Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

Perks For Older Investors

If you happen to be 50 or older, youre entitled to make catch-up contributions by adding an additional $6,500 for a total contribution of $26,000 in 2021, which is the same as the contribution limits from 2020. The total maximum that can be tucked away in your 401 plan, including employer contributions and allocations of forfeiture, is $64,500 in 2021, or $6,500 more than the $58,000 max for everyone else. Forfeitures come from an account in which company contributions accumulate from departing employees who werent vested in the plan.

What Is A Traditional 401 Plan

A traditional 401 plan is a retirement investment option offered by an employer. Compared with SIMPLE plans, traditional 401 plans offer more features and greater flexibility, which often comes with increased administrative expenses. Most plan providers offer different levels of prototype plans or varying options available under a particular plan, such as an automatic enrollment option or varied vesting schedules. With a traditional 401, you are not required to make employer contributions, and your employees can contribute up to an annual maximum as set by the IRS.

A traditional plan is subject to reporting obligations and tests:

- Average Deferral Percentage test: Compares employee deferrals of highly compensated versus non-highly compensated employees.

- Average Contribution Percentage test: Compares employer matching contributions and employee after-tax contributions of highly compensated versus non-highly compensated employees.

- Top-Heavy Test: Compares the overall benefits in the plan of key employees such as owners and officers to non-key employees.

These compliance tests must be performed annually, and failing a test may require additional contributions or highly compensated employee distributions to bring the plan into compliance.

Recommended Reading: How Do I Find Out Where My Old 401k Is

Benefits Of Establishing An Owners

The owners-only 401 plan was made possible by the Economic Growth and Tax Relief Reconciliation Act , which changed the rules regarding 401 contribution limits. You can designate up to 25% of your total compensation to a profit sharing plan, plus up to $18,000 to a 401 plan, if you earn at least that amount annually. This brings your total contribution level up to a maximum of $53,000, or 100% of your total compensation, whichever is less. If you are 50 or older, you can make an additional catch-up contribution of up to $6,000.

In addition to the benefits of traditional 401 plans including tax-deductible contributions, tax-deferred earnings, flexible contribution requirements and a variety of investment options and the higher funding limits, owners-only 401 plans offer:

Simple Ira Vs 401 Plans

Choosing the right retirement plan for your employees is an important decision, and requires thorough research. To evaluate different options, such as SIMPLE IRA vs. 401 plans, here are some key preliminary questions to ask:

- Who and what type of employees are you trying to benefit?

- What benefits do you want to offer the selected group of employees?

- What benefits administration costs are you able to pay?

- Will you provide these benefits to part-time employees?

Once you’ve answered these questions, it’s time to investigate the different retirement plan choices.

Don’t Miss: How To Find 401k From Previous Employer

How Much Can I Contribute To A 401 And Simple Ira

In 2021, the contribution limit for traditional 401 plans is $19,500, with an additional catch-up contribution of $6,500 for plan participants who are age 50 and older.

The contribution limit for SIMPLE IRA plans is $13,500 for 2021. Participants who are age 50 and older may make catch-up contributions up to $3,000, if the plan permits it. If an employee participates in any other employer retirement plan during the year, the total amount of contributions that they can make to all plans is limited to $19,500.

Percent Employer Contributions Limit

If you own your own business, you are limited to putting in 20 percent of net earnings from self-employment into a 401 account. This does include the employee contribution to the retirement account.

Net earnings exclude the amount used for S-Corp distributions since its not considered earned income.

Recommended Reading: Can I Check My 401k Online

What Is A 401 Account

Many employers offer the option to save for retirement using a 401 account. This type of account is named for the section of the tax code that helped establish it. It offers tax advantages for employees who use it to save money for their golden years.

Employers usually offer a match on contributions so it always makes sense to at least get the full match, regardless. For example, the company may offer to match dollar-for-dollar contributions made by employees up to a certain amount. This is free money in addition to your salary and can be a great way to supercharge your savings.

You cannot tap the money in your 401 account until age 55 or 59.5, or you will face a 10 percent early withdrawal penalty. Once you reach 55 or 59.5, you can withdraw your contributions, earnings, and dividends penalty-free. Keep in mind you will have to pay income tax on the distributions from a traditional 401 account.

You may also have the option to contribute to a Roth 401 account. Unlike traditional 401 accounts, money contributed to a Roth 401 is taxed similarly to a Roth IRA i.e. you pay taxes on contributions. However, all earnings and contributions can be withdrawn tax-free upon reaching 55 or 59.5 years of age. This can be an advantage for those who may be in a higher tax bracket in retirement.

