What Are The Penalties Fees Or Taxes Involved In Borrowing From Your 401

If you borrow the money, youll be required to repay the loan, typically within 5 years. Youll be paying interest while you do it, which is generally at the interest rate of 2 points over prime rate. But the interest will be used to pay yourself, which makes it a bit less onerous. However, remember these loans are paid with after-tax dollars so youre missing out on the tax benefits that make 401 accounts so attractive in the first place.

And note that if you use a 401 loan and then leave your job, the full amount must be repaid before you file taxes for the year in which you left your job . If you dont, its considered a withdrawal, which means it will be taxed at ordinary income tax rates.

Why Does Slavic401k Reimburse All Revenue Paid By The Funds

How Do You Repay

Since youre borrowing from your 401 plan, you have to repay the loan. This is typically done by taking a portion of each paycheck and applying it toward your loan. In most cases, you can borrow for a term of up to five years, but longer-term loans may be allowed if youll use the money to buy your home. Again, borrowing is risky, and longer-term loans are riskier than shorter-term loans .

When you repay money that youve borrowed from your 401 plan, you dont get any tax benefits. That money is treated as normal taxable income to you, so it wont be like any pre-tax contributions that youve been making to the plan. You can still contribute to the plan with pre-tax dollars contributions if your plan allows) but you dont get to double-dip and get a tax break on loan repayments. Remember: You werent taxed on the money you received when you took the loan.

If you leave your job before you repay the loan, you should have an opportunity to repay any money you borrowed from the 401. But thats not always easy. You probably took the loan because you needed cash, and its therefore unlikely that you have a lot of extra money sitting around. Try to repay if possible, otherwise, you may face income taxes and tax penalties as described below. If youve been recruited to a new job, you might be able to get some help from your new employer .

You May Like: How To Find Out If I Have Money In 401k

Ways To Help Manage A Margin Line Of Credit

To ensure that youre using margin prudently, it may be possible to manage your margin as a line of credit by employing the following strategies:

- Have a plan. You should never borrow more than you can comfortably repay. Think about a process for taking out the loan and ensuring that it aligns with your financial situation, and consider how youll respond in the event of various market conditions. Among other things, you should know how much your account can decline before being issued a margin call. Find out more on managing margin calls

- Set aside funds. Identify a source of funds to contribute to your margin account in the event that your balance approaches the margin maintenance requirement. This can be anything from cash in another account to investments elsewhere in your portfolio .

- Monitor your account frequently. Consider setting up alerts to notify you when the value of your investments declines by an amount where you need to start thinking about the possibility of a margin call.

- Pay interest regularly. Interest charges are automatically posted to your account monthly. Its important to have a plan for reducing your margin balance to minimize the interest amount youre charged which you can do by selling a security or depositing cash into your account.

Loans Are Tied To Your Company

If you leave your job, youre still required to pay the balance of any 401 loans.

If you don’t repay, and you sever ties with your existing company for whatever reason, the IRS will deem the loan a distribution, and you will be taxed in that tax year, says Allan Katz, certified financial planner at Comprehensive Wealth Management Group in Staten Island, New York. And if youre younger than 59½, youll incur a 10% early withdrawal penalty.

You could be left in a deeper financial hole than the one caused by your credit card debt.

About 86% of people who leave their job with an outstanding 401 loan default on it, according to the National Bureau of Economic Research, compared with 10% of all 401 loan borrowers.

Recommended Reading: Is It Worth Rolling Over A 401k

How Do I Keep Track Of My 401k Contributions

The retirement plan is required to keep larger accounts in place until you move the money out. If your former employer still exists, you can probably find it on the Internet. If you cant locate it, look for old account statements, which should list contact information for the administrator or trustee.

Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isn’t a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what’s been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What’s more, 401 loans don’t require a credit check, and they don’t show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

Also Check: How To Transfer 401k Between Jobs

What Are The Minimums And Maximums For Online Cash Transfers

The minimum amount for a brokerage account transfer is $10. The maximum transfer into your Fidelity brokerage account is $100,000. The minimum amount for a Portfolio Advisory ServicesSM account transfer is $250. You cannot request to withdraw more than 25% of your Portfolio Advisory Services accounts net worth.

