How Does Money Get Left Behind

Very few people stay at one employer the entire length of their career.

But unlike your bank account which you may have from job to job, a 401 account is linked to your employer. It is up to you to do something about it.

When you leave your employer, the money may stay in the account for an indefinite amount of time.

However, if the company closes the 401 plan, files for bankruptcy, goes out of business or is acquired by another company, you may be forced to decide, within a short period of time.

Its possible that years will go by after you parted ways with your old job, and then youll get a letter notifying you that you need to move your 401 account, or take a distribution.

If this happens, youre much better off rolling the money into an IRA account, or transferring the money into your current companys 401 plan.

Don’t Leave Your 401 Behind Here’s How To Reclaim Your Hard

Switching jobs pulls your mind in several directions at once, and it’s easy for your old 401 to get lost in the shuffle. But you can’t afford to forget about it for good. Building a nest egg to sustain you for decades is tough, so you can’t afford to leave any old retirement accounts behind. If you’ve lost track of your old 401, take these steps to find it and put that money to good use.

How To Check Your 401 Account

07.21.2019

No matter how much your investments are on auto-pilot, it is always beneficial to check your 401 account once or twice a year online. In your online account you can check your 401 balance, how your investments are performing, yearly rate of return and more. With this information, decide if any changes need to be made such as contribution amounts and investment choices. Summertime is the perfect time to check your 401 and see how youre doing against your retirement and 401 contribution goals.

If youre still new to retirement savings, check out John Olivers segment on retirement savings. He does the best job at making 401 plans entertaining.

Don’t Miss: Should I Convert My 401k To A Roth Ira

Retirement Plan Fees And Expenses

This section shows a detailed breakdown of fees that were directly debited from your account during the period.

These were listed in the above example chart as Plan Administrative Expenses. This is your share of expenses that everyone in your plan pays.

These normally include day-to-day costs to run the plan, such as legal, accounting, and trustee and recordkeeping costs.

Not all of the 401 fees you are paying are easy to find.

Sometimes, it takes a little more research to understand your true costs in your 401 plan.

As you can see in the disclosure in the fine print below, there may be other expenses paid directly from the investment options you have to choose from, such as revenue sharing agreements, 12b-1 fees, and sub-transfer agent fees.

There are some additional fees that come from the funds themselves.

These fees are called expense ratios.

A quick definition: expense ratios are the total percentage of fund assets used for administrative, management, advertising , and all other expenses.

For example, the 2030 target date fund expense ratio is 0.43% basis points, versus Vanguards Institutional Index expense ratio of 0.04% basis points. The expense ratio of the 2030 target date fund here is 10 times that of the Vanguard Fund.

How does the difference relate to you in terms of actual dollars?

Lets say you had $100,000 invested in both the 2030 target date fund example with an expense ratio of 0.43% and the Vanguard Fund with an expense ratio of 0.04%.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: When Can I Take Out My 401k

Us Department Of Labor Abandoned Plan Search

If your former employer has filed for bankruptcy, gone out of business, or was purchased by another company, your 401 might be in limbo.

In these cases, employers are required to notify you so you can receive your funds. However, if your contact information has changed or you’ve moved, your plan may have been abandoned.

You can use the Department of Labor’s Abandoned Plan Search tool to locate your old 401s. You will need to enter basic information about your former employer then, you can narrow your search using your social security number.

Like the National Registry of Unclaimed Retirement Benefits, the DOLâs Plan Search tool only located abandoned plan. Thereâs a good chance your old 401s wonât show up in these results.

Where Is My 401

When you leave your employer you have three options for the money youâve accumulated in your old 401 account. You can either:

- Leave it alone and keep it in the same account

- Roll over the funds to your new employerâs 401 plan or

- Roll over the funds to an IRA.

Most people leave their 401âs alone, either from neglect or they donât bother with facilitating the transfer.

You can rollover your old 401 funds to an IRA as soon as youâd like. If your IRA is already set up then it can accept the funds immediately.

However, if your new employer implements a waiting period before you can participate in their 401 program, then you have no choice but to leave it alone until youâre eligible.

This is where things fall through the cracks. Unattended 401âs can end up in a few different places: the old account you have with your former employers, an automatic safe harbor rollover account set up by your plan, the unclaimed property department in the state, or your old 401s could have been cashed out already if the balance was less than $5,000 when you left the job.

Recommended Reading: Should I Pay Someone To Manage My 401k

What Happens To Old 401s

401 administrators have different procedures for what to do with left behind accounts. Depending on the amount, they could be distributed directly to you, transferred to an IRA on your behalf, or sent to a separate holding account until you claim them.

Unwilling to bear the burden of maintaining vast amounts of accounts from former employees, 401 plans prefer to unload them any way possible. This can make it challenging to find your old 401s.

