But Avoid Being Too Aggressive

If you have a long time horizon, it can be smart to get aggressive with your portfolio, but those closer to retirement should be careful, too. For retirees and near-retirees, it may be time to shift into preserving your assets rather than trying to play catch-up.

Yet many are focused on growing their assets including aggressive investment strategies rather than preserving their assets against sudden market downturns, says David Potter, former spokesperson for MassMutual Financial, citing the companys research. Many people may be taking more risk than they realize.

Potter suggests that investors reevaluate their portfolio regularly to consider how they would fare if the market declined significantly.

Typically, financial professionals recommend that retirement savers dial back their exposure to stocks as they get within five years of retirement and within the first five years after retiring, he says. A steep market downturn of 20 percent or more during those periods could irreversibly reduce your income in retirement.

Heres how to tell if your portfolio is too aggressive.

How To Choose The Best Investments For Your 401k Plan

Employer-sponsored 401k plans are one of the best benefits available to employees. Because the money you contribute is deducted from your gross income before taxes are incurred, youre not taxed on the money you put in. The principal within the fund continues to grow on a tax-deferred basis until you receive distributions, and many employers contribute extra funds to your contribution, what some term free money.

For example, some employers contribute up to 6% of an employees salary on a dollar-for-dollar basis, up to the amount of the employees contribution. If you make $50,000 per year and set aside 10% of your salary into your 401k , in this scenario your employer would contribute an additional $3,000 , increasing your total investment to $8,000. This is a major benefit that substantially accelerates capital growth.

Investing $5,000 per year for 20 years with a 5% growth rate results in a fund of $104,493 investing $8,000 over the same period at the same return produces a fund of $167,188. The ending balance is a combination of the money you invest and the rate of return you earn on your investment over time. With that in mind, you should work to maximize your contributions including your employers matching contribution by selecting the investments that will help you achieve your retirement goals.

If You Want A Million

When you’re saving for retirement, you want to make sure that you’re making the most of your investments, so when that day finally comes, you have the most money possible. The account you invest can have huge implications for how much money you’ll have when you retire and how you can best minimize your tax hit.

Below, three seasoned Motley Fool contributors review the best ways to invest for retirement in order to make the most of the money you contribute.

Also Check: What Should My 401k Contribution Be

Investment Options: The Diy Approach

Target-date funds arent for everyone, and some prefer to adopt more of a hands-on approach. You typically cant invest in specific stocks or bonds in your 401 account. Instead, you often can choose from a list of mutual funds and exchange-traded funds . Some of these will be actively managed, while others may be index funds.

So what kinds of funds and investments can you expect to see?

You can bet that almost every plan will have large-cap stock funds. These are funds made up entirely of large-cap stocks, of stocks with a market capitalization of over $10 million. Large-cap stocks make up the vast majority of the U.S. equity market, so your 401 will almost certainly have multiple funds to choose from that invest in them. Notable large-cap funds include the Fidelity Large-Cap Stock Fund and the Vanguard Mega Cap Value ETF .

Another type of mutual fund youll likely find in your 401s catalog of option is a bond fund. A bond fund is a mutual fund that invests solely in bonds. Within this category exists several categories like corporate bond funds, government bond funds, short-term bond funds, intermediate-term bond funds and long-term bond funds. Bond funds are popular because, as a general rule, they provide the safety of investing in bonds, but theyre much easier to buy and sell than individual bonds. Still, bonds arent risk-free: Longer term bonds can be hurt by rising interest rates, and so-called junk bonds are at risk of default.

What Is A Registered Retirement Savings Account

An RRSP is a retirement savings plan that you open at a bank or other financial institution. You can do that either in person or online, depending on the services is offered by your chosen institution. RRSPs are registered by the federal government of Canada, which specifies the maximum amount each Canadian can contribute to it each year. There are two big benefits to saving or investing inside an RRSP: One, your money is allowed to grow tax-free until you need to withdraw it and two, you get an immediate break on the income tax you would otherwise pay on the amount you contribute each year, up to your annual limit.

Read Also: How To Check My 401k Balance

Invest In Dividends And Dividend Income Funds

Instead of buying individual stocks that pay dividends, you can choose a dividend income fund. These funds have managers who own and manage dividend-paying stocks for you. Dividends can provide a steady source of retirement income that may rise each year if companies increase their dividend payouts.

However, in bad economic times, dividends can also be reduced or stopped altogether.

Many publicly traded companies produce what are called qualified dividends,” which means the dividends are taxed at a lower tax rate than ordinary income or interest income. For this reason, it may be most tax-efficient to hold funds or stocks which produce qualified dividends within non-retirement accounts , etc).

