Don’t Wait Because Of Debt

Forty-four million Americans are in the process of paying off student loans, so if you have debt to pay off, you are not alone. Don’t make the mistake of waiting to start contributing to a 401 plan until after your loans are completely paid off, though. Budget your expenses carefully, try not to spend too much on fancy coffee drinks or craft beer, and paying off loans while saving won’t be nearly as difficult as you might think it will be.

Saving for the future is just as important as paying off debts from the past. You invested in your education now you need to invest in your retirement.

How To Start A 401

Setting up a 401 plan can be as simple or as complicated as you like. Most people outsource at least some portion of the process. In particular, they use a template legal document to establish the 401 plan, which is substantially less expensive than hiring attorneys to draft original documents. Unless your retirement plan is especially complicated or youre trying to get fancy , youll probably use preconfigured programs from 401 vendors. These programs are often called volume submitter or prototype plans, and theyre an excellent choice for most companies and nonprofits.

Here are the crucial pieces of any 401 plan. While this list seems extensive, in some cases, a single company provides several of these services.

The plan document is a legal document that details the rules of your 401 plan. It defines specific terms, and provides a roadmap for any questions that come up when administering the plan. The plan document is a long legal document that most people never see. Instead, employees receive a shorter version of the document, known as the Summary Plan Description , when they enroll in the plan. For reference, heres a sample of a plan document.

When You Can’t Open A 401 Without An Employer

To be eligible for most retirement accounts, you need to have earned income during that year. If you don’t have an employer and received only unemployment income for the year, you won’t be eligible to contribute to many of these retirement account options.

The one exception to this is the Roth IRA. If you have a significant amount of savings, you can contribute up to the limits set by the IRS.

However, if you are employed, and your employer doesn’t offer a retirement plan, you can still participate in the Traditional and Roth IRAs.

Also Check: Where Should I Put My 401k Money

Things To Consider When Opening A Solo 401k

If you’re considering opening a solo 401k, there are a few things to consider when it comes to plan features.

There are five key areas that you need to decide before you open your solo 401k:

Everyone who opens a solo 401k will have different requirements. However, I would recommend you open a solo 401k plan with the most options and flexibility. While you can always amend your plan documents, it can be a hassle and can cost you money . As such, it makes sense to create a solo 401k plan with the most options up front.

Managing Your Retirement Funds

Make no mistake, you need to start saving for retirement as soon as you start earning income, even if you cant afford much at the beginning. The sooner you start, the more youll accumulate, thanks to the miracle of compounding.

Let’s say you save $40 per month and invest that money at a 3.69% rate of return, which is what the Vanguard Total Bond Market Index Fund earned across a 10-year period ending in December 2020. Using an online savings calculator, an initial amount of $40 plus $40 per month for 30 years adds up to just under $26,500. Raise the rate to 13.66%, the average yield of the Vanguard Total Stock Market Index Fund over the same period, and the number rises to more than $207,000.

As your savings build, you may want to get the help of a financial advisor to determine the best way to apportion your funds. Some companies even offer free or low-cost retirement planning advice to clients. Robo-advisors such as Betterment and Wealthfront provide automated planning and portfolio building as a low-cost alternative to human financial advisors.

You May Like: How To Split A 401k In Divorce

Types Of Retirement Accounts: Iras And 401s

We can help. By learning about your options, you can choose the type of savings account thats right for your life, now and in the future.

Lets start with the two most common ways to saveIndividual Retirement Accounts and 401 accounts. Well break down the similarities and differences between traditional 401s and traditional IRAs, then share details around Roth IRAs and Roth 401s, giving you a basic understanding of each.

Read Also: What Employees Can Be Excluded From A 401k Plan

Gift Solo 401k Question:

- Neither the IRA nor the solo 401 regulations allow for gifting retirement money.

- The rules do not allow for transferring, assigning or gifting of solo 401k funds during the account owners lifetime.

- The only exception to the no transfers during life rule is for transfers due to divorce where the solo 401k funds are transferred to the ex-spouse to satisfy a QDRO.

Also Check: How To Invest In A 401k Plan

Covering Your Spouse Under Your Solo 401

The IRS allows one exception to the no-employees rule on the solo 401: your spouse, if he or she earns income from your business.

