Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

You May Be Able To Invest In Funds With Lower Fees

As a general rule, IRAs tend to be cheaper than 401s. You have more flexibility to find investments with lower fees when you invest with an IRA because its your account that you hold at an institution you choose. Your 401s leave you stuck with what your employer gives you within the plan. Its not out of the question to save 1% per year in underlying fees when you roll over to an IRA.

Roll Your Old 401 Into Your Current 401

This option assumes that you participate in your new 401, which, again, you should be doing if you have access to one! It also assumes your new employer allows you to do this. Check with your benefits department to see if they allow for rollovers into the plan. If so, you could put your 401k from previous employer into your new plan with your current company.

Recommended Reading: What Is 401a Vs 401k

When Not To Roll Over Your Retirement Account

There can be good reasons to NOT roll over an old 401 or 403 to an IRA. For tax reasons, its generally not a good idea to roll over company stock that has appreciated in value.

Second, if youre afraid of bankruptcy or are planning to retire early, leveraging your employers 401 or 403 provides additional protection from creditors and could allow you to take out funds before age 59 ½ without penalty.

Finally, while this is not a reason to avoid a rollover to an IRA, its important to note that many financial professionals will get a commission if you use them to roll your dollars to an IRA, but not if you roll your dollars to your new 401.

Can I Roll Over My Retirement Plan Assets Into A Roth Ira

If you have a Roth 401 or 403, you can roll over your money into a Roth IRA, tax-free.

If you have a traditional 401 or 403, you can roll over your money into a Roth IRA. However, this would be considered a “Roth conversion,” so you’d have to report the money as income at tax time and pay ordinary income tax on it.

Also Check: Can I Transfer Money From 401k To Ira

Decide Where You Want The Money To Go

If youre making a rollover from your old 401 account to your current one, you know exactly where your money is going. If youre rolling it over to an IRA, however, youll have to set up an IRA at a bank or brokerage if you havent already done so.

Bankrate has reviewed the best places to roll over your 401, including brokerage options for those who want to do it themselves and robo-advisor options for those who want a professional to design a portfolio for them.

Bankrate has comprehensive brokerage reviews that can help you compare key areas at each provider. Youll find information on minimum balance requirements, investment offerings, customer service options and ratings in multiple categories.

If you already have an IRA, you may be able to consolidate your 401 into this IRA, or you can create a new IRA for the money.

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

Don’t Miss: What Is The Tax Rate On 401k After 65

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to rollover an old 401 into an IRA, you will have several options, each of which has different tax implications.

Rolling Over To A New 401

The first step in transferring an old 401 to a new employer’s qualified retirement plan is to speak with the new plan sponsor, custodian, or human resources manager who assists employees with enrolling in the 401 plan. Because not every employer-sponsored plan accepts transfers from an outside 401, it is imperative for a new employee to ask if the option is available from the new employer. If the plan does not accept 401 transfers, the employee needs to select one of the three other options for the 401 account balance.

If the new employer plan accepts 401 transfers from other companies, there is often a substantial amount of paperwork that must be completed by the employee. The paperwork is provided by the new plan sponsor or human resources contact and requires the name, date of birth, address, Social Security number, and other employee identifying information.

In addition, the 401 transfer form must provide details of the old employer plan, including total amount to be transferred, investment selections held in the account, date contributions started and stopped, and contribution type, such as pre-tax or Roth. A new plan sponsor may also require an employee to establish new investment instructions for the account being transferred on the form. Once the transfer form is complete, it can be returned to the plan sponsor for processing.

A transfer from one 401 to another is a tax-free transaction, and no early withdrawal penalties are assessed.

Read Also: How To Find Out If I Have An Old 401k

Need Help With Making Decisions About Rollovers

Rollovers are a big financial move and a great opportunity to get professional advice on your investment strategies.

It can be useful and reassuring to model different financial moves in the NewRetirement Planner or consult with a Certified Financial Advisor.

Did you know that NewRetirement offers flat fee advisory services? You can collaborate with a Certified Financial Planner who has taken a fiduciary oath and specializes in retirement. Your advisor will:

- Review your NewRetirement plan to quickly understand your circumstances and make sure it is set up properly.

- Help you establish goals and identify ways to strengthen your finances.

- Meet with you via phone or video call to discuss your goals and suggest ideas for how to do better.

- Provide ongoing support.

You May Like: What Is Ira And 401k

Or You Have The Option To Use A New Fintech Company Capitalize

Capitalize takes over all of the mundane paperwork and time consuming process around rolling over your old 401K to a new IRA and they do it as a free service to you. Their compensation is through the brokerage firm that YOU choose to open your rollover IRA account with.

If you have been waiting to roll over your 401K or it just seemed like an annoying process you dont have time for click on the link below to roll it over now. If not now, then when!

You May Like: How To Protect Your 401k In A Divorce

Should I Rollover My 401 / 403 After A Job Change

Millennials are job switchers. Gallup polls have found that 21% of millennials report changing jobs within the past year.

