Heres An Example Of How You Could Have A Years Worth Of Salary Saved In Your 401 By Age 30

Here are our assumptions:

- You start work at 22

- You can immediately contribute to a 401

- Your employer will match 50% of your contributions up to a maximum of 6% of your salary

- Your investments get an 8% average return

- You get annual raises of 3%

With these assumptions, youll need to contribute about 9% of your salary every year to reach this goal. Here are year-by-year totals:

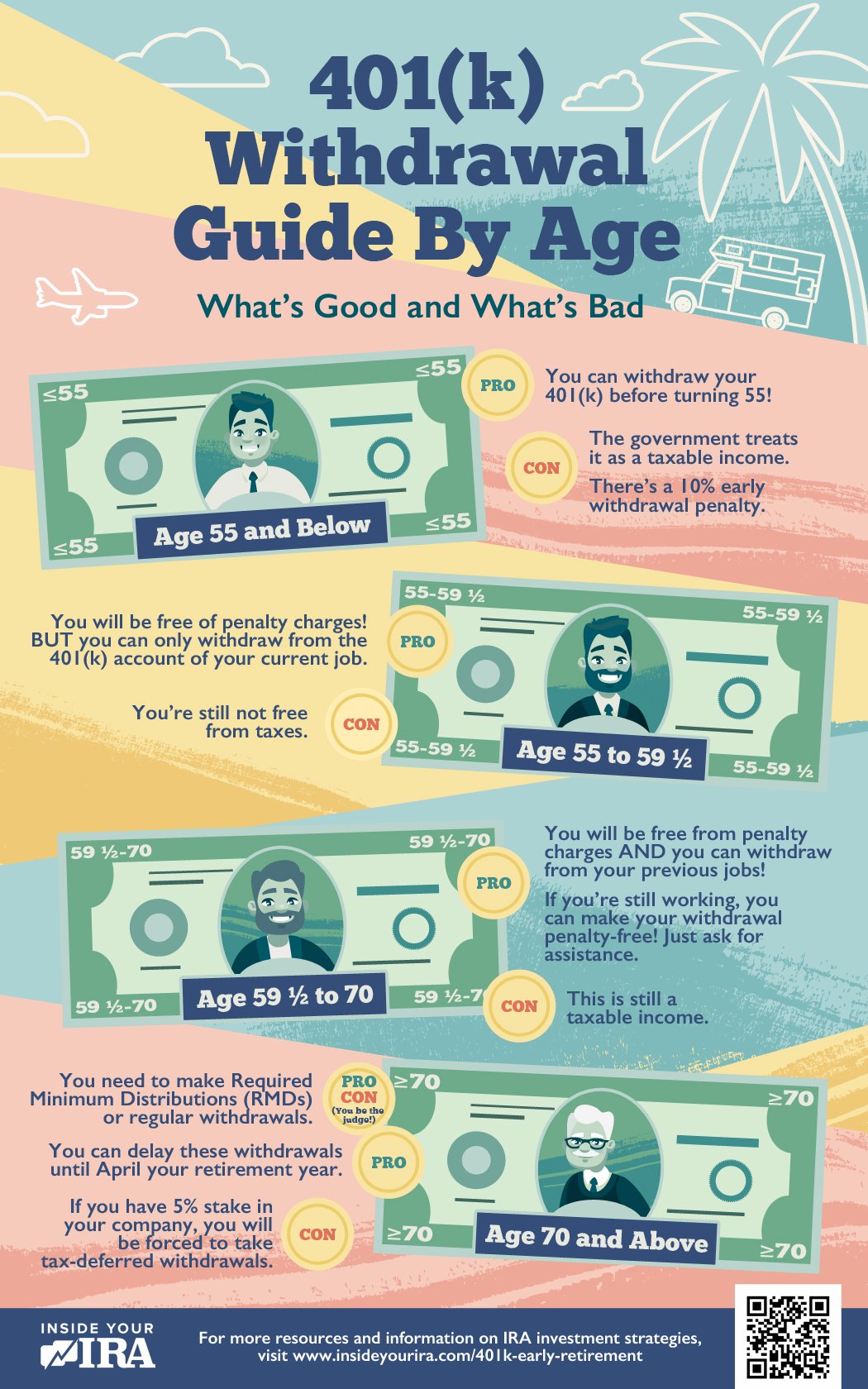

When Can You Withdraw From Your 401

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

If youre the kind of take-charge retirement planner whos diligently contributing to a 401 fund, receiving matching contributions from your employer, and watching your savings start to stack, you might find yourself wondering When can I withdraw from my 401 account?

