxable income for the year will be reduced by the amount of your contribution. But, if you’re also covered by a 401, your deduction may be reduced or eliminated based on income. If you has a workplace retirement plan, check out the IRA limits.

How To Open A Traditional Or Rollover Ira Account

Opening a traditional IRA and a rollover IRA are identical processesthe only difference is the funding. Open a traditional or rollover IRA by doing the following:

For instance, you can choose an online brokerage firm where you can choose your own investments, or you can select a robo-advisor that will offer automated recommendations based on your answers to a few basic investing questions. Open an account. From the providers website, select the type of IRA youd like to opentraditional or rollover, in this caseand provide a few pieces of personal information. Youll likely need to supply your date of birth, Social Security number, and contact and employment information. Fund the account. You can fund the account with a direct contribution via check or a transfer from your bank account, transferring money from another IRA, or rolling over the money from an employer-sponsored retirement plan. Contact your company plan administrator for information on how to do the latter.

You May Like: How Can I Use 401k To Buy A House

What Are Roth Accounts

So far, weve discussed traditional 401 and IRA accounts. But each type of retirement account also comes in a different flavorknown as a Roth.

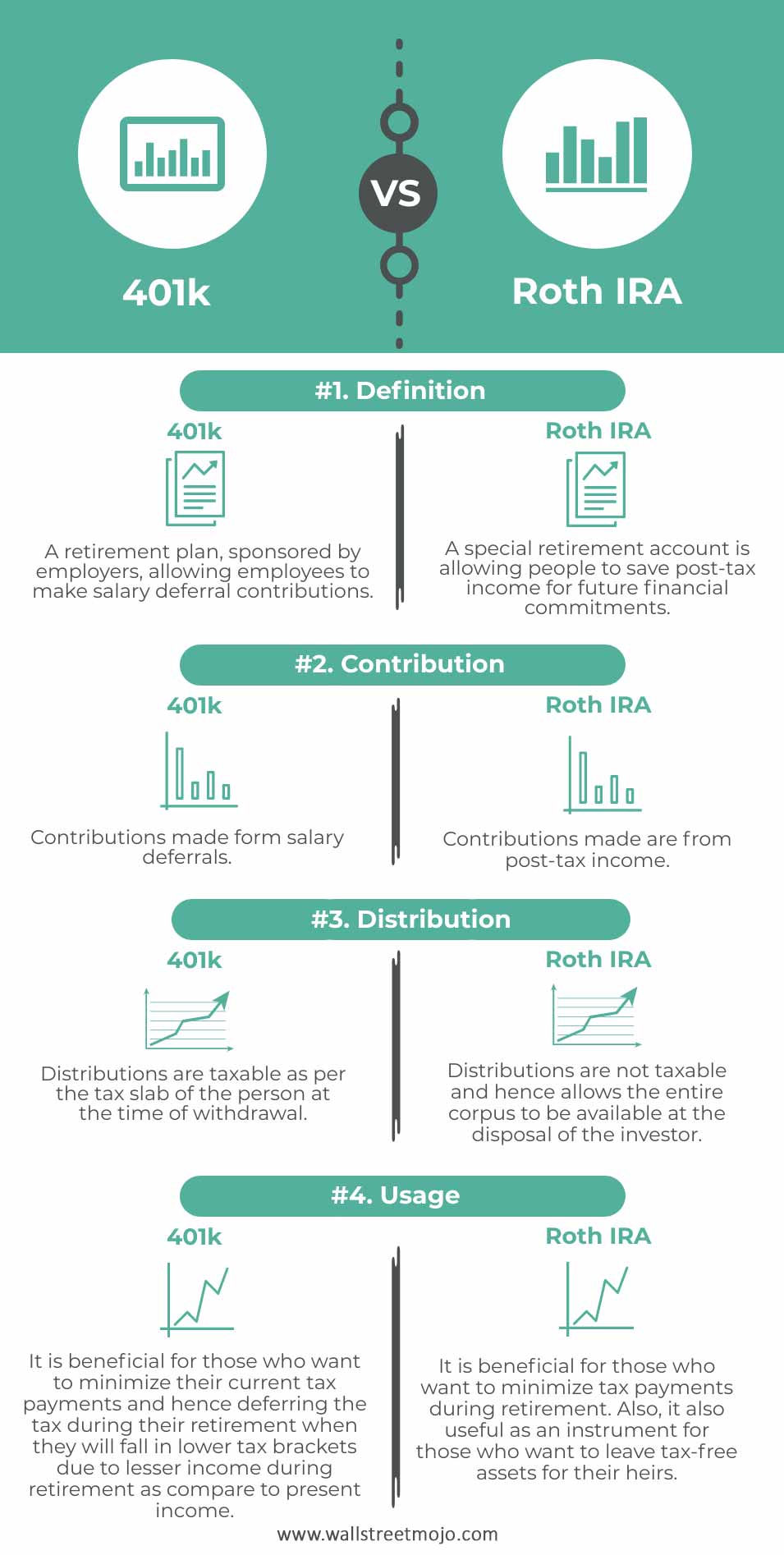

The main difference between traditional and Roth accounts lies in when your contributions are taxed. Traditional accounts are funded with pre-tax dollars. The contributions are tax deductible and may provide an immediate tax benefit by lowering someones taxable income and, as a result, their income tax bill.

Money inside these accounts grows tax-deferred and they pay income tax when they make withdrawals, typically when theyve reached age minimum age of 59 1/2.

Roth accounts, on the other hand, are funded with after-tax dollars. Someone with a Roth retirement account wont receive an immediate tax benefit. However, investments inside Roth accounts grow tax-free, and they are not subject to income tax when withdrawals are made at or after age 59 1/2.

Roths may be beneficial to use if someone anticipates being in a higher tax bracket when they retire than they are currently. For example, if someones just starting their career, they may be in a lower tax bracket than they will be once theyre more established.

If Your 401 Investment Choices Stink

If you have a good mix of mutual funds in your 401, or even some target date funds and low-fee index funds, your plan is probably fine. But, some plans have very limited investment options, or are so confusing that people cant make a decision and end up in the default investmenta low interest money market fund.

If this is the case, you might want to limit your contributions to the amount needed to get your full employer match and put the rest in an IRA.