That could effectively double the amount you can contribute as a family, depending on your income. Your spouse would make elective deferrals as your employee, up to the $19,500 employee contribution limit . As the employer, you can then make the plans profit-sharing contribution for your spouse, of up to 25% of compensation.

Other Benefits Of Solo 401s

The advantages of Solo 401s arent limited to taxes. If your spouse works with you at your companyeven part-timethey may be able to invest in a Solo 401 as well.

As long as your husband or wife works for you at least part-time, they can contribute up to $19,500 a year to a Solo 401, or up to $26,000 if theyre 50 or older. You, as their employer, can then contribute up to 25% of their compensation, up to a total of $58,000 in 2021 or $57,000 in 2020. This allows couples to invest more than $100,000 in tax-advantaged retirement accounts.

Also Check: When Can You Take Out 401k

Taking Rmd From Roth And Pretax Solo 401k Funds Question:

With respect to taking the RMD from the solo 401k plan, the standard practice is to take a separate RMD amount from each account . In that case, two separate calculations would need to be performedone on each source . If the plan allows you to do so, however, the amount of the distribution may be aggregated across account balances meaning that the total required minimum distribution amount can be satisfied in any combination between the two accounts. Please note that our Solo 401k plan would allow for this approach to satisfy the RMD requirement. A scenario where this approach may be preferable would be one where the requirements to make a qualified Roth distribution have not been satisfied .

Solo 401 Withdrawals And Details

As with all qualified retirement plans, there are rules to when you can and must start taking withdrawals from your Solo 401 plan. You must begin taking the minimum required distribution no later than age 72 . There is a 10% early withdrawal penalty for distributions take before age 59 1/2, but exceptions may apply.

Please refer to the IRS page on individual 401s and review our Solo 401 Guide for additional details.

Read Also: How To Rollover 401k To Charles Schwab

How Much Can I Contribute To A 401 Plan

401 plan accounts have higher contribution limits than individual retirement accounts . In 2021, you can set aside up to $19,500 across your 401 plan accounts.

To boost your contributions even further, you might consider catch-up contributions. If you are 50 or older, you can contribute an extra $6,500 to your 401 account. This increased limit can help increase your savings as you near the retirement finish line. But you dont actually have to be behind in your savings to take advantage of catch-up contributions.

Ira Or Solo 401k Question:

They both allow for investing in alternative investments including real estate, but the solo 401k is generally more advantageous. For example, the contributions limits are higher for a solo 4o1k plan, you can borrow from a solo 4o1k plan, and the ongoing fees are also generally much less. See the following link for more on this.

You May Like: How Often Can I Change My 401k Investments Fidelity

It Makes Sense To Invest On Your Own If You Can

Saving for retirement can feel like a daunting task, especially without the help of an employer-sponsored plan.

But it’s worth it to start investing in a retirement account as soon as you can, even if it’s just small amounts of money.

That’s because compound interest over time will help that money grow by a lot more than if you saved it in a checking or savings account.

“You’re getting interest on top of interest,” Zigo said. “So not only are you getting interest on your money but you’re also getting interest on the interest your money is earning.”

What Paperwork You Need To Fill Out To Open Your Account

I was surprised at how much paperwork is required to open a solo 401k account. You’d think it would be simple, with very common forms to fill out. However, it’s completely the opposite. It becomes even more challenging if you add a Roth solo 401k, and you have to do double the paperwork if you’re adding a spouse to your plan.

When opening your solo 401k plan, you will need to create the following documents. You will need to create separate plan documents for both your Traditional and Roth Solo 401ks. They are both considered separate plans for tax purposes.

Plan Documents For Traditional Solo 401k

- 401k Plan Adoption Agreement

- Designation of Successor Plan Administrator

Plan Documents For Roth Solo 401k

- 401k Plan Adoption Agreement

- Designation of Successor Plan Administrator

Required Documents For Individual

- Brokerage Account Application for 401k Account

- Brokerage Account Application for Roth 401k Account

- Designation of Beneficiary Form for Account

- Power of Attorney

Required Documents For Spouse

- Brokerage Account Application for 401k Account

- Brokerage Account Application for Roth 401k Account

- Designation of Beneficiary Form for Account

- Power of Attorney

When you’re done with all these documents, you’ll have two solo 401k plans, and 4 accounts .

