Why Does Certegy Deny Checks

Under the Fair Credit Reporting Act, Certegy cannot tell a merchant, its client, to approve or deny a check. It only provides decline recommendations if a consumers file or check seem suspicious. It is then up to the merchant to approve or deny the transaction. The reasoning given for a decline recommendation is vague and only provided in the form of a code.

The three Certegy reason codes are:

- Certegy Decline Code 1 Negative Information on File: Typically this means that a previous check using same routing and account number, or similar association with the consumer, was returned and reported to Certegy.

- Certegy Decline Code 2 High Risk Transaction: Certegy considers any fraud trends that may be relevant to that merchant or nearby locations. Perhaps the check is written for a larger dollar amount than whats typical, or the merchant has recently experienced fraud for similar purchases.

- Certegy Decline Code 3 Validity and Edit Errors: Certegy does not have enough information to provide a sufficient recommendation to its client.

Since these reason codes are vague, Certegy denying your check could be for a number of reasons. Like common credit report errors, it could be because of outdated information or matching your records with someone elses. If Certegy denied your check, you have the right to ask Certegy for a free copy of your file. The Fair Credit Reporting Act grants you the right to view your reports for free once every 12 months.

Endorse Your Check To A Friend

You can also endorse your check to a friend who can cash it for free. After all, what are friends for?

Endorsed checks are sometimes called third party checks.

Endorsing a check to a friend to cash is simple. On the back of the check, follow these steps:

- On the top line, write Pay to the order of Friends Name

- You sign the check underneath this endorsement

Every bank has different policies for cashing endorsed checks. To fight check fraud, you might have to accompany your friend to the bank branch to verify your identity too.

Some banks require you to complete a form. This form states your friend has permission to cash your check. Check online or call the bank before your friend goes alone to cash the check.

Certain banks including Ally Bank, Discover Bank and Regions do not accept third-party checks.

What Are The Walmart Money Center Store Hours Of Operation

The Walmart Money Center store hours of operation are:

- Monday through Saturday: 8 a.m. to 8 p.m.

- Sundays: 10 a.m. to 6 p.m.

The exact times can vary by location. For example, some of the locations near me are open until 10 p.m.

If you need extended hours, see our guide on the best 24-hour check cashing near me.

You May Like: What Is Max Amount You Can Put In 401k

How Much Should You Contribute

Walmarts 401 plan allows employees to start contributing with as little as 1% of their salary and can contribute up to 50%. With such a wide range to choose from, how do you decide what the right contribution is?

First, try to contribute at least enough to take advantage of Walmarts 6% employer match. After all, its literally free money. If you contribute $3,000 to your 401 plan, Walmart will fully match that amount, as long as it doesnt exceed 6% of your income. Think of it as a guaranteed 100% return on your investment.

Even though Walmart doesnt match contributions above 6% of your pay, you may still want to contribute more. With your employer match, youre essentially contributing 12% of your income to your 401 plan each year. But depending on your situation, that may not be enough for a comfortable retirement.

The Personal Capital Retirement Planner can help you figure out how much you should be saving for retirement based on your current retirement savings and your desired income during retirement.

Remember, you can contribute up to $19,500 to your 401 plan each year. And if youve maxed out your 401 contributions, you can also contribute up to $6,000 to an individual retirement account . Depending on your income, you may be able to contribute to only a traditional IRA or either a traditional or Roth IRA.