The answer depends on a number of factors including your age, whether youre still working or already retired, if you qualify for a hardship withdrawal, whether it makes sense to take out a 401 loan, or rollover your 401 into another account.

Distribution Rules Must Be Followed

Generally, distributions cannot be made until a “distributable event” occurs. A “distributable event” is an event that allows distribution of a participant’s plan benefit and includes the following situations:

- The employee dies, becomes disabled, or otherwise has a severance from employment.

- The plan ends and no other defined contribution plan is established or continued.

- The employee reaches age 59½ or suffers a financial hardship.

See When can a plan distribute benefits?

Benefit payment must begin when required. Unless the participant chooses otherwise, the payment of benefits to the participant must begin within 60 days after the close of the latest of the following periods:

- The plan year in which the participant reaches the earlier of age 65 or the normal retirement age specified in the plan.

- The plan year which includes the 10th anniversary of the year in which the participant began participating in the plan.

- The plan year in which the participant terminates service with the employer.

Loan secured by benefits. If survivor benefits are required for a spouse under a plan, the spouse must consent to a loan that uses the participant’s account balance as security.

Read Also: What’s A Good Percentage For 401k

Things To Consider When Withdrawing From Your 401 At Age 55

A common question people ask is, When can I withdraw money from my 401? After all, you worked hard for many years, and its only natural to want to know when you can reap the benefits of that time and effort.

You can technically withdraw money out of your 401 at any age. But if you take out money before youre at least age 59 ½, then your withdrawal will incur a 10% penalty in addition to the income taxes you must already pay.

However, you do have an opportunity to dig into your 401 starting at age 55 and not pay penalties on that withdrawalprovided you meet two criteria:

- You are no longer employed by the company with whom the 401 is affiliated

- You left that employer during or after the calendar year in which you reached age 55

Keep these four things in mind if youre thinking about taking 401 withdrawals from an old employer planbetween the ages of 55 and 59 ½:

For Financial Independence In Retirement

The 401 makes it easy to build wealth for retirement. Once you set your preferences, the work of saving and investing happens behind the scenes. Plus, you have tax savings and, possibly, matching contributions that expedite your savings momentum.

Here’s what it comes down to: The earlier you start contributing to a 401, the more you’ll get from its perks and the richer you can be when you retire.

Planning for retirement when you’re your own boss.

You May Like: How Much Should I Have In My 401k At 60

Roth Ira Contribution Ranges

Like a traditional tax-deductible IRA, the maximum Roth IRA contribution for 2022 is $6,000, and the catch-up contribution for those 50 and older is $1,000, for a total maximum contribution of $7,000 for those age 50 or older.

Keep in mind that these maximums assume you have earned income at or above these levels. If you earn less, your maximum is lower. For example, if you earn $1,000 in 2022, the maximum you can contribute is not $6,000 but $1,000.

For a discussion of what is earned income for purposes of an IRA, see Table 1-1 of IRS Publication 590-A. Examples: Wages, salaries, commissions, self-employment income. Whats not compensation for IRA purposes? Examples: Interest and dividend income, pension or annuity income.

For the rest of this discussion, lets assume you earn substantially more.

Benefits Must Not Be Assigned Or Alienated

The plan must provide that its benefits cannot be assigned or alienated. A loan from the plan to a participant or beneficiary is not treated as an assignment or alienation if the loan is secured by the participant’s account balance and is exempt from the tax on prohibited transactions under IRC 4975 or would be exempt if the participant were a disqualified person. See Publication 560 for additional information on prohibited transactions. A loan is exempt from the tax on prohibited transactions under IRC section 4975 if it:

- Is available to all such participants or beneficiaries on a reasonably equivalent basis,

- Is not made available to highly compensated employees ) in an amount greater than the amount made available to other employees,

- Is made in accordance with specific provisions regarding such loans set forth in the plan,

- Bears a reasonable rate of interest, and

- Is adequately secured.

Also, compliance with a qualified domestic relations order , does not result in a prohibited assignment or alienation of benefits.