Also Check: Can You Transfer Your 401k

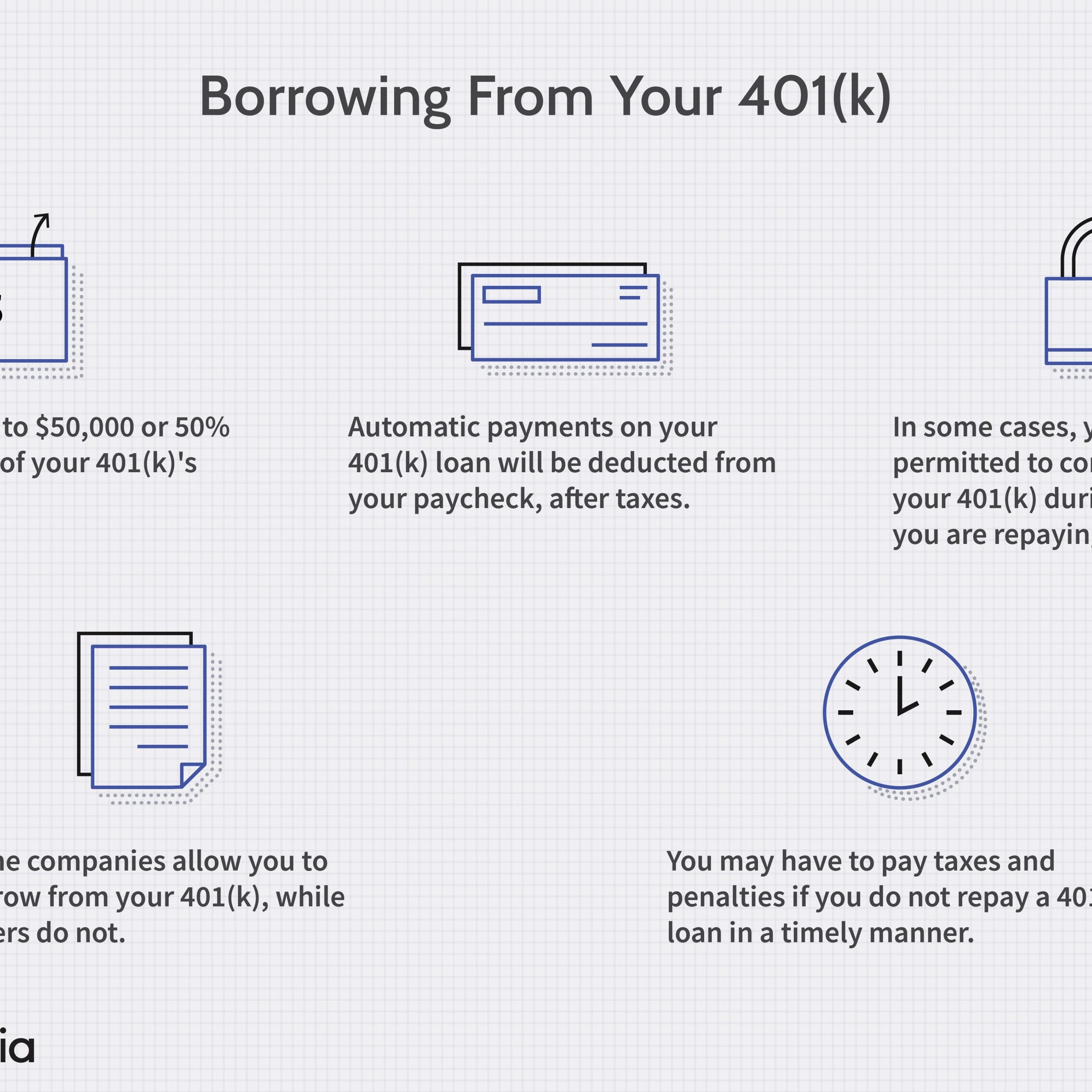

Not All 401 Plans Will Allow You To Borrow

Not all 401 plans allow you to borrow against your retirement account. If your employer doesnt permit it, you wont have this option available to you.

Further, while the CARES Act allows employers to enable larger loans, it doesnt require them to do so. Even some 401 administrators that generally permit borrowing may not double the loan limits.