Be cautious of dividend-paying stocks or funds with yields that are higher than the average rate. High yields always come with additional risks. If something is paying a significantly higher yield, it is doing so to compensate you for taking on additional risk. Dont invest without understanding the risk that you are taking.

Total Bond Market Index Fund

Total bond funds are mutual funds or exchange-traded funds that hold bondsor debtacross a wide range of maturities. The debt securities that these funds hold are usually corporate-level bonds, but you will also see holdings of municipal bonds, high-grade mortgage-backed securities . and Treasury bonds.

You only need one good bond fund, and a total bond market index fund will provide diversified exposure to the entire bond market.

Also Check: What Is The Difference Between An Annuity And A 401k

Revisit Your Plan And Consider Adjustments At Least Once A Year

One of the best things about using a 401 to invest for retirement is that you can put your investments on autopilot. However, this doesn’t mean you should simply set up your 401 contributions once and forget it forever. You need to make sure you’re on track with your retirement goals, that your portfolio remains balanced, and that your investments are performing as expected.

To stay on top of your retirement investing, make a repeating appointment on your calendar to check in on your 401 at least once a year.

You should also consider making changes as you reach key milestones in your life and career. If you get a big raise, consider upping the percentage of your salary that goes toward your 401. If you pay off your student loans, consider shifting the money you’d been spending there to instead build wealth on your behalf. When you hit key milestone birthdays or your kids become able to care for themselves, those are also great times to revisit your plan and make adjustments.

These Strategies Can Help You Use Your 401 To Grow Your Wealth

A 401 makes investing for retirement easy with pre-tax contributions withdrawn directly from your paycheck. However, once you’ve made your contribution, you need to choose the right investments to maximize returns while limiting risk. Most 401 plans usually provide a small selection of funds in which to invest, and you’ll want to pick an appropriate mix of assets for your age and risk tolerance.

This guide will help you develop a strategy to invest in your 401 to make the most of this tax-advantaged retirement account.

Also Check: Can I Borrow From My 401k For A House

Extra Benefits For Lower

The federal government offers another benefit to lower-income people. Called the Saver’s Tax Credit, it can raise your refund or reduce the taxes owed by offsetting a percentage of the first $2,000 that you contribute to your 401, IRA, or similar tax-advantaged retirement plan.

This offset is in addition to the usual tax benefits of these plans. The size of the percentage depends on the taxpayer’s adjusted gross income for the year and tax-filing status. The income limits to qualify for the minimum percentage offset under the Saver’s Tax Credit are as follows:

- For single taxpayers , the income limit is $33,000 in 2021 and $34,000 in 2022.

- For married couples filing jointly, it’s $66,000 in 2021 and $68,000 in 2022.

- For heads of household, it maxes out at $49,500 in 2021 and $51,000 in 2022.

A Key To Smart Retirement Saving: Spreading Your Portfolio Across A Few Of The Best Mutual Funds In Your 401 Plan Here Are The 30 Top Options Available As We Enter 2022

But it doesn’t have to be.

Every year, with the help of financial data firm BrightScope, a financial data firm that rates workplace retirement savings plans, we analyze the 100 mutual funds with the most assets in 401 and other defined-contribution plans, and rate them Buy, Hold or Sell. Our goal: to guide you toward the best mutual funds likely to be available in your workplace plan.

In the end, a cool 30 funds, which we’ll describe in detail below, won our seal of approval. But you’ll want to pay attention to the fine print. Some funds are appropriate for aggressive investors others are geared for moderate savers.

We’ll also point out that we didn’t weigh in on index funds. That’s because choosing a good index fund always rests on three simple questions: 1.) Which index do you want to emulate? 2.) How well has the fund done in matching that index? 3.) How much does the fund charge? Generally speaking, however, we have no issues with any of the index funds listed in the top 100.

Assessing actively managed mutual funds is a different beast. We look at each fund’s long-term returns and year-by-year performance, as well as its volatility and how it fares in difficult markets. We also consider manager tenure, fees and other factors.

1 of 30

- Rank among the top 401 funds: #97

- Best for: Value-oriented stock exposure

Consider yourself lucky.

The fund currently yields 1.6%.

DODIX yields 1.4%.

Read Also: When Can You Withdraw From 401k Without Penalty

Be Aware Of The Fees Associated With Your Plan

The goal of investing in a 401 plan is to grow your money over time through investments. Because its an active investment , there are fees included. Your plan negotiates these fees on your behalf. They can include amounts needed to cover administrative costs and management expenses. While you dont have complete control over the fees in your 401 plan, its important to be aware of what youre paying. If youre choosing your own investments, look at fees and returns to ensure that you get what you pay for.

The Benefits Of Investing After Retirement

Investing after retirement can generate returns that could allow you to live a better life, travel or buy the house you have always been dreaming of. So why consider investing even after you retire? It will give you the financial freedom to undertake a new project or contribute to something you care about. This article provides a few reasons why you should consider it.