Outside of learning the new company org chart, job switching presents another challenge: what to do with your old 401 or 403.

Currently, many millennials do nothing.

As a result, a 2017 study found that 59% of 25 34-year-olds had at least one old 401. For most individuals who are far away from retirement, this is almost certainly not the right option.

This article will lay out the disadvantages of doing nothing. It will also address some misconceptions about 401 rollovers, e.g., you should not roll over a 401 if its performing well.

Rollover The Money Into An Ira

If you moved to a higher-paying job, you should consider a rollover IRA to get greater control over your investments. A rollover IRA allows you to combine all your old 401s so that you have a single location for your retirement money.

Unlike a 401 where you are the participant, an IRA gives you full ownership of your retirement savings, and you can make decisions on your portfolio composition, and how much to invest in each type of security. You can also choose to convert your IRA account into a Roth IRA account if you think that your retirement income will be higher than your current income.

Recommended Reading: How Can You Get A 401k

How To Establish An Hsa Rollover

The easiest and safest way to kick off an HSA Rollover is by contacting your current HSA provider. It could be a financial institution such as a bank or a mutual fund company. If youve opened one through your employer, the benefits department should tell you exactly whom to get in touch with.

From there, instruct your HSA provider to establish a trustee-to-trustee transfer of your funds into a new account with a different HSA provider. Most allow you to do this online. Or you can call and ask for a trustee-to-trustee form. Fill it out, send it back and your HSA provider will handle the rest.

You may have heard that the IRS allows HSA rollovers once every 12 months. In truth, you can make as many trustee-to-trustee transfers as you wish. The IRS doesnt treat each transfer as an official rollover.

However, an actual rollover does follow the 12-month rule. Heres how it works. You contact your current HSA provider and request it sends you a check or direct deposit of your funds, so you can set up an HSA rollover. Then you have 60 days to deposit those funds into your new HSA account. If you fail to do so, the IRS will levy income tax on the amount you rolled over, plus a 20% penalty.

However, these methods apply to ordinary HSAs. If your HSA money is technically invested in securities like mutual funds and stocks, the process works a little differently.

Roll The 401 Over Into An Ira

What if youre not moving to a new employer immediately or your new employer doesnt offer a 401? What if your employer requires you to put in a number of years before you become vested and eligible to participate in their 401 plan?

In these circumstances, stashing your money in an IRA with the financial institution of your choice is a freeing solution. Youll be able to choose where, how, and when you invest unless you agree to pay a broker to manage the funds for you. A direct rollover is ideal to avoid paying taxes on the amount transferred over you have 60 days to roll your 401 over into the new IRA.

You May Like: Is It Good To Convert 401k To Roth Ira

Rolling Over A 401 To Your New Employers Plan

The process of rolling over a 401 might seem intimidating or inconvenient at first, especially if youre moving onto your second job and this is the first time youll be rolling over a 401. In actuality, the actual process of rolling over a 401 isnt too complicated once youve decided where your existing funds are going to go.

Also Check: How To Avoid Penalty On 401k Withdrawal

Defining Terms: What’s A 401

A 401 plan is a tax-advantaged retirement account typically sponsored by an employer.

The traditional form of the 401 works much like a traditional IRA: Your contributions in a given year reduce taxable income for that year. In a simplified example, if you earn $75,000 and contribute $10,000, your earnings fall to $65,000, saving you tax dollars up front. Your withdrawals will eventually be taxed, though.

401s differ in a few meaningful ways from IRAs:

- Contribution limits: 401s have much higher contribution limits. These typically change annually, but generally you can contribute about three times as much money to a 401 as an IRA.

- Investment options: 401s typically provide limited investment options, with most offering a dozen or fewer mutual funds. In IRAs opened at brokerages, you can invest in virtually any stock exchange-traded fund , or mutual funds.

- Matching funds: Many employers match employee 401 contributions up to a certain percentage of pay.

Don’t Miss: How Does Taking Money Out Of 401k Work

Take Advantage Of An Investment Option In The 401

Conversely, there may be an investment option available in your 401 that is not available in your IRA account. You may want to leave a portion of the funds in your 401 to take advantage of that opportunity. Remember, diversifying your portfolio is extremely important when it comes to investing and if you have access to something special inside your 401, its worth keeping some money there to take advantage of the investment opportunity.

Its Your Money And Your Choice

When it comes to what to do, there are advantages and disadvantages to all options so theres no one right answer for all. You need to review your options and choose whats best for you and your retirement. Retirement savings is one of the most important and long-lasting investment decisions youll ever make. If youre not sure what to do, you always have the option of talking to an advisor. Whether you need a bit of advice or a comprehensive financial plan, a Certified Financial Planner can help guide you in the right direction.