Read Also: Can You Pull From Your 401k To Buy A House

Which Account Is Right For You

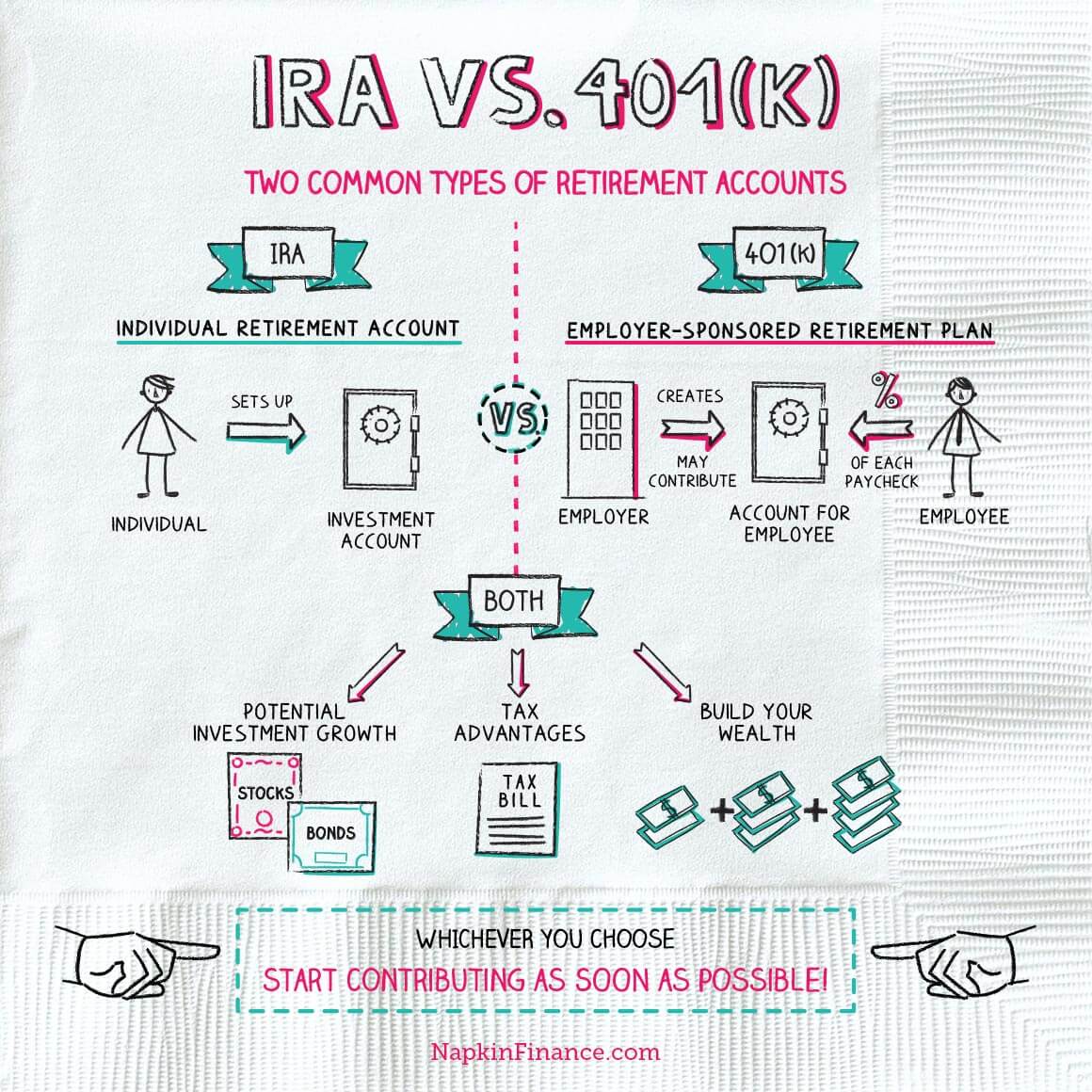

The main difference between a 401 and an IRA is that the former is offered through an employer and the latter is initiated by an individual or small business. If your employer offers a 401, there are several reasons to take advantage of it. Employers often offer matched contributions, which is another form of compensation. In addition, the 401 annual contribution limits are much higher at $19,500 when compared to $6,000 for IRA.

However, if your employer has a strict vesting schedule and you dont plan on staying long-term, it may still make sense to look beyond 401. An IRA may also make sense for employees who dont receive any type of matched contributions or dont have access to a workplace retirement account at all.

A Roth IRA, in particular, may be more attractive to younger professionals since contributions are taxed at a time when their tax brackets are lower and distributions can be made tax-free at a time when they are likely in a higher tax bracket. On the flip side, if youre earning a substantial income already, you may benefit more from getting the tax deduction now through a Traditional IRA. The same guidance applies to employees debating between a Traditional 401 and a Roth 401.

So What’s The Deal With Taxes And Withdrawals

With a traditional IRA, you can deduct your contributions from your taxable income provided you meet the criteria for adjusted gross income and employer-sponsored retirement plan.

As per the IRS, “If neither you nor your spouse is covered by a retirement plan at work, your deduction is allowed in full.” However, if you or your spouse are covered by an employer-sponsored plan ) or your income exceeds certain levels, your deductions might be limited or null.

