How Does Money Get Left Behind

Very few people stay at one employer the entire length of their career.

But unlike your bank account which you may have from job to job, a 401 account is linked to your employer. It is up to you to do something about it.

When you leave your employer, the money may stay in the account for an indefinite amount of time.

However, if the company closes the 401 plan, files for bankruptcy, goes out of business or is acquired by another company, you may be forced to decide, within a short period of time.

Its possible that years will go by after you parted ways with your old job, and then youll get a letter notifying you that you need to move your 401 account, or take a distribution.

If this happens, youre much better off rolling the money into an IRA account, or transferring the money into your current companys 401 plan.

Locate Where Your 401s Are

Before you can check how much is in your 401 account, you need to know where your 401s are.

The first place to look is the company with whom you’re currently working. Many companies have implemented auto-enrollment into their 401 plans, ensuring that most of their employees contribute to their retirement. Otherwise, participation may drop because they simply forgot or didn’t know it was available.

Contact your human resources department to get information on if you’re contributing to their 401 and your account information.

Additionally, if you’ve changed jobs a few times in your career, you may have old 401 outstanding in different places. Locating old 401s can be a tricky process as it requires much coordination and hunting down various entities and contacts.

If you’re unsure if you have outstanding 401s with old companies, we can help. Beagle will find any old 401s you have, identify any hidden fees, and provide options to consolidate into one, easy-to-manage account. Sign-up only takes a couple of minutes and Beagle will help you find all your 401 accounts!

Even misplacing one 401 from a previous employer could cost you thousands in potential retirement funds.

Do I Have A 401k I Dont Know About

If you think that you may have enrolled in a 401K plan with a previous employer, but youre not quite sure, there are a few ways to find out if you did.

The easiest way is to contact the HR department of your former employer and ask them whether you ever contributed to a 401K while in their employment. Youll need to give them your personal details along with the dates that you worked for them, so keep this information to hand.

If your old employer has since gone bust or you cant remember which companies youve worked for in the past, check the National Registry of Unclaimed Retirement Benefits website. Youll be able to see whether youve been listed on their database by your old employer as someone with unclaimed retirement plan funds.

If you havent been listed on the National Registry of Unclaimed Retirement Benefits database, there are a couple more options to explore. Visit NAUPA or missingmoney.comwhere you can search by state based on where youve lived or worked to find out whether any unclaimed assets belong to you.

You May Like: What Happens To My 401k After I Quit

Determine Your Need For Access

If your need for your 401 money is immediate and absolute, you can simply withdraw the assets from the account, and within a few days the money will be wired to your bank account or sent to you in a check. Taking a distribution in this way will subject your entire withdrawal to taxation at ordinary income rates, and if you are under the age of 59 1/2, you will owe a 10 percent early withdrawal penalty as well.

Video of the Day

Look For Contact Information

If you don’t know how to contact your former employer perhaps the company no longer exists or it was acquired or merged with another company see if you have any old 401 statements. These should have contact information to help put you in touch with the plan administrator.

If you don’t have an old 401 statement handy or yours doesn’t tell you what you need to know, visit the U.S. Department of Labor website and look up your employer. There you should find your old retirement account’s tax return, known as Form 5500. That will most likely have contact information for your 401’s plan administrator.

Recommended Reading: How To Check How Much Money Is In My 401k

Too Complicated Get Some Help

If this process seems like a lot of work, youâre not alone. Locating your old 401 accounts and finding the proper place to transfer them to can get confusing.

Fortunately, Beagle can do all of the difficult work for you. The tasks of finding your accounts and facilitating their transfers are all done for you. Getting started is easy.

Determine If Your 401 Account Was Rolled Over To A Default Ira Or Missing Participant Ira

One possibility is your employer rolled the funds over into a Default IRA.

If your employer tried to contact you for instructions as to what to do with your account balance, and you fail to respond, you may be deemed a non-responsive participant.

If they are unable to locate you altogether, you may be deemed a Missing Participant.

In either scenario, if the plan is being terminated, your employer may have put the funds in a Missing Participant Auto Rollover IRA.

This is an IRA account set up on your behalf to preserve your retirement assets until they are claimed by you or your beneficiaries under Department of Labor regulations.

To qualify for a Missing Participant or Default IRA, the account balance must be greater than $100 but less than $5,000 unless the funds are coming from a terminated plan, then the $5,000 ceiling is waived.

