Rmds Can Be Delayed For Some Workers

Putting off your retirement? If youre still working at age 72 and continuing contributions into a 401 or 403, youre entitled to an RMD reprieve as long as you dont own more than 5 percent of a company and your retirement plan lets you. If these conditions apply, you can delay the RMDs until April 1 after the year that you separate from service, at which point youll have to start taking withdrawals.

This is true as long as you work during any part of a year. So if youre 72 ½ years old and thinking about retiring by the end of the calendar year, reconsider if you dont want to make a withdrawal. If you keep working after Jan. 1 even if its just a day youll push off the date for taking that first RMD by one more year.

Keep in mind that the delay only counts for the 401 plan of the company youre still working for. If you have other 401 plans from previous jobs, youll need to take distributions from them if youre 72 or older.

How To Make An Electronic Signature For The Prudential 401k Withdrawal Form On Ios

If you own an iOS device like an iPhone or iPad, easily create electronic signatures for signing a prudential withdrawal form in PDF format. signNow has paid close attention to iOS users and developed an application just for them. To find it, go to the AppStore and type signNow in the search field.

To sign a prudential 401k withdrawal right from your iPhone or iPad, just follow these brief guidelines:

After its signed its up to you on how to export your prudential hardship withdrawal form: download it to your mobile device, upload it to the cloud or send it to another party via email. The signNow application is just as efficient and powerful as the web app is. Get connected to a smooth connection to the internet and start executing forms with a court-admissible eSignature in minutes.

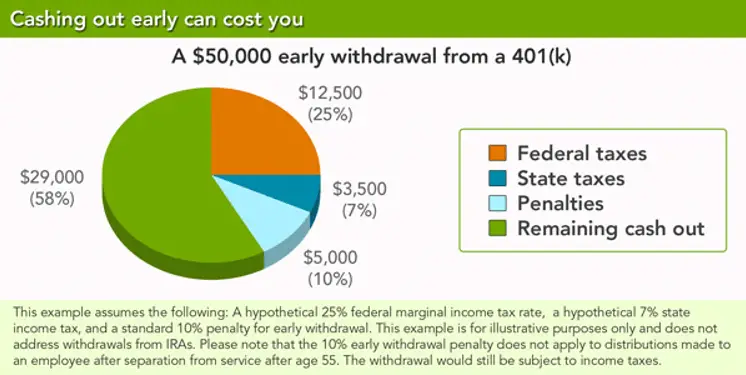

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be an expensive proposition because of the hefty penalties they carry under many circumstances.

