Key Employee Contribution Limits That Remain Unchanged

The limit on annual contributions to an IRA remains unchanged at $6,000. The IRA catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains $1,000.

The catch-up contribution limit for employees aged 50 and over who participate in 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan remains unchanged at $6,500. Therefore, participants in 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan who are 50 and older can contribute up to $27,000, starting in 2022. The catch-up contribution limit for employees aged 50 and over who participate in SIMPLE plans remains unchanged at $3,000.

Details on these and other retirement-related cost-of-living adjustments for 2022 are in Notice 2021-61 PDF, available on IRS.gov.

Contribution Limits For 2021 And 2022

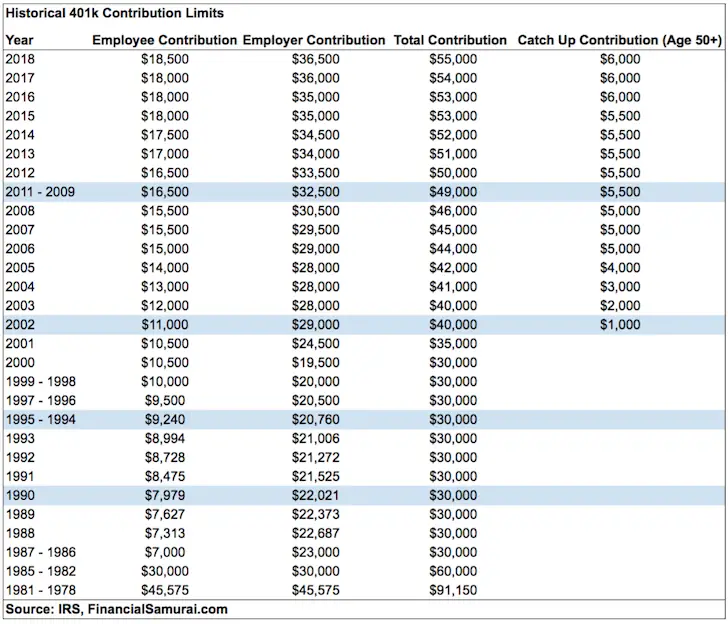

When most people think of 401 contribution limits, they are thinking of the elective deferral limit, which is $19,500 in 2021 and $20,500 for 2022. This is the maximum amount you are allowed to voluntarily defer to your 401 for the year. Adults 50 and older are also allowed $6,500 in catch-up contributions, which are additional elective deferrals, in 2021 and 2022. This brings the maximum amount they can contribute to their 401s to $26,000 in 2021 or $27,000 in 2022.

The IRS also imposes a limit on all 401 contributions made during the year. In 2021, it rises to $58,000 and $64,500, respectively. In 2022, it rises to $61,000 and $67,500, respectively. This includes all your personal contributions and any money your employer contributes to your 401 on your behalf.

Highly paid employees have some additional limitations to keep in mind. Companies can elect to stop a participant’s salary deferrals once that person has earned $290,000 in 2021 or $305,000 in 2022, and companies use only that first amount to calculate employer matching contributions.

For example, say your company matches up to 6% of your salary and you earn $300,000 in 2021. Six percent of $300,000 is $18,000 however, your company can only match you up to 6% of $290,000, the maximum employee compensation limit for 2021. So rather than up to $18,000, you’d get up to $17,400 as an employer match.

Here’s a useful reference chart to help you remember these important limits and thresholds:

|

Type of Contribution |

|---|

Contributions Save You Money On Taxes

Contributions to your 401 are made on a pre-tax basis, meaning you dont pay income taxes this year on money put into your 401. This can help lower your overall taxes and may even help you qualify for stimulus payments, child tax credits, or drop your income enough to avoid the Obamacare Surtax on investment income. Plus, saving for retirement will help you have a better retirement in the future.

Also Check: How Much Money Do I Have In My 401k

Can I Reverse 401k Contribution

Usually, when contributions are made to a 401 plan they cannot be withdrawn, even when a pay reversal is made. Instead they are placed in an unallocated account in the plan, where they can be used to offset future costs and contributions, as long as your plan allows for these payments.