Other Investment Accounts For Retirement

In addition to a Wells Fargo IRA and employee-sponsored retirement plans that Wells Fargo services, the financial services company also offers other investment options that you may be using to plan for retirement, including mutual funds, stocks and exchange-traded funds. By opening a WellsTrade® online and mobile brokerage account, you’ll not only be able to access your account online, but you’ll also be able to manage your own investment portfolio.

Visit the Wells Fargo online and mobile brokerage webpage and click “Apply Online” to set up your WellsTrade® account. After you set up your account, you’ll be able to plan for and manage your IRA by choosing the investments you want, entering self-directed online trades, transferring funds between your accounts and accessing this account information any time.

Also Check: When Can You Take Out 401k

Risk Analysis/retirement Goals Progress Section

The last section on most front pages will usually show either your risk profile or retirement goals progress.

Some of the larger 401 plans will have a section on the front page that tells you what your risk tolerance is based on your current holdings, as well as if you are on track to retire comfortably.

This may tell you if your 401 balance is in line with others of your age.

In this section, you may also find details to determine if you will have enough money at retirement, and how close you are to reaching these goals.

Some statements may also show what your balance may be worth as a monthly stream of income in retirement.

Contact The 401 Plan Administrator

If your employer is no longer around, try getting in touch with the plan administrator, which may be listed on an old statement.

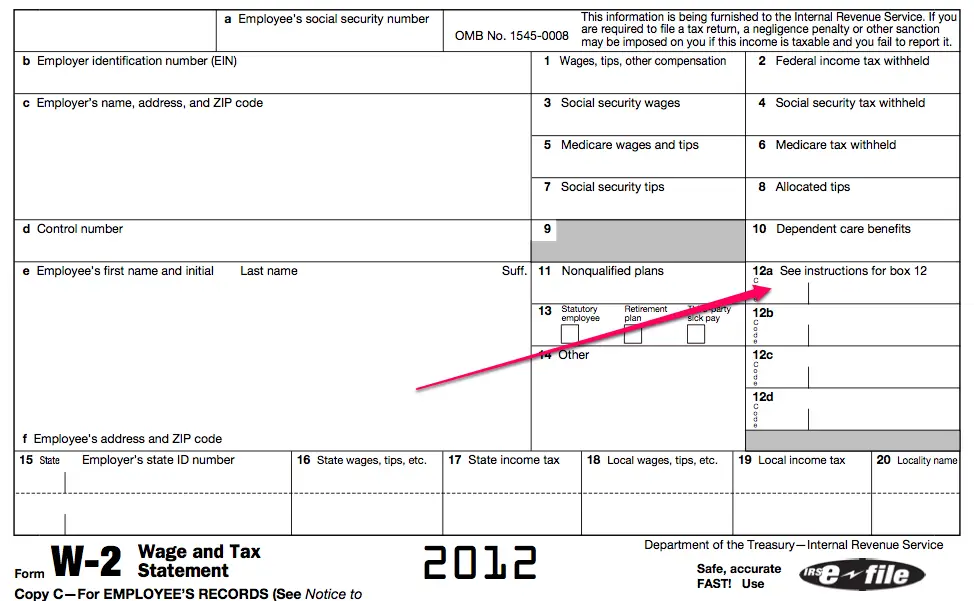

If youre unable to find an old statement, you still may be able to find the administrator by searching for the retirement plans tax return, known as Form 5500.

You can find a 5500s by the searching the name of your former employer at www.efast.dol.gov.

If you locate a Form 5500 for an old plan, it should have the contact information on it.

Don’t Miss: How Can I Take Money Out Of My 401k

Option : Move The Money To An Ira

If you’re not able to transfer the funds to your current 401 or you don’t want to, you can roll over the funds to an IRA instead. The process is the same as doing a rollover to a new 401, and you still have the choice between a direct or indirect rollover.

You’ll need to set up a new IRA with any broker if you don’t already have one. Make sure you choose an IRA that’s taxed the same way as your old 401 funds. Most 401s are tax-deferred, which means your contributions reduce your taxable income in the year you make them, but you pay taxes on your withdrawals in retirement. You want a traditional IRA in this case because the government taxes these funds the same way.

If you had a Roth 401, you want a Roth IRA. Both of these accounts give you tax-free withdrawals in retirement if you pay taxes on your contributions the year you make them.

In most cases, losing track of your old 401 doesn’t mean the money is gone for good. But finding it is only half the challenge. You must also decide where to keep those funds going forward so they’ll be most useful to you. Think the decision through carefully, then follow the steps above.