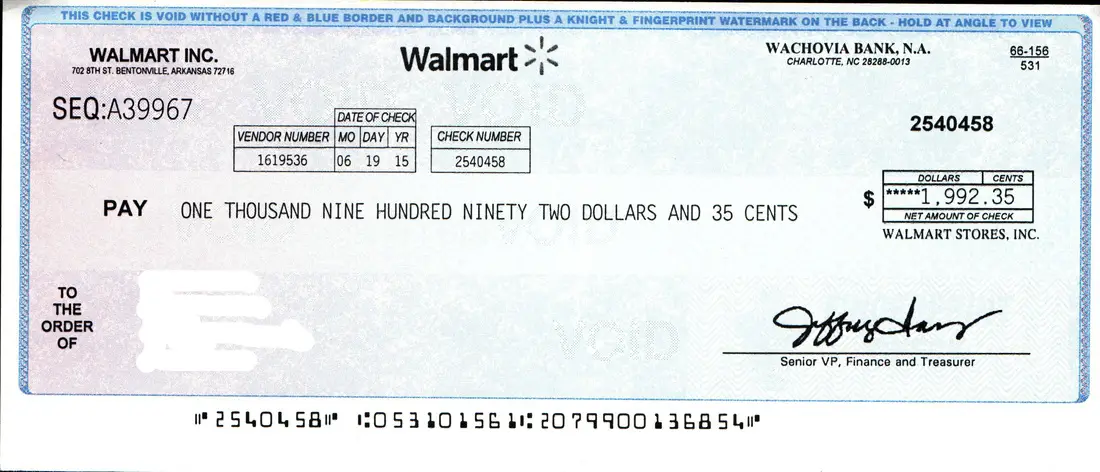

Will Walmart Cash 401k Checks

Walmart already cashes payroll, government and tax refund checks. Now, the retailer will cash more types of pre-printed checks including rebate, student loan, 401k, retirement, loan, IRA, pension, expense, insurance and MoneyGram money orders. The designated lanes will be for check and card cashing only.

Read Also: How To Withdraw My 401k From Fidelity

Can I Cash A Check Without A Bank Account

Whether youre a temporary or contract worker, and you have a payroll check, or an income tax refund check, you dont have to go to a bank or need a bank account to cash it.

Just take it to your nearest Money Services location for it to be processed with our check cashing service. As were open evenings and weekends unlike most bank branches you can cash your check with us even if the bank is closed.

How Should You Invest

When you sign up for Walmarts 401 plan, youll have a few decisions to make. First, youll have to decide whether to contribute to a traditional or Roth 401.

When you contribute to a traditional 401, you contribute with pre-tax dollars. As a result, you reduce your taxable income and therefore, your tax burden for the current year. The money grows tax-deferred in your 401, and youll pay income taxes on the money you withdraw during retirement.

In the case of a Roth 401, on the other hand, you contribute with after-tax dollars. The downside is that you dont reduce your taxable income with your contributions. However, the money grows tax-free in your account, and you can withdraw without paying taxes during retirement.

When it comes to choosing between traditional or Roth contributions, consider your income today and what you expect it to be in the future. In general, a traditional 401 is better for people who expect their tax rate to be lower during retirement, while a Roth 401 is better for those who expect their tax rate to be higher during retirement.

Unfortunately, Walmart doesnt currently offer Roth conversions. So if you change your mind later, you may have to utilize a Roth IRA later to convert your money.

The other decision youll have to make when you sign up is what you want to invest in. As we mentioned, you have two options: You can either invest in the offered target-date funds or choose your own funds.

Also Check: How To Opt Out Of Fidelity 401k

Walmart Expands Check Card Cashing Services

Payroll, Eligible Government Benefit Cards Cashed to the Penny

BENTONVILLE, Ark., Aug. 8, 2011 Today, Walmart announces expanded check cashing and card cashing services at stores nationwide, including the ability to cash payroll and eligible government benefits cards to the penny.

The expansion includes cashing most types of pre-printed checks up to $5,000 and accepting more forms of ID for check cashing, as well as establishing Express Check Cashing check-out lanes at selected stores during peak hours.

We are constantly looking for ways to make life better for our customers while saving them money, said Daniel Eckert, Head of Walmart Financial Services. This expanded program now enables Walmart to bring every day low price cashing services to more customers who have a need for immediate access to their cash.

Check Cashing*Walmart already cashes these types of checks:

- Payroll

With todays announcement, Walmart now cashes most types of pre-printed checks. Examples include:

- Rebate

- MoneyGram money orders

Cashing Payment CardsIn addition, customers will now be able to cash payroll cards and eligible government benefit cards down to the penny.

