Set Your Contributions As A Percentage Of Your Salary

There are two general ways 401 plans allow people to manage their contributions — either as a specific dollar amount per paycheck or as a percentage of their salaries. If you have the option to enter your contribution based on a percentage of your salary, it’s a good idea to go that route.

If you choose to contribute a percentage of your salary, your contributions will increase automatically as your salary rises over time with yearly adjustments and raises. This can help to scale up your retirement savings goals over the course of your career with minimal intervention on your part.

Determine Your Asset Allocation

Asset allocation is the way you divide your money among groups of similar investments or “asset classes.” The three main asset classes are stocksTooltipStocks represent ownership in a company. They can provide both price appreciation and dividend income. Stocks are considered relatively risky, because the stock price may also decrease and there’s no guarantee you’ll be paid dividends. Stocks also tend to be more volatile than bonds. , bondsTooltip A bond represents a loan you make to a government, municipality or corporation . In return, that issuer promises to pay you a specified rate of interest and to repay the face value after a certain period of time, barring default. They can provide income and help balance the risks of stocks. As with any investment, bonds have risks such as default risk and reinvestment risk. and cash investmentsTooltip Cash and cash investments include bank deposits , money market funds and short-term investments . These can provide flexibility and stability. Shorter-term investments tend to have lower returns than longer-term investments. . In general, if you’re a conservative investor looking for income and stability, you may want to hold more bonds than stocks. But if you’re a long-term investor looking for high-growth potential and less concerned about immediate income, you may want to invest more aggressively by holding more stocks. See our model portfolios for sample asset allocation plans.

Investing In Your 401

The variety of investments available in your 401 will depend on who your plan provider is and the choices your plan sponsor makes. Getting to know the different types of investments will help you create a portfolio that best suits your long-term financial needs.

Among the most importantand perhaps intimidatingdecisions you must make when you participate in a 401 plan is how to invest the money you’re contributing to your account. The investment portfolio you choose determines the rate at which your account has the potential to grow, and the income that you’ll be able to withdraw after you retire.

Read Also: How To Make A Loan From 401k

The Problem With A 401k

Now, Im not the biggest fan of 401ks for a couple of reasons.

For one, they afford you practically ZERO control over your investments.

If you do have any sort of control over where your money goes, its usually limited to which fund to choose from. Funds are baskets of stocks that typically dont even beat the market when it comes to returns. Plus, they normally have high fees, which means you not only make less than you would make if you invested on your own but youre also charged a fee on your investments.

The problem is that you cant invest in individual stocks through a 401k, and as Rule #1 investors know, investing in individual stocks of incredible companies is the best way to make returns on your money.

So, thats my beef with 401ks. They restrict the type of investments you can make so you miss out on the opportunity to choose investments that are more profitable. However, that doesnt mean they are bad. A 401k has its benefits too.

How To Choose Investments For Your 401 Plan

While target date funds are often chosen as investment options in a 401 plan, there are myriad options to choose from, including alternative investment strategies. In addition, if you plan to go the do-it-yourself route, you may want to consider what kind of retirement portfolio would best suit your needs.

You May Like: How Much Can You Borrow From 401k

It Helps You Save For Retirement

A 401k is a great way to save for retirement because you can automatically invest a portion of your pre-or post-tax earnings directly from your paycheck. Since contributions are automatic, theres no need to think about the contributions you should make each month. Also, you cant access your funds without penalty until youre 59.5 years old and you, therefore, wont be tempted to spend your retirement money early.

Further, you decide how much you save for retirement as well as choose the investment vehicles based on your goals and risk tolerance. Typically, retirement contributions are invested into a diversified portfolio with a level of risk/return that helps you grow your principal investment. Upon retirement, you can withdraw this money and use it to finance your non-working years, taking advantage of 30 years or more of capital gains.