Can employees stop 401k contributions at any time?

Yes. In general, traditional 401 plans do not require employer contributions, and employers are allowed to discontinue or reduce their contribution.

Can you change 401k contributions at any time?

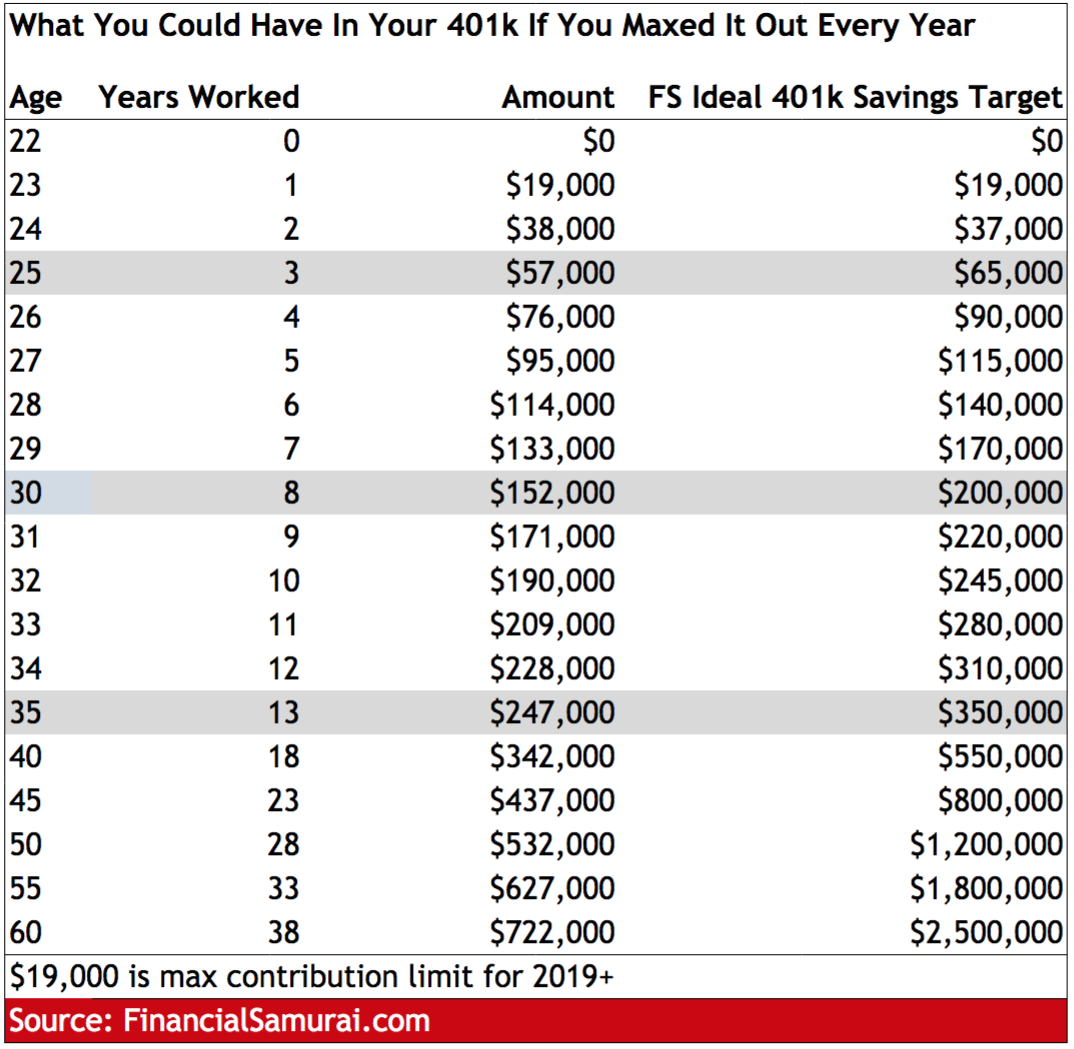

Your employer determines how often you can change your 401 contribution. Some employers may allow you to change only once a year, while others may allow you to change as often as you want. From 2019, the maximum you can contribute to a 401 is $ 19,000 per year or your annual salary, which is less.