Don’t Miss: What Happens To 401k When You Die

Generate Income Beyond Investing

Your investments are likely a stream of income you plan to use in retirement. Besides your portfolio and retirement savings, however, you should think of other ways to increase your earnings, like getting a side hustle.

A 2019 Bankrate survey found that 45 percent of Americans earn extra income on the side. Freelancing or serving as a consultant can provide additional earnings if youre behind when it comes to saving for retirement. And its less risky than alternative routes like buying an annuity.

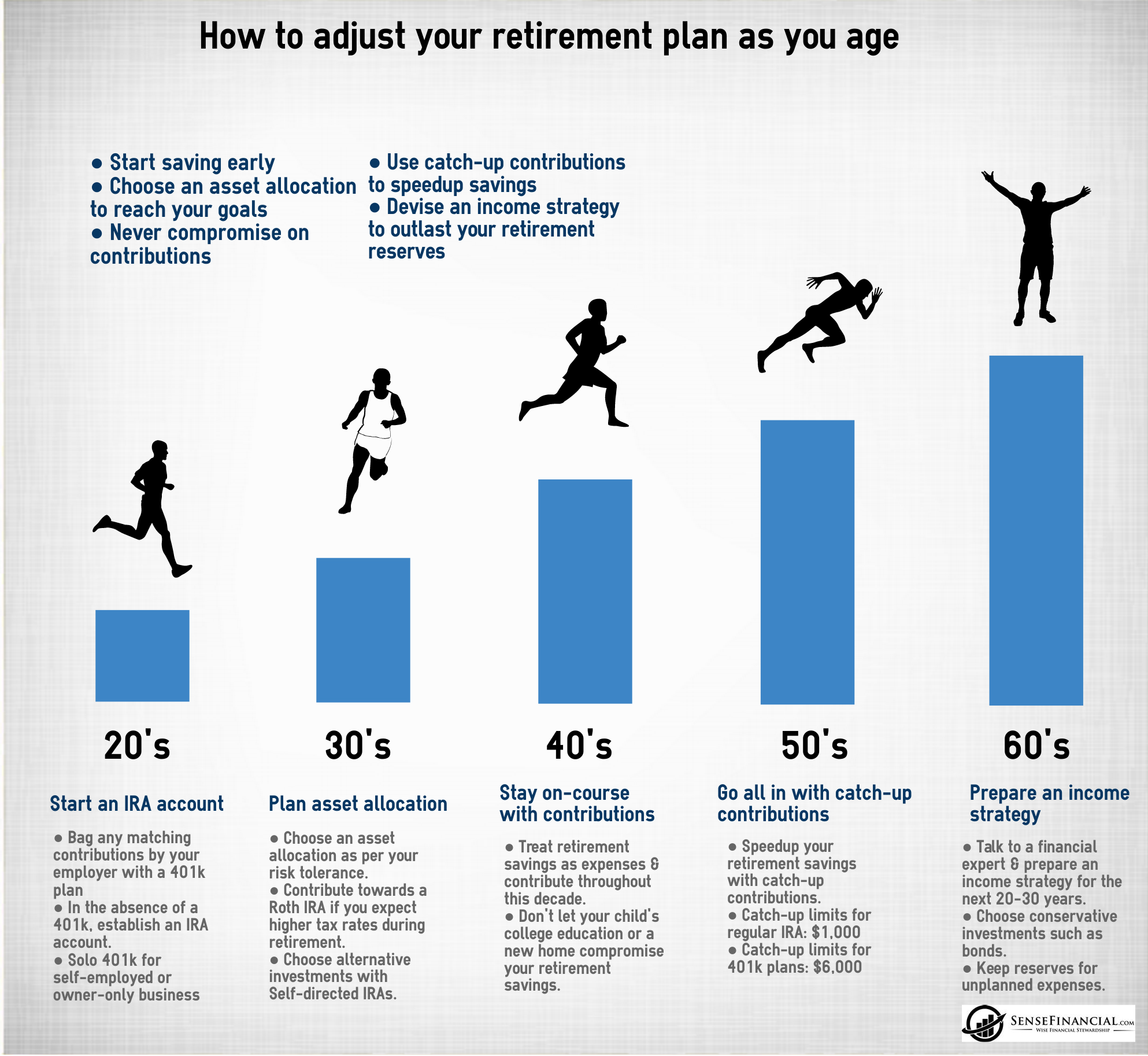

Starting Late Turn Up The Dial On Your Contributions

Making the most of the early years of your career is one way to hit your retirement savings goaland probably the easiestbut it’s not the only way. If you have less time to save for retirement, you’ll simply need to save more each year.