You can grow your retirement income: When you retire, your pension or Social Security check may not be enough. It can be a good idea to invest and potentially increase your retirement income. In fact, 70% of people plan to keep investing after they retire according to a 2018 study. It showed that respondents used 13.3% of their retirement savings to continue investing.

You can help the kids or grandkids: It can be expensive for new parents to plan for a house and for their childs future. As a retiree, you can invest in your grandkids or familys education by contributing to their education funds or paying directly for private school.

Maybe you start a business: Its good to follow your passion, and your twilight years may be the best time to start a business.

Buying your dream house: It may be a good time to buy that house by the ocean. You may have been dreaming of downsizing now that the kids are in college. You might prefer to buy another home to rent out and try to generate extra income on a monthly basis. Income from rent can increase during inflationary periods.

Also Check: Why Is Roth Ira Better Than 401k

Tips For Choosing The Best 401k Investments

Determining which investments are the best investments is not a one size fits all endeavor. Everyone starts saving at different ages, with different goals, different incomes and expenses, and varied retirement expectations. All of these factors affect which investments are most likely to fit your particular needs. Your decision may be further complicated by the investment options made available to you by your employer.

Go With The Simplest Option

Alternatively, you can opt for a target-date fund, which takes most of the guesswork out of the equation. With these funds, you select a “target” retirement year and risk tolerance, and the fund is automatically set to an appropriate asset allocation for you. These are great options for beginner investors.

“Most people aren’t interested in researching selecting funds for their 401,” Charles C. Weeks, a Philadelphia-based CFP, tells CNBC Make It. “Target date funds will help people avoid blowing up their portfolios by making avoidable mistakes like putting too much in one asset class, chasing returns by investing based on past performance and/or letting greed and fear dictate their investment strategy.”

Over time, the fund will automatically rebalance, becoming more conservative as you near retirement. If you choose a target-date fund, you only need to choose the one fund otherwise you’re essentially canceling out its benefits. Another mistake to avoid with target-date funds is choosing a year without researching how it will change its mix of stocks and bonds over time, Howard Pressman, a Virginia-based CFP, tells CNBC Make It.

Recommended Reading: Should You Always Rollover Your 401k

Can You Lose Money In A 401

Its possible to lose money in a 401, depending on what youre invested in. The U.S. government does not protect the value of investments in market-based securities such as stocks and bonds. Investments in stock funds, for example, can fluctuate significantly depending on the overall market. But thats the trade-off for the potentially much higher returns available in stocks.

That said, if you invest in a stable value fund, the fund does not really fluctuate much, and your returns or yield are guaranteed by private insurance against loss. The tradeoff is that the returns to stable value funds are much lower, on average, that returns to stock and bond funds over long periods of time.

So its key to understand what youre invested in, and what the potential risks and rewards are.