What happens if you accidentally contribute to 401k?

Get a new W-2 and pay the fees. The excess refund will be added to your total taxable salary for the past year, so a modified W-2 will be issued. Your tax bill will increase as much as the amount of the excess 401 contribution.

When A Withdrawal Penalty Applies

While you can take money out of your 401 without penalty for a few reasons, you’ll typically still pay income taxes on it. What if you just want to take the money out to do some shopping before you’ve reached age 59 1/2, or before age 55 if the Rule of 55 applies to you? Well, the IRS will hit you with a 10% penalty on top of taxes. That means that expenses such as a new car or a vacation don’t count as reasons to take out your 401 savings.

You May Like: Can I Convert My 401k To A Roth

What Is A 415 Correction

Excessive annual additions under Section 415 of the Code may now be self-correcting by distributing the excessive amounts no later than 9 ½ months after the plans limitation year . in excess must be distributed within 2 ½ months after the plan limitation year). See the article : Navigating taxes in retirement | Business.

Workers Will Be Able To Send More Money Into Their Retirement Savings In 2022 Due To Changes In The Cola But Americans Still Face Retirement Insecurity

The 401 plan is a retirement savings plan offered by many American employers that has tax advantages to the saver. It is named after a section of the US Internal Revenue Code, and it is facing changes in 2022.

This is tied up into inflation and the COLA increase for 2022. The Consumer Price Index increased 0.9 percent in October after rising 0.4 percent in September, the US Bureau of Labor Statistics reported. Over the last 12 months, the index increased 6.2 percent before seasonal adjustment, marking the highest rate of inflation in the country since 1990. This in turn has led to the Social Security Administration announcing a 5.9 percent cost-of-living adjustment increase for 2022.

These changes mean workers will be allowed to submit more money into their retirement plans, as the money they have saved may not sufficient with high inflation levels.

Recommended Reading: How To Contact My 401k

What Percent Should I Contribute To A 401

Brewer suggests that your contributions should be based on a percentage of your income, depending on your age. She recommends that you stash away between 10 percent and 15 percent of your gross income if youre in your 20s and 30s, or if you started saving during those years. If youre behind in retirement savings in your 40s and 50s, Brewer encourages you to set aside between 15 percent and 25 percent of your income.

If youre not saving anything for retirement right now and want to get started, start with at least 3 percent to get going, Brewer says. Increase your contribution by at least 2 percent each year and do a larger increase in years where you get a big raise until you hit your target savings percentage.

How Are Solo 401k Contribution Limits Calculated

The IRS sets contribution limits each year. The maximum limit went from $57,000 in 2020 to $58,000 in 2021. If you are 50 years old or older the maximum contribution limit went from $63,500 in 2020 to $64,500 in 2021. As a self-employed person you play multiple roles in your Solo 401k. Because of this, there are multiple ways to contribute to a Solo 401k that allow you to get to the maximum contribution amount for 2021.

You are the employee of your business, so you can do an employee salary deferral which can total $19,500 in 2021. This contribution can be up to 100% of your net compensation or W2 depending on your business structure. If you are 50 years old or older, you can also make a catch up contribution of $6,500. This makes the total possible employee salary deferral for 50 year old or older $26,000.

Since you are also the employer, you can also contribute as an employer profit sharing contribution. This contribution can be between 20-25% of your net business self employment income or W2, depending on your business structure. The more you earn, the more you can contribute. If your spouse works in your business and receives compensation you can double your contribution amount. Imagine being able to tax-shelter over $100,000 per year!

Read Also: How To Find My 401k Balance

How Much Should You Save For Retirement

To start, invest 15% of your gross income into retirement savings accounts like a Roth 401 and Roth IRA. Spread your money evenly across four types of mutual fundsgrowth and income, growth, aggressive growth, and internationalinside of those retirement accounts.