Finding a Missing Participant IRA

If your money has been transferred to a Missing Participant IRA, you should be able to find it by searching the FreeERISA website.

This search is slightly more time consuming than the national registry. Registration is required to search the database, which contains 2.6 million ERISA form 5500s, covering 1.3 million plans and 1 million plan sponsors.

If you know your money has been transferred to one of these default accounts, you should get it out into a standard IRA account.

Typically, these accounts must be interest-bearing, bear a reasonable rate of return, and be FDIC insured.

Here’s the bad part:

Recommended Reading: How Do You Pull Out Your 401k

Leave Your 401 With The Old Employer

In many cases, employers will permit a departing employee to keep a 401 account in their old plan indefinitely, although the employee can’t make any further contributions to it. This generally applies to accounts worth at least $5,000. In the case of smaller accounts, the employer may give the employee no choice but to move the money elsewhere.

Leaving 401 money where it is can make sense if the old employer’s plan is well managed and the employee is satisfied with the investment choices it offers. The danger is that employees who change jobs over the course of their careers can leave a trail of old 401 plans and may forget about one or more of them. Their heirs might also be unaware of the existence of the accounts.

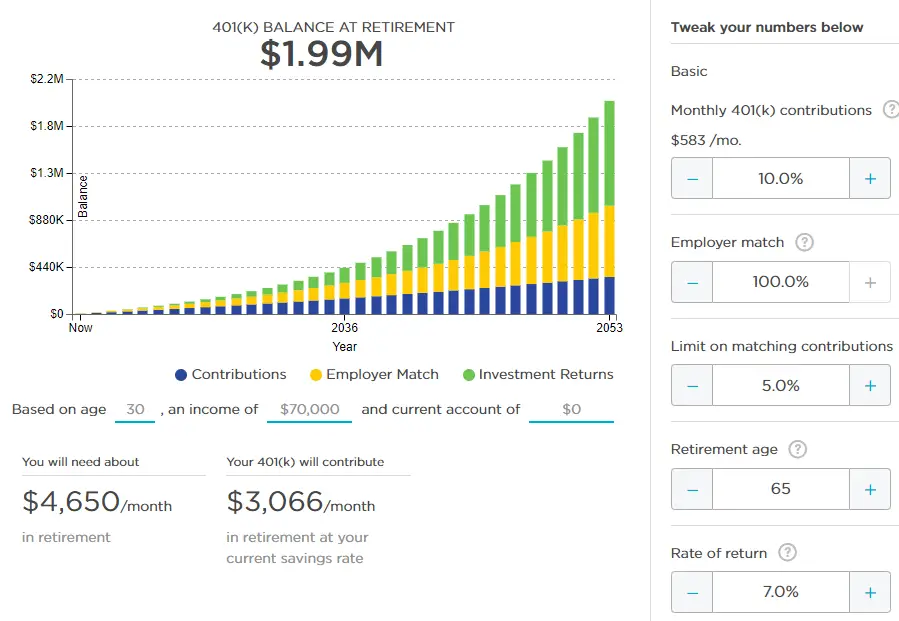

How Much Can You Contribute To A 401 Plan

Now that you know what a 401 plan is, what is the maximum contribution you can make to this plan?

Since your 401 has a lot of tax benefits, the IRS has a limit on how much you can contribute.

According to IRS, the contribution limit to a 401 plan in 2022 is $20,500 or $27,000 if you are 50 or older. If you can be able to max out this retirement plan, your taxable income will be reduced by a lot. Due to this move, some people end up moving from a higher tax bracket to a lower tax bracket.

These contributions are higher by $1,000 from what they were in 2021. That is your max contribution on a 401 in 2021 was $19,500 or $26,000 if you are 50 or older.

The IRS makes changes to retirement contributions and requirements. For this reason, you must keep up with these changes and adjust your contributions accordingly.

You May Like: How Do I Use My 401k To Start A Business

Search Form 5500 Directory

All employers that provide 401 plans to their employees are required to fill out a 5500 form every year with the DOL. Websites like FreeERISA* allow users to search by company name to locate the correct Form 5500. Another option is to search the DOLs 5500 database. Both simple searches will provide you with additional contact information.