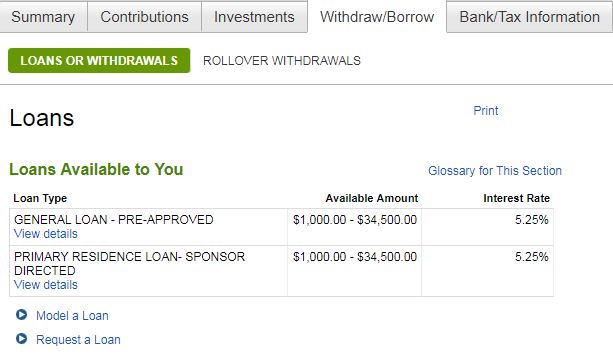

Youll need to check with your plan administrator to see if youre allowed to borrow at all and, if so, how much you can borrow.

Recommended Reading: How To Roll Over 401k To New Company

Does A 401k Grow If I Stop Contributing

Your 401K will continue to grow even if you stop contributing, as long as you leave it in your current retirement account, or transfer it to a new one, whether that be with a new employer or through an outside account. If you withdraw your funds, they can not grow, and you may delay your retirement.

Hardship And Loan Distributions

Hardship and loan distributions are only available through Fidelity. You may request a hardship distribution from the contributions you have through Fidelity provided that certain IRS requirements are met for this type of distribution. Please reference the Instructions for requesting a Hardship Distribution.

You may also be eligible to take out a loan against your contributions to the plan. When you take out a loan, you are simply borrowing money from your retirement plan account. You will repay the loan amount and interest to Fidelity on a monthly basis. The interest you pay on the loan is not tax deductible. However, there are no taxes or penalties unless you default on the loan. If you default on your repayments, you will be taxed as if the outstanding balance of your loan was distributed to you and might possibly include a 10 percent penalty, if you are under the age of 59 ½. Contact Fidelity to apply for a loan. Learn more about the Duke loan program.

Also Check: Can You Move Money From Ira To 401k

Also Check: What Happens To 401k If You Retire Early

How To Protect Your 401k From A Stock Market Crash

Are you riding your retirement on the success of the stock market? If so, its understandable that youre worried about what a crash could mean for your 401k.

If thats you and youre wondering how to protect your 401kfrom a stock market crash, Ive got good news for you:

You dont have to worry.

The stock market is volatile, but you can minimize that risk with the right investing strategy.

If you invest your money the right way, you can not only protect your retirement but also experience even greater returns so your retirement can be even sweeter. Ill show you how to take advantage of stock market volatility, which includes a stock market crash, so you can profit from the fluctuations instead of watching your portfolio take a plunge.

Are you with me?

How Borrowing From Your 401 Works

Most 401 programs let you set up a loan all on your own, without any assistance, via the website you use to handle other 401 tasks, such as changing your contribution amounts and allocating your savings to different investment funds.

Setting up the loan is as simple as finding the loan page on the 401 site and specifying the amount you want to borrow. The online form wonât let you borrow more than youâre entitled to, and interest rate and payroll deduction payments based on a standard five-year repayment period will be calculated automatically.

Once you authorize the loan, the amount of the loan will likely be included with your next paycheck .

If you have any questions about the process, youâll find an option for contacting fund administrators on the webpage.

Also Check: Can I Rollover My 401k To An Existing Ira

Read Also: Can A Spouse Get Your 401k In Divorce

Early Withdrawals Less Attractive Than Loan

One alternative to a 401 loan is a hardship distribution as part of an early withdrawal, but that comes with all kinds of taxes and penalties. If you withdraw the funds before retirement age youll typically be hit with income taxes on any gains and may be assessed a 10 percent bonus penalty, depending on the nature of the hardship.

You can also claim a hardship distribution with an early withdrawal.

The IRS defines a hardship distribution as an immediate and heavy financial need of the employee, adding that the amount must be necessary to satisfy the financial need. This type of early withdrawal doesnt require you to pay it back, nor does it come with any penalties.

A hardship distribution through an early withdrawal covers a few different circumstances, including:

- Certain medical expenses

- Some costs for buying a principal home

- Tuition, fees and education expenses

- Costs to prevent getting evicted or foreclosed

- Funeral or burial expenses

- Emergency home repairs for uninsured casualty losses

Hardships can be relative, and yours may not qualify you for an early withdrawal.

