Will I Pay Taxes When Rolling Over A Former Employer

Generally, there are no tax implications if you move your savings directly from your employer-sponsored plan into an IRA of the same tax type to a Roth IRA).

If you choose to convert some or all of your pretax retirement plan savings directly to a Roth IRA, the conversion would be subject to ordinary income tax.

Roth 401 To Roth Ira Conversion

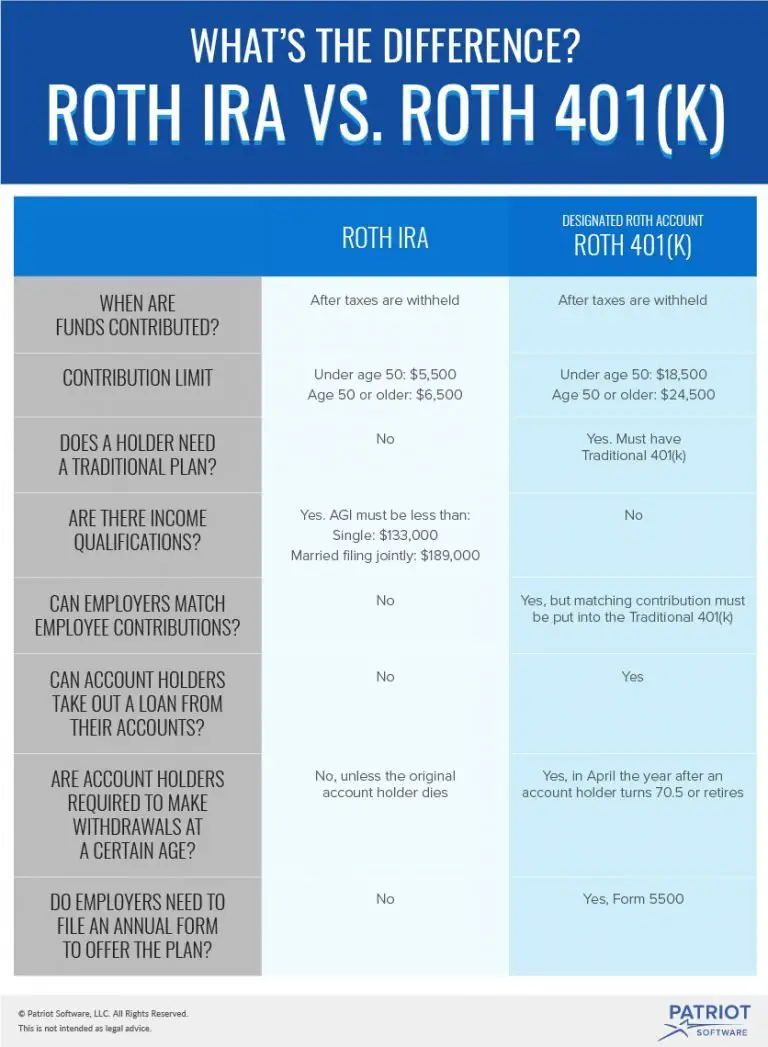

Roth 401s are essentially the same as traditional 401s, except they’re funded with after-tax dollars, like the Roth IRA, instead of pre-tax dollars. The exception to this rule is employer-matched funds. These are considered pre-tax dollars even in a Roth IRA.

Because the government taxes Roth 401 and Roth IRA contributions the same way, you can roll over Roth 401 savings to a Roth IRA without paying any taxes on your Roth 401 contributions. But if the amount you’re rolling over includes employer-matched funds, these will affect your tax bill for the year.

Advantages And Disadvantages Of A 401 Rollover

One primary advantage of a 401 rollover is that you have control over the funds for the short term and can use them before completing your rollover. For example, if you need funds for a specific purpose , you can use the distribution and not incur any income tax as long as you come up with other funds to complete the rollover within 60 days.

A primary disadvantage is that the distribution is subject to the automatic 20% withholding tax. If you take a distribution and then decide to make a full rollover, youll have to come up with the 20% amount from your own pocket to complete the rollover youll recoup this amount when you file your tax return.

For example, say you have $50,000 in your 401 and want to take a complete distribution. The plan will send you $40,000 ). To make a full rollover so that you wont owe any current tax on the distribution, youll have to use the $40,000 you received plus $10,000 of your own money to complete the rollover. When you file your return, the $10,000 withheld is a tax credit that you can receive as a refund. Another drawback is that its all too easy to miss the 60-day rollover deadline, despite good intentions.

If you do this and cant get an extension from the IRS, youll owe income tax on the distribution. Whats more, if youre under the age of 59½, youll owe a 10% early distribution penalty unless you can show that you used the funds for a purpose thats exempt from the penalty .