How To Access My 401k Online

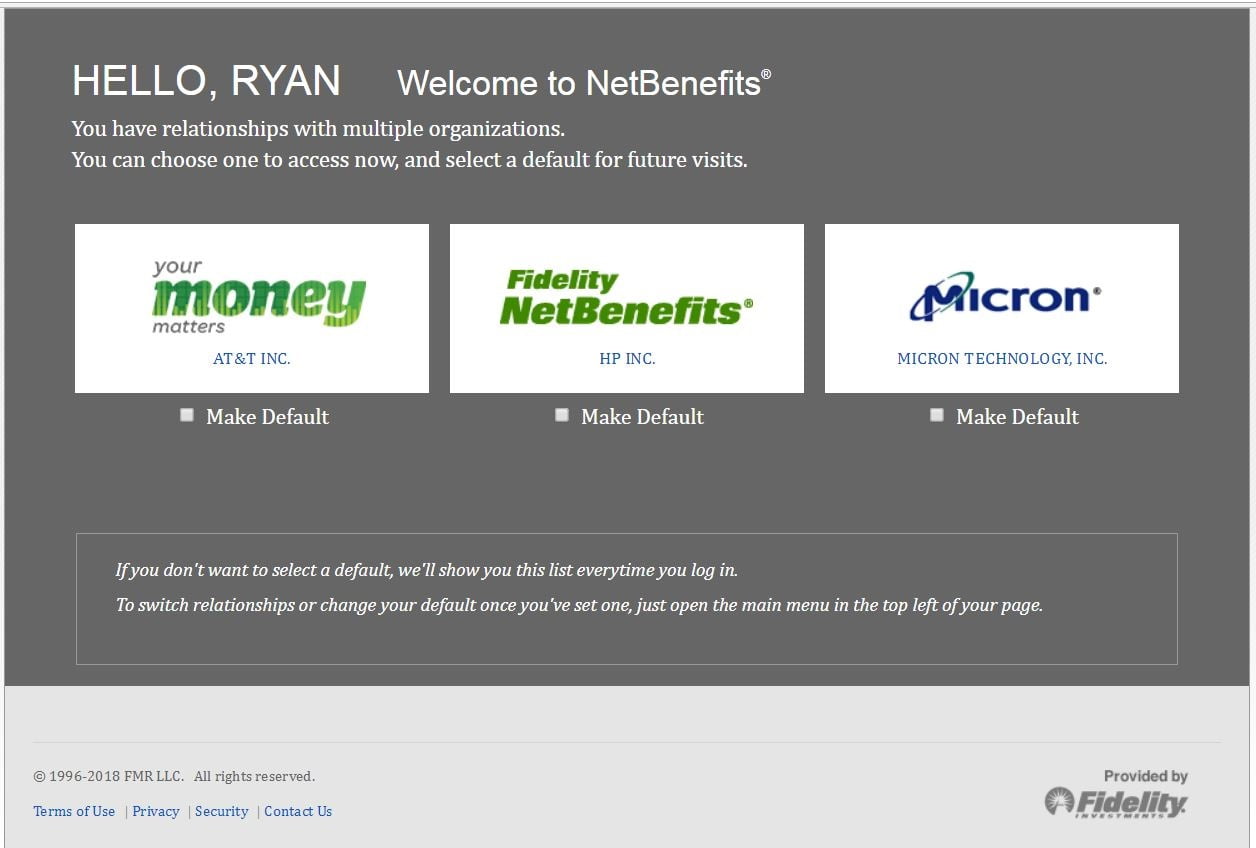

Although youll have set up your 401K through your employer, your funds will be managed through a custodian or brokerage firm, for example, the likes of Charles Schwab or Vanguard. You should be able to log into your 401K account online through the website of the broker your 401K is with.

If you cant remember your login details, youll need to contact your 401K provider to get your password reset, or failing that you may be able to check your balance over the phone.

If youre not sure which custodian your 401K is set up with, speak to your human resources department at work. They wont be able to tell you your 401K balance, but theyll be able to direct you to the relevant 401K broker.

Also Check: Can I Transfer Part Of My 401k To An Ira

How To Read A 401 Statement Front Page Overview

Not all 401 statements are the same. In fact, there are hundreds of different types of 401 statements based on the company you work for and the plan you are in.

While they might look different, most statement front pages contain the following summary information of your account:

The following is an example of what is on the front page of most statements.

Lets break down each section in detail.

Retirement Funds Are Different

They are not turned over to the state, which means, its possible that nothing will happen to your money until something happens with your company ).

A common scenario is when you leave a company and move, perhaps you even change your email address.

Perhaps months or even years have gone by, or youve moved to the other side of the country. Then something happens with your employer and they need to contact you for instructions of what to do with your account.

You May Like: How Often Can I Change My 401k Investments Fidelity

What You Can Do Next

To keep track of your retirement accounts, you first must know where they all are. Once you gather all your old accounts in one place and make sure they are properly balanced, its about sticking to the same investment principlesensuring your money is in diversified, low-cost fundsthat you would follow for your current company retirement plan.

