Taking Money Out Of A 401 Once You Leave Your Job

If you no longer work for the company that sponsored your 401 plan, first contact your 401 plan administrator or call the number on your 401 plan statement. Ask them how to take money out of the plan.

Since you no longer work there, you cannot borrow your money in the form of a 401 loan or take a hardship withdrawal. You must either take a distribution or roll your 401 over to an IRA.

Any money you take out of your 401 plan will fall into one of the following three categories, each with different tax rules.

Can I Roll My Qrp Over To A Roth Ira

A QRP designated Roth account can roll to a Roth IRA.

One way to benefit from tax-advantaged growth potential and possible tax-free distributions is to convert your QRP to a Roth IRA. A conversion allows you to reposition your existing tax-deferred QRP assets to a potentially tax-free Roth IRA by paying federal and possibly state income tax on the taxable portion of the conversion. Before you convert be sure you have met with your tax professional to review your specific situation, because once you convert, you can no longer recharacterize, or undo the conversion.

It is important to remember that generally, you must have a triggering event, such as separation of service, to be eligible to make distributions from your QRP. Learn more about converting to a Roth IRA.

What Type Of Ira Should I Open

During the process of opening your new account, you may get asked which type of IRA youd like to open. You might see the following options: Rollover IRA, Traditional IRA, or Roth IRA. Heres how to pick the right one:

- If you had a Traditional 401 pick a Rollover IRA or, if thats not available, Traditional IRA or, if thats not available, just IRA. The only exception would be if youre considering a Roth conversion, but this is an advanced tax planning strategy that most people dont need to worry about.

- If you had a Roth 401 pick a Roth IRA. Youll need to match the Roth 401 to a Roth IRA for tax reasons.

- If your 401 has mixed assets youll need to open two IRAs, one Roth and one Traditional to for their respective assets.

Recommended Reading: How Do You Take Money Out Of 401k

How Much Should Employees Contribute

Like the employer, employees are free to contribute as much as they like to the plan, within IRS limitations. For 2021, salary deferrals are $19,500, plus a catch-up contribution limit of $6,500 for employees 50 and older. Consider ways to help employees improve their financial wellness and increase their 401 participation. Doing so could benefit your business in the form of happier, less-stressed employees who are more engaged and productive.

Withdrawing After Age 595

You May Like: How To Transfer Your 401k To Another Company

Weighing Pros And Cons

Before you determine whether to borrow from your 401 account, consider the following advantages and drawbacks to this decision.

On the plus side:

- You usually dont have to explain why you need the money or how you intend to spend it.

- You may qualify for a lower interest rate than you would at a bank or other lender, especially if you have a low credit score.

- The interest you repay is paid back into your account.

- Since youre borrowing rather than withdrawing money, no income tax or potential early withdrawal penalty is due.

On the negative side:

- The money you withdraw will not grow if it isnt invested.

- Repayments are made with after-tax dollars that will be taxed again when you eventually withdraw them from your account.

- The fees you pay to arrange the loan may be higher than on a conventional loan, depending on the way they are calculated.

- The interest is never deductible even if you use the money to buy or renovate your home.

CAUTION: Perhaps the biggest risk you run is leaving your job while you have an outstanding loan balance. If thats the case, youll probably have to repay the entire balance within 90 days of your departure. If you dont repay, youre in default, and the remaining loan balance is considered a withdrawal. Income taxes are due on the full amount. And if youre younger than 59½, you may owe the 10 percent early withdrawal penalty as well. If this should happen, you could find your retirement savings substantially drained.

When Do I Become Vested

The vested portion of your 401 is the part that is yours to keep, even if you leave your job. Any money that you contribute is always 100% vested. The contributions made by your company, however, will be subject to a vesting requirement. There are two types of vesting schedules: graded and cliff.

With graded vesting, funds vest over time. You may, for example, be 25% vested after your first year, 50% vested the next year, and so forth until you are fully vested. With cliff vesting, the employer contribution is 0% vested until you have been on the job for a specified amount of time , at which point it becomes 100% vested. Either way, once you become fully vested, all the money in the plan is yours, and you can take it with you when you change jobs or retire.