What Are The Contribution Limits For 401 Accounts?

Why Have You Set The Default Life Expectancy Of The Calculator To 95 Years

For starters, people are living longer. Even though the average life expectancy in Canada is 82 years, many people live past this. It’s better to have more money tucked away for retirement than to run out of savings. Extra savings can always be passed down to your beneficiaries. You can change the default life expectancy if you think you’ll live a longer or shorter life.

Read Also: Can You Have Your Own 401k

Maximizing 401ks And Benefits While Moonlighting Multiple Jobs

Have you ever wondered if you could maximize contributions to more than one 401K while moonlighting multiple jobs? Youre not alone. Years ago, when I landed my first contracting side hustle, I did some research and started a solo 401K . Since then, Ive been maxing out multiple 401Ks per the IRS rules and so can you. Ill focus exclusively on the solo 401K because it provides more flexibility than other self-directed retirement plans like the SEP-IRA. You can read why here. TLDR the solo 401K is superior. Additionally, Ill delve into how you can optimize employer-provided benefits like healthcare and life insurance while doubly employed perks that are often overlooked when considering taking a second job as a contractor than an employee.

To make things simple, lets assume only pre-tax retirement contributions. Its better to delay taxes until old age when your tax liability is lower unless, of course, your employers offer the mega backdoor Roth IRA option . More on the mega backdoor Roth IRA in a fast follow-on.

Sidenote: Overemployed is technically sunlighting since youre working multiple full-time jobs simultaneously. But hey, whatever.