For example, as we saw above, if your goal is to have $1 million at age 65 and you save just under $4,500 each year starting at age 20, there’s a good chance you’d meet your goal.

If you start at age 30 instead, you’ll have to save about $9,000 each year for the same chance at reaching your goal.

Beginning at age 40? You’ll need to save about $18,000 a year. And if you wait until age 50, you’ll need to put away over $40,000 a year to give yourself a good shot at reaching your goal.*

In other words, no matter what your current age, you’ll always be better off starting now rather than waiting until later.

Read Also: How To Find Out If You Have A 401k Account

What Are The Potential Tax Benefits Of A Solo 401

One of the potential benefits of a Solo 401 is the flexibility to choose when you want to deal with your tax obligation. In a Solo 401 plan all contributions you make as the “employer” will be tax-deductible to your business with any earnings growing tax-deferred until withdrawn. But for contributions you make as an “employee” you have more flexibility. Typically, your employee “deferral” contributions reduce your personal taxable income for the year and can grow tax-deferred, with distributions in retirement taxed as ordinary income. Or you can make some or all of your employee deferral contributions as a Roth Solo 401 plan contribution. These Roth Solo 401 employee contributions do not reduce your current taxable income, but your distributions in retirement are usually tax-free. Generally speaking, there are tax penalties for withdrawals from a Solo 401 before 59 1/2 so be sure to know the specifics of your plan.

Employee Participation Standards Must Be Met

In general, an employee must be allowed to participate in a qualified retirement plan if he or she meets both of the following requirements:

- Has reached age 21

- Has at least 1 year of service

- plan may require 2 years of service for eligibility to receive an employer contribution if the plan provides that after not more than 2 years of service the participant is 100% vested in all plan account balances. However, the plan must allow the employee to participate by making elective deferral contributions after no more than 1 year of service.)

A plan cannot exclude an employee because he or she has reached a specified age.

Leased employee. A leased employee is treated as an employee of the employer for whom the leased employee is providing services for certain plan qualification rules. These rules apply to:

- Nondiscrimination requirements related to plan coverage, contributions, and benefits.

- Minimum age and service requirements.

- Vesting requirements.

- Limits on contributions and benefits.

- Top-heavy plan requirements.

Certain contributions or benefits provided by the leasing organization for services performed for the employer are treated as provided by the employer.

Also Check: When You Leave A Job Do You Get Your 401k

Traditional Ira Vs Pretax 401

It used to be the case that if you were older than 70½, you lost the ability to contribute to a traditional IRA. But under the new law, there are no age restrictions. There is also no age restriction placed on the 70+ crowd for contributions to a 401.

Nonetheless, 2020 contribution limits for a 401 are higher than those of an IRA, making the 401 ultimately a better choice.

With an IRA, contributions are capped at $6,000 per year, or $7,000 if you’re over 50 for 2020 and 2021. But for 401s, the limit is $19,500 for 2020 and 2021 with an additional catch-up contribution for those over 50 of $6,500, for a total of $26,000.

In many cases, the older worker is a self-employed consultant or contractor: if that’s your situation, be aware of the RMD requirements placed on the 5% or greater business owner. At first glance, the idea of contributing to a plan that requires you to take RMDs each year sounds silly, but if you do the math it’s really not a bad deal.

What If You Only Need The Money Short Term

Although there are other qualifying exceptions to withdraw IRA or 401k assets penalty-free, those listed above are the major ones. But suppose youre not interested in paying any taxes at all. You can still use your 401k to borrow money via a loan. The interest goes to you, the loan isnt taxable, and it wouldnt show up on your credit report. Heres how it works.

Recommended Reading: Can I Move Money From 401k To Ira

Kids And Money: Start Them Early With A Family 401

One of the best things you can do for your kids is get them to start saving money early in life. I’m doing what I can with a self-fashioned family 401, where I match my kids’ summer earnings with a contribution to their Roth IRA.