IRS rules now permit hardship withdrawals from a 401 to include not just your contributions but also your company’s match and earnings on these amounts. Check with your human resources department to determine your employer’s policy.

Also Check: What Is The 401k Retirement Plan

Looking For A Retirement Plan Loan

When bills or debt feel overwhelming, it can be tempting to consider borrowing against your account in a 403, 401, or 457 plan. But the trade-offs can be steepand we want to make sure you understand them.

In the long run, you may pay more than the loan amount you withdraw, including:

- Any initial set-up and quarterly loan fees

- Taxes you pay on the money you use to repay your loan

- Interest paid to yourself based on loan interest rates over time

On top of that, you may miss out on some potential growth and compounding of your earnings, which can be a major advantage of long-term savings in an account under 401, 403, or 457 plans.

To give you an idea, $20,000 in a 401, 403, or 457 account could triple in 20 years at an average 7% rate of returnbut not if you withdraw it today.2

Can I Take The Money Out Of My Qrp And Then Decide What To Do

You can, but it’s a good idea to consider the impacts. A QRP distribution made payable to you will trigger taxes, and depending on your age, the 10% additional tax for early or pre-59 1/2 distributions unless you roll over those assets by having them deposited into an IRA or QRP within 60 days. While completing an indirect rollover seems fairly easy, there are several rules that can make it complicated.

- First, the QRP is required to withhold a mandatory 20% for federal taxes when you receive a check, made payable to you, from your QRP. Some states may require withholding of state taxes as well.

- Second, to avoid paying taxes and potential 10% additional tax for early or pre-59 1/2 distributions on the distributions, you will need to roll over the total amount distributed into an eligible retirement account within 60 days of your receipt. This is accomplished by personally depositing the 20% tax withholding that was deducted from your distribution within the 60-day period.

- Last, you are not required to deposit the entire amount at one time. Instead, this rollover can be completed with multiple rollover deposits as long as the deposits are completed within the 60-day period.

Recommended Reading: Can You Borrow Money Against Your 401k

Make Sure Your Ira Is Being Invested Appropriately

Remember there are two goals of rolling over an old 401 into an IRA the first is to consolidate your 401 assets, and the second is to grow those assets by allocating them into investments that will increase in value over time.

Your very last step in executing a rollover is to make sure that second goal is being met and that the funds in your IRA are being appropriately invested. If you chose an automated IRA then this should happen automatically. Thats because as soon as your funds arrive theyll be allocated into a portfolio that was created for you during the sign-up process for your new IRA account. You should still log in and check to make sure thats the case, but usually theres nothing more for you to do.

If you choose a self-directed account then youll have to invest the money yourself. Often the simplest option is to purchase a target-date retirement fund this is an investment vehicle that puts your money into a combination of higher-risk, higher-return stocks and lower-risk, lower-return bonds. The exact mix changes as you age so that you have more stocks when youre younger and less as you get older: because stocks generate higher returns but are more volatile we should own more of them early on when we can withstand their fluctuations in order to achieve their higher long-term returns.

Otherwise you can assemble a portfolio on your own by making trades.

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

Also Check: Can I Invest In 401k And Roth Ira

Your Money Deserves More Than Thoughts And Prayers

Whether you manage your 401 yourself or with an advisor, take advantage of the controllable aspects, like your asset allocation. When the account becomes a big part of your retirement strategy or if you realize you need financial guidance beyond what you can do yourself, it’s likely worth acting on. The benefits of working with a financial advisor often go beyond money management. Google is great, but there’s still no substitute for a real person giving personalized advice.

Why Maxing Out Your 401k Could Mean Missing Out On Thousands

For many of us, our 401 or similar employer-sponsored retirement plan is our primary vehicle for retirement savings. A is a defined contribution plan meaning that our retirement benefit is determined primarily by the amount that we save and how we invest those savings. However, there is a maximum 401k contribution limit that we will cover.