For further assistance in finding lost 401 plans, the U.S. Department of Labor has an Abandoned Plan Search, which helps participants and others find out whether a particular plan is in the process of beingor already has beenterminated. The name of the Qualified Termination Administrator responsible for the termination will be listed as well, giving you a good idea of who to contact .

But beware: some companies, even legitimate ones, can acquire your information about unclaimed retirement accounts and offer to assist you with your search, often with a percentage fee for their services.

When it comes to planning and saving for retirement, its vital to have all your assets accounted for. Locating an old 401 plan is like finding cash in the pocket of an old pair of jeans. Its money you forgot you had but are happy you found. So if you know youve contributed funds to a 401 account but cant figure out where those funds are, the resources listed above may help you find past retirement accounts that may have been lost along your employment journey.

Review Your Investment Mix

Your investment mix consists of the funds you choose for your investments. This is an excellent opportunity to review your current investment mix and access the tools provided to see if you are on track to reach your goals. If you decide to make changes, you may consider reallocating your current balance, changing how your contributions will be invested going forward, or both. To review or change your investment mix:

Visit the Xerox 401 Savings Plan website or call the Xerox Retirement Service Center at 1.833.608.2886.

Don’t Miss: Can I Cancel My 401k And Cash Out

Contributing To A 401 Plan

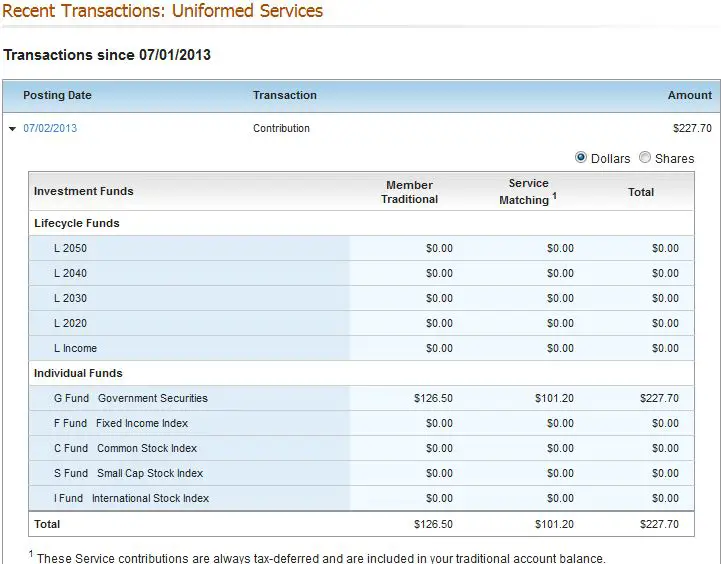

A 401 is a defined contribution plan. The employee and employer can make contributions to the account up to the dollar limits set by the Internal Revenue Service .

A defined contribution plan is an alternative to the traditional pension, known in IRS lingo as a defined-benefit plan. With a pension, the employer is committed to providing a specific amount of money to the employee for life during retirement.

In recent decades, 401 plans have become more common, and traditional pensions have become rare as employers shifted the responsibility and risk of saving for retirement to their employees.

Employees also are responsible for choosing the specific investments within their 401 accounts from a selection their employer offers. Those offerings typically include an assortment of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as the employee approaches retirement.

They may also include guaranteed investment contracts issued by insurance companies and sometimes the employer’s own stock.

Check Your 401 Beneficiary

While youre in your online account dont forget to check that youve named a beneficiary for your 401 account. Typically, a spouse must be the beneficiary unless they sign a waiver. If youre not married its important to name a beneficiary in your account. The Motley Fool shares additional tips on when someone inherits a 401.

Recommended Reading: Can You Roll Over 401k To New Employer

Why You Should Roll Over Your Old 401 Accounts

Once you find forgotten retirement funds, you can make it easier to keep track of your money by simply rolling over your old 401 accounts into an IRA at a brokerage you already have an account with. This way you can manage your nest egg easier since all of your money is in one place.

“It’s beneficial to consolidate your accounts to reduce oversight obligations,” Cavazos says. “Having all of your funds consolidated in one account allows you to keep track of your balance and account performance.”

If you already have an existing IRA, you can roll your 401 balance into that account. Otherwise, it’s easy to open a new IRA at the big-name brokers like Charles Schwab, Fidelity, Vanguard, Betterment or E*TRADE. Rolling over your old 401 plan into an IRA gives you more control over how you invest your retirement funds since you won’t be limited to just the funds that were offered by your former employer. These large brokerages give you thousands of investment options, including mutual funds, index funds and individual stocks.