Withdrawing From Your 401 Before Age 55

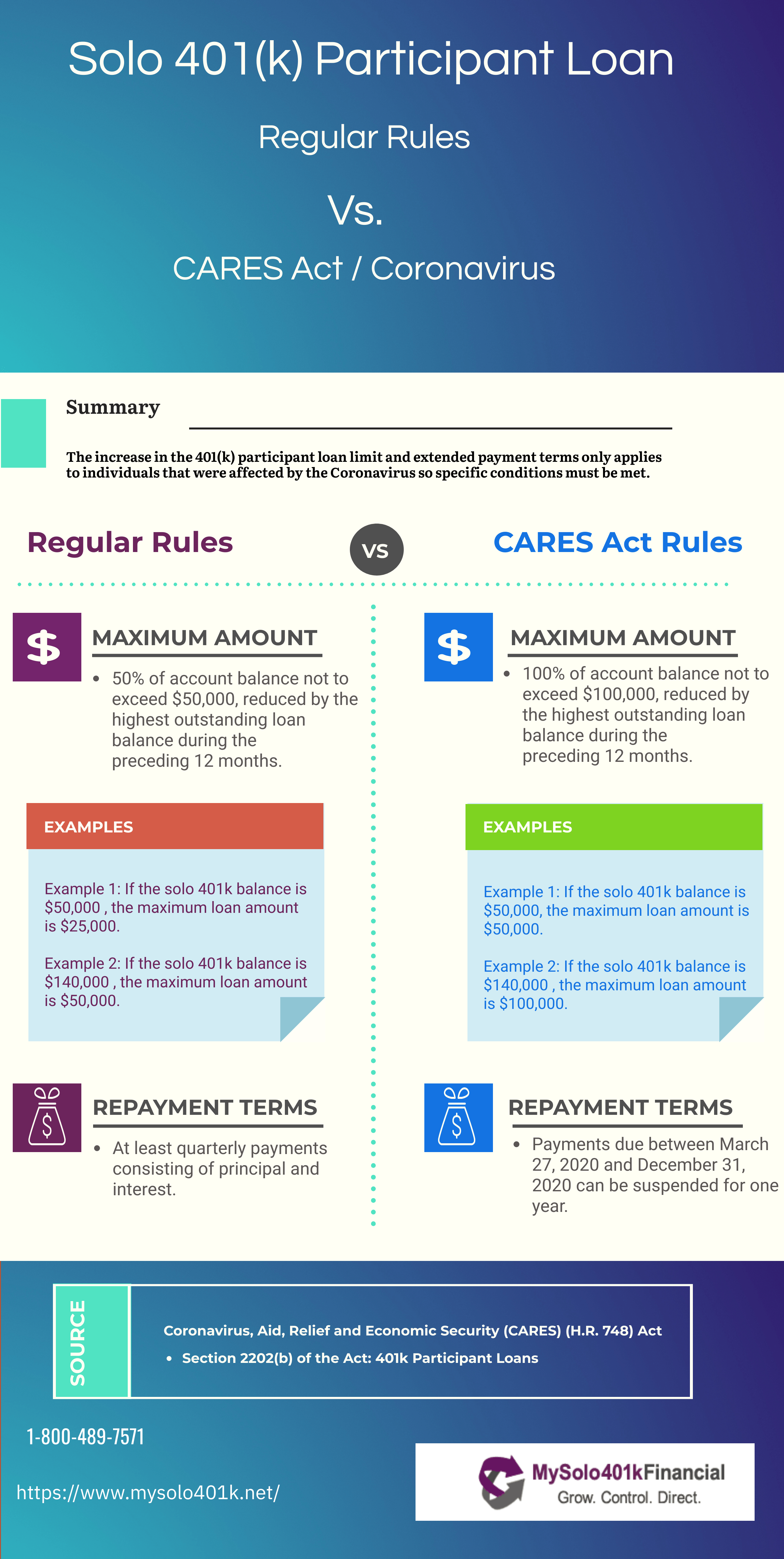

You have two options if you’re younger than age 55, and if you still work for the company that manages your 401 plan. This assumes that these options are made available by your employer. You can take a 401 loan if you need access to the money, or you can take a hardship withdrawal. but only from a current 401 account held by your employer. You can’t loans out on older 401 accounts. You can roll the funds over to an IRA or another employer’s 401 plan if you’re no longer employed by the company. But these plans must accept these types of rollovers.

Think twice about cashing out. You’ll lose valuable creditor protection that stays in place when you keep the funds in your 401 plan at work. You could also be subject to a tax penalty, depending on why you’re taking the money.

Also Check: How To Tell If You Have A 401k

You Can Have More Than One 401 Plan But There Are A Few Things You Should Know

Image source: www.gotcredit.com.

A 401 is the most popular type of retirement plan private-sector companies offer, so you may have several different 401 accounts over your working lifetime. Or, if you work multiple jobs, you might be offered 401 plans from more than one employer simultaneously. Is this allowable?

The short answerThe short answer is yes, you can have multiple 401 accounts at a time. In fact, it’s rather common for people to have an old 401 account from their previous employer, in addition to their current one.

Another common situation is where individuals earn self-employment income in addition to income from their job. With self-employment income, these people can set up and contribute to an individual 401 even if they have another 401 at their job.

Overall contribution limitsIf you have more than one active 401 account, you need to be aware that the IRS’s contribution limit for elective deferrals refers to your combined 401 accounts.

For the 2016 tax year, you can choose to defer up to $18,000 of your pay into your 401 plan. If you have more than one 401, this limit applies to your total elective deferrals. For example, if you choose to contribute $15,000 to your primary employer’s 401 plan, you would be limited to $3,000 in elective contributions to any other plans you participate in. Also, if you’re over 50, you are allowed an additional $6,000 in catch-up 401 contributions for a total of $24,000.

Rollover Ira There Are Many Options

- Print icon

- Resize icon

Q.: Hi Dan, I have multiple 401 accounts from various jobs over my career. My current company has a 401 plan. I participate in the plan and there is a company match. Should I roll all my other 401 plans into my current plan, leave them where theyre at, or move them to an IRA or other investment? I dont have a lot of time to manage my investments.

Thanks, Phil

A.: Phil, To avoid taxation, the money needs to stay in a 401 or an IRA, and any rollover needs to be done properly. So, I would say No to any nonretirement accounts.

The differences between 401s and IRAs come in a variety of forms and there are a lot of angles to this issue. I will only be able to address a few of these differences in this limited space. Talking to a good financial planner would be wise, especially with little time to attend to these matters yourself. Id look for a fee-only financial planner at the National Association of Personal Financial Advisors www.napfa.org and the Financial Planning Association. There are many good fee-based planners, but true fee-only planners have fewer, clearer, and more easily managed conflicts and are subject to fiduciary duty at all times.

The first thing you should consider is simplicity. If youre happy with your current employers 401, it will be simpler for you to roll everything into your current 401 plan. A good plan has a variety of investment options and low fees.

Read Also: How Much To Invest In 401k To Be A Millionaire

Can I Have Both A 403 And A 401

If your employer offers both a 403 and a 401, you can contribute to both plans in order to boost your retirement savings. However, there are limits on the combined total of so-called salary reduction contributions you can make in a tax year.