These types of plans have primarily replaced pension plans of our parents and grandparents generation, which were funded mainly by employers.

Ideally, you got started saving for your retirement in your companys 401 plan right out of the box when you started working. If not, hopefully, by now you have gotten going and this is a regular deduction from each paycheck.

Its not easy to do when youre in your twenties. There are plenty of other things on your mind than saving money out of your paycheck. It’s a tough pill to swallow in our instant gratification society, and an even more challenging concept to teach.

However, if youre reading this today, then youre probably well on your way to contributing to your 401 and, most likely, on an annual basis. To that, I say congratulationsyou have made a great achievement.

For 2021, the new maximum contribution has increased to $19,500. If you are 50 or older, then you can contribute an additional $6,500 for a total of $26,000. Thats a lot of money on an annual basis from what the 401k maximum contribution used to be.

Also Check: Can I Start A 401k

Contact Your Former Employer

The first place you should look is your prior employer. Contact their human resources department. There, they should have all of the information as to the whereabouts of the 401 account you had with them.

They should send you the proper paperwork and be able to facilitate the transfer of your funds to whatever account you choose.

If they are unable to locate any information on your account, they should be able to provide you the contact information of the administrator who handled your 401 on their behalf.

Let the administrator know your situation, and just like the HR department, should be able to assist you in moving your money properly.

Do I Have To Pay Taxes When Rolling Over A 401

Whether you owe taxes on a rollover depends on whether youre changing account types . Generally, if you move a traditional 401 account to a Roth IRA, you could create a tax liability. Here are a few scenarios:

- If youre rolling over money from a traditional 401 to another traditional 401 or traditional IRA, you wont create a tax liability.

- If youre rolling over a Roth 401 to another Roth 401 or Roth IRA, you wont create a tax liability.

- However, if youre rolling a traditional 401 into a Roth IRA, you could create a tax liability.

Its also important to know that if you have a Roth 401 that has any employer matching funds in it, those matching funds are categorized as a traditional 401 contribution. So if you transfer a Roth 401 with matching funds into an IRA, youll need to create two IRA accounts a traditional IRA and a Roth IRA to avoid any tax issues during the rollover.

Of course, youll still need to abide by the 60-day rule on rollovers. That is, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan, according to the IRS. Taxes generally arent withheld from the transfer amount, and this may be processed with a check made payable to your new qualified plan or IRA account.

Sign up for Bankrates myMoney today to track your finances in one place.

