How An Ira Works

As the name implies, these accounts are opened by individuals and are not sponsored through an employer. To open this account, you simply contact your bank or brokerage firm. These accounts offer a great deal of flexibility when it comes to investment options. Not only can you choose to invest in traditional stocks, bonds, and mutual funds, but you also have many other options. You might choose to invest your IRA funds in real estate, gold coins, silver, ETFs, or some type of commodity. Many of these options are usually not available for investment through a 401 plan.

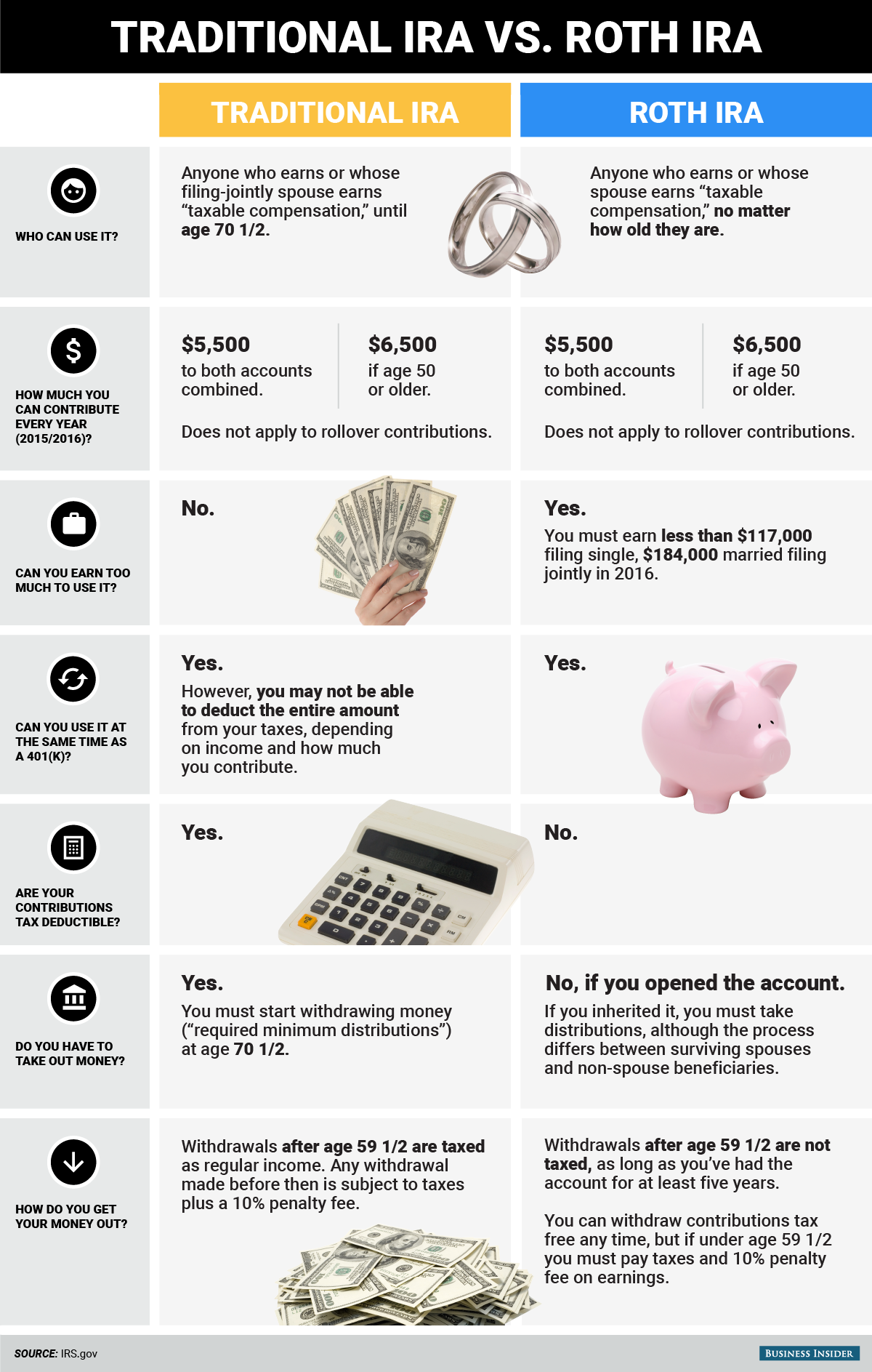

The funds that you place into a traditional IRA are tax deductible for the year in which you make the contribution. This helps with your tax bill in the current year, but really just delays payment of the taxes until you make a withdrawal. If you choose to invest in a Roth IRA, then you will contribute after-tax dollars. This does not provide any current year tax benefits, but it does allow you to take withdrawals that are tax-free. There are income limits to Roth IRA eligibility, so if your income is too high, you will not be able to contribute to a Roth account. While discussing contributions, it should also be noted that the contribution limits for an IRA are somewhat low. In 2021, you can only contribute $6,000 per year to an IRA. If you are over age 50, then you are allowed to contribute an extra $1,000 in catch up contributions for a maximum of $7,000 during the year.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Who May Be Best Fit For A Sep

Self-employed individuals

Individuals who own a small business as a side gig

Side gigs and freelance roles often have unpredictable incomes. SEPs have flexible contribution rules that allow you to contribute when times are good and skip contributions when business might not be as healthy as youd like. In addition, you have until your tax filing deadline to contribute for the previous year.

Family-owned businesses

Since SEPs require the employer to make contributions to all eligible employees, they are a great option for family-owned businesses. Business owners can share business profits with family, while saving for retirement and getting a tax deduction in the process. And if cash flow is unpredictable, the flexibility to decide whether or not to contribute each year is valuable.

