The Agriculture Mining Construction Industry Has The Highest 401 Average And Median Balances

At an average 401 balance of $161,065 and a median of $39,869, the agriculture, mining, construction industry sits at top of the average 401 balance by industry table.

In fact, lets look at the rest of that table, shall we?

Average 401 balance by industry:

| Industry | |

|---|---|

| $71,795 | $13,089 |

If youre in the wholesale and retail industry and your savings are north of these figures, youre doing something right and should share it with the rest of us!

Average 401k Match 2017

The average 401 match in 2017 was 4.5% of eligible employee compensation. A 2017 Vanguard Study titled âHow America Savesâ reported an increase in the average contributions to 4.7% up from 3.9% in 2015 and 3% during the financial crisis of 2007/08.

After the financial crisis, most companies reduced or suspended their 401 match when their earnings dropped. As revenue stabilized, employers increased their match to retain and attract the best talents, especially in competitive sectors. Most companies also introduced automatic enrollment for new hires as an inducement for employees to save for retirement.

How Much Should You Save For Retirement

Everyone has different retirement goals and different retirement income needs.

There are a variety of factors that could impact whether a persons retirement savings efforts are on track, says Shamrell. For example, what your goals are in retirement, where you plan to live, and how long you plan to wait to retire would all factor in.

While median and average 401 balances can be interesting points of reference, comparing yourself to them isnt the best way to determine if youre on track for retirement.

Instead, look at your own personal situation to set retirement goals.

Each participant will have their own unique income needs in retirement, so wed encourage them to focus less on their balances and more on their target savings rate, Stinnett says.

Stinnett notes that studies suggest that retirement savers should aim to replace between 70% and 85% of pre-retirement income to maintain their current lifestyle once they stop working.

Recommended Reading: When To Withdraw From 401k

Other 401 Employer Match Rules And Considerations

Beyond the annual combined limits for employer and employee contributions, employer match contributions are subject to some additional employer discretionary contribution rules. Nondiscrimination tests require that employer matches pass the Actual Contribution Percentage test, which is designed to see that contributions made to Highly Compensated Employees dont exceed contributions made to Non-Highly Compensated Employees by more than 125%. For more information on ACP tests, review this resource from the Internal Revenue Service.

Other 401 discretionary contribution rules allow employers some flexibility in how they implement an employer match. Employers are allowed to set up a vesting schedule for employer matches, which means employees will have to put in a certain amount of service before being eligible to collect the full employer match. This can take the form of up to 3 years in a cliff vesting schedule, or up to 6 years in a graded vesting schedule. Finally, employers have the option to require a certain number of hours worked in a year, or to require that employees work on the last day of the year in order to qualify for employer matching contributions.

Additional Business Considerations

For highly-compensated employees , which for 2022 is defined as an employee earning more than $135,000, employer contributions may be limited.

Employer contributions to employee 401 accounts are considered a business expense, and can help lower your businesss tax bill.

How Much Can You Contribute To Your 401

The Internal Revenue Service sets the contribution limit for 401s annually. This limit varies based on your age, but for 2022, most Americans can contribute up to $20,500 across the entire year. If you’re 50 or older, the limit goes up to $27,000 .

That is just your personal contribution limit, though. You can technically exceed these amounts – up to 100% of your compensation or $61,000, whichever is lower – if your employer also contributes to the account. Some employers offer a matching contribution, meaning for each dollar you contribute to your account, they’ll contribute a matching amount up to a certain threshold.

According to a report from investment management group Vanguard, most employers with matching benefits will contribute 50 cents on the dollar for up to 6% of the employee’s pay. So if you made $50,000, your employer would contribute up to $1,500 per year, provided you contributed at least $3,000 yourself .

Also Check: Who Is The Plan Sponsor Of A 401k

Average Employer Contribution: $4040

Probably the best feature of 401 plans is the employer contribution aka free money typically provided by matching a portion of what employees save. Employers contribute $4,040 per year on average, according to Fidelity’s data.

If you add the average employee contribution to the average employer contribution, the combined total of $10,980 represents an average savings rate of 13.5% of salary.

Thats right on target, considering experts recommend saving 10% to 15% of your salary for retirement.

Average Balances Vs Median Balances

Its important to remember that averages dont always give an accurate picture of data. Thats because outliers on the high and low ends can skew the numbers.