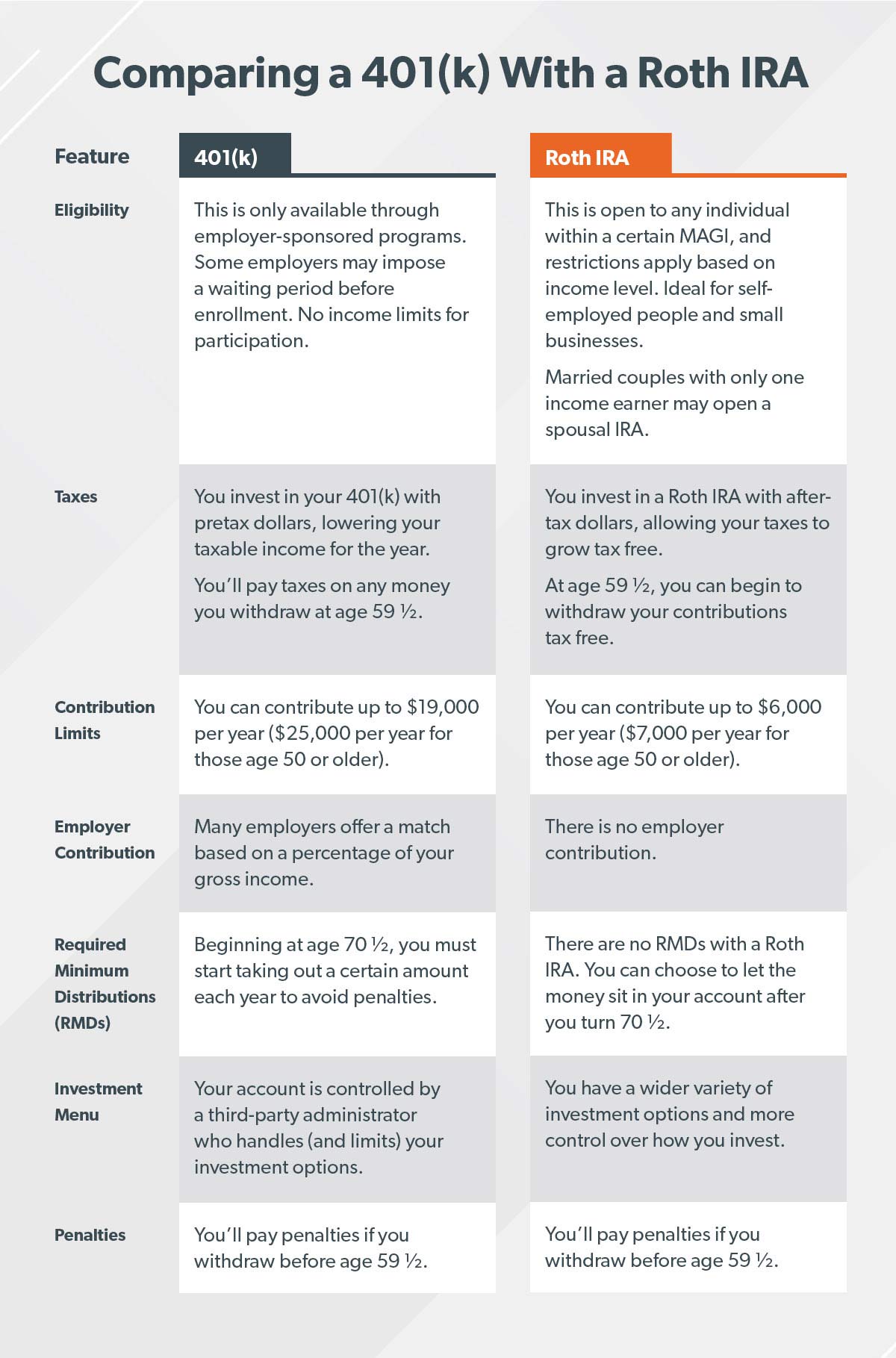

How To Invest Without A 401

Fortunately, you do have some alternatives if your company does not offer a 401 plan or a good one. For example, anyone with earned income can access an IRA and those with their own business even a side gig have alternatives, too.

If your employers retirement plan doesnt measure up, here are eight investing alternatives to consider:

Also Check: How To Set Up A Solo Roth 401k

Read Also: Can I Use My 401k To Start A Business

We Offer A Variety Of Investment Options To Help Build Your Retirement Portfolio

Fixed income funds

Our Fixed income funds include market-valued bond funds as well as the Sentry Guaranteed Fund. Fixed income funds are generally considered to be less risky than equity funds, and are generally expected to have lower long-term returns than equity funds.

Equity/income blended funds

Our Equity/income blended funds are separate accounts including bonds for income and common stocks for growth. Blended funds are generally riskier than fixed income funds, but generally less risky than equity funds.

Equity funds

Our Equity funds are separate accounts that invest primarily in stock mutual funds. They are commonly referred to as stock funds.

Target retirement funds

Our target retirement funds are separate accounts designed and managed around an anticipated retirement date. Our target retirement funds are designed to become more conservative as you approach retirement.

Understanding your investment options

Interested in learning more about investing? Our glossary of terms is a good place to start.

Other Types Of Investment Strategies

As an investor, you may decide to add other types of investments to your portfolio. Types of securities you can add might be higher risk, but can compliment your index funds. Whatever other securities you decide to add, make sure you align them with your investment goals and do some research before to make sure you know what youre investing in.

You May Like: What Happens To Your 401k When You Die

Make The Middleman Work For You

Eric Volkman: I would suggest opening a traditional brokerage account. In my opinion, it’s the best choice for retirement investing because it offers so much flexibility.

These days, even the most bare-bones trading account offers a raft of securities to invest in — ETFs, stocks, bonds, mutual funds, derivatives, etc. A brokerage is happy to allow a client to basically invest in anything they’re interested in plowing money into.

It’s nice to have such a wide variety of choices available, not least because it makes it easy to tailor a portfolio to an eventual retiree’s investing style and goals. Are you a frequent risk taker who likes to buy derivatives? A blue chip stock buy-and-holder? A set-it-and-forget-it type? A mix of all of the above? A good broker can provide the opportunities and the resources that best fit your profile.

For retirement savers, another positive with traditional brokerage accounts is the many tools available with most of them. These include, but are by no means limited to, access to analyst research, advisory services, and educational resources that allow you to acquire or brush up on your knowledge of financial securities and trading.

Another plus with brokerages is that, thanks to a fee war that broke out a few years ago, trading commissions today are basically non-existent. So buying even a large block of your favorite company will generate exactly $0 in such fees at many brokerages.