Also Check: Can You Use Your 401k To Start A Business

Contribute To The 401 Plan Match Then Go For The Roth Ira

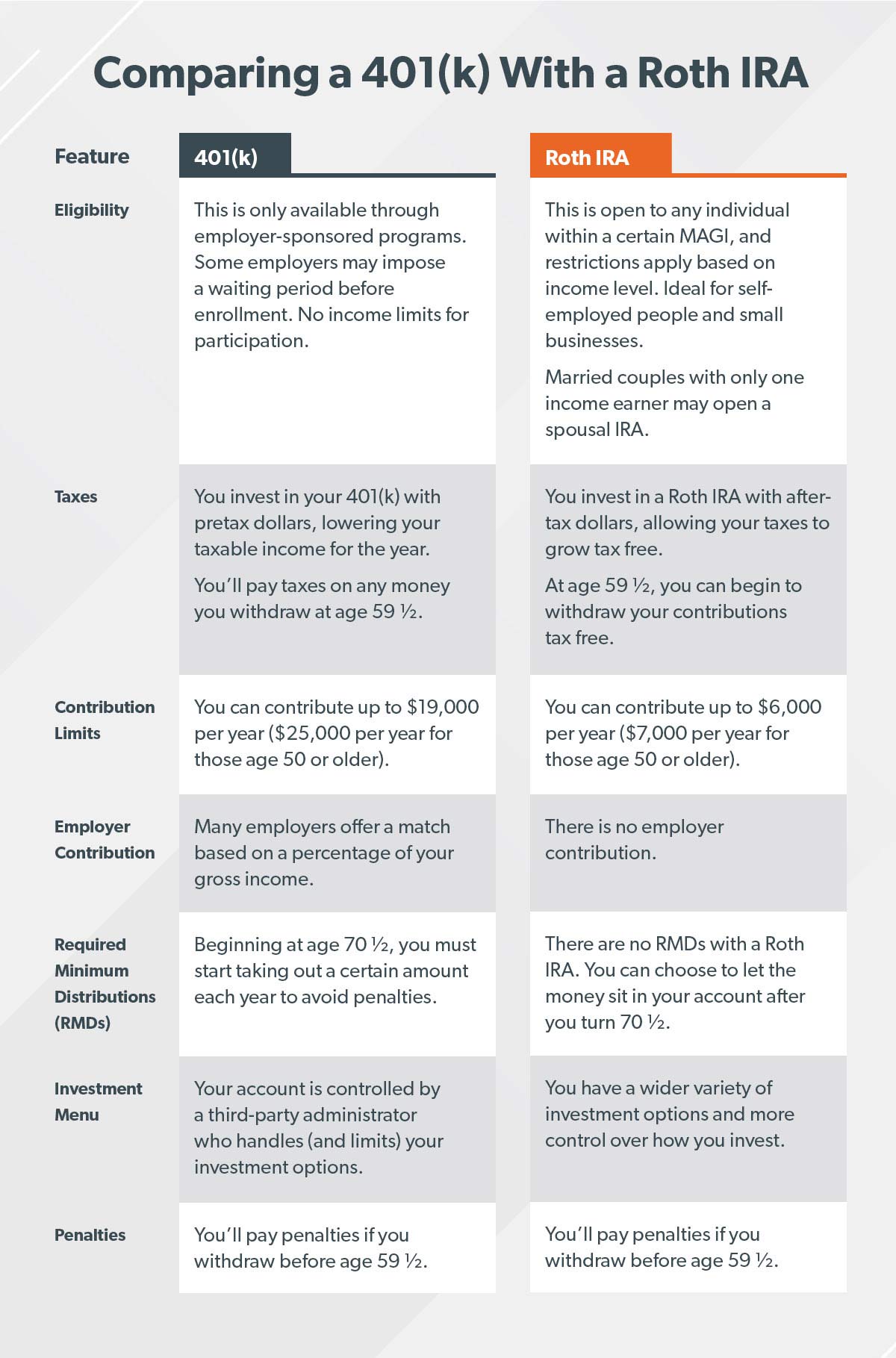

After getting the match, focusing on putting the maximum to a Roth IRA can be a savvy move. Roth IRAs are more flexible than 401 plans since you can withdraw your contributions at any time tax-free and penalty-free. With more investing optionsoften at a lower costyou can keep more of what’s yours in an IRA versus a 401.

Once an individual is saving enough in their 401 to take advantage of the full company match, it usually makes sense to then save additional dollars to a Roth IRA , says Eric Simonson, financial planner and founder of Abundo Wealth. The benefits of a Roth IRA over a 401 are: 1) You are the owner of the account, rather than a plan participant. 2) You have far greater investment options to add diversification and potentially lower your fees. And 3) Roth IRAs have more favorable withdrawal options, and these dollars are potentially more accessible than a 401.

Ira Vs : Whats The Difference

Editorial Note: The content of this article is based on the authors opinions and recommendations alone and is not intended to be a source of investment advice. It may not have not been reviewed, commissioned or otherwise endorsed by any of our network partners or the Investment company.

An IRA, or individual retirement account, is a self-managed account that anyone can open, while a 401 is only available through your employer if they offer one. The two types of retirement plans also have different contribution limits, investment options and associated costs.

Its important to understand these differences to maximize your retirement savings, though you dont necessarily have to choose one plan over the other it can be a good idea to open one of each to reach your retirement goals.