Don’t Miss: What Is The Minimum 401k Distribution

Traditional 401s Vs Roth 401s

Employer-sponsored 401 plans are an easy, automatic tool for building toward a secure retirement. Many employers now offer two types of 401s: the traditional, tax-deferred version and the newer Roth 401.

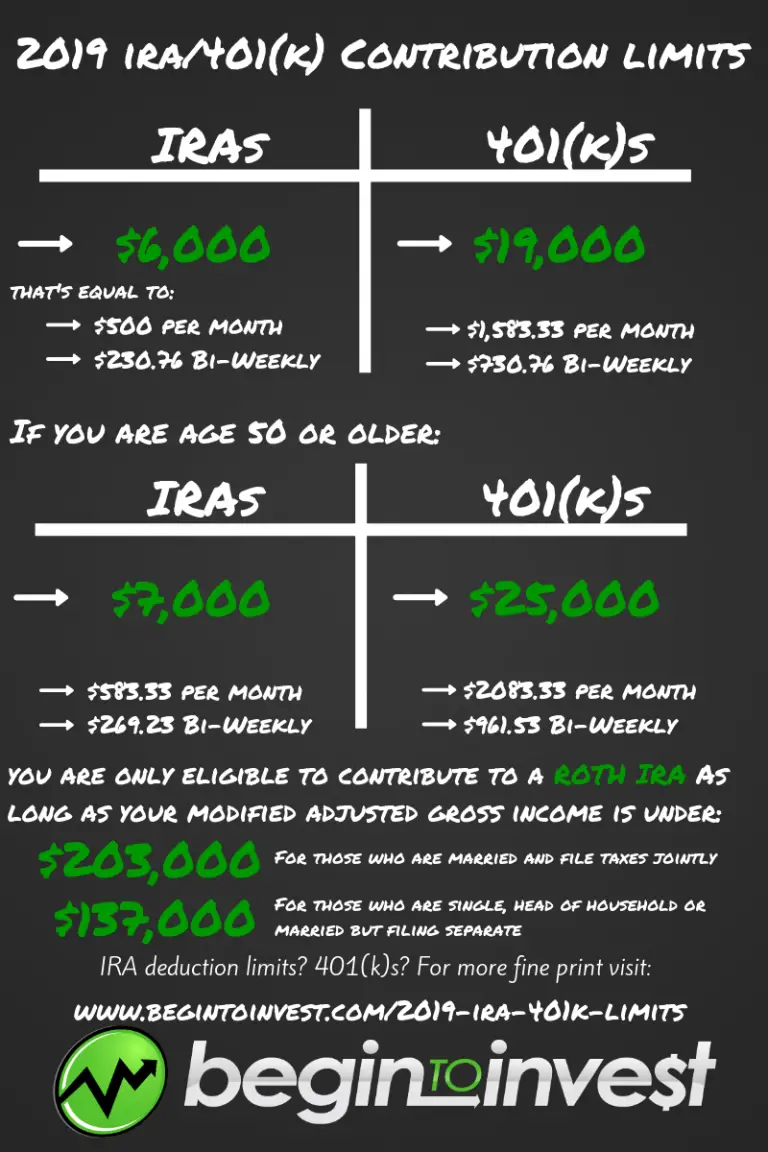

Of all the retirement accounts available to most investors, such as 401 and 403 plans, traditional IRAs, and Roth IRAs, the traditional 401 allows you to contribute the most money and get the biggest tax break right away. For 2021, the contribution limits are $19,500 if youre under age 50. If you’re 50 or older, you can add an extra $6,500 catch-up contribution, for a total of $26,000.

Plus, many employers will match some or all of the money you contribute.

A Roth 401 offers the same convenience as a traditional 401, along with many of the benefits of a Roth IRA. And unlike a Roth IRA, there are no income limits for participating in a Roth 401. So if your income is too high for a Roth IRA, you may still be able to have the 401 version. The contribution limits on a Roth 401 are the same as those for a traditional 401: $19,500 or $26,000, depending on your age.

The biggest difference between a traditional 401 and a Roth 401 involves when you get a tax break. With a traditional 401, you can deduct your contributions, which lowers your taxable income for that year. With a Roth 401, you dont get an upfront tax break, but your withdrawals will be tax-free. Once you put money into a Roth, youre done paying taxes on it.

Eligibility Tax And Investment Considerations

A Roth conversion is an optional decision to change part or all of an existing tax-deferred retirement plan, such as a 401 or a traditional IRA, to a Roth IRA. Converting makes sense if you believe that the benefit from your money growing tax-free will be greater than the immediate cost of paying the taxes due at the time of the conversion.

