Should I Move My 401 To Bonds

Whether it makes sense to move assets in your 401 away from mutual funds, target-date funds or exchange-traded funds and toward bonds can depend on several factors. Specifically, those include:

- Years left to retirement

- Where else youve invested money

- How long you expect a stock market downturn to last

First, consider your age. Generally, the younger you are, the more risk you can afford to take with your 401 or other investments. Thats because you have a longer window of time to recover from downturns, including bear markets, recessions or even market corrections.

If youre still in your 20s, 30s or even 40s, a shift toward bonds and away from stocks may be premature. The more time you keep your money in growth investments, such as stocks, the more wealth you may be able to build leading up to retirement. Given that the average bear market since World War II has lasted 14 months, moving assets in your 401 to bonds could actually cost you money if stock prices rebound relatively quickly.

On the other hand, if youre in your 50s or early 60s then you may already have begun the move to bonds in your 401. That might be natural as you lean more toward income-producing investments, such as bonds, versus growth-focused ones.

One Potential Risk Of Investing In A 401

Despite its many advantages, the downside to investing in a 401 is that you typically don’t have many investing options. That may not be a dealbreaker for some investors, but it can be more costly than you might think.

When deciding how to allocate your investments within your 401, you will typically have a few mutual funds to choose from. There’s nothing inherently wrong with that, especially if you prefer to take a hands-off approach to investing and don’t necessarily want to choose from hundreds of different investments. However, what could potentially be a problem is the high fees you may be stuck with.

Whether you realize it or not, you’re paying fees when you contribute to a 401. The average 401 plan charges an annual fee of around 1% of total assets under management, according to a report from the Center for American Progress. In other words, if you have $100,000 stashed in your 401, you’ll be paying $1,000 per year in fees.

Because you generally won’t have many options when choosing which funds to invest in with a 401, you may be stuck with higher-than-average fees, whether you like it or not. And those fees can add up substantially over time.

What Are The Rules For 401 Withdrawals And 401 Loans

When life happens, its easy to turn to the savings stashed in your 401. The money is just sitting there, right? Turns out, withdrawing money from your 401 early is more complicated than that.

According to the IRS, you cant withdraw money out of your 401 before you reach the age of 59 1/2 without paying income taxes and a 10% early withdrawal penalty.5

But there is a loophole: 401 loans allow you to use your retirement savings without paying penalties or taxes as long as you pay the money back. Of course, doing this comes with a bunch of rules and things can go wrong really fast.

Heres why 401 loans are a really bad idea:

- You have to pay back the amount you withdraw with interest.

- Your investments into your workplace 401 account are pre-tax, but youll pay back the loan with after-tax dollars. That means it will take longer to build up the same amount.

- Youll have to pay additional taxes and penalties if you dont pay back the loan in a certain time frame.

- If you leave your job for whatever reason and still have an outstanding 401 loan balance, you have to pay it back in full by the tax filing deadline of the following year, including extensions .6 Under previous law, you had 60 to 90 days to pay off your balance completely.

Thats a lot of good reasons to keep your hands off your 401 until you reach retirement age.

Recommended Reading: Can I Rollover My 401k To A Roth Ira

Reason #: You Are Now A Target

You might agree that the good folks in Washington, D.C., have a spending problem. But how are they going to pay for it all?

You can bet your last dollar that they all know that there are trillions of dollars sitting in 401 and 403 plans that have never been taxed. This is like candy to a baby, and they want it. Do you really want the bulk of your retirement dollars sitting in the crosshairs of a government with a spending habit?

What you should do:

1. Only put the minimum in your 401 / 403 to get your company match. Free money is a good thing. Take advantage of your employer match. Adding in additional funds beyond that is a mistake.

Note: If your company allows your contribution to be put into a Roth 401, then by all means, max that out. It is okay to max out your 401 into a Roth option, but not the traditional one.

2. Any additional dollars should go into Roth IRAs that will be tax-free for life. If you make too much money to contribute to a Roth IRA, just deposit your money into a non-tax deductible IRA, and convert it to a Roth the next day.

Note: Please verify this approach will work with your accountant. If you already have traditional IRAs out there, it may not work.

3. Look into maximum-funded life insurance as a 401 option. Be careful on this one, but if you have a really good financial person on your side, they can help you set it up in the proper way.

It is okay to pay a little now to be tax-free later. In fact, its better than okay.

How Much Should I Invest

If you are many years from retirement and struggling with the here-and-now, you may think a 401 plan just isn’t a priority. But the combination of an employer match and a tax benefit make it irresistible.

When youre just starting out, the achievable goal might be a minimum payment to your 401 plan. That minimum should be the amount that qualifies you for the full match from your employer. To get the full tax savings, you need to contribute the yearly maximum contribution.

Don’t Miss: How Much Money Do I Have In My 401k

The Average 401k Balance By Age

401k plans are one of the most common investment vehicles that Americans use to save for retirement. The 401k is an employer-sponsored plan that allows you to save for retirement in a tax-sheltered way to help maximize your retirement dollars.