Recommended Reading: How To Check My Walmart 401k

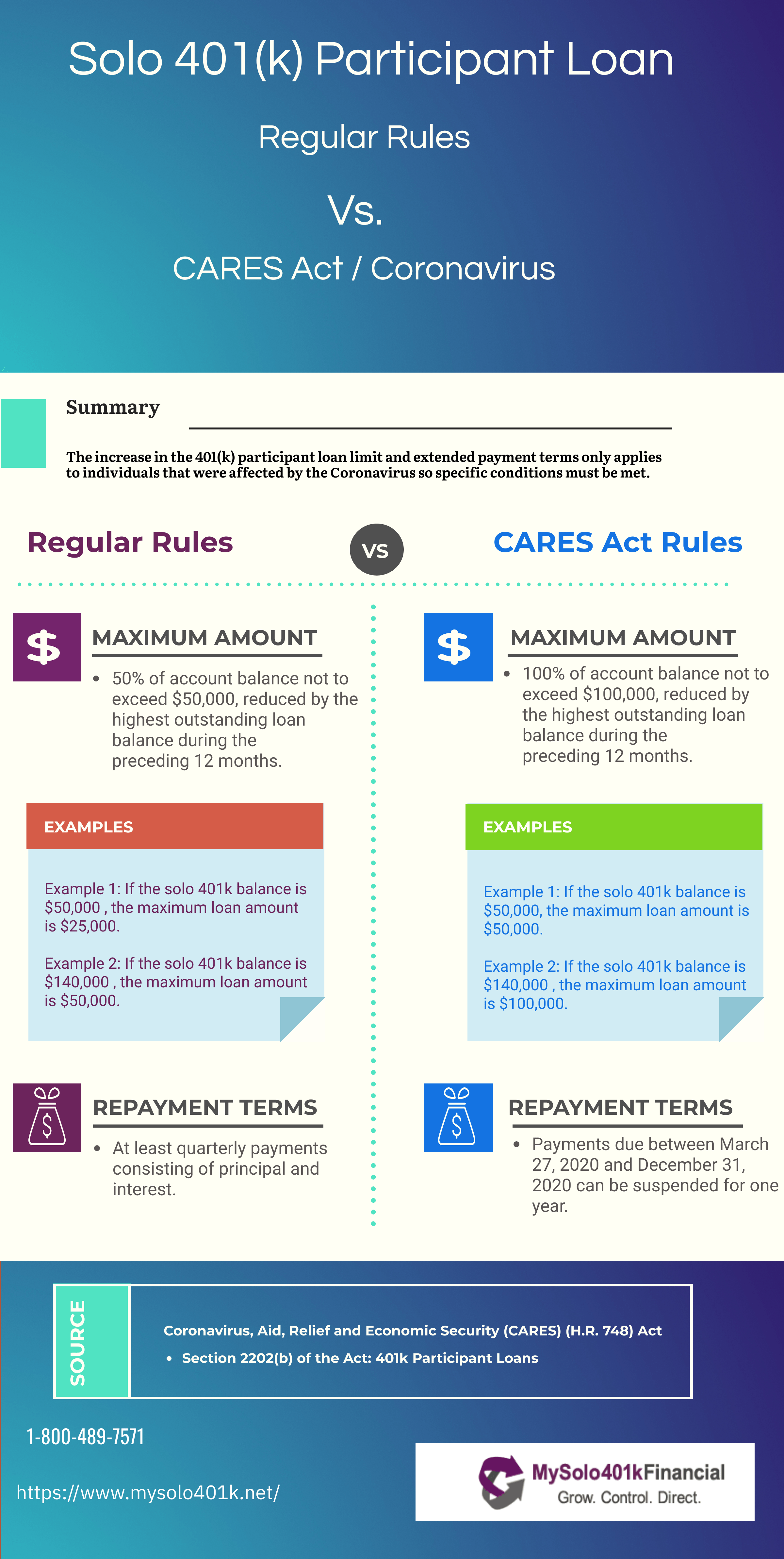

How Borrowing From Your 401 Works

Most 401 programs let you set up a loan all on your own, without any assistance, via the website you use to handle other 401 tasks, such as changing your contribution amounts and allocating your savings to different investment funds.

Setting up the loan is as simple as finding the loan page on the 401 site and specifying the amount you want to borrow. The online form won’t let you borrow more than you’re entitled to, and interest rate and payroll deduction payments based on a standard five-year repayment period will be calculated automatically.

Once you authorize the loan, the amount of the loan will likely be included with your next paycheck .

If you have any questions about the process, you’ll find an option for contacting fund administrators on the webpage.

Is It Better To Roll Over A 401 To An Ira

If you like your former employers 401 plan the investment options and the expense ratios on the investments then it wont necessarily be better to roll it over into an IRA. But you may find that if you roll your 401 into an IRA, you may have more investment options. Compare expense ratios and fees to see which option is best for you.

Kaleb Paddock, a certified financial planner at Ten Talents Financial Planning in Parker, Colorado, says a typical 401 plan only has approximately 20 to 40 mutual funds available. But an IRA could give you access to thousands of exchange-traded funds and mutual funds.

Another reason might be, if you want to invest in socially responsible funds or funds that invest according to a certain set of values, those funds may not be available in your 401 or your prior employer 401, Paddock says.

But by rolling it over to one of these large custodians, youll likely be able to access funds that may be socially responsible or fit your values in some fashion and give you more options that way, he says.

Plus, rolling over your 401 to an IRA may result in you earning a brokerage account bonus, depending on the rules and restrictions that the brokerage has in place.

Recommended Reading: How Can I Take Money Out Of My 401k