For Compliance Use Only:1020356-00003-00

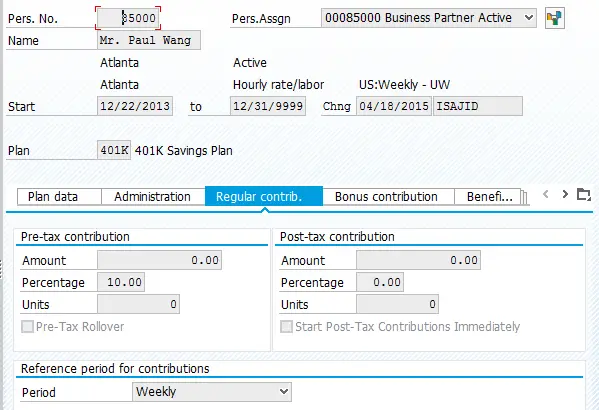

Check If Your Yearly 401 Contribution Goals Are On Track

In the summary tab online there should be a contribution box that tells you the percentage of youre salary youre contributing, your contributions this year and your employer contributions this year.

At minimum, always make sure you contribute enough to get your 401 employee match. This is free money that requires no additional effort. Additionally, consider contributing the maximum amount for tax benefits. Confirm if you are on track to get your company match. Are you halfway to your yearly contribution goals? If you want to contribute the maximum for tax benefits , have you contributed at least $9,500 this year?

If your 401 contribution goals arent on track identify what the gap is between where you are now and your yearly goal, how long it takes contribution changes to go through for your plan and how many paychecks will the new amount be withdrawn from. Then, figure out how much you need to increase your contribution per paycheck.

Don’t Miss: How To Take Out 401k Money For House

Contact Your 401s Administrators

Your human resources department or administrator will be able to help you check your 401 balance.

You have most likely been mailed statements of your 401 accounts yearly or quarterly unless there is a different address on file.

Speak with your representative to verify that your contact information and address are up to date to prevent future lapses in correspondences.

If your 401 plan’s administrator uses an online portal, similar to your online banking platform, they can help you get set up.

Online access to your 401 is excellent in checking your 401 balance and how your funds are performing. Some 401 platforms allow you to research the various funds, as well as reallocate your investments right on the platform.

Check The National Registry Of Unclaimed Retirement Benefits

The National Registry is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

It is essentially a search engine of lost 401 plans.

The only thing you need to search the database is your social security number. No additional information is needed, and there is no cost to search the database.

Read Also: What’s The Maximum Contribution To A 401k

How To Find A Lost Retirement Account

A national database to find forgotten 401s and pensions could be on the way, but savers should take action now to locate any missing retirement accounts.

- Living in Retirement

- 401

At a time when many Americans are worried that they wont have enough money to retire comfortably, thousands have lost track of billions of dollars in savings.

There are more than 24 million forgotten 401 accounts containing some $1.35 trillion in assets, according to a report from Capitalize, which helps workers roll over their retirement plans when they change jobs. Companies are also holding on to billions in unpaid pension payments earned by former employees.

The problem is so widespread that Congress is considering legislation to address it. SECURE Act 2.0, which includes a wide range of benefits and protections for retirement savers, would create a national online lost-and-found database to help people track down these orphaned plans.

Brian Stivers, owner of Stivers Financial Services, in Knoxville, Tenn., says he typically meets one to two new clients a month who are in this situation. Most of the time, theyve changed jobs and forgotten about an old plan, usually because it had a small balance. Retirement plans are also misplaced when one spouse dies and the survivor is unaware of accounts with his or her former employers.

How To Find Your 401 With Your Social Security Number

Knowing how to find your old 401s with your social security number can save a lot of time and headache. There are tools you can use to find your 401 and roll them over.

If you’re like most, you’ve changed jobs quite a bit during your career. According to a Department of Labor study, the average American will have had about 12 jobs during their career. All of that moving around is bound to cause some things to get lost in the shuffle. And if you’ve participated in any company-sponsored 401 plan, your retirement money may have been left behind. Luckily, there are ways to find your 401s using your social security number.

The sad fact is billions in retirement funds are left behind in 401 plans where the participant no longer works for that company.

401s that have been left behind with former employers can be cumbersome at best to find. However, it’s vital in building your retirement to locate your old funds and bring them back into your active portfolio.

The first step would be to contact your former employer’s human resources department. If you can get in touch with them, they should have the best route to getting a hold of your old 401s.

Next would be to reference your old 401s summary plan description. In that, you should be able to find your plan administrator’s contact information and what they do with former employees’ 401s.

You May Like: Why Choose A Roth Ira Over A 401k