While it is often thought that with the average, there may be a few big accounts at the high end that are pulling things up, its just as true that we regularly have people joining our platform with a zero balance, either because they are just joining the workforce, are just now joining a company that offers a 401 or they may have just switched jobs and rolled their 401 savings into an IRA, says Shamrell.

Its helpful to look at median balances by age as well to help determine if outliers are present.

For example, we already have 1.2 million Gen Z employees on our 401 platform, and their average balance is $5,300. In looking at the median, Gen Z participants in the 90th percentile still only have $13,700, Shamrell says.

Don’t Miss: What Happens To 401k When Switching Jobs

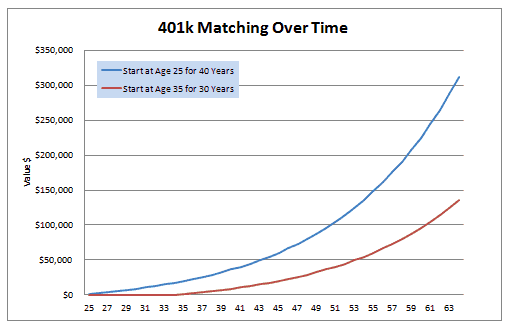

How Long Your Money Remains Invested

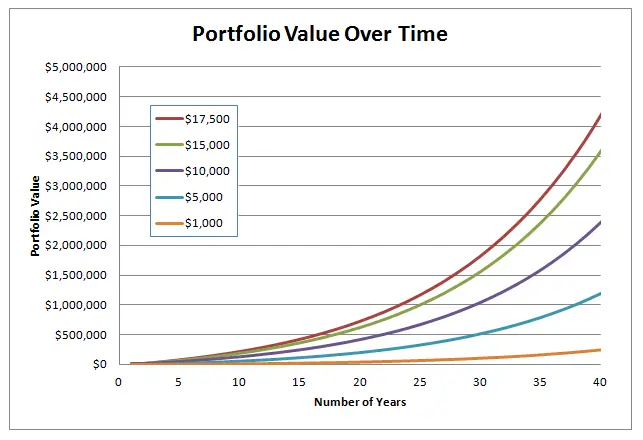

The longer your money remains invested, the more it will be worth, assuming you’ve invested wisely. Returning to our example of a $2,000 annual 401 match from above, if you earned that match every year for a decade and your investments had a 7% average annual rate of return, your matching contributions alone would be worth close to $29,000 after 10 years.

If you claimed your match every year and let it grow for 30 years, your matching contributions would be worth over $196,000, all other factors being the same. And that’s not counting any money that you personally contributed in order to get the match in the first place. If it was a dollar-for-dollar match, your personal contributions would at least equal your matching contributions, which means your 401 would be worth double the estimates above. Those who contributed more than the amount required to max out their match could have even more.

What Is A Dollar

With a dollar-for-dollar 401 match, an employerâs contribution equals 100% of an employeeâs contribution, and the employerâs total contribution is capped as a percentage of the employeeâs salary.

âWe commonly see employers offer a 3%, dollar-for-dollar match,â said Taylor. âThey match 100% of your contributions up to 3% of your salary.â

Imagine you earn $60,000 a year and contribute $1,800 annually to your 401âor 3% of your income. If your employer offers a dollar-for-dollar match up to 3% of your salary, they would add an amount equal to 100% of your 401 contributions, raising your total annual contributions to $3,600.

Also Check: Where To Find My 401k

How 401 Plans Work

A 401 plan is a profit-sharing or stock bonus plan that contains a cash-or-deferred arrangement . The most prevalent CODA is a salary reduction agreement.2 Under such an agreement, eligible employees may elect to reduce their compensation and have their employer contribute the difference to a retirement plan. Employers often match the employee’s contribution. A typical match is 50 cents for each dollar contributed by the employee, with the match ending when employee contributions equal 6 percent of compensation.3 Beyond 6 percent, plans often permit employees to make unmatched pretax contributions up to the legislated limit.

Both employee and employer contributions to 401 plans are tax-deferred. That is, no income taxes are levied on the original contributions or the earnings on those contributions until funds are withdrawn from the plan.4 Because the saving is tax-favored, the Internal Revenue Code limits the amount that employees and employers can contribute. For instance, elective employee contributions could not exceed an indexed amount of $10,500 in 2001.5 Some plans allow employees to make after-tax contributions beyond the limit set for tax-deferred contributions. Total contributions were limited in 2001 to the lower of $35,000 or 25 percent of the participant’s compensation.6

When Determining Your Contribution Percentage Consider Automatic Boosts

In 2021, the average employee contribution to a Vanguard 401 plan was 7.3 percent of pay, according to Vanguard 401 data. Meanwhile, only 23 percent of 401 participants saved more than 10 percent of their salary for retirement in 2021.