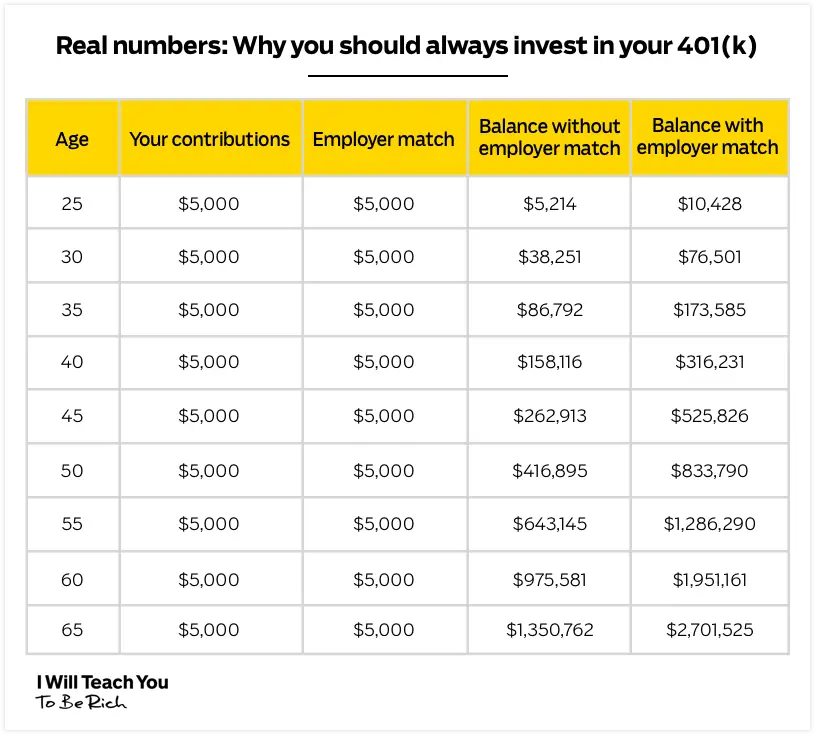

Finally, most employers will match a certain percentage of your 401k contributions, typically up to 5% of your paycheck. This serves as additional funds for your retirement. Make sure that you thoroughly understand the rules of your employer regarding matching contributions so you can maximize your 401k plan and have more money to use at retirement.

Keep Your Money Where It Is

Keep your savings invested in your former employer’s retirement plan.

- Your savings stay invested, with the same tax advantages

- You continue with the plan’s investment options

- You can’t make additional contributions

- Your past employer may decide to make changes to the plan that impact your account

- Loans aren’t allowed, but you may be able to withdraw money before you retire under certain circumstances

Don’t Miss: How Do You Pull Out Your 401k

Never Loan Money To Friends And Family You Can’t Trust

Think long and hard before you give your money away to a friend or family member. Otherwise, in the event that you don’t get your money back, your relationship with them might suffer.

“It is hard to say ‘no’ to friends and family who ask to ‘borrow’ money, but there is very little upside to doing this,” said Kirk Chisholm, a wealth manager and principal with Innovative Advisory Group. “Sure, you might get your money back, but do you really want to pester them to get it? The bigger question is, what if they don’t pay you back? Are you OK with saying goodbye to that money?”

What Options Do You Have When You Invest In A 401

Unfortunately, most 401 programs are incredibly restrictive. Theyre focused on mutual funds and exchange-traded funds.

In other words, they are highly diversified forms of investing. Forms of investing that unfortunately dont allow you to pick individual stocks. What that means is that you may end up stuck with an average rate of return of whatever the market is or less, and youre paying fees on top of that.

I dont love those type of 401 programs and Im going to encourage you to ask your company if they would give you access to your own brokerage account so that you can invest in individual companies.

Read Also: How To Access My Fidelity 401k Account

You Are Leaving The Wells Fargo Website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control. Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