Walmart cashes checks and cards up to $1,000 for $3, and cashes checks up to $5,000 for $6, offering significant savings over many other check cashers.

Walmart Money ServicesWalmart is a leading provider of affordable money services to help customers manage their money and save. Products and services include:

# # #

What Kinds Of Checks Does Walmart Cash

There are many different types of checks that you can walk in and cash at Walmart.

They include pre-printed checks, checks from the government, payroll checks, tax checks, and cashiers checks.

But thats not all. You may also cash insurance settlement checks, MoneyGram money orders, 401 or other retirement checks, and two-party personal checks.

If you arent sure if the pre-printed check qualifies under Walmarts check-cashing program, ask the staff at the money service center.

So now that you know that Walmart does in fact cash checks, how do you do it?

Recommended Reading: Can You Withdraw Your 401k When You Leave A Company

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most the best banks, latest rates, different types of accounts, money-saving tips and more so you can feel confident as youre managing your money.

The Bank Listed On The Check

If youre trying to cash a check without a bank account, the easiest place to start is with the bank on the check youre trying to cash.

To find this information, simply look above the memo line in the bottom left corner. Call a local branch to find out its check cashing policy.

It can easily verify the availability of funds by checking the account balance of the one who wrote you the check. Some banks will even give the account owner a phone call on the spot as a security measure to ensure there is no fraud taking place.

The bank listed on the check used to be the cheapest option to get your cash. Now, most of the big banks have started implementing fees to get your check cashed if you do not have an account with them. Most charge a flat rate or a percentage of the check amount up to a certain maximum.

Every bank will have different terms and requirements to cash checks that are tied to its institution. The most foolproof option is to call ahead and ask about its policy and fees.

Youll need 1-2 forms of valid ID to confirm the check is yours, so make sure to bring a drivers license, passport, or another government-issued ID card.

Recommended Reading: What Is The Difference Between Roth 401k And Roth Ira

Cashing A Check At The Check

Banks and often will cash government, payroll, and other official checks along with personal checks if the check-writer has an account at the same institution. The check-issuing banks logo typically is printed on the check. Somebut not allmajor banks will cash checks for non-account holders, usually for a fee, as long as the checking account has sufficient funds. In some cases, the bank may waive check-cashing fees if you open a bank account.

| Bank | Fee for Cashing a Check |

|---|---|

| Bank of America | $8 for Bank of America checks over $50 |

| Chase | |

| No fee for PNC checks | |

| SunTrust | $7 for SunTrust checks over $50 |

| TD Bank | $7 for TD Bank checks |

| Wells Fargo | $7.50 for Wells Fargo checks |

How To Cash Your Checks At Walmart

Walmart makes the process easy for you to cash your checks in their stores. And remember, you dont need an account, and you arent required to register first. You also arent required to shop in order to cash a check, although its probably a perfect time to take care of your shopping list and get some groceries.

All you need to do to cash your check is to bring a valid photo ID and the check. Youll endorse the check by signing your name on the back. If you have questions about endorsing the staff at Walmart will be happy to assist you.

Now, what exactly is this going to cost you for the cash checking service?

Also Check: Where To Deduct Solo 401k Contribution

Get Help With Check Cashing

For answers to your Check Cashing questions, please call 1-800-WALMART

*Max fee of $4 for checks up to $1,000. Max fee of $8 for checks greater than $1,000. Subject to applicable law. Check Cashing is limited to preprinted and other checks authorized by Walmart policy. LICENSED BY THE GEORGIA DEPARTMENT OF BANKING AND FINANCE, license number 183274. Authorized check casher under MA General Laws Chapter 169A, license number 903778. Check Cashing available in the following jurisdictions: AL, AK, AR, AZ, CA, CO, CT, DC, DE, GA, HI, ID, IL, IA, KS, KY, LA, ME, MA, MD, MI, MN, MO, MT, NC, ND, NE, NH, NV, OK, OR, PA, SC, SD, TX, UT, VA, VT, WA, WV, WY.