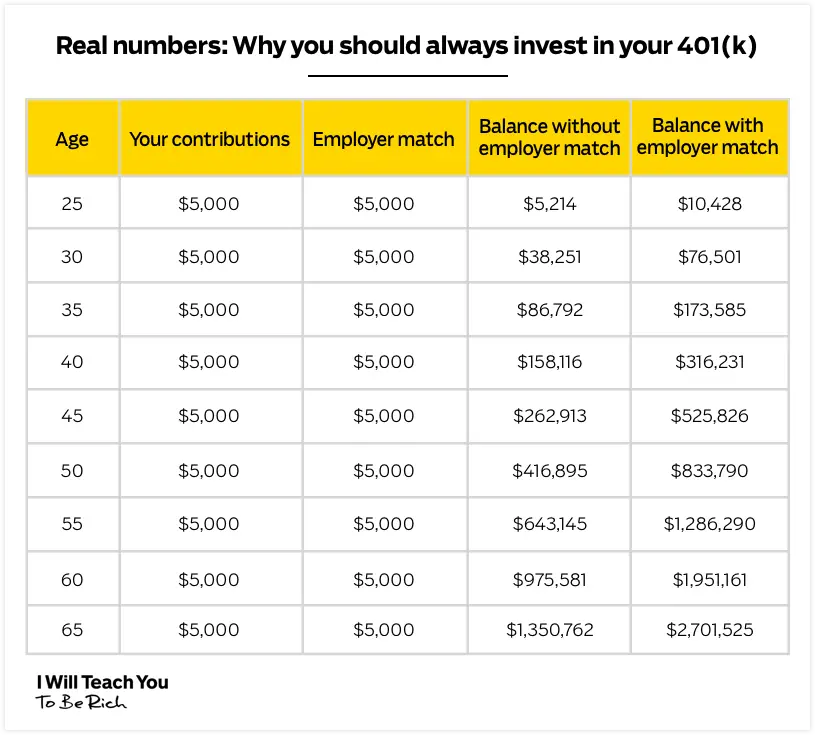

If your employer offers a 401k and you are not utilizing it, you may be leaving money on the table especially if your employer matches your contributions.

While the 401k is one of the best available retirement saving options for many people, only 32% of Americans are investing in one, according to the U.S. Census Bureau. That is staggering given the number of employees who have access to one: 59% of employed Americans.

Do you have enough in your 401k to retire when you want? You can find out using Personal Capitals free and secure Dashboard, which includes a Retirement Planner for testing different scenarios.

As American households face the financial fallout of the COVID-19 pandemic, many have put retirement saving on the back burner. In a recent Personal Capital survey, only about 50% of people reported currently contributing to their 401k every paycheck. Around 49% said they receive the maximum match from their employer.

So how much do people actually have saved in their 401k plans? And how does this stack up against what they could have saved if they were maxing out their 401k every year?

K Savings Potential By Age

The following chart depicts 401k savings potential by age, based on several assumptions. So this is how much you could have saved. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

| AGE | |

|---|---|

| $827,000.00 | $6,610,084.46 |

*Generally, financial planners say the expected rate of return for a 401k is between 8% and 10%.

So, how do you stack up? Are you on the high end? The low end? Do you think these numbers are realistic?

You May Like: When Can I Withdraw From 401k

What Is A 401 Everything You Need To Know

11 Minute Read | September 27, 2021

If you just started a new job and youre looking at the 401 options that are available, you probably have questions about how it all works.

You might be wondering: How do I know these are good investment options? How much should I invest? What kind of return should I expect? And what in the world does vesting mean?

If youre leaning on your 401 to be a big part of your financial picture, its important to get your questions answered. Your golden years literally depend on investment choices you make today. Learning how your 401 works is the first step toward making confident decisions about your retirement future.

Lets get started!

How To Manage Your 401 In A Bear Market

When a bear market sets in, the worst thing you can do is hit the panic button on your 401. While it may be disheartening to see your account value decreasing as stock prices drop, thats not necessarily a reason to overhaul your asset allocation.

Instead, look at which investments are continuing to perform well, if any. And consider how much of a decline youre seeing in your investments overall. Look closely at how much of your 401 you have invested in your own companys stock, as this could be a potential trouble spot if your company takes a financial hit as the result of a downturn.

Continue making contributions to your 401, at least at the minimum level to receive your employers full company match. If you can afford to do so, you may also consider increasing your contribution rate. This could allow you to max out your annual contribution limit while purchasing new investments at a discount when the market is down. Rebalance your investments in your 401 as needed to stay aligned with your financial goals, risk tolerance and timeline for retiring.

Read Also: Can I Move My 401k To A Different Company

But I Dont Know Much About Investing

Another reason you might put off joining the 401 is that you are overwhelmed by all those investment choices. If you are, touch base with a ForUsAll advisor. Our advisors are ready to answer questions about 401 investing, and even help with financial matters outside your 401.

