Use For Emergencies Only

If you face a serious financial need, borrowing money from your 401k plan may make sense, as it can be easy to get. But consider it only after you’ve exhausted your cash savings accounts. Keep in mind if you leave your employer for any reason, a 401k loan can create a major financial burden.

The information in this article was obtained from various sources not associated with State Farm® . While we believe it to be reliable and accurate, we do not warrant the accuracy or reliability of the information. State Farm is not responsible for, and does not endorse or approve, either implicitly or explicitly, the content of any third party sites that might be hyperlinked from this page. The information is not intended to replace manuals, instructions or information provided by a manufacturer or the advice of a qualified professional, or to affect coverage under any applicable insurance policy. These suggestions are not a complete list of every loss control measure. State Farm makes no guarantees of results from use of this information.

Loans To An Employee In The Armed Forces

If the employee is in the armed forces, the employer may suspend the loan repayments during the employees period of active duty and then extend the loan repayment period by this period.

If during a leave of absence from his or her employer, an employees salary is reduced to the point at which the salary is insufficient to repay the loan, the employer may suspend repayment up to a year. Unlike the exception for active members of the armed forces, the loan repayment period is not extended and the employee may be required to increase the scheduled payment amounts in order to pay off the loan in the originally scheduled period.

What To Expect If You Have A 401 Loan And Lose Your Job

- 13% of 401 savers have an outstanding loan, according to Vanguard’s 2019 How America Saves report.

- If you lose your job, there’s a good chance your plan will either require you to repay the loan fairly quickly or will end up reducing your account balance by the amount owed and consider it a distribution.

- Here are the rules for what happens next if you find yourself in that situation.

If you already are paying on a loan from your 401 account and lose your job amid the coronavirus pandemic, that borrowed money could generate a tax bill you weren’t expecting.

Although the latest round of economic rescue legislation provides relief for coronavirus-related withdrawals from 401 plans, loans that already have been in repayment are subject to some existing rules that apply when you’re laid off or otherwise part ways with your company. In other words, your loan could morph into a distribution that comes with taxes and an early withdrawal penalty.

“If an individual is laid off, it can speed up the time of repayment,” said Will Hansen, executive director of the Plan Sponsor Council of America.

Although the CARES Act makes some changes to 401 withdrawals and loans for individuals financially impacted from the coronavirus including waiving early withdrawal penalties and giving qualifying individuals three years to replace what they took out the legislation does not cover loans unrelated to the current crisis. That includes ones that already were outstanding.

Read Also: Should I Roll Over 401k Into Ira

Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isn’t a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what’s been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What’s more, 401 loans don’t require a credit check, and they don’t show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

Make A Lump Sum Payment

If you receive a windfall or a large payment, you can use part of the money to settle the loan in one lump sum payment. You will need to calculate how much loan is unpaid, including any interest payments, and settle any outstanding obligations. You wonât owe any prepayment penalties for paying off the loan early.

Recommended Reading: Where To Put My 401k

Contact Fidelity And Close Your Account

There are a few different ways to close your account. The most efficient way is to call Fidelity directly at 1-800-343-3548. You can speak to a representative that will guide you through the process of closing your account.

You can also log into your account online and transfer funds out of your account. Some people think just moving the funds out of the account is sufficient. However, you need to fully close the account. Leaving it open, even with a zero balance, leaves you at risk for fraudulent activity by an unauthorized user. You can send a message through the online chat to initiate the closing process.

Finally, you can visit a Fidelity branch in person. If you go that route, consider calling ahead to set up an appointment. That can make the process go much more quickly.

How To Get 401 Loans

The process of obtaining a 401 loan will vary depending on your plan provider. But since theres typically no credit check required, you can request information about the rates and fees associated with a 401 loan without hurting your credit score. Heres how to initiate the process.

Don’t Miss: How To Get Money Out Of Fidelity 401k

What Happens If I Leave My Job With An Outstanding 401 Loan

Leaving a job, whether by quitting or getting fired, is always a stressful time. Parting ways with a company with whom you have an outstanding 401 loan can cause even more problems.

Regardless of how long you have left on a 401 loan, the IRS requires 401 loans to be repaid within 60 days of leaving an employer who sponsors the plan in which you took a loan out.

Borrowers who fail to repay the remaining balance within 60 days will be required to pay income tax on the amount at the applicable tax rate. Additionally, a 10% early withdrawal penalty tax will be assessed as the IRS will deem the unpaid portion as an unqualified 401 disbursement.

