Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

A qualified distribution from a Roth IRA is tax-free and penalty-free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59½ or older, disability, qualified first-time home purchase, or death.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Why I Roll Over My Old 401ks

Like many thirtysomethings, Im on my third job since college. At this rate, I will have ten, maybe eleven, jobs before I retire. Each job will likely offer me a new retirement plan. In my sixties, I could have ten or more separate work-sponsored retirement accounts, each with their own logins, passwords, and fees.

Instead, I have rolled over my old work retirement accounts to an individual retirement account , and believe that more millennials should do the same. Currently, the average 25-34 year old has a 401K or 403b that they have left behind at a previous job. I want to put 401K rollover on the I-just-got-a-new-job checklist right after posting a LinkedIn status update and scheduling a fun employment vacation. Heres why.

When you change jobs, you have four options for dealing with your work-sponsored retirement account:

Cash out

Keep your money where it is

Roll your account to your new employer

Roll your account to an individual retirement account through a financial services company like Vanguard, Schwab, or Blackrock.

Returning to the four options you can choose from, cashing out your retirement account is the worst option. When you cash out a retirement account, you generally have to pay taxes and an early withdrawal fee of 10%. In addition, you are effectively resetting the clock on starting your retirement savings growth.

Cares Act 401k Withdrawal Deadline 2021

What are the withdrawal rules for a 401k? When you withdraw money from a 401k, you must include the money you withdraw as income on your federal income tax return. In general, 20 percent of the distribution must be withheld for estimated tax payments. In addition to the taxes you owe, you must also pay a 10% early withdrawal penalty.

Also Check: How To Find My Fidelity 401k Account Number

How Are You Taxed On 401k Withdrawals

How To Calculate Income Tax When Deriving 401 Plan Calculate your taxable income for the year. Because the IRS uses a tiered income tax, the tax amount is higher for those who pay. Find your tax category in IRS Publication 17 based on estimated taxable income. Multiply your 401k plan withdrawal amount by your marginal income tax rate.

Can i buy and sell stocks in the same dayCan I buy after hours? Yes, you can buy shares after the normal trading day. Post-trade or post-trade negotiations usually take place between 4 a.m. M. And 8:00 a.m. MET. Trading outside office hours uses electronic communication networks, also known as ECNs.What is the best trading platform to use?TD Ameritrade is at the top of this rank

Advantages Of A 401 Or 403 Rollover

First, you can pick an IRA provider who is known for their commitment to low fees and investment variety.

Certain IRA providers like Vanguard, Blackrock, and Schwab are known for their transparency and commitment to low fees. Many charge no administrative fees on IRAs with over $10,000 and offer expense ratios less than 0.2% on a large variety of investments.

In addition, while a 401 or 403 will offer a curated list of investing options, an IRA will give you access to a much larger list of funds.

The going wisdom used to be that the buying power of a large 401 plan would get you better pricing than going it alone. However, in a world where there are NO-fee mutual funds, you dont need your employer to get access to cheap investment options.

Plus, if you want to invest in socially good funds or other specific accounts, you probably wont have access through an employer plan like you will through an IRA.

Second, you can see all your money in one place.

As noted above, most financial experts advise that you invest in risky assets like stocks when youre young and shift to more conservative investments like bonds as you get closer to retirement.

Its much easier to make sure your money is invested strategically and that your savings are on track for retirement when its in one account with one password and one fee disclosure.

Third, even if your 401 or 403 is performing well, you can probably get that same growth at a lower cost in an IRA.

Also Check: Can I Borrow Against My 401k

Will I Pay Taxes When Rolling Over A Former Employer

Generally, there are no tax implications if you move your savings directly from your employer-sponsored plan into an IRA of the same tax type to a Roth IRA).

If you choose to convert some or all of your pretax retirement plan savings directly to a Roth IRA, the conversion would be subject to ordinary income tax.

Previous 403b Roth Ira Rollover Rules

Prior to 2008, you could only roll funds over from a Traditional IRA, a SEP IRA, or a SIMPLE IRA to your Roth IRA.

However, as of 2008, you can roll over to your Roth IRA all, or part, of a rollover distribution you receive from your :

- Tax-sheltered annuity plan

- Employer’s qualified pension, profit sharing, or stock bonus plan

- Annuity plan, or

- Governmental deferred compensation plan

Because of the law change, your 403b is now eligible for a direct rollover distribution into your Roth IRA. So if you wanted to perform a 403b rollover to a Roth IRA prior to 2008, but couldn’t… Now’s your opportunity!

The rules for such a rollover are essentially the same as a Traditional IRA rollover to a Roth IRA…

Recommended Reading: How Do I Cash Out My 401k Early

Disadvantages Of Rolling Over Your 401

1. You like your current 401

If the funds in your old 401 dont charge high fees, you might want to take advantage of this and remain with that plan. Compare the plans fee to the costs of having your money in an IRA.