This is a familiar subject to my regular readers. But it’s such a powerful and simple device — one that I’ve not seen widely mentioned — that I want to spend a little more time with it.

The concept is simple. Every penny my college-aged kids earn in a summer job I match — part in cash, but most in the form of a contribution to their Roth IRA. This gives them an incentive to work hard and to maximize their earning potential. It also approximates a real-world 401 plan, exposing them to an important life-long savings vehicle and, I hope, predisposing them to sign up for the real deal as soon as they are employed full-time.

For good reason, 401 plans have come under attack since the Great Recession. Despite their drawbacks, though, a 401 plan where an employer matches a portion of everything you save is the closest thing to a gift you’ll find in the investment world. Yet some 40% of workers who are eligible for a 401 plan do not take part, according to the Employment Benefit Research Institute. I don’t want my kids, as adults, to be part of that statistic.

My hope is that the kids will see their money start to grow and make their own contributions when the Bank of Dad is done. Until then, though, the family 401 is my solution.

Is It A Good Idea To Use The Rule Of 55

Just because you can take distributions from your 401 or 403 early doesn’t mean you should. Depending on your financial situation, it might be better to let your money continue to grow. Holding off withdrawals could help you better position yourself for a financially sound future. If you’re tempted to withdraw retirement funds before you’re eligible, instead consider finding another job, drawing from your savings or using other sources of income until you need to tap into your retirement savings.

If you decide to begin withdrawing funds from your 401 early, the long-term value of your portfolio will likely decrease. It’s essential that you time your withdrawals carefully and take into account how much they would cost you in taxes. To create a strategy that makes sense in your situation, consider working with a financial advisor or a retirement planner.

Recommended Reading: Should I Transfer My 401k To A Roth Ira

The Average 401k Balance By Age

401k plans are one of the most common investment vehicles that Americans use to save for retirement. The 401k is an employer-sponsored plan that allows you to save for retirement in a tax-sheltered way to help maximize your retirement dollars.

If your employer offers a 401k and you are not utilizing it, you may be leaving money on the table especially if your employer matches your contributions.

While the 401k is one of the best available retirement saving options for many people, only 32% of Americans are investing in one, according to the U.S. Census Bureau. That is staggering given the number of employees who have access to one: 59% of employed Americans.

Do you have enough in your 401k to retire when you want? You can find out using Personal Capitals free and secure Dashboard, which includes a Retirement Planner for testing different scenarios.

As American households face the financial fallout of the COVID-19 pandemic, many have put retirement saving on the back burner. In a recent Personal Capital survey, only about 50% of people reported currently contributing to their 401k every paycheck. Around 49% said they receive the maximum match from their employer.

So how much do people actually have saved in their 401k plans? And how does this stack up against what they could have saved if they were maxing out their 401k every year?

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

Read Also: Can You Transfer Your 401k

Advantages Of Roth Iras For Kids

Because many kids don’t earn enough money to benefit from the up-front tax deduction associated with traditional IRAs, it makes sense in most cases to focus on Roth IRAs. In general, the Roth IRA is the IRA of choice for minors who have limited income nowas it’s recommended for those likely to be in a higher tax bracket in the future.

“If a child keeps until age 59½ , any withdrawal will be tax-free. In retirement, they would likely be in a much higher bracket, so would effectively be keeping more of their money,” says Allan Katz, president of the Comprehensive Wealth Management Group, LLC, in Staten Island, NY.

Even if a child wanted to use the funds earlier than that, the account would be advantageous: Roth IRAs are tailor-made for people whose tax bracket is likely to be higher when they need to take the money out, as opposed to when they’re putting it in.

What Did The Ira Call The Troubles

In 1977 the IRA created a new plan that they called the Long War, in which they would keep their plans for most of the Crisis. Sinn Féin maintains the media war and is the public and political voice of the movement .

What do the Irish call the troubles?

The Troubles is an ethno-nationalist conflict in Northern Ireland that spanned some 30 years from the late 1960s to 1998. It is also known internationally as the Northern Ireland conflict, sometimes described as an unusual value or low value.

Was the IRA punished?

In the 1970s, when the IRA took control of the organization of no -go places, humiliation was often used as a form of punishment. The victim was forced to hold a paper or tar and feather. In government areas, women accused of colluding with British soldiers shaved their heads.

Recommended Reading: How To Manage 401k In Retirement