But rest assured, you dont have to be the next Warren Buffet to grow a meaningful retirement nest egg. The broad stock market historically has increased in value over long periods. So young investors have good odds of watching their retirement nest egg grow over the next two, three, or four decades.

A good place to start investing is in a low-cost broad stock market index fund. Of course, you may be automatically enrolled in a target-date fund. If so, thats great! These funds do the investing for you. Target date funds set the asset allocation based on your age, and select the investments suitable for each basket of assets.

But lets suppose you are assured of becoming a better investor later. Even so, odds are youre better off putting aside money today. You can see thats the case in the next chart.

Below we assume that you can invest immediately and earn a 5% annual return over 40 years. Historically, thats a low assumption, by the way. Or, lets assume you can earn a 10% annual return if you wait to invest until Year 16. In both cases, we are making annual investments of $5,000 per year.

Diversify Your 401 Portfolio

Your portfolio is the collection of assets you have. You have nine investments in your portfolio if you have three mutual funds, three stocks, and three bonds. This mix is also diversified. It’s made up of different assets. This reduces the risk.

You have many options for planning your diversification. One is the “100 minus age” rule. The percentage of stocks in your portfolio should be the number you arrive at when you subtract your age from 100. The rest should be made up of mutual funds, bonds, or other investments. Your portfolio should be 60% stocks, with the remaining 40% in mutual funds and bonds, if you’re 40 years old and setting up your 401.

You May Like: How Do I Find Previous 401k Accounts

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Why Examine The 401

Why am I writing about 401ks? The short answer is that it is a fascinating subject.

As we explore it, youre more than welcome to listen and learn or youre welcome to ignore my perspective. I have no agenda here, nor anything to sell.

I simply want to educate you about the facts, share some history, and explore the myths youve likely been told by the people around you. Then you can decide.

What may be noteworthy is that Ive been studying the tax code for decades, read books about this topic in my spare time, and regularly dig through the dreaded IRS tax code which is an estimated 74,608-pages long.

Thankfully, the online version of the tax code lets you search by topic. Phew!

However, if youre not keen to believe me, you can also listen to financial experts like Grant Cardone or James Altucher, who share my perspective that 401ks are a scam. In Grants words, The 401 is merely where you kiss your money away for 40 years hoping it grows up.

As James puts it, are scams. This is another trillion dollar industry that has a lot of money at stake if people stop believing in the mythology bolted to the scam Then there is revenue-sharing between employers and 401k plan managers. Is this legal? Yes.

What created financial freedom for me was not money within a 401k that I cant access for decades.

It was cash flow from assets and investments that pay me today. With that context, should we get started?

Also Check: How Often Can I Change My 401k Investments Fidelity

Breaking It Down: Where Do You Fit In

There are many reasons you might think this chart seems totally reasonable, or, conversely, totally unreasonable. And thats understandable. Life presents us all with different challenges. We have unexpected medical expenses, decide to go back to school, or have kids and want to pay their college tuitions. These are all perfectly valid excuses as to why you might be falling behind where this chart says you should, or could, be.

Based on this chart, you would think that most Americans should be retiring as multi-millionaires at age 65. This probably seems way off-base, and in reality, it is most people retire with very little in the way of savings and investments. The point is that this chart shows what is possible if you are disciplined and strategic about your 401k savings.

If you are on the younger end of the ages shown on the chart, you may be daunted at the prospect of contributing $8,000 per year to your 401k, not to mention $19,500. Where you live, what your first-year salary is, or what loans you may be paying can make it difficult for this contribution to seem realistic. Its crucial, however, to recognize the importance of saving as much as you can for retirement as early as you can.

So, lets determine, based on the two scenarios in the potential savings chart, whether these figures would be sufficient to support your lifestyle for the rest of your retirement.The average life expectancy for men is around 84 years old, and 86.5 years old for women.

How To Protect Your 401 From A Stock Market Crash

Stock market crashes are impossible to predict. However, you can protect your 401 from losing money if the market does crash.

Making sure you have enough money for retirement is the primary goal of contributing to a 401. Your 401 will inevitably go through a series of ebbs and flows throughout your working years. Some years youâll see tremendous growth, others you may even lose money. However, as you near retirement, youâll want to protect your 401 from down years, even a stock market crash.

To protect your 401 from stock market crash, invest more in bond, which has a lower rate of return but also much lower risk. To gain as much value as you can, investments heavier in stocks give you the best chance of multiplying your money. However, with stocks comes increased risk. Shifting the percentage of your investments to a more bond-heavy allocation can help shield you if the stock market crashes as you get closer to retirement.

Capturing as much of the good times as possible while avoiding significant losses isnât an exact science there are strategies to help shift the odds in your favor. Letâs take a look at the basics of investing your 401, so you can protect your retirement nest egg.

You May Like: Where Is My 401k Money Invested