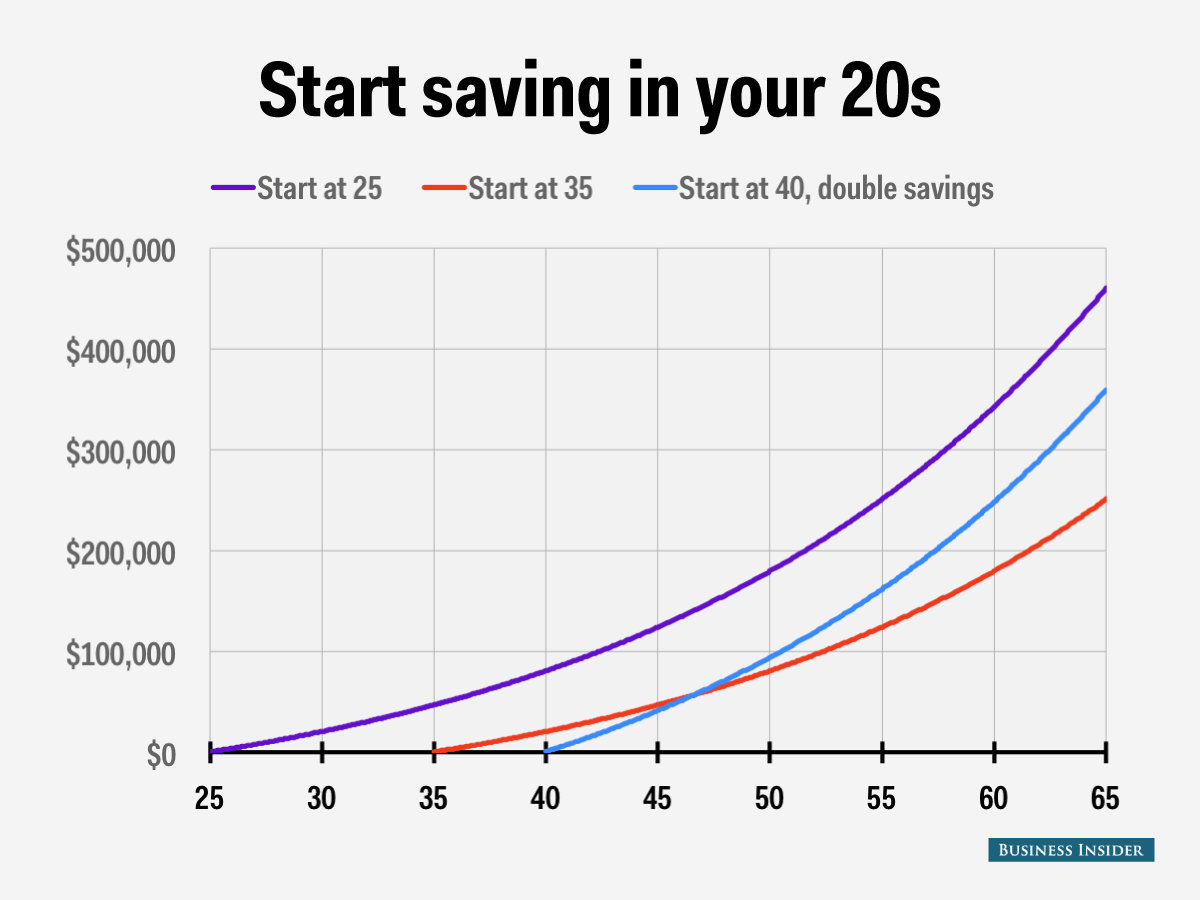

Retirement may seem a long way off and far removed from your day-to-day concerns. And yet, this is actually the best time to start planning and saving that is, when you still have time to accumulate the money youll need.

Here are some common mistakes that throw people off course in their retirement planning. Knowing these pitfalls should help you steer clear and save more.

How To Invest In Your 401

Starting a new job? Here’s a beginner’s manual to understanding 401s.

Editor’s note: This article originally ran on Jul. 24, 2020.

This month marks a significant milestone for my family as my oldest child, who graduated from college in May, begins his first full-time job, which gives him access to a 401 for the very first time.

Read Also: What Happens To 401k When Switching Jobs

Don’t Forget The Match

Of course, every person’s answer to this question depends on individual retirement goals, existing resources, lifestyle, and family decisions, but a common rule of thumb is to set aside at least 10% of your gross earnings as a start.

In any case, if your company offers a 401 matching contribution, you should put in at least enough to get the maximum amount. A typical match might be 3% of salary or 50% of the first 6% of the employee contribution.

It’s free money, so be sure to check if your plan has a match and contribute at least enough to get all of it. You can always ramp up or scale back your contribution later.

“There is no ideal contribution to a 401 plan unless there is a company match. You should always take full advantage of a company match because it is essentially free money that the company gives you,” notes Arie Korving, a financial advisor with Koving & Company in Suffolk, Va.

Many plans require a 6% deferral to get the full match, and many savers stop there. That may be enough for those who expect to have other resources, but for most, it probably won’t be.

If you start early enough, given the time your money has to grow, 10% may add up to a very nice nest egg, especially as your salary increases over time.

Weigh Your Investment Options

401s tend to have a small investment selection thats curated by your plan provider and your employer. Youre not selecting individual stocks and bonds , but mutual funds ideally ETFs or index funds that pool your money along with that of other investors to buy small pieces of many related securities.

Stock funds are divided into categories. Your 401 will probably offer at least one fund in each of the following categories: U.S. large cap which refers to the value of the companies within U.S. small cap, international, emerging markets and, in some plans, alternatives such as natural resources or real estate. Diversify your portfolio by spreading the portion youve allocated to equities among these funds.

You want to allocate more to the biggest asset classes, like U.S. large caps and international. U.S. small cap, natural resources and real estate are not as prevalent asset classes, so youll take smaller bits of those, Walters says.

That might mean putting 50% of your equity allocation into a U.S. large cap fund, 30% into an international fund, 10% into a U.S. small cap fund and spreading the remainder among categories such as emerging markets and natural resources.

The bond selection in 401s tends to be even more narrow, but generally youll be offered a total bond market fund. If you have access to an international bond fund, you might put a bit of your savings in there to diversify globally.

Don’t Miss: What Is The 401k Retirement Plan

Fund Types Offered In 401s

Mutual funds are the most common investment options offered in 401 plans, though some are starting to offer exchange-traded funds . Both mutual funds and ETFs contain a basket of securities, such as equities. Mutual funds range from conservative to aggressive, with plenty of grades in between. Funds may be described as balanced, value, or moderate. All of the major financial firms use similar wording.