Recommended Reading: Can I Roll My Roth 401k Into A Roth Ira

What Is A 401 Plan

A 401 plan is a type of IRS-approved retirement plan that allows employees to contribute pretax amounts to individual retirement accounts. Employers also can contribute to employee accounts, often by matching employee contributions, up to a certain percentage.

You can choose from several types of small-business 401 plans and other varieties of retirement plans. Get help from a retirement plan advisor to select the best one for your business.

Be Smart With Your 401

Opening a 401 is a smart step on the road to a comfortable retirement, but it’s not quite as simple as signing some papers and setting aside a percentage of your paycheck. You have to understand the rules, choose your investments wisely, and continue to maintain your plan for as long as you own it. If you do that, you can feel confident that you’re giving yourself the best shot at a secure retirement.

Don’t Miss: What’s My 401k Balance

Supplement Your Savings Outside Of A 401

The IRS is so keen on individuals saving for retirement that its willing to allow workers to save in multiple types of tax-favored accounts at once. Combining the powers of a 401 and an IRA can really supersize an individuals tax savings and future financial freedom.

The ability to contribute to a Roth or traditional IRA is not just beneficial for workers stuck with a subpar 401. IRAs offer a lot more flexibility and control for all investors in terms of investment choices , access to portfolio building and investment management tools, and control over account fees.

Open A Solo 401k If I Also Participate In Day

QUESTION 4: If I already have a full-time job as an employee, can I still open a solo 401k plan for my side business?

ANSWER: If you are self-employed or have income from freelancing, you can open a solo 401k plan. Even if you have a full-time job as an employee, if you earn money freelancing or running a small business on the side with no full-time W-2 employees, you could take advantage of the potential tax benefits of a solo 401k plan. While you wont be able to make pretax or Roth solo 401k contributions if you have already maxed out these contributions to your day job employer 401k plan, you will still be able to make profit sharing contributions to the solo 401k plan.

You May Like: How To Rollover Ira To 401k

Christopher Gething Certified Financial Planner

If you have a business, including a sole proprietorship, you may implement a 401K plan. 401K plans for sole proprietors are frequently referred to as “solo K’s”. There are other options available for business owners, including SEP-IRA’s. You should consult a financial adviser to assist you in determining the best solution for your particular situation.

Benefits To You And Your Employees

Investments in the plan grow tax-free after contributions are made, and no tax is paid on investment gains until employees take out the money. Contributions to the plan can reduce taxable income for the year.

Employees can make contributions through payroll deductions, and move the assets in their plan to another employers plan when they change jobs.

Don’t Miss: How To Transfer 401k From Old Employer

How Much Does It Cost To Set Up A 401 For A Small Business

Costs to set up a 401 plan will vary depending on the size of your business and the types of benefits you select. Initial setup fees can generally run anywhere from $500 to $3,000, depending on the chosen retirement service provider. Other costs to consider are fees associated with rolling assets over from another plan and initial consulting costs for investment advice.

Also Check: What Is Max Amount To Contribute To 401k

How To Set Up A 401 Plan

Now that you know the landscape, youre ready to set up a plan as an employer or self-employed individual. Whether youre establishing a plan for a large enterprise or or on your own the next steps are:

- Complete the adoption agreement along with other agreements and submit to your vendor.

- Communicate and educate: Inform employees of the plans existence and features.

- Set up individual participant accounts.

- Fund the plan through payroll or any employer contributions.

- Review the plan regularly to ensure its meeting the needs of plan participants.

- Monitor and adjust the plan as regulations change and your needs evolve.

- Provide required information to participants on an ongoing basis.