And listen, we know youre eager to start saving money for your retirement future . . . but if youre still getting out of debt or need to get a solid emergency fund in place, now is not the time to save for retirement. Your income is your number one wealth-building tool, and you cant take full advantage of it if its tied up in credit card or student loan payments.

So lets say youre out of debt with a fully funded emergency fund and you have an annual salary of $75,000. That means your goal is to save $11,250 each year for retirement. Where do you start? Lets walk through it step-by-step.

What Happens If You Put Too Much Money In Your 401k

Excess amount If the excess contribution is returned to you, any gain included in the amount returned to you must be added to your taxable income on your tax return for that year. Read also : A smart way to save for retirement in Illinois could get even smarter | Editorial. Excess contributions are taxed at 6% per annum for each year that excess amounts remain in the IRA.

How do you signal an excessive 401k delay? What is the correct way to report excessive 401k contributions in

- Open your back.

- Scroll down to Less Common Income and click Show more

- Select Miscellaneous Income and click Start or Update

Recommended Reading: Can You Use Your 401k To Buy Real Estate

Knowing These Rules Can Save You A Lot Of Trouble With The Irs

A 401 is a tax-advantaged retirement account, so the government sets limits on how much you can contribute every year. But it also understands that inflation makes retirement more expensive over time, so it reevaluates its limits every year and sometimes raises them. Here’s an overview of all of the contribution limits the government imposes on 401s in 2020 and 2021.

Total Annual 401 Contribution Limits

Total contribution limits for 2022 are the following:

- $61,000 total annual 401 if you are age 49 or younger

- $67,500 total annual 401 if you are age 50 or older

The dollar amounts listed above are the total maximum amount that can be contributed. This number is a combination of both your own and your employers contributions.

In some cases, you can contribute additional amounts to other types of plans these may include a 457 plan, Roth IRA, or traditional IRA. It all depends on your income and the types of plans available to you.

You May Like: Will Walmart Cash A 401k Check

Treatment Of Excess Deferrals

You have an excess deferral if the total of your elective deferrals to all plans is more than the deferral limit for the year. Notify your plan administrator before April 15 of the following year that you would like the excess deferral amount, adjusted for earnings, to be distributed to you from the plan. The April 15 date is not tied to the due date for your return.

Excess withdrawn by April 15. If you exceed the deferral limit for 2020, you must distribute the excess deferrals by April 15, 2021.

- Excess deferrals for 2020 that are withdrawn by April 15, 2021, are includable in your gross income for 2020.

- Earnings on the excess deferrals are taxed in the year distributed.

The distribution is not subject to the additional 10% tax on early distributions.

Excess not withdrawn by April 15. If you don’t take out the excess deferral by April 15, 2021, the excess, though taxable in 2020, is not included in your cost basis in figuring the taxable amount of any eventual distributions from the plan. In effect, an excess deferral left in the plan is taxed twice, once when contributed and again when distributed. Also, if the entire deferral is allowed to stay in the plan, the plan may not be a qualified plan.

Reporting corrective distributions on Form 1099-R. Corrective distributions of excess deferrals are reported to you by the plan on Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Choosing Investments Within A Plan

Generally, 401 plans offer several options in which to invest contributions. Such options generally include mutual funds that may invest in stocks for growth, bonds for income, or money market investments for protection of principal. This flexibility may help lower investment risk by diversifying a portfolio amongst different types of classes, manager styles, investment styles, and economic sectors.

Also Check: How To See How Much 401k You Have

Will My 401k Automatically Stop At Limit

If your employer makes corresponding contributions, their payments will automatically cease when yours is due. So, if you reach your $ 18,500 before the last payment of the year, your landlords payments will cease before the end of the year and you will not be able to receive your full payment.

What happens if you exceed the 401k limit? Excess contributions are taxed at 6% per annum for each year that excess amounts remain in the IRA. To avoid 6% tax on excessive contributions, you must withdraw: Excessive contributions from your IRA on the due date of your individual income tax return Any income earned on excessive contribution.

