The Four Levels Of Retirement Savings

The lesson is: Figure out what percentage of your income you can save in total, and allocate it appropriately:

Level 1: Max out your employer match in your 401.

Level 2: Max out your emergency savings .

Level 3: Max out your Roth IRA .

Level 4: Max out your 401 .

This flowchart from my post on creating an automated investing program will also help:

Is A Roth Ira Ever A Bad Idea

A Roth IRA isnt necessarily a bad idea if you qualify for an employer match through your companys retirement plan, but it isnt a great first choice. You can contribute up to $19,500 to a 401 in 2020 or $26,000 if youre 50 or older, compared to just $6,000 and $7,000, respectively, for a Roth IRA.

Can you lose all your money in a Roth IRA?

Likewise, if you invest all of your Roth IRA money in one stock and that company goes bankrupt, you could lose all of your money. Even a well-diversified equity portfolio can lose a significant amount of its value in a short period of time under adverse economic conditions.

Why a Roth IRA is a bad idea?

A major drawback of Roth IRA contributions is done with after-tax money, meaning there are no tax deductions in the year of the contribution. Another drawback is that no withdrawals should be made until five years have passed since the first deposit.

What Is The Maximum 401k Contribution Amount

Starting in 2020 , you can contribute up to $19,500 each year to your 401k if you are under 50. If you are over the age of 50, you may be able to make catch-up contributions. This provision lets you invest up to an additional $6,500 in your 401k .

PRO TIP: You need to be behind in your 401k contributions to make catchup contributions.

When compared to a Roth IRA, where you can only contribute up to $6,000/year, this is an amazing opportunity especially since your pre-tax money is being compounded over time.

Don’t Miss: How To Take A Loan From 401k

Depend On Nobody But Yourself

Contribute the maximum pre-tax income you can to your 401k for as long as you work. This is the absolute MINIMUM you can do to by on the right 401k savings by age path. Below is a chart that shows the maximum 401k contributions in 2021 by employee and employer.

After you contribut a maximum to your 401k every year, try and contribute at least 20% of your after-tax income after 401k contribution to your savings or retirement portfolio accounts.

This way, you will have potentially DOUBLE the amount in total retirement saving if your household income is $100,000 or more. If your household income is closer to $50,000, you should still see a nice 30% boost to your retirement savings if you consistently save 20% of your after tax income.

Treat your 401k just like Social Security and write it off completely from your mind. Do not expect either accounts to be there for you when you retire. Its just like how you should never expect the government to ever help you when youre in need.

Just imagine 30 years from now, the government deciding to raise penalty free 401k withdrawal to age 75 from 59.5? Unfortunately, you need the money at age 60. Because you withdraw, the government imposes a 30% penalty on top of the taxes you have to pay. Dont think it cant happen. Expect it to happen!

What Are The 401 Contribution Limits For 2021

7 Minute Read | September 27, 2021

Do you know what simple step most millionaires took to help them build their wealth? Believe it or not, they didnt roll the dice on flashy investment trends or inherit most of their seven-figure net worth. Nope! More than anything else, they put money in their 401.

Thats right! According to the National Study of Millionaires, eight out of 10 millionaires invested in their companys 401 plan. They put money into their accounts month after month, year after year, until one day they looked up and their net worth was in the seven figures. And if they can do it, you can too!

One of the amazing things about a 401 is that it lets you put thousands of dollars away each year for retirement. So if youre one of the millions of Americans with access to a 401, dont take it for granted!

But just how much can you put into your 401 in 2021? Lets take a look.

401 Contribution Limits For 2021

| The 401 contribution limit is $19,500. |

| The 401 catch-up contribution limit for those age 50 and older is $6,500. |

| The limit for employer and employee contributions combined is $58,000. |

| The 401 compensation limit is $290,000. |

Recommended Reading: What’s A Good Percentage For 401k

Get Help With Your 401

Already have a 401? While youre researching contributions, take a minute to analyze your current holdings toothere could be big savings to be found.

is a free app that creates easy-to-understand visuals of the investments you own in your 401, IRA, and other investment accounts. It then provides recommendations for how to rebalance your portfolio for maximum results and reduced expensesit can even show you how changing funds within your existing 401 might save you thousands. or read our review.