Also Check: How Does 401k Work If You Quit

Is Solo 401 Tax Deductible Solo 401 Tax Advantages

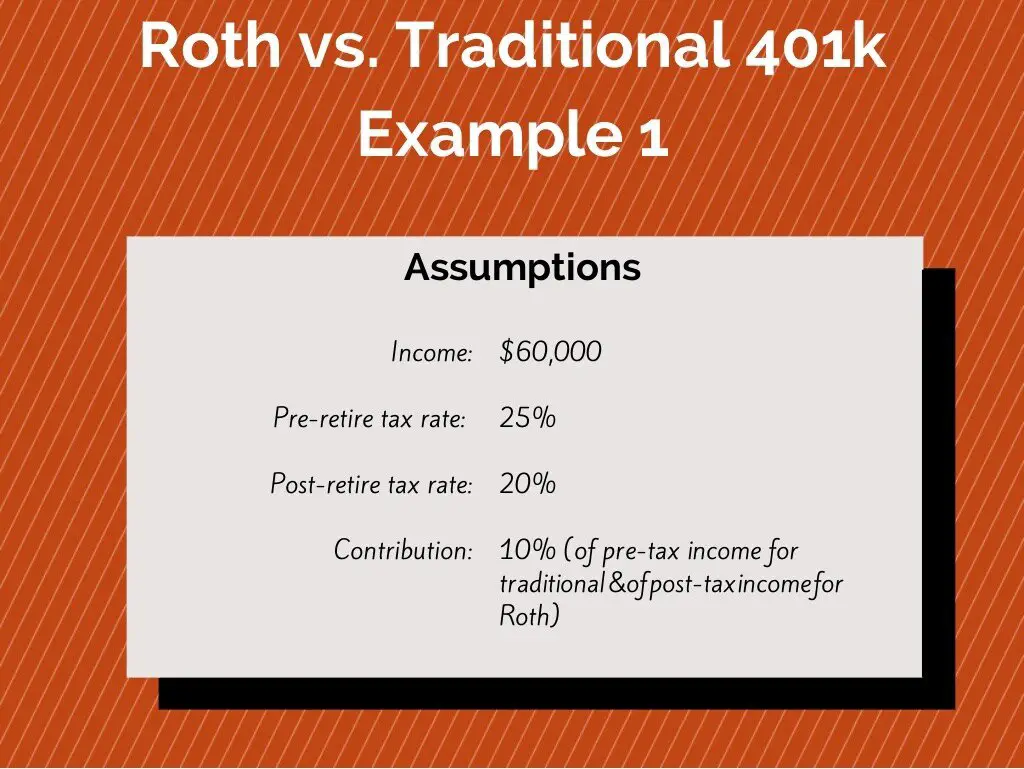

The nice thing about a solo 401 is you get to pick your tax advantage: You can opt for the traditional 401, under which contributions reduce your income in the year they are made. In that case, distributions in retirement will be taxed as ordinary income. The alternative is the Roth solo 401, which offers no initial tax break but allows you to take distributions in retirement tax-free.

In general, a Roth is a better option if you expect your income to be higher in retirement. If you think your income will go down in retirement, opt for the tax break today with a traditional 401.

Because of these tax perks, the IRS has pretty strict rules about when you can tap the money you put into either type of account: With few exceptions, youll pay taxes and penalties on any distributions before age 59 ½.

»Want more info? Heres our in-depth comparison of Roth and traditional 401s

What Are The Maintenance Costs For Setting Up A 401

Once you establish a 401, your business will have ongoing costs in the form of administrative fees and any matching contributions. Fees generally fall into three categories: day-to-day operations, investment fees, and individual service fees.

There are also potentially fees or penalties associated with being non-compliant with regular 401 benchmarking, which you’ll want to avoid at all costs. A few examples of 401 penalties include:

- Non-compliance with ERISA for failing to meet certain filing and notification requirements

- Failing to file Form 5500 with the IRS each year

- Not providing 402 notices to plan participants who are seeking distributions from their retirement plan accounts

One way to avoid fines and penalties is working alongside a knowledgeable retirement services provider that can help ensure compliance when it comes to retirement plan forms, deadlines, and notifications.

Recommended Reading: Can A Sole Proprietor Have A 401k

Solo 401k Plan For A Sole Proprietor

QUESTION 2: Can a sole proprietor open a solo 401k plan?

ANSWER: Yes a sole proprietorship can also sponsor a solo 401k plan. A sole proprietor files a Schedule C to report the self-employment activity. We would list your name as the self-employed business on the solo 401k plan documents, and your contributions to the solo 401k plan would be based on line 31 of the Schedule C.