The contribution limit is $19,500 for 2021 and $20,500 for 2022. For those over 50, the catch-up contribution limit is $6,500. These are the same limits placed on contributions to either plan individually. So you are free to use both vehicles, but the caps on tax-deferred contributions remain the same.

How Much Do I Need To Retire

How much you need in retirement will depend on how your income and expenses change when you retire. As a general rule, you’ll want to aim for at least 70-80% of your pre-retirement income for each year of your retirement. In retirement you may spend less money on savings, housing, tax, and transportation to work, but more on hobbies, utilities, and healthcare. Ask yourself when I retire will I need same amount of money I’m earning now or less? You could use a tool to figure out your ideal replacement ratio.

Also Check: How To Check Your 401k Balance Online

Benefits Of A Solo 401

Solo 401s provide several advantages over other types of retirement accounts.

One of the main advantages is that contribution limits are typically the highest among retirement plans. Like an employer-sponsored 401, contributions can be made from the employee and employer. With a solo 401, you wear both hats and can make contributions in both roles.

Rule # 2 $58k Per Unrelated Employer

The IRS also only allows you and your employer to put a total of $58,000 for 2021 per year into a 401. This includes the employee contribution, any match from the employer, and any employer contributions. This is the same limit for a which is technically all employer contributions. However, unlike rule # 1, this limit applies to each unrelated employer separately.

Unrelated employers means that the businesses doing the employing are not a controlled group. There are two types of controlled groups:

So if the two businesses you are involved in aren’t a controlled group, and they each have a 401, and a SEP-IRA) you get two $57K limits. Pretty cool, huh? There are several common examples where this could apply to a physician:

Multiple 401k Example One

A 40-year-old single physician is an employee of two completely unrelated hospitals. The first pays her $200K per year and matches 100% of her first $5K put into the 401. It also offers her a 457. The second pays her $100K per year and matches 50% of the first $7K she puts into her 401. What retirement accounts should this physician use in order to maximize her contributions in 2020?

- Hospital 1 401: At least $5K = $10K

- Hospital 1 457: $19.5K

Multiple 401k Example Two

Multiple 401k Example Three

Don’t Miss: How Do I Know Where My 401k Is

Is Solo 401 Tax Deductible Solo 401 Tax Advantages

The nice thing about a solo 401 is you get to pick your tax advantage: You can opt for the traditional 401, under which contributions reduce your income in the year they are made. In that case, distributions in retirement will be taxed as ordinary income. The alternative is the Roth solo 401, which offers no initial tax break but allows you to take distributions in retirement tax-free.

In general, a Roth is a better option if you expect your income to be higher in retirement. If you think your income will go down in retirement, opt for the tax break today with a traditional 401.

Because of these tax perks, the IRS has pretty strict rules about when you can tap the money you put into either type of account: With few exceptions, youll pay taxes and penalties on any distributions before age 59 ½.

»Want more info? Heres our in-depth comparison of Roth and traditional 401s

The Rules For Contributing To Multiple Retirement Accounts In The Same Year

Jim Blankenship is the founder and principal of Blankenship Financial Planning, Ltd., a financial planning firm providing hourly, as-needed financial planning and advice. A financial services professional for over 25 years, Jim is a CFP professional and has earned the Enrolled Agent designation, a designation that qualifies him as enrolled to practice before the IRS. Jim is also a NAPFA-registered financial advisor, which designates him as a Fee-Only Financial Advisor.

Quite often, we are faced with several options for retirement savings. With these decisions, it is important to understand what options are actually available to you such as, can you contribute to both a 401 or 403 plan and an IRA in the same year?

Don’t Miss: Can I Use My 401k To Start A Business

Working With Your Financial And Tax Professionals

A 401 plan can become the cornerstone of a personal retirement savings program, providing the foundation for future financial security. Consult your financial and tax professionals to help you determine how your employer’s 401 and other savings and investment plans could help make your financial future more secure.

Important NoteEquitable believes that education is a key step toward addressing your financial goals, and we’ve designed this material to serve simply as an informational and educational resource. Accordingly, this article does not offer or constitute investment advice and makes no direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your needs, goals and circumstances are unique, and they require the individualized attention of your financial professional. But for now, take some time just to learn more.

Please be advised that this material is not intended as legal or tax advice. Accordingly, any tax information provided in this material is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transactions or matter addressed and you should seek advice based on your particular circumstances from an independent advisor.

What’s the next step for you?

A financial professional can help you decide. Let’s talk.