Pros Of A Brokerage Account

Brokerage accounts are far less restrictive than any kind of IRA. Perhaps the largest difference is that brokerage accounts do not have any contribution limits. You can deposit however much you want into your account. You can then continue to make deposits of any size at any time. You have the complete liberty to invest and/or trade as you please.

Most brokerage accounts also carry no minimum investment balance. Many enable you to create an account without an initial investment at all. There are also no limits to the number of brokerage accounts you open and how much you contribute to each.

Brokerage accounts are simple. They are accounts where an intermediary connects you and the assets you wish to acquire/trade. For this reason, there are often no fees apart from small trading margins/fees.

How Do You Invest

A Roth IRA will give you more flexibility to choose your own investments, but a 401 gets points for convenience.

Roth IRA

You can open a Roth IRA through a brokerage firm or a robo-investing service. You could set it up in person if you opt for a brokerage with a brick-and-mortar location or by applying online.

You can invest your Roth IRA money however you want in mutual funds, ETFs, individual stocks, bonds and annuities.

If you prefer to choose your own investments, youll want to open a brokerage account. Consult with a financial adviser if you arent sure what investments to choose. If you prefer a set-it-and-forget-it approach, youll probably prefer a robo-adviser, which uses super-smart software, instead of humans, to manage your investments.

You can set up automatic transfers from your bank to make investing more convenient.

401

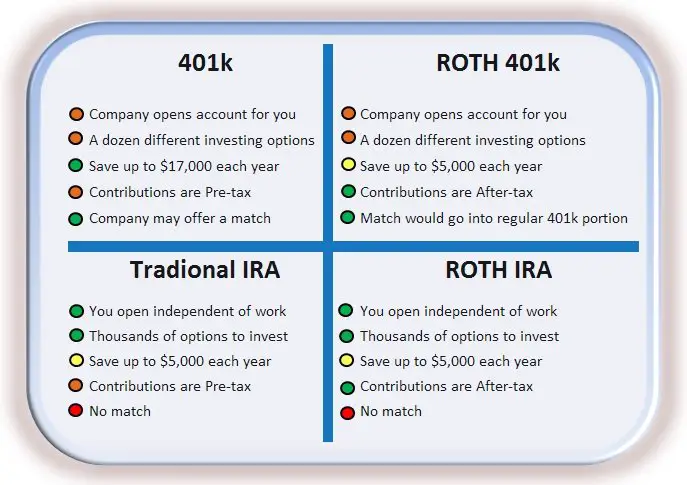

If your employer offers a 401, you may have to sign up for it or you may be automatically enrolled. Most companies let you enroll when youre hired, though some smaller companies will make you wait as much as a year.

Once youve signed up, youll have to decide how much to invest and what you want to invest in. Your investment options will be limited compared with your options for a Roth IRA, but you can usually choose from several categories of mutual funds.

You can change the amount youre contributing and your investment allocations at any time.

The M1 Finance Investment Platform

The M1 Finance investment platform allows you to choosethe type of accounts that can help you to best meet your needs. The platformoffers a choice between individual, joint, retirement, and trust accounts.

After you choose the account that fits you the best, youcan then fund it according to your risk tolerance. You are able to select yourown investments and decide what percentage of your investment funds that youwant to allocate to each investment that you choose.

You can set up an automatic transfer of money from yourdeposit account so that you can invest on a continuing basis without giving ittoo much thought. M1 Finance engages in automaticrebalancing so that your savings have the opportunity to grow.

Don’t Miss: How To Rollover My Fidelity 401k

Eligibility And Contribution Limits

There are no modified adjusted gross income limits for saving to a 401, so you can make use of this type of account, no matter how much or how little money you earn. You might not be able to save the full amount allowed each year to a Roth IRA, or you may not be able to contribute at all if you earn above certain MAGI limits.

The amount of your contribution also depends on your income tax filing status.

| 2022 Roth IRA Income Limits | ||

|---|---|---|

| If Your Filing Status Is: | And Your MAGI Is: | |

| $10,000 | Zero | |

| Single, head of household, or married filing separately, and you didn’t live with your spouse at any time during the year | < $129,000 | Up to the limit |

| Single, head of household, or married filing separately, and you didn’t live with your spouse at any time during the year | $129,000 but < $144,000 | A reduced amount |

| Single, head of household, or married filing separately, and you didn’t live with your spouse at any time during the year | $144,000 | Zero |

The IRA contribution limit for 2021 is $6,000. It’s $7,000 if you’re 50 or older. These limits will remain the same in 2022. Subtract from your MAGI one of three amounts to figure out the amount of your permitted reduced contribution in 2022:

- $204,000 if you’re married and filing a joint return or are a qualifying widow or widower

- $0 if you’re married and filing a separate return, and you lived with your spouse at any time during the year

- $129,000 if you have any other filing status

Roth Ira Vs Brokerage Account: What Is Right For You

In general, Roth IRAs are the better option when you are just considering retirement goals. There is little use for Roth IRAs apart from retirement planning.