You May Like: How Much Will I Have When I Retire 401k

Its Easier To Set Up A Roth With An Ira

Both the 401 and the IRA have a variation called a Roth, which provides special tax advantages. The key advantage of either Roth account is that participants will not have to pay any tax on withdrawals at retirement. In exchange, their contributions are made with after-tax money, so they dont receive a tax break on todays taxes as they do with traditional plans.

However, not all employers offered a Roth 401 just 75 percent in 2019. If your company doesnt offer the Roth version, you dont have that alternative.

But anyone who can open an IRA can open the Roth variant. While the Roth IRA technically has an income limit that prevents participants from opening it, theres a legal way to do so anyway called a backdoor Roth IRA.Here are the details on the backdoor Roth.

Ks And Iras Have Early Withdrawal Penalties

Heres the thing about retirement accounts: Theyre meant for retirement.

That means there are early withdrawal penalty.

If you withdraw cash from a traditional 401k or IRA before you turn 591/2, you will owe a 10 percent penalty to the IRS on top of ordinary income taxes.

IRAs provide a bit more flexibility in this arena, and there are a number of exceptions to the IRA early withdrawal penalty. You can, for example, use funds to cover higher education expenses and up to $10,000 towards the purchase of your first home.

With a 401k, you must prove severe financial hardship to obtain an exemption from the early withdrawal penalty.

Some employers, however, allow you to take out a 401k loan. Essentially, you borrow money from yourself. Although this sounds like a great idea, its a slippery slope. Any money you borrow ceases to earn returns for you and, if you lose your job, you must repay the entire loan or pay income taxes and the 10 percent penalty on the outstanding balance.