A Roth conversion of an existing retirement account is a major decision, particularly in a year like 2021 when your income might be at least marginally off-track due to circumstances beyond your control.

Making the right decision for your circumstances can be easier when you understand the logistics and the tax implications of such a move.

You May Like: Can I Cancel My 401k And Cash Out

Roth Ira Conversion Ladder

A Roth IRA conversion ladder is a series of Roth IRA conversions made year after year. It’s a way for people to tap their retirement savings early without penalty. The government lets you withdraw your Roth IRA conversions tax- and penalty-free after they’ve been in your account for five years, and Roth IRA conversion ladders leverage this to get around the government’s 10% early-withdrawal penalty on tax-deferred savings for those under 59 1/2.

You start by converting the sum you expect to spend in your first year of retirement from your 401 or other tax-deferred account to a Roth IRA at least five years beforehand so you can access it penalty-free when you retire. Then, four years before you’re ready to retire, you convert another sum you can use in your second year of retirement. You continue doing this until you have enough to last you until you’re 59 1/2, at which point you can use all your savings penalty-free.

It requires a lot of retirement savings to pull off, and it could result in a larger tax bill, but it’s a strategy worth considering if you plan to retire before you’re 59 1/2.

There are quite a few rules to keep in mind when you’re doing a 401 to Roth IRA conversion, but as long as you check your plan’s restrictions and prepare yourself for the accompanying tax bill, you shouldn’t run into any problems.

Roll Over Your 401 To A Roth Ira

If you’re transitioning to a new job or heading into retirement, rolling over your 401 to a Roth IRA can help you continue to save for retirement while letting any earnings grow tax-free.2

- Cons

-

- You can’t borrow against a Roth IRA as you can with a 401.

- Any Traditional 401 assets that are rolled into a Roth IRA are subject to taxes at the time of conversion.

- You may pay annual fees or other fees for maintaining your Roth IRA at some companies, or you may face higher investing fees, pricing, and expenses than you did with your 401.

- Some investments offered in a 401 plan may not be offered in a Roth IRA.

- Your IRA assets are generally protected from creditors only in the case of bankruptcy.

- Rolling over company stock may have negative tax implications.

Also Check: Can I Borrow From My 401k To Start A Business

Do I Want To Pay The Taxes

Sometimes, making a good financial move can be a difficult thing to do. Thats the feeling many traditional IRA owners get when considering a Roth IRA conversion. Can you imagine someone having $300,000 in an IRA and, right upfront, giving up $75,000 of it? A Roth IRA conversion may look good on paper, but in the real world it may be more complicated.

You can use charitable contributions to offset the taxes for a Roth conversion. Tax deductions may be an effective strategy to lower the tax cost of a Roth IRA conversion. Of course, you must first have the financial resources and a desire to gift to a charitable organization to use this strategy.

Even If You Plan Ahead And Manage To Set Aside The Hypothetical $7000 It Has To Come From Somewhere

$7,000 when youre 25 is way more valuable to you than $7,000 when youre 50. Why? Because at 25, you have HELLA TIME on your side.

You saw the impact of a $7,000 loss early on more than $100,000 over 40 years!

The tricky thing to remember here is that even if you do get the $7,000 from a savings account or a taxable brokerage account, youre still robbing yourself of the ability to allow that $7,000 to compound for the next four decades.

$7,000 compounding over 40 years at an average annualized rate of return of 7% is worth about $105,000 on its own it doesnt have to be part of a larger account to achieve the same outcome .

The only way I could justify performing a big Roth conversion in my current tax year would be if the $7,000 came from money that was earmarked to be spent. If you were planning to spend the money and instead use it to pay your taxes, then theres no opportunity cost it was going to be spent anyway. But if youre dipping into money you wouldve invested to pay it, the opportunity cost stings.

Unfortunately, most of us are not setting up a Roth conversion, looking at the tax liability, and saying, Hm, all right, Ill just spend $600 less each month this year to offset that big tax bill! It just becomes another expense that eats into money we wouldve invested.

So whats a Rich Girl to do?

Also Check: Will Walmart Cash A 401k Check

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

Can I Convert My 401 To A Roth Ira To Save On Taxes

Q. I would like to begin converting my 401 into a Roth IRA. Do I have to have earned income to do so? I retired in 2014.

Trying to reduce future taxation

A. Its a good time for many to convert their retirement funds to a Roth IRA.

But converting a traditional 401 to a Roth IRA is a two-step process.