Complete Your Plan Enrollment Form

This is the form youve been waiting for! Its the one youll use to officially commit a percentage of your paycheck for retirement. But there are a couple of other things about this form you dont want to miss:

- Pre-tax or Roth: Whats the difference between a traditional pre-tax 401 and a Roth 401? A pre-tax 401 allows you to make contributions from your pay before taxes are taken out. But when you contribute to a Roth 401, your contributions are made after taxes are taken out. We always recommend the Roth option since you wont have to pay taxes on the money you withdraw from your Roth 401 in retirement. Pre-tax contributions will lower your taxable income now, but youll pay taxes on withdrawals in retirement.

Your Action Step: Contact your 401 plan manager to find out if you have the option to choose pre-tax or after-tax contributions. If you can, take advantage of the Roth option with your next paycheck!

Your Action Step: Again, your 401 plan manager can tell you if your plan offers an automatic rebalancing feature for your investment selections. Tip: call the plan manager and speak with an actual person.

Recommended Reading: Can I Keep My 401k After I Leave My Job

Is A 401k An Ira Retirement Plan

The answer to your question is, “Is 401K a Traditional IRA?” New. There is a difference between 401K accounts and traditional IRAs. While the two plans offer retirement income, each plan has different rules. 401K is a type of retirement account for employers. An IRA is an individual retirement account.

Mistake #: Borrowing From Your Qrp

Many QRPs allow you to borrow from your account. Unless you need the money for an emergency, try not to. Borrowing can be an expensive choice, in two ways:

- Smaller retirement savings: When you take out a loan you are losing the potential for investment growth and that could leave you with a smaller retirement savings. How much smaller? This depends on a number of factors, including the size of the loan, the repayment period, whether you continue contributions during this period, the earnings on your account, and the loan interest rate. Also, if you stop contributing while you are paying back your loan, you wont receive any employer matching contributions.

- Repayment requirements: If you lose your job or take another one, youll have to repay the money quickly, usually within 30 to 60 days. However, if not repaid, the outstanding loan balance is generally subject to income tax and possibly an IRS 10% additional tax for early or pre-59 1/2 distributions. The 2020 Coronavirus, Aid, Relief and Economic Security Act includes provisions providing greater repayment flexibility for certain individuals affected by the coronavirus pandemic. If these apply to you, you should still consider the potential effects of borrowing from your QRP on your ability to reach your retirement goals.

In addition, cashing out of your 401 when you move to a new employer might be costly as well. Know your distribution options when changing jobs.

You May Like: Can My Wife Take My 401k In A Divorce

How To Protect Your 401 From A Stock Market Crash

Market volatility is inevitable. Corrections happen every one or two years when stocks decline 10% or more from their most recent peak. These can even last several months at a time. Stock market crashes, on the other hand, are less common than corrections, but are more abrupt and severe. Look no further than the 2008 financial crisis or the 2020 crash ushered in by the coronavirus pandemic. But preparing for market volatility ahead of time is possible. A financial advisor can help you shore up your retirement savings for inevitable market events.

Think About Opening A Roth 401

If youre looking ahead a few years, you may also want to consider opening a specific type of 401 called a Roth 401. With the Roth version, you fund with after-tax money, but youre able to enjoy tax-free withdrawals at retirement. .)

Tax rates are relatively low, so now could be a good time to fund a Roth 401 rather than a traditional 401.

With the Trump tax law due to sunset in 2025, we are facing higher rates in the future, says Kinder. It could be an excellent time to utilize the Roth 401 option and take advantage of the lower rates now. This is especially true for folks under 40 or folks in the 10 percent or 12 percent tax bracket.

Lower tax rates mean that the cost to take advantage of the Roth plan is lower, since you fund it with after-tax money. Taxpayers in higher brackets may find their break on current taxes is more advantageous, however, and stick to the traditional 401 plan.

This Bankrate calculator can help you decide whether the traditional 401 or Roth 401 is better for you.

Recommended Reading: Can I Roll My 401k To A Roth Ira

So Whats Right For You

Use this chart to help see which options match your wants and needs.

Investment and Insurance Products are:

- Not insured by the Federal Deposit Insurance Corporation or Any Federal Government Agency.

- Not a Deposit, Obligation of, or Guaranteed by any Bank or Banking Affiliate.

- May Lose Value, Including Possible Loss of the Principal Amount Invested.

The subject matter in this communication is educational only and provided with the understanding that Principal® is not rendering legal, accounting, or tax advice. You should consult with appropriate counsel or other advisors on all matters pertaining to legal, tax, or accounting obligations and requirements.

Financial professionals are sales representatives for the members of Principal Financial Group®. They do not represent, offer, or compare products and services of other financial services organizations.

Insurance products and plan administrative services provided through Principal Life Insurance Co. Securities offered through Principal Securities, Inc., 800-547-7754, member SIPC. Principal Life and Principal Securities are members of Principal Financial Group®, Des Moines, IA 50392.