Also Check: Can You Transfer Your 401k

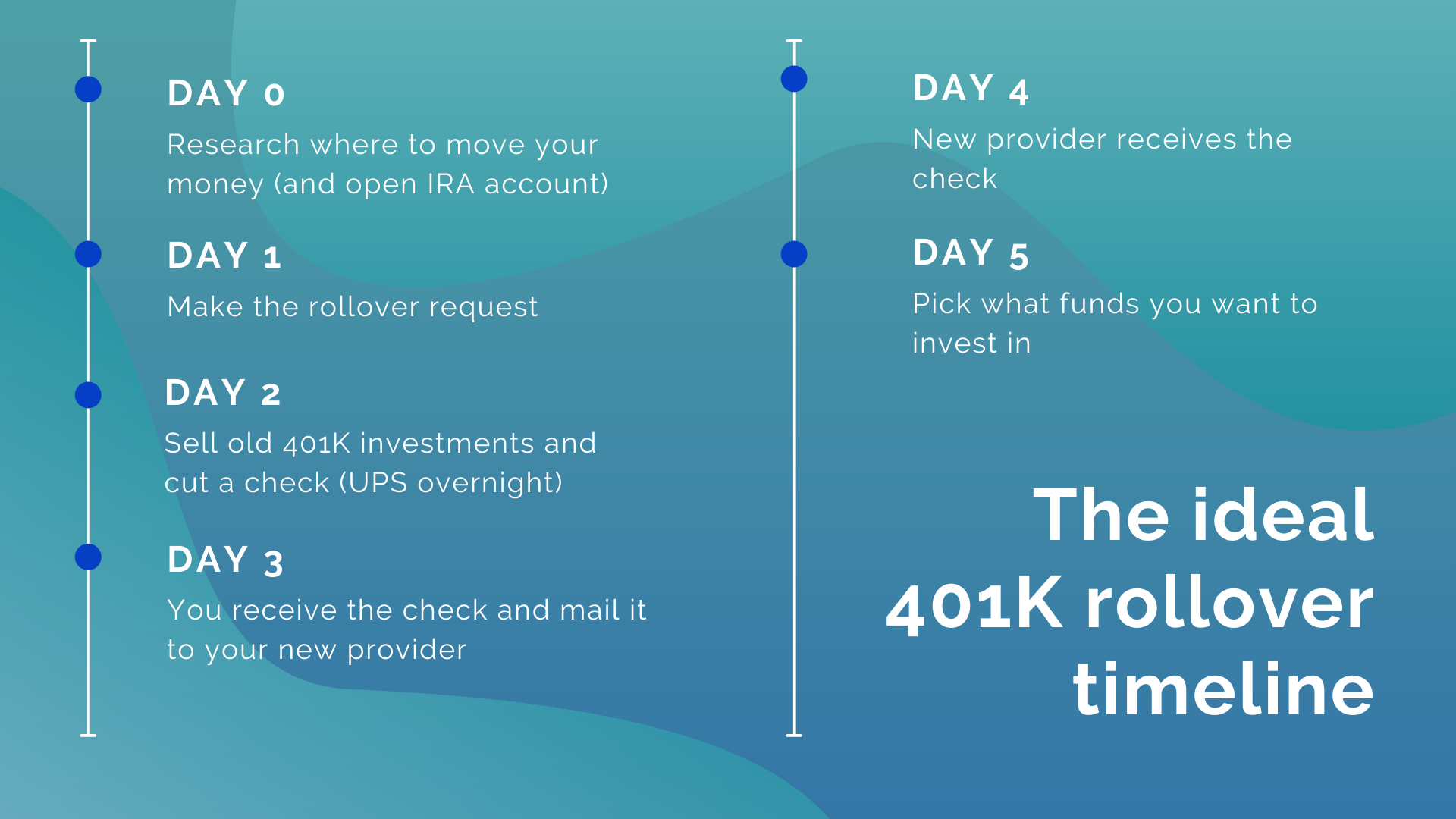

S To Roll Over Your 401

Before you can roll over your 401, youll need to open an account to roll it into. Consider your options, like your new employers 401 or an IRA.

Drawbacks Of A 401 To Ira Rollover

IRA rollovers give individuals more control over their money, but they do come with potential tradeoffs.

Less legal protection: Unlike a 401, money in an IRA may be vulnerable to creditors and civil lawsuits. While blanket bankruptcy protections that 401s enjoy do extend to money that gets rolled into an IRA, those funds may be exposed in other legal proceedings.

Distribution age: The Rule of 55, which 401 investors can tap, does not apply to IRA rollovers. After rolling money over into an IRA, you have to wait to reach age 59.5 to withdraw funds without incurring an extra 10% penalty.

Higher fees: An IRA will give you more investment options than a 401, but you may lose out on access to institutional funds mutual funds that carry the lowest expense ratios and are only available to institutional investors, like 401 plans and hedge funds.

No loan option: Youll also forfeit the option to borrow against your 401. That choice does not exist for IRAs.

Don’t Miss: Can You Take A Loan From 401k For Home Purchase