As for withdrawals, you can begin using your IRA savings without incurring penalties, but paying income tax, after you reach 59½ years.

If you are tempted to withdraw money from your IRA before reaching 59½, you’ll have to pay the income tax plus a 10 percent penalty on the money withdrawn. Early withdrawals might be exempt from the 10 percent fee if they are made as so-called “hardship distributions.”

The only thing standing in your way is that the government requires holders of IRA to start mandatory withdrawals, called “required minimum distributions,” after the age of 70½. So, even if you have other income sources to take care of you, after clocking in 70½ years you’ll have to take some money out of your account, and, yes, pay taxes on it.

How much you’ll have to take out depends on a formula that involves the amount of money present in the account at the end of the preceding calendar year.

You May Like: Can You Self Manage Your 401k

How To Get Started Investing In Either Iras Or 401s

If you want a 401 plan, check to see what your employer offers. You can only get a 401 plan through your job. The HR department is a good place to start looking for information about 401 plans at your work.

If you want an IRA, all you need to do is open an account with a broker. Figure out which IRA is best for you . Deposit your money and make sure its invested.

IRAs and 401s are not mutually exclusive you can get both.

You Can Take A Loan On A 401

Generally if you take out cash from an IRA or a 401, youll likely be charged taxes and penalties. But the 401 may allow you to take out a loan, depending on how your employers plan is structured.