In many cases the best advice is If it isnt broke, dont fix it. If you like the investment options you currently have, it might make sense to stay in your previous employers 401 plan.

2. A 401 may offer benefits that an IRA doesnt have

If you keep your retirement account in a 401, you may be able to access this money at age 55 without incurring a 10 percent additional early withdrawal tax, as you would with an IRA.

With a 401, you can avoid this penalty if distributions are made to you after you leave your employer and the separation occurred in or after the year you turned age 55.

This loophole does not work in an IRA, where you would generally incur a 10 percent penalty if you withdrew money before age 59 1/2.

3. You cant take a loan from an IRA, as you can with a 401

Many 401 plans allow you to take a loan. While loans from your retirement funds are not advised, it may be good to have this option in an extreme emergency or short-term crunch.

However, if you roll over your funds into an IRA, you will not have the option of a 401 loan. You might consider rolling over your old 401 into your new 401, and preserve the ability to borrow money.

What Is The Difference Between A Direct Vs Indirect Rollover

The easiest and safest way to rollover your 403 plan is to do a direct rollover, in which your money transfers electronically from the trustee of your old plan to the trustee of your new plan. If you choose an indirect rollover, your plan trustee sends you a check directly, and you only have 60 days to get the money into a new account.

Your trustee will be required to withhold 20 percent of your rollover, so if you want to fund the full amount, you’ll have to come up with that 20 percent from another source. If your 403 rollover is not the full amount, that 20 percent withholding will be taxed as income and may also incur a 10 percent penalty for early distribution.

If you fail to complete your rollover within 60 days, the IRS will consider your rollover to be a distribution, and you’ll owe tax on the full amount. If you’re under age 59 1/2, you might also owe an additional 10 percent early withdrawal penalty.

References

Also Check: How Does 401k Work If You Quit

Transferring Money From 403b To 401k

I worked for an employer with a 403b and contributed, but my new employer only does 401k.

Can I put the money from the 403b into the 401k? How?

You can move money from a 403b to a 401k plan, but the question you should ask yourself is whether it is a wise decision. Unless there are specific reasons for wanting to invest in your new employer’s 401k , you would be much better off moving the 403b money into an IRA, where you have many more choices for investment and usually can manage to find investments with lower investment costs than in a typical employer’s 401k plan.On the other hand, 401k assets are better protected than IRA assets in case you aresued and a court finds you to be liable for damages the plaintiff cannot come afterthe 401k assets if you cannot pay.

The following January, you will receive a 1099-R form from your 403b planshowing the amounttransferred to the new custodian, with hopefully the correct code letterindicating that the money was rolled over into another tax-deferred account.

The Pros And Cons Of Funding A 403 Rollover Account With Paper Gold

Paper gold is just thata declaration of gold value on paper or papers that state you hold shares in a gold mine or a company that owns a gold mine. You can find companies like this on the Gold Miners Index . ETFs are another form of paper gold whose value rises and falls depending on how risky the financial climate is.

Owning part of a mining facility can be very profitable but you are also prey to circumstances beyond your control. You are at the mercy of regulations and taxes imposed on these companies by the federal government. If you buy stock in a mine that is located in a foreign country you could profit more due to the lack of regulation. However, if your mine is in a volatile, unstable country you run the risk of it being confiscated by a temporary government, rendering your investment worthless.

Owning stock in a mine also means that your profits depend on the costs or production and the quality of management in charge of the facility. Poor management can mean that you are left holding worthless paper if the mine shuts down. You are also out of luck if the nation experiences a currency collapse since the value of your gold is only on paper, not in your physical possession.

Don’t Miss: How To Rollover Ira To 401k

Do I Have To Pay Taxes When I Roll Over My Funds

To avoid mandatory federal income tax withholding on the distribution, be sure to have your former employer send the money directly to the IRA custodian. If you dont, your former employer must withhold 20% for federal income taxes. When the money is sent directly to you, you have 60 days to put the funds into an IRA including the 20% that was withheld, which must be made up with other assets or it will count as a distribution and could be subject to federal income taxes and a 10% additional federal tax, if youre under age 59½ and no exception applies.

Are There Rollover Options For A 403

Since a 403 is a tax-deferred account, you can rollover your 403 plan into most other types of tax-deferred accounts. For example, if you have an individual retirement account, you can roll your 403 plan over into your IRA. If you start a new job, rolling over a 403 into your new employer’s 403 plan is also an option, if the employer offers one.