Brokerage accounts are more diverse and less restrictive. However, they can be used for many goals, including retirement. If you have more money to invest than your IRA contribution limits allow for, you can use the remainder for brokerage account retirement-oriented investing.

You May Like: How Can I Find My 401k

Benefits Of Roth Iras For Kids

Children, too, can benefit financially from Roth IRAs, for reasons similar to those given above and other reasons, too. An 18-year-old, for example, likely still has several milestones ahead including college, a first home purchase, and retirement. Roth IRA beneficiaries may access the funds without penalty at any age provided that the money is used for college tuition or a down payment on a first home. Their Roth IRA contributions are also available at any time without any restrictions. As adults, people with Roth IRAs may even retire a few years early if they have enough money in contributions to fund their living expenses.

Investors of any age may contribute to Roth IRAs as long as they have taxable income. A persons contributions cant exceed his or her earned income or the standard contribution limit for the year. And the standard income limits do still apply. For beneficiaries younger than age 18 or 21, depending on the state in which you live, custodians are required to supervise their accounts. The child assumes legal ownership of the Roth IRA upon reaching the age specified by your state.

Roth Ira Vs Brokerage Account

Brokerage accounts are not meant strictly for retirement savings, but they can be used for that purpose. A Roth IRA, however, offers you tremendous tax advantages intended to give you an edge in retirement savings.

The differences between Roth IRAs and brokerage accounts can be summed up as:

- Tax savings vs. investment potential

- Safety vs. liberty

These simplified explanations dont cover each unique aspect of the two account types, but they offer some point of reference.

You May Like: How Young Can You Start A 401k

Disadvantages Of A 401

While a 401 is a great way to save for retirement, here are a few drawbacks to be aware of:

- Fewer options for mutual funds. Your employer hires a third-party administrator to run the companys retirement plan. That administrator determines which mutual funds you can invest in, limiting your options.

- Waiting period. If youre new to a company, you may have to wait a certain length of time to participate in a 401 plan.

- Required minimum distributions . You cant leave your money in your 401 forever. Beginning at age 72, you must start withdrawing a certain amount of your savings each year, or youll pay a penalty.2 Alsothere are penalties for withdrawing money before age 59 1/2. Either way, Uncle Sam wants his share!

Lets turn to the Roth IRA, and then well compare the two.