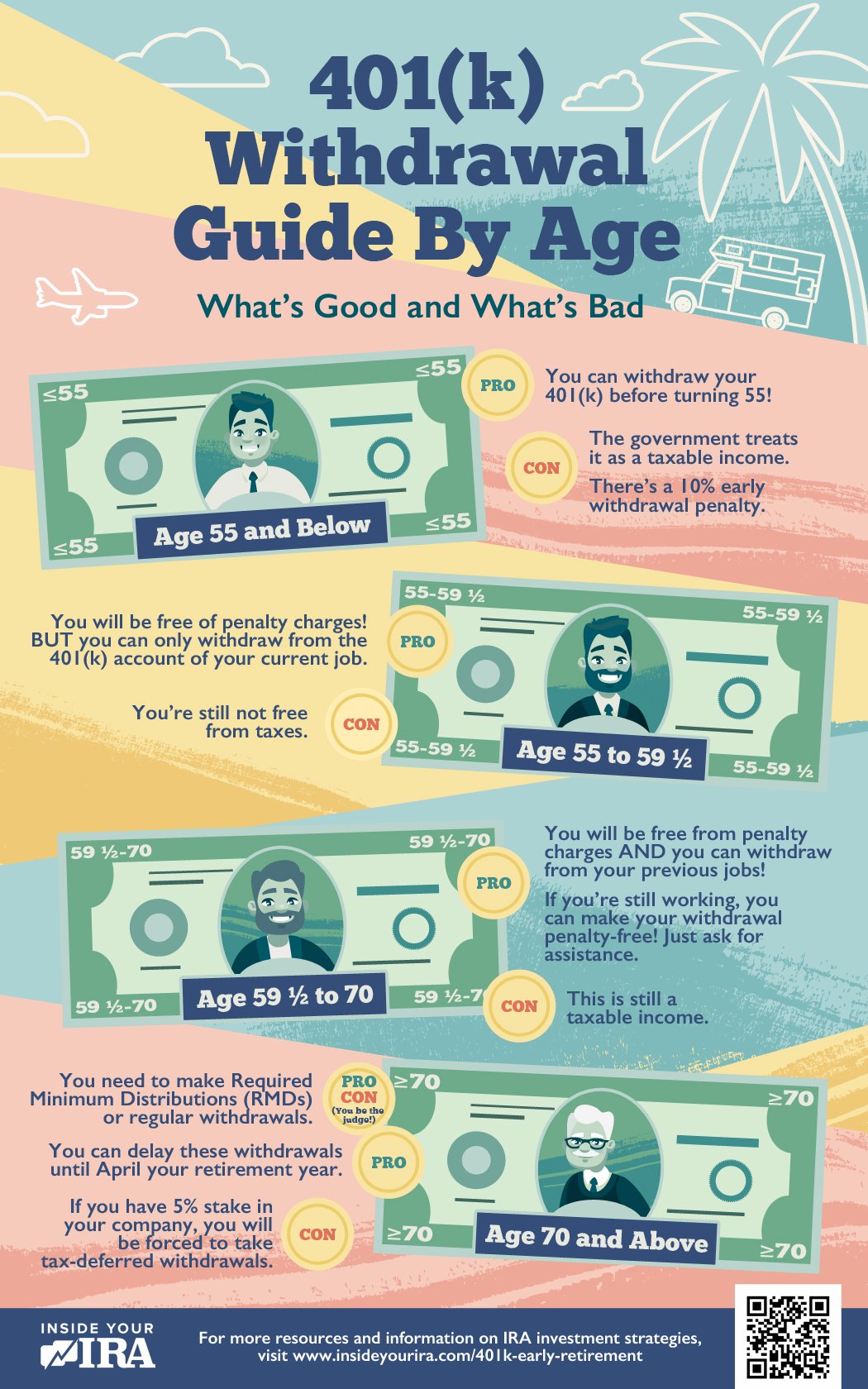

The IRS allows penalty-free withdrawals from retirement accounts after age 59 ½ and requires withdrawals after age 72 . There are some exceptions to these rules for 401ks and other qualified plans.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement. The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, you can use this calculator to determine how much other people your age have saved.

You May Like: How To Know If I Have 401k

Early Money: Take Advantage Of The Age 55 Rule

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an individual retirement account .

If your account is between $1,000 and $5,000, your company is required to roll the funds into an IRA if it forces you out of the plan.

Retirement Savings Can Benefit

As you make loan repayments to your 401 account, they usually are allocated back into your portfolio’s investments. You will repay the account a bit more than you borrowed from it, and the difference is called “interest.” The loan produces no impact on your retirement if any lost investment earnings match the “interest” paid ini.e., earnings opportunities are offset dollar-for-dollar by interest payments.

If the interest paid exceeds any lost investment earnings, taking a 401 loan can actually increase your retirement savings progress. Keep in mind, however, that this will proportionally reduce your personal savings.

Don’t Miss: Can I Access My 401k If I Lose My Job

In Kind Withdrawals Qualify As Rmds

Dont want to sell your assets? Its easier to take withdrawals in cash, but that doesnt mean you have to or should. So-called in-kind distributions are taken out in the form of stocks or bonds, and they may make more sense for people who want to keep assets for various reasons. Youll simply move the assets from your IRA into a taxable account. These in-kind withdrawals will be assigned a fair market value on the date they are moved.

An in-kind withdrawal may be easier and less expensive than triggering fees by selling the securities in the IRA and buying them back in a brokerage account.

Ira 705 Irs Withdrawal Rules

An IRA can be a useful retirement planning tool.