Blooom is a new tool that can automatically manage and optimize your 401 for just $10 a month. Designed especially for 401 accounts, blooom works with your available investments to find the lowest-cost and best allocation for your goals. You can get a free 401 analysis from Blooom or learn more in our review. Plus they have a special promotion where you can get $15 off your first year of Blooom with code BLMSMART

is a great all-in-one financial app that allows account holders to take control over their finances, automate saving and investing, and manage their accounts all in one place. Wealthfronts Self-Driving Money tool continuously monitors your cash flows to ensure that bills are paid and savings are instantly routed into the right investment accounts. Wealthfront account holders can also take advantage of the apps automated investment services, like daily rebalancing and tax-loss harvesting.

Should I Invest In A 401k Before Paying Off Student Loans

Only you can make this decision. However, its generally recommended to start saving for retirement as early as possible especially if you have student loans that take years or decades to pay off.

Waiting until your student loans are paid off to save for retirement can prevent you from putting money aside during your prime earning years, meaning youll have to work twice as hard to save once your loans are paid in full.

If you are having trouble paying down student loans and putting money aside for retirement, you should use it as a motivating factor to work harder and earn more money. Keep rising and elevating yourself in your field and increase your salary to offset losses from student loan debt.

Don’t Miss: Can Anyone Open A 401k

How Does An Employer Match In A 401 Work

Some of the more generous employers will not only allow employees to take advantage of a 401 and its tax deferrals, they will also provide what is known as a match. Each company offers a different program. It is entirely up to your employer whether or not this is offered. If it is offered though, it can be a huge boost to your income.

Your employer may offer to match your contribution into the 401 up to a certain amount. Often this is a percentage of your salary. So to take that $100k salary example again, lets assume an employer offers a 100% match up to 6% of salary. This means that for ever dollar you contribute to your 401, your employer will add another dollar up to $6k .

In our example above, your $10k contribution would still defer taxes. In addition, your employer would add another $6k to your account that is entirely for you to invest and enjoy! All that money is totally tax-deferred!

Each companys plan will be different, and you should always consult with your HR department to be sure you understand. But the benefits of an employer match can be a total game-changer in building a comfortable, stress-free retirement. If you can, definitely take full advantage of your 401.

Benefits Of Having A 401k

Different 401k plans come with different perks, each with unique advantages.

Tax advantages: Traditionally, the savings in your 401k account is pre-tax. This means that the amount you contribute is exempt from current federal income tax, which also lowers your taxable income. In this case, you dont have to pay tax on the funds until you actually withdraw them. Since most people are in a lower tax bracket during their retirement years, this may lower the amount they pay in taxes on 401k withdrawals. However, depending on the type of plan you have, the tax break can come when you contribute money or withdraw funds during retirement .

Employer matching contributions: In some cases, employers will offer to match the amount you put into your 401k, which is essentially free money! Employers might offer a certain percentage of what you contribute or even dollar-to-dollar matching. Consider saving up to the maximum annual contribution amount because employer contributions dont count towards your annual limit.

Lifetime contributions: In the case of some retirement accounts and IRAs, there is often an age limit for contributions. However, 401k accounts are not subject to this stipulation so you can contribute funds as long as you are working.

Automatic investment: For many, 401k plans may be the easiest way to save for the future because they automatically deduct funds from your paycheck and place them in the account. This way you dont have to think twice about your savings.

Also Check: Can I Rollover My 401k To A Roth Ira

How Much Should I Put Into My 401k Plan

How much should I put into my 401k plan? I thought about this as a walked in to talk to my financial adviser. When I asked my company financial adviser how much I should put into my 401 plan the answer was more. A year or two passed and again I asked the same question and received the same response, more. This game of more didnt quench my thirst for an exact percentage. I needed my assets to be balanced if we were going to keep a budget. I realized that I needed more clarity and did some research.

Possible recommendations:

- Ramit Sethi: ~15% max

The F.I.R.E. option is a little extreme at the moment because I have dreams of having real estate investments as well and I would like to get my house paid off first.

15% seems to be the magic number . We plan on paying off our house first and then adding beyond 15%.