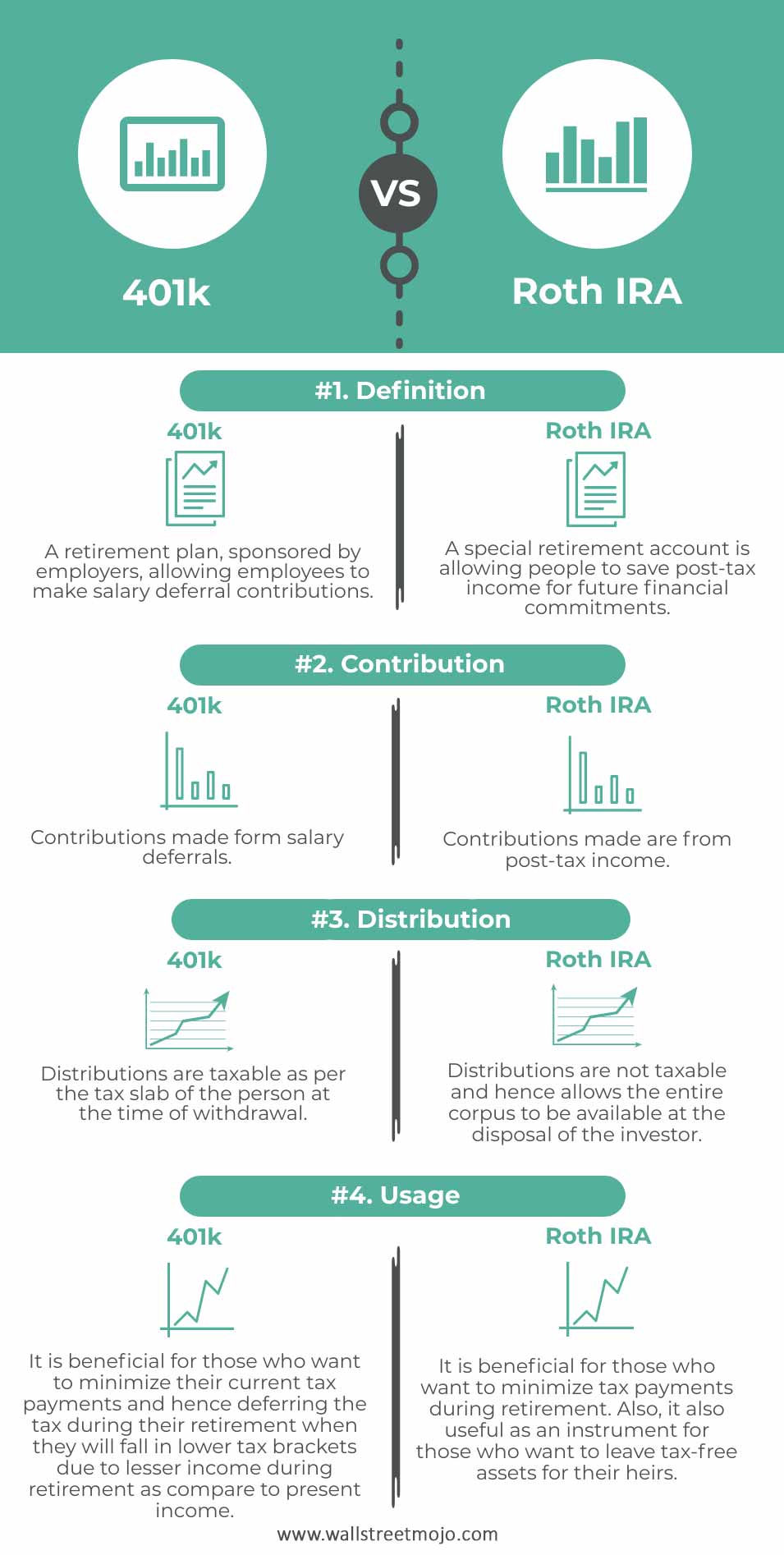

Whats The Difference Between A Roth Ira And A 401

Both Roth IRAs and 401s are popular forms of retirement accounts. Each account offers generous tax advantages, making them valuable tools for building wealth over time. A Roth IRA is an account you open as an individual, but to invest in a 401 plan, youll need to work for a company that offers one.

Recommended Reading: Where Does My 401k Go If I Quit My Job

Next Steps To Consider

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

A distribution from a Roth 401 is federally tax free and penalty free, provided the five-year aging requirement has been satisfied and one of the following conditions is met: age 59½, disability, or death.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

The Top Benefits Of The Roth Ira

December 19, 2020 by Retirement

The Tax Reform Act of 1986 greatly simplified the once-byzantine United States Tax Code, but among its casualties was the individual retirement account, or IRA. No longer could investors receive highly attractive tax deductions by stowing their income in their IRAs, which discouraged prudent retirement savings for many Americans. But in 1997, Senator William Roth pushed for an alternative to the traditional IRA that inverted the tax burdens. By devising an IRA that taxed modest contributions up-front but paid out tax-free, Congress could concurrently reinstate the traditional IRA with its deductible contributions and taxed income. Now, the Roth IRA allows middle-class investors to enjoy retirement without substantial tax burdens. Here are some more of the top benefits of the Roth IRA.

Read Also: How Do I Withdraw Money From My 401k

How Are Iras And 401s Different

The government wants you to prioritize saving for retirement. As a result, they provide tax incentives for IRAs and 401s. Some IRAs and all 401s offer tax-deferred growth, and other IRAs protect those who have them from having to pay taxes down the line.

The main difference between the two is that 401s are qualified employer-sponsored retirement plans. You typically only have access to these plans through an employer who offers them as part of a full-time compensation package.

In addition, your employer may choose to provide matching funds as part of your compensation, which may be equal to a percentage of the amount you contribute.

Not everyone is a full-time employee. You may be self-employed or work part-time, leaving you without access to a 401. Fortunately, there are other options available to you.