When you own a traditional IRA you benefit from a number of tax advantages. Your contributions may qualify for a tax deduction , and investment earnings in the plan accumulate tax free. You only pay tax when you begin taking withdrawals.

One major restriction is that you are forced to take distributions once you reach age 70.5. Failure to do so can result in a hefty 50 percent penalty from the IRS.

Also Check: How Do I Rollover My 401k To My New Job

Also Check: How To Split 401k In Divorce

Impact On Student Debt

The SECURE Act also allows people to withdraw up to $10,000 during their lifetime from their 529 plans, tax-free, in order to pay off their student loan debt. Originally, 529 plans were strictly for post-secondary education expenses, but that has been expanded to include K-12 expenses.

Under the SECURE Act, 529 funds can be used to pay off college debt. That said, not all states may allow the student loan benefit to come out tax-free at the state level.

Convert The 401 To An Ira

Individual retirement accounts typically have different withdrawal rules compared to 401s. So, converting to an IRA first might save you the 10% early withdrawal penalty.

Theres also no mandatory tax withholding on IRA withdrawals, so youre almost certain of a bigger check. Youll still pay the tax when its time to file returns, but youll have more money to deal with the situation in the immediate term.

Its a perfect option to go with for those in a lower tax bracket sure of getting refunds.

However, before switching to an IRA, you need to make sure you understand the peculiarities, including fees.

Recommended Reading: How Much Can I Withdraw From My 401k

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Rollover To A Traditional Ira

If you are simply withdrawing funds from a 401 and transferring them to another retirement account, you can opt for a direct rollover. A direct rollover moves retirement money directly from one retirement account to another, and it does not have a tax implication. You can also choose an indirect rollover, where the plan sponsor sends you a check with your 401 balance. You must then deposit the funds to a 401 or IRA within 60 days, failure to which the amount will be considered a distribution for tax purposes.

Read Also: Is It Good To Invest In 401k

Do A Roth Conversion During Semi

If your career is winding down and you find yourself earning less income, it may be necessary to take distributions from your retirement plan. If youre at least 59 ½ years old, youll be able to take distributions from retirement plans without getting hit with a 10 percent early withdrawal penalty.

It may also be an opportune time to convert a portion of your traditional IRA to a Roth IRA especially if your marginal rate is lower than you expect it to be after you turn age 72, when you will be required to take minimum distributions. This strategy can also help you put off taking Social Security until a later age, when benefits will be bigger.

Discuss it with your tax accountant to see if this makes sense in your situation.

Cashing Out A : What A 401 Early Withdrawal Really Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Contributing to a 401 can be a Hotel California kind of experience: Its easy to get your money in, but its hard to get your money out. That is, unless youre at least 59½ years old thats when the door swings wide open for a 401 withdrawal. But try cashing out a 401 with an early withdrawal before that magical age and you could pay a steep price if you dont proceed with caution.

Read Also: How Much You Should Contribute To 401k

The Way To Make An Esignature For A Pdf On Ios Devices

To sign a transamerica hardship withdrawal form right from your iPhone or iPad, just follow these brief guidelines:

After its signed its up to you on how to export your transamerica withdrawal process: download it to your mobile device, upload it to the cloud or send it to another party via email. The signNow application is just as productive and powerful as the online tool is. Get connected to a strong internet connection and begin executing forms with a legally-binding eSignature within a few minutes.

Rmds Smaller For Some Married Couples

If you have a significantly younger spouse who is expected to inherit your IRA, you may be able to reduce your required distributions, thereby trimming taxes and making your retirement funds last longer.

Remember that RMDs are calculated using factors that include your life expectancy as determined by the IRS. But if youve named a spouse as the sole beneficiary of your IRA and he or she is at least 10 years younger than you, then your RMD is computed using a joint-life expectancy table. That will reduce the amount you need to distribute in any given year.

For example, a single retiree who turns age 72 in the current year and who would have to take their first RMD by April 1 of the following year would have a life expectancy of 25.6 more years in the eyes of the IRS. So if that persons IRA was worth $200,000, their first RMD would be $7,812.50 .