My company offers a Roth 401 plan with good mutual funds within it. They also match my contribution up to 6%. I put in 9% and my company puts in 6%. This adds up to a total of 15%. If your company offers a Roth 401 plan, I would jump straight to the 15% magic number and youll be glad you did! The earlier you start the better. The Roth 401 plan is like having both a traditional 401 plan and a Roth IRA combined .

Why does 15% work?

15% is not bad even at an earlier retirement, although other sources of income might be needed.

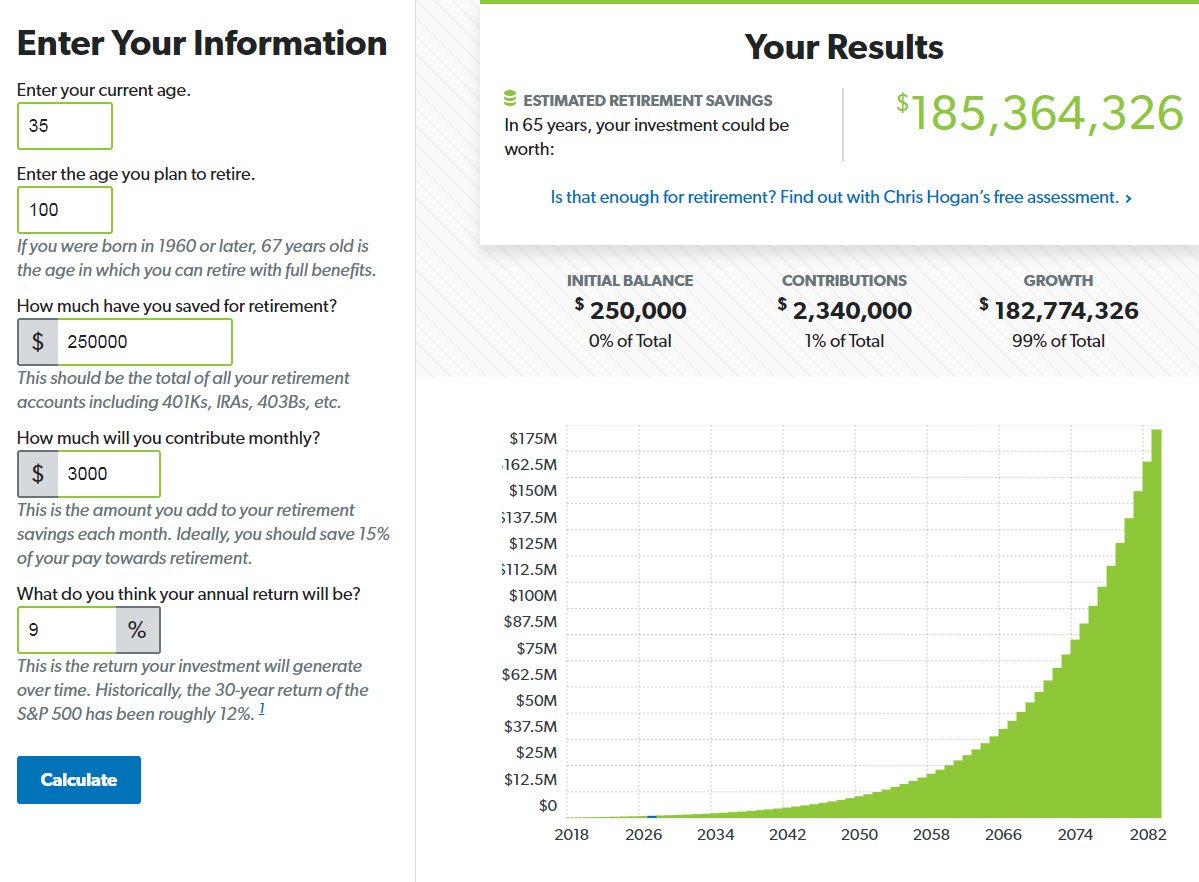

My Favorite Retirement Calculator:

How Much Should I Contribute To My 401k

Every investor is different in terms of earning potential and personal finance goals. If you want an accurate assessment, the best thing to do is consult with a certified financial advisor who is able to take a close look at your portfolio and determine whether you are on track for retirement.