Also Check: Can You Use 401k To Buy Investment Property

The Advantages And Disadvantages Of A 401k Plan Versus An Ira Plan

The great advantage a 401k plan has over an IRA is the high maximum contribution you can make. A 401k plan allows an employee to contribute $19,500 a year and $26,000 if you are older than 50.

With an IRA, as you know, the current maximum is $6,000 a year of $7,000 if you are over 50 years old.

If your employers offers a 401k plan at work, make sure you take advantage of it. Another advantage of 401k plan over an IRA is that your employer can contribute matching a dollar for each dollar the employee contribute.

Thats a big plus!

However, with an IRA, and unlike a 401k, you have more control on where you want to set up your retirement account .

Youre also responsible for creating your own portfolio and monitoring your account.

Read: How Much Is Enough for Retirement?

How Do I Open An Ira

Opening an IRA requires a little more work on your part. You will need to visit your local bank or brokerage firm. Many online brokerage firms allow you to open an IRA easily. You will simply need to decide how much money you will be placing into the IRA and make your investment selections. Once opened, you will receive regular statements to show how your investments are performing. You can deposit additional funds on any schedule you choose up to the maximum contribution amounts each year.

Read Also: How To Collect My 401k Money

Special Circumstances For Foreign

Depending upon your status as a US citizen, it’s essential to consider additional factors that could have a meaningful impact on your potential tax advantages of choosing a Roth IRA vs. 401. A financial advisor who specializes in working with immigrants and foreign nationals could prove invaluable to minimizing the risk of losing tax benefits.

With the foreign-born families that I work with, there is always a possibility that they plan to go back to the country where they were born. In this case, then we consider whether the foreign country will recognize the tax-free nature of the Roth IRA, says Jane Mepham, financial planner and founder of Elgon Financial Advisors. Some countries like Germany do not and will tax the Roth IRA account again at withdrawal. In that case, I would shy away from having the client open a Roth IRA and have them stick with the 401 account.

The Differences Between A 401 And A Simple Ira

When evaluating a SIMPLE IRA vs. 401 plan option, it’s important to acknowledge that each plan may be a better fit for certain companies, based on factors such as business size as well as the wants or needs of employees. Understanding the differences between 401 plans and IRAs help companies make sound decisions about their benefit plans.

- A 401 plan can be offered by any type of employer, but a SIMPLE IRA is designed for small businesses with 100 or fewer employees.

- Contribution limits for SIMPLE IRA plans are lower than traditional 401 plans.

- SIMPLE IRAs require an employer contribution. 401 plans do not, although many employers do choose to make contributions.

- With SIMPLE IRAs, employees are always 100 percent vested, while 401 plans may have different vesting rules for employer contributions.

Read Also: How Do I Take Money Out Of My Fidelity 401k

Contributions Limits And Matching

Contribution limits are lower for a SIMPLE IRA plan than with a 401.

An employee can contribute up to $19,500 to a 401 plan in 2021 . Combined, employer and employee contributions to a single employees 401 cannot exceed the lesser of either 100% of the employees compensation or the total cap, which is $58,000 in 2021.

An employee can contribute up to $13,500 to a SIMPLE IRA in 2021 .

The employer must contribute either a dollar-for-dollar match up to 3% of the employees compensation, or a flat 2% contribution. While employer contributions to a 401 plan are entirely optional, an employer must contribute to a SIMPLE IRA. So while 401 plan participants can potentially save more annually, SIMPLE IRA participants are guaranteed to get at least some employer matching.

Disadvantages Of An Ira Rollover

A rollover is not for everyone. A few cons to rolling over your accounts include:

- . You may have credit and bankruptcy protections by leaving funds in a 401k as protection from creditors vary by state under IRA rules.

- Loan options are not available. The funds may be less accessible. You may be able to get a loan from an employer-sponsored 401k account, but never from an IRA.

- Minimum distribution requirements. You can generally withdraw funds without a 10% early withdrawal penalty from a 401k if you leave your employer at age 55 or older. With an IRA you generally have to wait until you are age 59 1/2 to withdraw funds in order to avoid a 10% early withdrawal penalty. The Internal Revenue Service offers more information on tax scenarios as well as a rollover chart.