If youâve spent the entire amount you received from your 401 loan, this amount will need to be made up by April 15, when taxes are due.

To avoid any taxes or penalties, you could take out a personal loan depending on the outstanding amount. This method would essentially extend the repayment period and avoid having you come up with a lump sum on your own.

Additionally, if you have made enough contributions to a Roth IRA to cover the outstanding balance on your 401, you may be able to withdraw the amount you need tax and penalty-free. Withdrawals of Roth IRA contributions are not considered ineligible distributions as those contributions were already taxed prior to them being deposited into the Roth IRA.

Tags

What You Should Know About 401 Loans

A 401 is a financial instrument that is used to save for retirement. You and your employer can both contribute, and the account accrues returns. There are some financial actions you may be able to take with your 401 if you need to, depending on whether the program managers and your employer allow them.

If you are in a pinch and need money quickly, you can take a loan from your 401 instead of paying double-digit interest to a credit card company. You’d pay interest to yourself, effectively contributing more money to your retirement plan.

There are a few considerations you should take before taking out a loan from your retirement account. There is a maximum amount you can take out, and a repayment period that must be met.

Don’t Miss: How Do I Check My 401k For Walmart

Create A Structured Repayment Plan

If the loan payments are not automatically deducted from your paycheck, you should create a plan on how you are going to repay the loan. Start by examining your monthly budget to determine how much is left after paying other debts and household expenses. Then, decide how much you can comfortably pay each repayment period.

If you have a tight budget, and you cannot afford the expected periodic payments, it doesn’t hurt to start a conversation with the employer on how you are going to pay back the loan. If the expected loan payments exceed your monthly budget, you can agree to a quarterly payment. You can then deposit the loan payments into a savings account so that you can accumulate enough money for the quarterly payments.

Who Gets The Interest Payments From A 401 Loan

You get the interest you pay on the 401 loans, since you are essentially lending money to yourself. Keep in mind that the interest payments are made with after-tax dollars. That’s a downside to 401 loans, because those after-tax dollars will be taxed again when they’re taken out as a 401 withdrawal in retirement.

Read Also: Can You Leave Money In 401k At Your Old Job

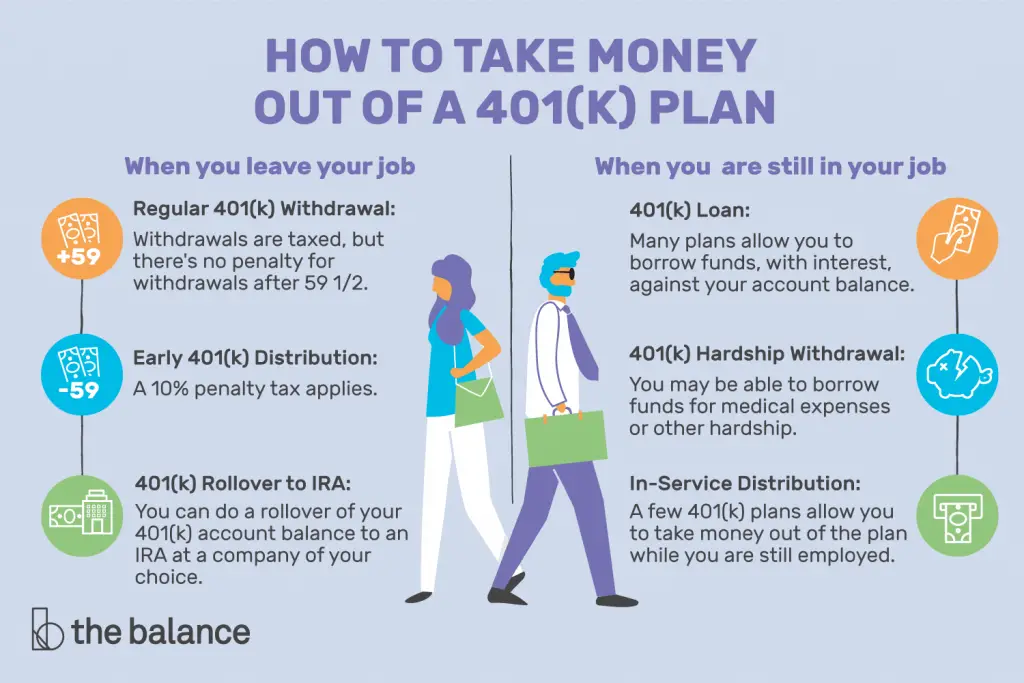

Loans Vs Hardship Withdrawals

For the most part, the money you place in your retirement accounts is untouchable during your working years. If you follow these rules, the IRS affords you various tax benefits for saving for retirement. However, there may come a time when you need money and have no choice but to pull funds from your 401. Two viable options include 401 loans and hardship withdrawals. A 401 loan is generally more attainable than a hardship withdrawal, but the latter can come in handy during times of financial strife.