If you cant afford to contribute that much initially, many employers will allow you to increase your contribution percentage automatically each year , which may be a more comfortable and gradual way to increase your contribution amount.

A 401 can be one of your best tools for creating a secure retirement. But you may want to also consider some retirement investing alternatives.

Read Also: Can You Use Your 401k For A House Down Payment

Goldman Sachs 401k Match

Goldman has an automatic enrollment feature for its 401 plan that allows employees to be enrolled into the plan immediately upon hire. Employees can contribute up to 50% of their eligible pay to the plan.

For an employee to qualify for the employerâs match, he/she must have completed 12 months of service. Goldman Sachs matches 100% of the employee’s 401 contributions each pay period up to 4% of the employeeâs base pay.

Matched contributions become fully vested immediately.

Average Employee Contribution: $6940

The average annual employee 401 contribution was $6,940 during the 12 months ending March 2019, according to Fidelity, which is one of the largest retirement-account record keepers. The IRS sets the bar for contributions pretty high: The 401 contribution limit for employees is currently $19,000 per year, with those 50 or over allowed to save $25,000.

Recommended Reading: Should You Always Rollover Your 401k

What Is The Maximum Employer Match

Employer matches are deposited into an employees 401 account on a pre-tax basis. Although there is not a specific limit to how much an employer can match each employees contribution rate, there is a total limit for combined contributions into an individuals 401. Combined contributions from both employer and employee can be no more than $61,000 or 100% of compensation, whichever is less, for the 2022 tax year.

Why You Should Make Catch

There are a number of advantages to making catch-up contributions, and these are largely similar to the more general advantages of a 401 plan. By choosing to contribute more to your 401, you will further reduce your tax bill. If you are in a relatively high tax bracket, these savings can be significant: If a worker over age 50 who is in the 35% tax bracket contributes the full $27,000 to a 401, they will reduce their current tax bill by $9,450, an extra $2,275 in tax savings in comparison to not making catch-up contributions.

In addition, if you start putting extra money into your 401 at age 50 and dont retire until you are 65 or even older, it can boost the value of your retirement portfolio significantly. Youll have saved almost an extra $100,000 in those 15 years, and during retirement that could grow still further, depending on the performance of the economy and how your money is invested.

That said, contributing $27,000 a year to a 401 is a stretch for many people. Even a worker earning a relatively generous salary of $100,000 per year would have to put aside a quarter of their income, and someone earning $50,000 a year is unlikely to be able to put aside half their income for retirement.

Also Check: How Much Will My 401k Be Worth In 20 Years

What Is A 401 Retirement Savings Plan

A 401 is a retirement savings plan some employers offer their team as a financial benefit for working at the company. The U.S. government established the 401 to incentivize workers to save for their retirement.

Employees volunteer to have a certain amount deducted from their paychecks each pay period to go toward their 401 savings accounts. While employees usually choose how much theyd like to deduct from their paycheck, they often have a limit on how much theyre allowed to contribute.

Employers can offer one of two plans: a traditional 401 plan or a Roth 401 plan. For traditional plans, 401 withdrawals are taxed at the employees current income tax rate. Roth 401 withdrawals arent taxable if the 401 account is five years old or older and the employee is over 59 years old. There are specific regulations to follow regarding how much and how often an employee can withdraw these funds for their 401.

Many employers use 401s as an employee benefit for working at the company and as an incentive to keep long-term employees. Some employers require employees to work at a company for a certain amount of time before they can start depositing their paycheck money toward a 401.

Employees can choose the specific types of investments from a selection their employer offers. Some of these investment types may include stock and bond mutual funds, target-date funds, guaranteed investment contracts or the employers company stock.

Take Note Older Savers

If you start saving later in life, especially when you’re in your 50s, you may need to increase your contribution amount to make up for lost time.

Luckily, late savers are generally in their peak earning years. And, from age 50, they have a greater opportunity to save. As noted above, the 2021-2022 limit on catch-up contributions is $6,500 for individuals who are age 50 or older on any day of that calendar year.

If you turn 50 on or before Dec. 31, 2021, for example, you can contribute an additional $6,500 above the $19,500 401 contribution limit for the year for a total of $26,000 including catch-ups.