But lets say this person designates their 56-year-old married partner to be the sole beneficiary of that retirement account. In that case, their joint life expectancy would be 30.0 years. So the first RMD would be trimmed to $6,666.67. The IRS provides a table for this situation in its Publication 590-B.

Also Check: What Is An Ira Account Vs 401k

Setting A Withdrawal Rate

Aside from the minimum required withdrawal, how much you take out is largely up to you.

The retirement lifestyle you can afford will depend not only on your assets and investment choices, but also on how quickly you draw down your retirement portfolio. The annual percentage that you take out of your portfolio, whether from returns or both returns and principal, is known as your withdrawal rate. Figuring out an appropriate initial withdrawal rate is a key issue in retirement planning and presents many challenges.

Why?

Take out too much too soon, and you might run out of money in your later years. Take out too little, and you might not enjoy your retirement years as much as you could. Your withdrawal rate is especially important in the early years of your retirement, as it will have a lasting impact on how long your savings last.

Understanding 401 Early Withdrawals

If an account holder takes withdrawals from their 401 before age 59½, they may incur penalties in the form of additional taxes. The additional tax for taking an early withdrawal from a tax-advantaged retirement account is 10% on top of any applicable income taxes.

The 10% early withdrawal tax may be waived if the account owner withdraws 401 funds in order to pay for certain qualified expenses, however.

Recommended Reading: How Much Does Fidelity Charge For 401k

Exceptions To 401 Early Withdrawal Penalty:

- You stopped working for the employer sponsoring the plan after reaching age 55

- Your former spouse is taking a portion of your 401 under a court order following a divorce

- Your beneficiary is taking a withdrawal after your death

- You are disabled

- You are removing an excess contribution from the 401

- You are taking a series of equal payments that meet certain rules under the tax laws

- You are withdrawing money to pay unreimbursed medical expenses that exceed 10% of your adjusted gross income

Ubiquity is amazing! Always ready to answer questions and never makes me feel ridiculous for asking them. Additionally, she’s wonderful at returning calls and really making her clients feel valued and listened to! I feel 100% secure in all things related to retirement because I know Meli has our back :).

How To Access Funds When You’re Unemployed

Under ordinary circumstances, unemployment presents a series of choices for an individual who owns a 401. First, there’s the question of whether to keep the account with the former employer or transfer the funds to a rollover IRA. If handled correctly, this transfer is not considered a taxable event.

Rolling over a 401 into an IRA might make it easier to access the funds. Under certain circumstances, IRAs are not subject to the 10% early withdrawal penalty . Some penalty-free IRA withdrawals include paying for unreimbursed medical expenses, health insurance premiums while you’re unemployed, higher education expenses, or becoming permanently disabled.

Even if you didn’t leave on the best of terms, read the rest of this article before deciding whether to roll over your 401 into an IRA.

Recommended Reading: How Do I Cash Out My 401k After Being Fired

Taking Money Out Of A 401 Once You Leave Your Job

If you no longer work for the company that sponsored your 401 plan, first contact your 401 plan administrator or call the number on your 401 plan statement. Ask them how to take money out of the plan.

Since you no longer work there, you cannot borrow your money in the form of a 401 loan or take a hardship withdrawal. You must either take a distribution or roll your 401 over to an IRA.

Any money you take out of your 401 plan will fall into one of the following three categories, each with different tax rules.

Medical Expenses Or Insurance

If you incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you are able to pay for them out of an IRA without incurring a penalty.

For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year then the penalty will likely be waived.

Also Check: How To Check Your 401k Account

Do You Have To Calculate Rmds On Your Own

Luckily, no. Most financial institutions will calculate the figure for you. For all my clients that have reached RMD age, my custodian calculates the RMD amount for my clients and then I contact the client to notify them of the amount.

Another thing to consider is that since it is a taxable distribution, your IRA custodian will most likely require you to sign a form to take out the money . If a form needs to be signed, dont procrastinate and wait till the last minute.

Read Also: When Can You Take 401k Out