How Can I Find Out My 401k Balance

Over $5.3 trillion is held in 401 plans as of September 2017, according to the Investment Company Institute. If you’re using a 401 to help you save for retirement, it’s important to know how much you have in your plan so you can determine if your savings are in line with the amount you’ll need to fund your golden years. If you don’t receive paper statements with your 401 balance, there are other ways you can check how much you’ve saved.

Also Check: Can I Move My 401k

Vs Roth : How Do They Differ

The key difference between a 401 and a Roth 401 is the tax treatment of contributions and distributions.

A 401 is a type of retirement savings account that is funded with pretax dollars. When you contribute to a 401 account, the contribution is deducted from the employee’s taxable income. When you take a distribution from a traditional 401 account, the amount withdrawn will be subject to income taxes. For example, if you have accumulated $1 million in your 401, and you are in the 32% tax bracket, it means you will pay $320,000 in income taxes to the IRS.

In comparison, a Roth 401 is a post-tax retirement account that is funded with post-tax dollars. This means that the taxes are already taken out, and you remain with reduced pay. Since you paid income taxes when contributing to the Roth 401 account, you wonât pay any taxes if you withdraw money in retirement. However, if your employer contributed a match to your retirement account, you will be required to pay taxes on the employerâs match. For example, assume that you have $1 million in your Roth 401, out of which $100,000 represents the employerâs match. When you take a distribution, you wonât owe any income taxes on the $900,000 you contributed from your paycheck. However, if you are in the 22% tax bracket, you will owe $22,000 in taxes on the employerâs match.

Tags

Tracking Down Your Plan

If you think youve lost track of a savings plan, search your files for old retirement account statements. These should provide some key data to help your search, such as your account number and contact information for the plan administrator. If you dont have any statements, contact your former employers human resources department.

If your employer filed for bankruptcy, your 401 balance is protected from creditors and is likely still held at the investment company that administered your plan. In the case of a pension, it was either taken over by an insurance company or the federal Pension Benefit Guaranty Corp., which protects traditional pensions. You can track down your pension at pbgc.gov/search-all.

Its also possible that your employer turned over your 401 balance to your states unclaimed property fund. Your states treasury department should offer an online service that lets you search for your money. You can also check the National Registry of Unclaimed Retirement Benefits.

Recommended Reading: Should I Use My 401k To Pay Off Debt

How To Access My 401k Online

Although youll have set up your 401K through your employer, your funds will be managed through a custodian or brokerage firm, for example, the likes of Charles Schwab or Vanguard. You should be able to log into your 401K account online through the website of the broker your 401K is with.

If you cant remember your login details, youll need to contact your 401K provider to get your password reset, or failing that you may be able to check your balance over the phone.

If youre not sure which custodian your 401K is set up with, speak to your human resources department at work. They wont be able to tell you your 401K balance, but theyll be able to direct you to the relevant 401K broker.

How To Track Down That Lost 401 Or Pension

Tweet This

Can’t Find your old 401 or that old pension? Here is how to track your money down. Shutterstock

At least once every few months a long-term client brings in a retirement account statement and says, I forgot I had this retirement account. Can you help me with it? Sometimes these accounts are tiny but other times they hold a substantial amount of money. All of them are old, and havent been looked at in years. If you find yourself in this position, follow these steps to locating your 401 or other retirement accounts from previous employers.

Do you ever feel like you know you saved more for retirement than your statements indicate? Are you certain you must have forgotten about an old retirement account or pension with a previous employer? You likely arent crazy, and youre definitely not alone.

Americans lost track of more than $7.7 billion worth of retirement savings in 2015 alone by accidentally and unknowingly abandoning their 401.– USA Today, February 25, 2018

The days of graduating college, getting a corporate job and staying with the same employer until the retirement age of 65 are long gone. Today, people are jumping from job to job which often leaves a trail of old retirement accounts and even a few pensions. Because of this, a surprising number of people lose track of these old accounts. Forgetting about these accounts can really hurt your overall retirement security when you factor in compounding interest.

What happens when a 401 plan is terminated?

Read Also: How To Borrow From Fidelity 401k