A financial advisor could help you put a financial plan together for your retirement needs and goals.

Can I Use My 401 To Buy A House

Using your 401 to make a downpayment on a house is generally allowed.

There are even some benefits:401 loans arent taxed, they dont affect your credit score,and they havelow interest rates.

However, borrowing from your401 can do severe and lasting damage to your retirementsavings. Thats why financial advisors recommend borrowers tap their 401 fundsonly as a last resort.

Before you decide to use your 401 to buy a house, consider the no- and low-down-payment mortgages available today.

Many people can buy a house withas little as 3% or even 0% down so theres a good chance you dont need totap your retirement savings to make a down payment.

Read Also: What Employees Can Be Excluded From A 401k Plan

Possible Consequences If You Borrow From Your 401

Although paying yourself interest on money you borrow from yourself sounds like a win-win, there are risks associated with borrowing from your retirement savings that may make you want to think twice about taking a 401 loan.

- The money you pull out of your account will not be invested until you pay it back. If the investment gains in your 401 account are greater than the interest paid to your account, you will be missing out on that investment growth.

- If you are taking a loan to pay off other debt or because you are having a hard time meeting your living expenses, you may not have the means to both repay the loan and continue saving for retirement.

- If you leave your job whether voluntarily or otherwise, you may be required to repay any outstanding loan, generally within 60 days.

- If you cannot repay a 401 loan or otherwise break the rules of the loan terms, in addition to reducing your retirement savings, the loan will be treated as taxable income in the year you are unable to pay. You will also be subject to a 10% early distribution tax on the taxable income if you are younger than age 59½. For example, if you leave your employer at age 35 and cannot pay your outstanding loan balance of $10,000, you will have to include $10,000 in your taxable income for the year and pay a $1,000 early distribution tax.

What Are Some Alternatives To A 401 Loan

When cash is tight, borrowing from your 401 plan and paying yourself interest may seem like a good idea. But before you borrow, weigh all your options. Here are a few.

Read Also: How To Calculate Company 401k Match

How Is My Solo 401k Participant Loan Secured

Up to 50 percent of the present value of a participants account balance can be used to secure a loan. This is determined at the time the Solo 401k loan is made. See

Therefore, if a Solo 401k participant borrows one half of his or her account balance and then takes a Solo 401k hardship distribution before the loan is repaid, he or she will still be in compliance with this rule.

Do You Qualify For A Mortgage Without 401 Funds

With such a wide range of mortgageoptions and down payment assistance on the market, most people simply dontneed to tap their 401 in order to purchase a home.

On top of that, todays lowmortgage rates increase your home buying power by reducing monthly payments.Its easier to afford a home than ever before.

Before taking money out ofretirement, find out whether you qualify for a mortgage based on your currentsavings. You might be surprised.

Popular Articles

Step by Step Guide

Don’t Miss: Can You Move Money From 401k To Roth Ira

What Is The Difference Between A 401 Loan And A 401 Withdrawal

The biggest difference between a 401 loan and a 401 withdrawal comes down to taxes.

When you withdraw money from your 401, that money will be treated like ordinary income. That means youll have to pay taxes on that money now . Youre not obligated to put the money you took out back into your 401its yours to do whatever you want with it.

Note: Sometimes, you could qualify for a hardship withdrawal, which would allow you to take money out of your 401 without an early withdrawal penalty under special circumstances .

With a 401 loan, youre just borrowing the money from your own account. Like any other loan, you haveto pay that money backin this case, back into your 401over a certain period of time, plus interest too). Since the money you borrow isnt treated like ordinary income, you wont owe any taxes or have to pay an early withdrawal penalty.

But, like we mentioned earlier, that all changes if you leave your job for whatever reason. If you dont repay the balance on your 401 loan by the time your tax return is due, your loan will be in default and Uncle Sam will be sending you a tax bill.