Anyone can set up an Individual Retirement Account as long as youre earning income. In fact, even if you already have a 401, you can still open an IRA and contribute to both accounts.

The two types of accounts also differ in how much money you are allowed to contribute and the types of investments you have access to.

Heres a deeper look at both types of accounts and the advantages each offers.

Retirement Planning: Roth Ira Vs Traditional Ira Vs 401

Along with building your financial independence comes the responsibility of retirement planning. For many, guaranteed pension plans are not an option and Social Security isnt enough. Its up to you to decide what amount of money you can save now in order to provide a living well into your golden years. Heres a look at the three most popular savings accounts: Roth IRA, IRA, and a 401.

Recommended Reading: What To Do With 401k When You Quit Your Job

Benefits Of Roth Iras For Young Adults

Roth IRAs are well suited for young adults who are early in their working careers. There are three main reasons why.

First, having a relatively low income maximizes the tax advantages of a Roth IRA. Remember that you contribute to a Roth IRA with after-tax dollars? You pay taxes in the current tax year on the amount of this years contribution, instead of being taxed on the withdrawals in retirement. This arrangement is tax advantageous because your tax bracket when you first start working is likely lower than your tax bracker later in life.

Second, you are more likely to not exceed the Roth IRA income limits when youre just starting your career. In 2021, you may not contribute to a Roth IRA if your modified adjusted gross income is more than $140,000 for a single filer or $208,000 for married taxpayers filing jointly. The only way for a high-earner to still contribute to a Roth IRA is to use a backdoor Roth IRA strategy.

And finally, the earlier that you start contributing to a Roth IRA, the greater the tax advantages. You have more years to grow your earnings on a tax-deferred basis, and more money to withdraw tax free in retirement.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

You May Like: How To Get The Money From Your 401k

When Should You Use A 401

If your employer offers a 401, it may be worth taking advantage of the opportunity to start contributing to your retirement savings. After all, 401s have some of the highest contribution limits of any retirement plans, which means you might end up saving a lot. Here are some other instances when it may be a good idea:

Roth Ira Vs : Both Offer Tax Advantages But Which Is Better

Last updated Jan 25, 2022| By Lance Cothern

FinanceBuzz is reader-supported. We may receive compensation from the products and services mentioned in this story, but the opinions are the author’s own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies.

Investing is key to preparing for your retirement. But knowing how to invest money and figuring out where to invest yours can be tricky. You could contribute to several types of accounts depending on your situation. Each may have its tax benefits, advantages, and disadvantages.

Two popular ways of saving for retirement include the Roth IRA and a traditional 401. Deciding which to choose requires you to understand how each works. Take the following into account when making your choice between a Roth IRA vs. a 401.

|

+$6,500 |

You May Like: How To Transfer 401k When Changing Jobs

Cons Of A Brokerage Account

The cons of brokerage accounts can be summed up by their lack of financial incentives. On the other hand, retirement accounts of all types offer substantial tax incentives for you to use them. They may have restrictions limiting their utility, but their tax sheltering benefits are not matched by brokerage accounts.

Investment Choices And Costs

Roth IRAs typically give you more investment options than 401s do but having more options doesnt automatically mean the investments are better. Due to their size, many 401 plans at large employers offer a diversified set of extremely low-cost investments. Unfortunately, smaller 401 plans may have higher investment costs than investing on your own in a low-cost Roth IRA. That means your dollars would go further in a Roth IRA depending on the 401 your company offers.

Don’t Miss: Can I Keep My 401k With My Old Employer

Benefits Of A Roth Ira

- Multiple Investment Opportunities: With Roth IRA, you wouldnt be limited to or dependent upon third-party administrators for investment opportunities. IRAs allow you to choose from literally thousands of mutual funds. This opens a whole new world of investment options, empowering better choices and future prospects!

- Tax-free Returns: As brushed upon earlier, Roth IRAs dont cost you anything in taxes. They do this by investing only after-tax money . This means the money in your account would only grow with time, without you paying anything back to the government. And the best part is that your investments in Roth would have grown larger upon retirement.

- No Required Minimum Distribution: When it comes to Roth IRA, the money can be kept in the account for as long as you want. This means that you would always be able to continue saving.

- No Employers: Unlike 401k, Roth IRA is not a workplace retirement plan. It can be opened at any point in your life, regardless of employment circumstances. You wouldnt have to worry about keeping track of the multiple 401ks from your previous jobs.