Another clear advantage is that you can take loans from a 401 and continue to contribute to your 401, says Lackwood.

Like a normal loan, youll have to pay interest, and youll have a repayment period, not more than five years. But the rules differ from plan to plan, says Lackwood, so youll have to check on your specific 401 rules to see what youll need to do.

You can also take cash from a 401 for a hardship withdrawal, and you can do so from an IRA, too. But the terms in each case are strict.

401s allow for emergency withdrawals, but most plans offered through employers are very rigid and dont have much flexibility, says David Wilson, CFP and founder of Planning to Wealth.

But taking a non-retirement withdrawal can drastically set back your retirement plans.

Don’t Miss: How Much Should You Put In Your 401k

Tip : Money Stylespender Or Saver

Some people spend all of their available money, some people tend to save it. That’s no judgment against spenders: How you manage your money can help you choose which type of account may make sense for you.

Other things equal, and assuming contributions of similar size, traditional accounts preserve more money to spend today while Roth accounts tend to provide more money to spend in the future. Traditional 401, 403, and IRA contributions leave money in your pocket because they generally lower your current taxable income. But these tax savings can help you reach your retirement goal only if you invest them. If you spend your tax savings, it’s not going to help you when you retire.

On the other hand, a contribution to a Roth account reduces the amount of money left in your pocket compared with a similar contribution to a traditional account, because you pay taxes on your contributions up front. If youre like many people who tend to spend their take-home pay, opting for a Roth and thus having less available to spend might be a good thing when it comes to your retirement savings. In other words, because youve already paid your taxes today, you get more to spend tomorrow.

Which type of account may be right for you?

Sam ends up with the most. His Roth IRA, like Sara and Brian’s traditional IRAs, grows to $38,061, but unlike them he doesn’t have to pay any tax when he withdraws the money. The Roth IRA gives Sam 2 advantages over the other 2 investors:

Talk With An Investment Pro About Your Roth 401

If you want to learn more about your Roth 401 or other investing options, find an investing pro in your area. A financial advisor can help you understand your investments and make confident decisions.

A do-it-yourself approach to investing is never a good idea. Even the pros work with a financial advisor! Your familys future is way too important to wing it.

Looking for a qualified investing pro? Try the SmartVestor program! Its a free way to find top-rated financial advisors near you. Start building a relationship with an investing pro who understands the financial journey youre on.

Don’t Miss: Where Can I Find My 401k Balance

The Best Choice: Work With A Pro

Heres the deal: Investing is worth the hard work. If you dont save and invest now, you wont have anything to live on in retirement. It can be intimidating and complex, but you dont have to do this alone.

Talk with an investment professional like our SmartVestor Pros. Get someone on your team who will help you stay focused and chasing your dreams. They can walk you through your 401 and Roth IRA contribution options and create a plan for your situation.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Think About Investing In A Taxable Brokerage Account If

Youve maxed out all contribution limits to your 401 and IRAs. You want to invest in more tax-efficient investments such as passively managed funds, exchange-traded funds , or individual stocks held for more than one year. You want more control over your investments with the opportunity to withdraw funds at your leisure.

Recommended Reading: How To Do A 401k Rollover

Max Out Both To Boost Your Nest Egg

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

How Much Money Can You Contribute

- IRA: $6,000 if youre younger than 50 $7,000 if youre 50 or older. A high modified adjusted gross income can phase out or exclude you from contributing.

- 401: $19,500 if youre younger than 50 $26,000 if youre 50 or older. Including employer contributions, the limit is $58,000 if youre younger than 50 and $64,500 if youre 50+.

Read Also: How To Collect My 401k Money

What Is A Roth Ira

A Roth IRA is also an individual retirement account but it differs from the “traditional” in that you contribute with after-tax dollars. This means that you can’t deduct your contributions but do get tax-free withdraws when you become eligible for distribution.

Like with their “traditional” counterpart, Roth IRAs allow you to invest in securities, and, again, if you’d like a more flexible option you can opt for a self-directed Roth IRA.

As for limits, the same applyup to $6,000 if are under 50 years old, and up to $7,000 if you are over 50. Also, you’ll be a subject to lower limits or be ineligible for a Roth IRA based on your tax filings.