**Max fee of $6 for Two-Party Personal Checks up to $200. Subject to applicable law. LICENSED BY THE GEORGIA DEPARTMENT OF BANKING AND FINANCE, license number 183274. Authorized check casher under MA General Laws Chapter 169A, license number 903778. Two-Party Personal Check Cashing available in the following jurisdictions: AL, AK, AR, AZ, CA, CO, DC, GA, ID, IA, KS, KY, LA, ME, MA, MI, MO, MT, NC, ND, NE, NH, NV, OK, OR, PA, SC, SD, TX, UT, VA, VT, WA, WY. Not available in NJ.

What About Check Cashing Services

Check cashing stores are another option for cashing checks. On the pro side, you dont need a bank account to use one. Check cashing services can also be useful if you dont have access to any other ways to cash a check outlined above. They sometimes also offer other financial services, such as bill payment and money orders, which is a plus if you dont have a bank account.

However, there are downsides, namely the fees you might pay, which can be quite high. Or, instead of charging a flat dollar amount, check cashing services may charge a percentage of the checks face value. So if you need to cash a $5,000 check, and the service charges a 10% fee, youre automatically handing over $500 to the check cashing company.

Thats quite a bit more than what youd pay to cash a check at, say, Walmart, which maxes out its fee at $8. So consider the fees carefully before using a check cashing service to cash a check.

Recommended Reading: Can I Borrow From My 401k To Start A Business

Cashing A Check At A Check Cashing Store

If you are desperate, you may consider cashing a check at a check cashing store. This method may seem convenient, but it will likely be the most expensive option.

Check cashing centers charge a fee for the convenience of the availability of the funds. The fee is a percentage of the check amount, usually 1% to 5%.

You get the full amount of the check right away. If you had a bank account, you would likely have to wait at least one business day for the funds to be available.

Essentially, check cashing centers give you a short-term loan by giving you the cash right away. The service fee is their “interest” for the loan.

How to Cash a Check Without an ID:

If you don’t have a reloadable prepaid card or a bank account, you may have to resort to endorsing the check over to a family member or friend to cash it for you.

Your Local Bank Or Credit Union

The best place to cash a check is your personal bank or credit union. Free check cashing may be one of your account benefits. By visiting your local branch, you could have instant access to your cash.

That said, depending on your local bank options, you might be better off joining a credit union. Credit unions usually charge fewer fees than banks.

If you dont need access to a national network of branches, credit unions are a great choice. A credit union might also have a lower minimum balance requirement to avoid monthly checking account fees.

Many credit unions only require a $5 minimum balance to keep your account open.

Pick a local credit union or bank that offers free checking and is convenient to access. If your bank doesnt cash checks for free, you should look for a new checking account.

Don’t Miss: When You Leave A Job Do You Get Your 401k

Things To Remember When Cashing A Personal Check

There are a few things to remember the next time you cash a check:

- You always need to bring a photo ID

- Some locations wont cash handwritten checks

- Certain stores and banks charge more to cash a check than others

- Most places have a daily redemption limit

For the most part, cashing a check in-person is extremely easy.

This is true when you have a pre-printed check from one of these issuers:

- Employers

- Government Agencies

- Your tax refund

All you need to do is sign your check and show a photo ID card. You instantly receive the balance minus any cashing fees.

What Are The Walmart Check Cashing Limits

To protect itself and its customers, Walmart sets check cashing limits based on the time of the year and the type of check. Walmart check cashing limits are as follows:

- From May to December: The limit is $5,000.

- These are the tax months. During the tax season, customers are more likely to bring in larger checks due to their tax refunds. To accommodate large checks, Walmart temporarily increases the check cashing limit to $7,500.

- Two-party personal checks: You can cash two-party personal checks up to $200.

Walmart customers are limited to three transactions per day. You should also note that some Walmart stores may set lower limits depending on the location. Call your local Walmart customer service desk before you bring a large check for cashing.

Recommended Reading: When Can You Take Out 401k Without Penalty