“As far as an ‘ideal’ contribution is concerned, that depends on many variables,” says Dave Rowan, a financial advisor with Rowan Financial in Bethlehem, PA. Perhaps the biggest is your age. If you begin saving in your 20s, then 10% is generally sufficient to fund a decent retirement. However, if you’re in your 50s and just getting started, you’ll likely need to save more than that.”

The amount your employer matches does not count toward your annual maximum contribution.

Also Check: Should I Do 401k Or Roth Ira

How Does Your 401 Compare To Average

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

More than 97 million Americans have access to an employer-sponsored retirement plan. If your retirement savings is a portion of the $5.3 trillion invested in 401s, you may have wondered how your companys plan and the investment choices you have within it stacks up to the competition. Lets take a look.

What Is The Average Balance For A 401

The Internal Revenue Service sets yearly limits for how much employees can contribute to their 401 each year. For 2022, workers under age 50 may contribute $20,500 per year. Those 50 and older may contribute an additional $6,500.

According to a recent report by Vanguard, savings rates are increasing slightly, most likely due to automatic contribution plans. The average percentage contributed by employees for 2021 was 7.3%, and 11.2% with employer matches.

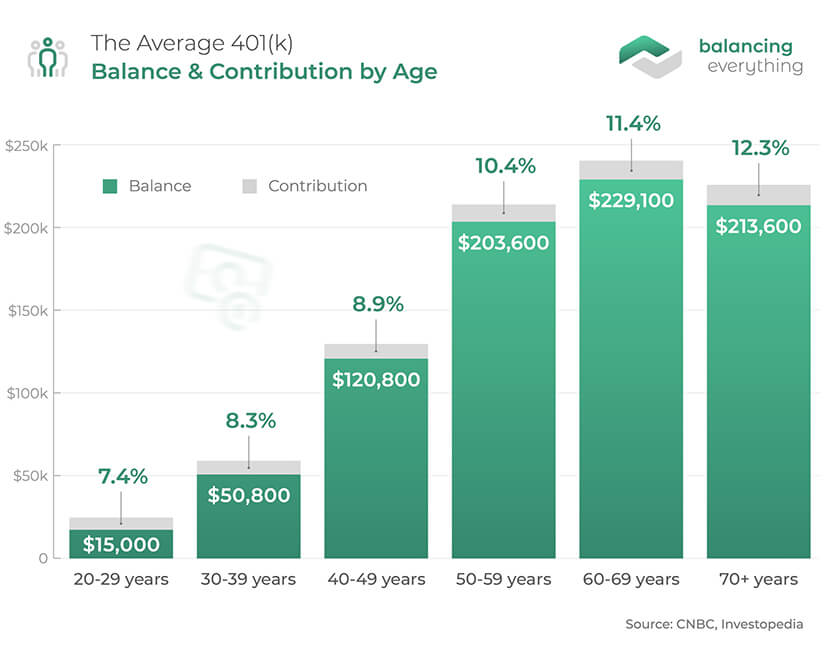

The overall average in a 401 account is $141,542, but this number includes balances for workers across all experience levels and tenure. When broken down by age, the average account amounts are significantly different.

- Under 25$6,264

- 5664$256,244

- 65 and older$279,997

These numbers are only part of the retirement savings picture. Many people also invest in traditional or Roth individual retirement accounts and taxable brokerage accounts.

Read Also: Can You Transfer 401k To Another Company

The Low Down On Contribution Matching

First things first: By law, employers do not have to match any part of an employees investment in a 401k plan. There is, however, required annual nondiscrimination testing plans are fair to all employees.Since Uncle Sam offers tax incentives for the contribution-friendly employer, many businesses do offer such contributions as part of an overall employee benefits package. Some advantages are the following:

- Attracting and retaining top talent

- 401k contributions are tax deductible and can be tax-deferred up to a limit established by the IRS

- A 401k plan puts the onus of retirement investing on the employee, cutting the employers workload.

If You Want To Get The Most Out Of Your Employer Match You Have To Understand The Factors That Influence It

A 401 match is a flashy perk employers dangle in front of prospective employees, but its actual value varies quite a bit: anywhere from nothing to tens of thousands of dollars.

To find out how much you’ll get, you have to weigh several factors, which I outline below. Once you understand these basics, you can leverage this information to secure an even larger company match.

You May Like: Is A 401k A Defined Benefit Plan