This type of withdrawal doesnt require you to pay it back. But its a good idea to avoid an early withdrawal, if at all possible, because of the serious negative effects on your retirement funds. Here are a few ways to sidestep those hefty levies and keep your retirement on track.

Other Alternatives To A 401 Loan

Borrowing from yourself may be a simple option, but its probably not your only option. Here are a few other places to find money.

Use your savings. Your emergency cash or other savings can be crucial right now and why you have emergency savings in the first place. Always try to find the best rate on an online savings account so that youre earning the highest amount on your funds.

Take out a personal loan. Personal loan terms could be easier for you to repay without having to jeopardize your retirement funds. Depending on your lender, you can get your money within a day or so. 401 loans might not be as immediate.

Try a HELOC. A home equity line of credit, or HELOC, is a good option if you own your home and have enough equity to borrow against. You can take out what you need, when you need it, up to the limit youre approved for. As revolving credit, its similar to a credit card and the cash is there when you need it.

Get a home equity loan. This type of loan can usually get you a lower interest rate, but keep in mind that your home is used as collateral. This is an installment loan, not revolving credit like a HELOC, so its good if you know exactly how much you need and what it will be used for. While easier to get, make sure you can pay this loan back or risk going into default on your home.

You May Like: Does My Employer 401k Match Count Towards Limit

How To Use Your 401k To Buy A House

Buying a home is one of the biggest purchases youll make in your lifetime. If youre like many homebuyers, you may not have abundant amounts of cash lying around to make a substantial down payment. However, the larger your down payment, the lower your monthly mortgage payments will be. For this reason, you might consider borrowing from your 401k for down payment funds.

Read Also: How To Find 401k From An Old Employer

Pay On Your Extra Pay Periods

Maybe you have not thought about it before, but if you get paid weekly, you usually get four paychecks a month, and you will receive five paychecks every year for four months.

If you get paid biweekly, you typically bring home two paychecks a month. These extra paychecks are fun to spend on petty things, but they are perfect for paying down your loan debt. Remember the more you settle towards your loan, the faster you will get it paid off.

Also Check: Can I Borrow Against My 401k

Handling A Previous 401k

You usually have a few options when it comes to handling a 401k from a former employer. These include leaving the 401k where it is, rolling it into a taxable or nontaxable Individual Retirement Account or transferring it to a 401k with your current employer and cashing it out. Of all your options, cashing out will cost you the most now and in the future. You will have to pay income taxes on the withdrawal along with a 10 percent early withdrawal penalty. Youll also lose the tax benefits offered by the 401k as a qualified retirement plan.

How Do I Know If My Retirement Account Is In Track

To find your savings benchmark, look for your approximate age, and consider how much youve saved so far for retirement. Compare that amount with your current gross income or salary. For example, a 35-year-old earning $60,000 would be on track if shes saved about one year of her income, or $60,000.

You May Like: How To See How Much Is In My 401k

How Can A 401 Loan Default

Because most loan payments are generally required to be paid back with deductions from your paycheck the default rate on 401 loans is relatively low. However, the single biggest cause of loan defaults is the loss of ones job. Once separated from employment , your employer can no longer just debit your paycheck to ensure timely payments and the full balance of the loan must be repaid promptly to avoid the loan going into default.

Less commonly, loan payments are not required to be paid back via deductions from your paycheck and you become fully responsible for ensuring timely payments. Of course, laying the responsibility of making timely payments on the loan recipient opens up the door to loan defaults. Falling behind on payments can cause a loan to default.

Dont Miss: Is An Ira Better Than 401k

What Is A 401 Loan

If your employer provides a 401 retirement savings plan, it may choose to allow participants to borrow against their accounts although not every plan will let you do so. Borrowing from your own 401 doesnt require a credit check, so it shouldnt affect your credit.

As long as you have a vested account balance in your 401, and if your plan permits loans, you can likely be allowed to borrow against it. Just like with any other loan, youll need to repay a loan from your 401 with interest within a set time frame.

Recommended Reading: How To Take A Loan From 401k