First, you roll over the funds to a traditional IRA then, you convert that IRA into a Roth IRA, said Laurie Wolfe, a certified financial planner and certified public accountant with Lassus Wherley, a subsidiary of Peapack-Gladstone Bank, in New Providence.

She recommends you consult with your financial advisor who is aware of your total financial picture before making this decision. Thats because the decision has several ramifications, and you dont want to do the conversion in error.

Wolfe said Roth IRAs have the benefit of growing on a tax-deferred basis and withdrawals are tax-free, if all criteria are met.

You do not have to earn income to convert to a Roth IRA, but there are a number of things to consider when converting, especially if you are already retired, she said.

When you convert retirement money that is in a 401 to a Roth IRA, you will pay income tax on those funds at ordinary income tax rates, Wolfe said.

If any of your contributions were made on an after-tax basis, however, those contributions will not be subject to tax, she said.

Other than in that instance, there is a cost to conversion.

The time horizon is determined by your life expectancy, she said.

Also Check: How Do I Get My 401k

Roll Over Your Money To A New 401 Plan If This Option Is Available

If you’re starting a new job, moving your retirement savings to your new employer’s plan could be an option. A new 401 plan may offer benefits similar to those in your former employer’s plan. Depending on your circumstances, if you roll over your money from your old 401 to a new one, you’ll be able to keep your retirement savings all in one place. Doing this can make sense if you prefer your new plan’s features, costs, and investment options.

-

- Any earnings accrue tax-deferred.1

- You may be able to borrow against the new 401 account if plan loans are available.

- Under federal law, assets in a 401 are typically protected from claims by creditors.

- You may have access to investment choices, loans, distribution options, and other services and features in your new 401 that are not available in your former employer’s 401 or an IRA.

- The new 401 may have lower administrative and/or investment fees and expenses than your former employer’s 401 or an IRA.

- Required minimum distributions may be delayed beyond age 72 if you’re still working.

The Backdoor Roth Ira Strategy

The removal of a $100,000 MAGI limit for Roth conversions in 2010 created a loophole in the tax code that allows high-income filers to legally make indirect contributions to Roth accounts using the backdoor Roth IRA strategy.

A backdoor Roth IRA is not a type of retirement account, but rather a strategy to convert funds in a traditional IRA or 401 to a Roth IRA.

To use the backdoor Roth IRA strategy, youll need to take the following steps:

You May Like: Can You Roll A 401k Into An Existing Roth Ira

Why Are 401 Plans So Popular

Probably because they represent the easiest way to save and earn money on thatsavings. Automatic payroll deductions and dollar-for-dollar employer matches mean investors can sock away money without ever missing it and in some cases earn a 100% rate of return almost immediately.

401s also offer lucrative tax benefits. The funds you invest in a 401 get withdrawn before you pay taxes. You might even drop into a lower tax bracket if you save enough. Consequently, you only pay taxes on your investments when you withdraw from your account after you retire.

Even though most 401 plans are attached to an employer, you can take the money with you if you decide to switch jobs.

How To Roll Over A Roth 401 To A Roth Ira

Saving through a Roth 401 can help you grow a nest egg that you can then tap into in retirement without having to pay taxes. If you leave your job or youre ready to retire, you may be wondering what to do with the funds in your 401. Rolling your Roth 401 over to a Roth IRA is just one possibility. But make sure you know how this process works to avoid triggering an IRS tax penalty. A financial advisor can walk you through a rollover if youre new to it.

You May Like: What To Do With 401k When You Retire

You Wont Need To Use The Money In Retirement

One of the pesky drawbacks of traditional IRAs and 401k plans are the required minimum distributions, or RMDs. Since the IRS doesnt want us to leave money in tax advantaged retirement accounts forever, theyll make you take withdrawals once you turn 70 1/2.

Essentially, youll take the account balance on the December 31 of each year, and divide by your life expectancy. This is the amount youll need to take out of the account each year and pay tax on.

With Roth accounts, youve already paid the tax either on your initial contribution or when you converted the account. Since youve already paid the tax due, and the IRS isnt sitting around waiting for their money, they dont impose RMDs on Roth IRAs.

The IRS does require RMDs on Roth 401k plans however, unless youre still employed at the company sponsoring the retirement plan. Fortunately theres an easy workaround, since its simple to roll over your Roth 401k assets into a Roth IRA. This can be done easily at any brokerage firm, without complications, taxes due, or fees.

This is a huge advantage of Roth 401k features. Without RMDs, you can keep your retirement dollars in a Roth IRA and continue to let them grow tax free.

If you dont need your 401k money to live off of in retirement, a Roth conversion might be a good idea. It will leave you more flexibility in the future and save you from forced, taxable withdrawals.