- More fees. You may be responsible for higher account fees as compared to a 401k which has access to lower-cost institutional investment funds because of group buying power.

- Tax rules on withdrawals. You may be eligible for favorable tax treatment on withdrawals if your 401K is invested in company stock.

Neither State Farm nor its agents provide tax or legal advice.

Also Check: Can You Have Your Own 401k

How Much Can I Contribute To A 401 And Simple Ira

In 2021, the contribution limit for traditional 401 plans is $19,500, with an additional catch-up contribution of $6,500 for plan participants who are age 50 and older.

The contribution limit for SIMPLE IRA plans is $13,500 for 2021. Participants who are age 50 and older may make catch-up contributions up to $3,000, if the plan permits it. If an employee participates in any other employer retirement plan during the year, the total amount of contributions that they can make to all plans is limited to $19,500.

Eligibility And Contribution Limits

To participate in a 401 plan, your employer first must offer it, and not all do. If it does, you would decide on the amount you want deducted from your paycheck and can start saving right away.

A traditional or Roth IRA, on the other hand, may be opened by anyone who earns an income and has some savings to start the account with. Some financial institutions expect a minimum deposit of $1,000 or more.

There are also contribution limits to keep in mind. In 2020, you can contribute up to $19,500 to a 401 plan, though if you’re age 50 or older you can make additional catch-up contributions of up to $6,500. With an IRA you can only contribute $6,000, or $7,000 if you’re 50 or older.

Also Check: How To Find Lost 401k

Use Online Resources To Help You Choose How To Save For Retirement

So, a mix of 401 and Roth IRA contributions makes sense for many people. Workers in their high-earning years are likely to be better off making pre-tax contributions deferrals). In contrast, younger workers in their low-earning years might be better suited to choosing after-tax Roth contributions. Here is a tip: Be sure to research online calculators to help determine which contribution type and account type are ideal for your situation.

Beyond Traditional 401s How Do Roth Iras Differ From Roth 401s

Another trend that has emerged in the 401 space is the offering of a Roth 401. A Roth 401 works like a Roth IRA in some ways and like a 401 in other ways. We know that Roth means contributions are made after-tax. A Roth 401 is simply another employer-sponsored retirement account, but money in that account has already been taxed and will grow tax-free through retirement.

Recommended Reading: Can You Merge 401k Accounts

What Is A 401k

A 401k plan is a retirement savings plan that is offered by your for-profit company. If you work for a non-profit company, then you may have access to whats called a 403 plan.

Your contribution to a 401k plan is deductible on both federal and state taxes in the year you make them. A 401k plan allows you to contribute up to $19,500 per year .

If youre an older employee, at least age 50, you can contribute an additional $6,500 , making it a total of $26,000 each year.

Read: 401k Contribution Limits for 2020: What Are They?

In most cases, your employer may offer a match. That is if you contribute 3% of your paycheck, your employer may match it with 3%, making your 401k contribution 6%.

Under some circumstances, you may be able to withdraw money from your 401k before age 59 1/2, but only if you show financial hardship.

Otherwise, youll get hit with a 10% penalty and federal, state and local taxes on that amount. See more on the IRA vs 401k withdrawal rules below.

| 2020 401k Maximum Contribution |

Iras Require Some Investment Knowledge

The flip side of having many investment choices in an IRA is that you have to know what to invest in, and many participants simply arent in a position to do that. And thats where a 401 may offer a better option for workers, even if the investment selection is more limited.

A 401 is often turnkey, says Claire Toth, senior wealth strategist at Peapack-Gladstone Bank in Summit, New Jersey. Set it and forget it.

So while a 401 may offer fewer choices, says Toth, they do provide okay default investment options for participants without knowledge and they may offer coaching to help participants understand their choices.

Still, if you do have that knowledge already, Lackwood says, you can manage your IRA how you see fit with quick attention and with possibly less administrative cost.

Also Check: When Can You Get Your 401k

Traditional And Roth Iras

Like 401s, contributions to traditional IRAs are generally tax-deductible. Earnings and returns grow tax-free, and you pay tax on withdrawals in retirement. Contributions to a Roth IRA are made with after-tax dollars, meaning you dont receive a tax deduction in the year of the contribution. However, qualified distributions from a Roth IRA are tax-free in retirement.