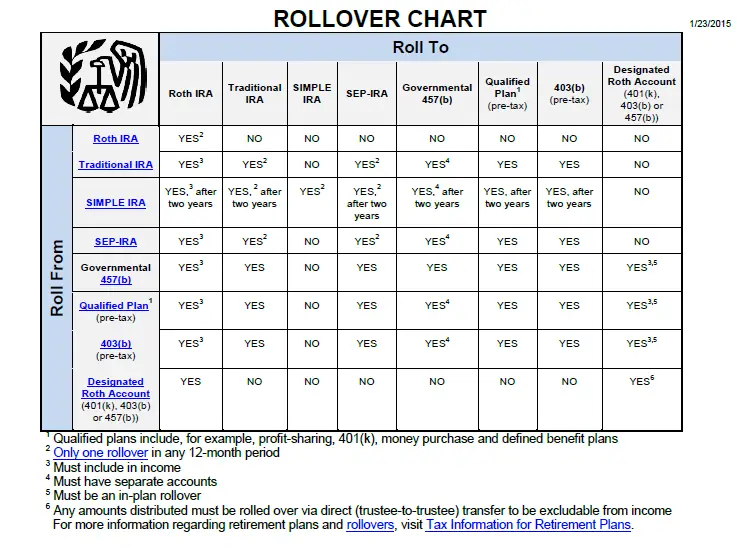

The IRS publishes a rollover chart that lists the following types of accounts as eligible to receive a 403 rollover:

- traditional IRA

- qualified plan, such as a 401

- 403

- SIMPLE IRA

Bear in mind that rolling over a 403 into a SIMPLE IRA requires having the SIMPLE account for at least two years prior to the rollover. You can also roll over your 403 into a Roth IRA or designated Roth account within a qualified plan, but you may face tax consequences.

Also Check: How To Figure Out Employer Match 401k

How Long Do You Have To Roll Over A 401

If a distribution is made directly to you from your retirement plan, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan or an IRA, according to the IRS.

But if you have more than $5,000 in a 401 at your previous employer and youre not rolling it over to your new employers plan or to an IRA there generally isnt a time limit on making this decision.

Taxes Due From Your 403b Rollover

So what sort of tax consequences do you trigger with a 403b rollover to a Roth IRA?

You’ll have to pay income taxes on any amount you roll over, unless of course, you made non-deductible contributions, such as with a Roth 403b .

But assuming you have a typical 403b plan, you’re going to owe income taxes on the full amount of the rollover distribution, with the applicable tax rate being the same as what you would pay on your regular income.

For tax purposes, you simply add the full amount of the rollover distribution to your adjustable gross income .

But don’t worry about your rollover pushing you into a higher tax bracket. The tax rate you pay is based on your pre-rollover AGI, not your post-rollover AGI.

For instance, let’s say you have a 403b with $225,000, an annual salary of $37,000, and you’re in a 20% tax bracket.

Even though you file a tax return with $262,000 in adjustable gross income, you remain in the 20% tax bracket. So your total tax liability is $52,400.

Don’t Miss: How To Max Out 401k Calculator

Are Early Distributions From Roth Ira Taxable

For example, payments from traditional IRAs are generally considered regular income and may be subject to income tax, as well as an additional early allocation penalty if the payment is made when the IRA holder is below 59. The Roth IRA, on the other hand, allows for qualified distribution with no taxes or penalties.

How To Withdraw Principle From A Roth Ira

How to Withdraw Capital from a Roth IRA Account. In most cases, if you are under 59½ you will need to submit a formal withdrawal request to your broker. You must also complete IRS Form 8606 and attach it to your regular tax return. degree. A client’s exit from the Roth IRA is always tax and penalty free.

Also Check: When You Leave A Job Do You Get Your 401k

Can You Rollover A Roth 401 To A Roth Ira Income

If you convert your 401 into a Roth IRA, you will have to pay tax on the amount you converted. The good news is that if you receive a post-retirement benefit, you don’t have to pay tax on the money.

Portfolio rebalancingDoes portfolio rebalancing actually improve returns? Rebalancing is an important part of portfolio management. Rebalancing allows you to maintain a constant level of risk in your portfolio and possibly even increase your profitability. However, when rebalancing, you must ensure that you do not generate excessive taxable income in taxable accounts.How often should you rebalance your p

Should You Rollover A 401 Or 403

For most millennials, rolling over your 401 or 403 to a low-fee IRA is a smart financial decision. You can get both low fees and a lot of variety.

Reasons people do nothing can range from my current 401 is performing well to I want to look at the returns before I make a decision.

If you decide now to roll over your 401 every time you switch jobs, you wont have to make this decision each time you change employers.

While its never fun to spend time on the phone with financial services customer service, it takes less than an hour to set up an IRA and a similar time investment to rollover your old plan.

If you reduce your fees by 0.5%, you could have a $120,000 return on those two hours.2 Your future self will thank you.

Article written by, guest contributor, Eryn Schultz, the founder of Her Personal Finance. Starting with a desire to help her co-workers get their 401 match, Eryn began creating financial content using her education from Harvard Business School. She is the creator of a 10-week money bootcamp, and would love for you to join her money community.

1A 2.21% investment fee is based on a real retirement plan for a smaller employer. Larger employers may have considerably lower fees.

Also Check: Can You Get 401k If You Quit