That said, as a general rule of thumb, you should aim to have the equivalent of roughly one years salary saved in your 401k by the time you are 30. So, if you make $60,000 per year, you should have $60,000 socked away in a tax-deferred account.

This can be achieved by setting aside 15% to 20% of your annual salary each year while also leveraging employer contributions. If you take this approach and set aside a healthy annual contribution amount each year, the money is going to add up over time and turn into a strong account balance. Take my word for it.

Having $60,000 or more set aside for retirement at 30 may seem like a lot of money. But its important to remember thats the combination of base contributions in addition to investment returns and interest. If you invest your money in the funds, its possible to stretch your funds much further than if you had it stashed away in a checking or savings account.

Also Check: Can You Get A Loan Using Your 401k As Collateral

How Much Can You Put In A 401

The maximum amount you can contribute increased to $19,000 in 2019.

Employee contributions to 401 accounts increased to $19,000 in 2019 . This means that you can contribute $1,583.33 a month if you want to max out your 401 retirement savings this year.

For a lot of folks, however, putting more than $1,500 a month toward retirement isnt possible.

Saving for retirement is a long-term goal, and starting small is much better than not starting at all, even if youre only contributing the equivalent of a daily latte.

Transparency Is Our Policy Learn How It Impacts Everything We Do

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Wed like to share more about how we work and what drives our day-to-day business.

Read Also: How Do I Start My Own 401k

Better Still If The Employer Offers A Roth Option The Money Inside The Plan Will Grow Tax

Q: My son just finished college and started his first real job. He recently asked me how much he should put in his companys 401. He is young, single, and doesnt own a home yet. My question is, should he start participating in the 401 now, or should he instead start saving for a house? Also, if he uses the 401, should he use the traditional 401, or would he be better off utilizing the Roth option?

A: Regardless of his other financial priorities, your son should absolutely be saving in his companys 401 plan. There are three main reasons why.

First, and I believe that this is the most important reason, is the forced savings that a 401 provides. Most young people are not great savers and tend to confuse their wants with their needs. They believe that theyll start saving when their income goes up, but, typically, as their income rises, they tend to increase their expenses rather than save.

With company savings plans, the money is deducted from the paycheck before you have the chance to spend it. You dont have to decide whether you should use that money to take a weekend trip, or whether you should put those dollars into savings, because you never see the money in the first place.

The third benefit of 401 participation is the tax advantages. Whether you use a traditional, pre-tax 401, or the Roth, the money inside the plan grows tax-deferred.

As an adviser for more than 20 years, I find the benefits of the 401 are obvious.

How Much Should I Have Saved So I Can Retire Early

The general rule of thumb for whatever age you plan on retiring is to have 80% of your pre-retirement income replaced. Create a careful budget of your expected total expenses per year in retirement and multiply that by how many years you wish to be in retirement. Suppose you plan on retiring around 40 or shortly after. In that case, you need to consider things like waiting to qualify for Medicare or Social Security benefits when considering how much your expenses will be.

Recommended Reading: How To Move 401k To Another Company

Take Advantage Of Employer Matching

At a minimum, you should contribute enough to your 401 that you’re taking full advantage of your employer’s matching program. For example, if your employer is willing to match all of your contributions up to 4% of your salary, then you should do everything you can to contribute at least that amount. Not doing so is the same thing as agreeing to a salary reduction you’re simply refusing part of the compensation you’re entitled to.

An important factor to consider is that many employers dole out the 401 match based on your contribution for each pay period. So if you temporarily halt contributions to your 401 for a few months to handle an emergency, you might not be able to get those salary matches back by contributing extra in the last few pay periods.

Likewise, if you defer a big chunk of your paycheck early in the year and max out the contribution limit, you might forgo matching contributions later in the year. Talk to your HR department to see what the policy is.

Employer matching is the way many people turn relatively small amounts of their salary into a large retirement nest egg. Let’s say you make $60,000 and your employer matches up to 4% of your salary. That means you’re contributing $2,400, but $4,800 is going into your account.

Over a 35-year career, assuming 2% annual salary increases, you could end up with a 401 balance of $900,000, assuming 7% average annual returns . With good market performance, you could even get to $1 million or more.