Retirement Savings Plan Contribution Limits

The information below summarizes the retirement plan contribution limits for 2022.

| Plan |

|---|

More details on the retirement plan limits are available from the IRS.

457 Plans

The normal contribution limit for elective deferrals to a 457 deferred compensation plan is increased to $20,500 in 2022. Employees age 50 or older may contribute up to an additional $6,500 for a total of $27,000. Employees taking advantage of the special pre-retirement catch-up may be eligible to contribute up to double the normal limit, for a total of $41,000.

401 Plans

The total contribution limit for 401 defined contribution plans under section 415 increased from $58,000 to $61,000 for 2022. This includes both employer and employee contributions.

401 Plans

The annual elective deferral limit for 401 plan employee contributions is increased to $20,500 in 2022. Employees age 50 or older may contribute up to an additional $6,500 for a total of $27,000.

The total contribution limit for both employee and employer contributions to 401 defined contribution plans under section 415 increased from $58,000 to $61,000 .

403 Plans

The annual elective deferral limit for 403 plan employee contributions is increased to $20,500 in 2022. Employees age 50 or older may contribute up to an additional $6,500 for a total of $27,000.

The total contribution limit for both employee and employer contributions to 403 plans under section 415 increased from $58,000 to $61,000 .

IRAs

Don’t Miss: How To Claim 401k From Previous Employer

Get The Full Company Match

If you arent contributing enough to your 401 to get the full company match, you are essentially flushing money down the toilet. In many cases, your employer will match your 401 contributions dollar for dollar up to a certain amount of income. For the average American worker, skipping this step could easily turn into a million-dollar retirement mistake.

Do You Think Its Possible To Contribute 100 Percent Of My Earnings To A 401 Account

The maximum amount you can contribute is the amount of money you earn if your wages are less than $19,500 annually. Be aware that every 401 plan has their own rules and regulationsthat might limit the amount the money you are able to put into your account each year. If you earn more than $130,000 annually or have more than 5% ownership of the company will be affected as will the highest-paid employees, who will be classified as having a salary of more than $130,000 annually or have more than 5% ownership of the company as of 2021.

To ensure that highly-rewarding employees do not receive a disproportionate benefit when compared with other employees The sponsors of the most important business plans must adhere to strict discriminatory testing criteria. The highest-paid workers, despite likelihood to to save greater, often not able to contribute more than 2 percentage points higher than those who earn less on average. Instead of favouring the one group over the other, the idea is to make everyone participate in the program.

This could be avoided in the event that a company is worried about complying with anti-discrimination testing rules. They can either provide all employees with a three percent match, regardless of the amount employees contribute or they can match everyones contributions with four percent match and vice versa.

Recommended Reading: What Should You Invest Your 401k In

Contribution Limits For Highly Compensated Employees

Some 401 plans have extra contribution limits on employees who are highly compensated. plan and you are a high earner, these limits may not apply to you.)

Highly compensated employees can contribute no more than 2% more of their salary to their 401 than the average non-highly compensated employee contribution. That means if the average non-HCE employee is contributing 5% of their salary, an HCE can contribute a maximum of 7% of their salary. In addition to the federal limit, your company may have specific caps established to remain compliant.

The IRS determines you are a HCE if:

Either you owned 5% or more of a company last year and are participating in its 401 plan this year.

Or you earned $130,000 or more in 2020 from a company with a 401 plan youre participating in this year.

Unlike most other 401 limit guidelines, HCE classifications are based on your status from the previous year. For the 2022 plan year, the employee compensation threshold is $135,000.

If HCE contribution rates exceed non-HCE contribution rates by more than 2%, companies workplace retirement plans may lose their tax-advantaged status. As a HCE, you may be prevented from contributing to your 401 to the employee contribution max due to low 401 participation rates. You should still be able to make catch-up contributions on top of your HCE cap if you are eligible, though.