If Youve Already Taken A Withdrawal Or Loan You Can Recover

Stay calm and make steady progress toward recovery. It can be done. Build up a cushion of at least three to nine months of your income. No matter what incremental amount you save to get there, Poorman says, the key detail is consistency and regularity. For instance, have the sum automatically deposited to a savings account so you cant skip it.

Scale back daily expenses. Keep your compact car with 120,000 miles and drive it less often to your favorite steakhouse or fashion boutique.

Save aggressively to your 401 plan as soon as possible and stay on track. Bump up your 401 contribution 1% annually, until you maximize your retirement savings. Sock away the money earned from any job promotion or raise.

Read Also: How To Pull Money From 401k

Can I Close My 401k And Take The Money

Cashing out Your 401k while Still Employed If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income.

https://www.youtube.com/watch?v=rG-8UjwW6C4

What Happens To My 401 If I Quit My Job

You have several choices. You can leave your 401 with your former employer or roll it into a new employers plan. You can also roll over your 401 into an individual retirement account . Another option is to cash out your 401, but that may result in an early withdrawal penalty, plus youll have to pay taxes on the full amount.

Also Check: When Can You Draw Money From 401k

Invest In High Cash Companies

Some companies are in a far better position to survive and thrive in a stock crash than others. In particular, companies with a lot of money grow and make more money in a crash.

For instance, Warren Buffetts Berkshire Hathaway expanded during the stock market crash of 2008. In fact, Berkshire Hathaway bought the Burlington Northern Santa Fe Railroad for $26 billion in cash and stock in 2009. Berkshire could buy them because it had lots of cash.

Hence, investing in companies with large amounts of cash on hand is a great way to protect your portfolio from a market crash. You can learn how much cash a company has by checking its balance sheet. Companies list cash as cash and equivalents, short-term investments, or cash and short-term investments in their balance sheets.

Currently, companies with a lot of cash include:

- Berkshire Hathaway

- Banks. Notably, big banks like Goldman Sachs

- Wells Fargo

Concentrating your investments in high-cash industries like finance and technology is one way to protect yourself from crash effects. Moreover, avoiding low cash companies like retailers is a good way to protect your funds.

Finally, a simple rule of thumb you can follow is to only invest in companies with at least $20 billion in cash. Such companies are more likely to profit and grow during a crisis. Stock Rover provides a 10-year history and cash forecasting data for all stocks on the USA and Canada stock exchanges.

How Long Does It Take To Get A 401k Loan Approved

Generally the review takes about 5-7 business days. If your application is approved, you will receive a notification that your promissory note and amortization schedule are available for your review. Once the promissory note terms have been accepted, it takes about 2-3 business days for the check to be mailed out.

Also Check: What Is Max Amount To Contribute To 401k

Roll It Over To Your New Employer

If youve switched jobs, see if your new employer offers a 401, when you are eligible to participate, and if it allows rollovers. Many employers require new employees to put in a certain number of days of service before they can enroll in a retirement savings plan. Make sure that your new 401 account is active and ready to receive contributions before you roll over your old account.

Once you are enrolled in a plan with your new employer, its simple to roll over your old 401. You can elect to have the administrator of the old plan deposit the balance of your account directly into the new plan by simply filling out some paperwork. This is called a direct transfer, made from custodian to custodian, and it saves you any risk of owing taxes or missing a deadline.

Alternatively, you can elect to have the balance of your old account distributed to you in the form of a check, which is called an indirect rollover. You must deposit the funds into your new 401 within 60 days to avoid paying income tax on the entire balance and an additional 10% penalty for early withdrawal if youre younger than age 59½. A major drawback of an indirect rollover is that your old employer is required to withhold 20% of it for federal income tax purposesand possibly state taxes as well.

Need Money From Your Retirement Fund Vanguard Advises Taking Loans Instead Of Withdrawals

Need some emergency money? With more than 36 million Americans unemployed in the wake of the pandemic, you are not alone.

- May 18, 2020

Need to take emergency money out of your retirement fund?

With more than 36 million Americans unemployed in the wake of the pandemic, you are not alone. Thats the largest rise in claims since the U.S. Department of Labor started tracking the data in 1967.

As a result, the federal government changed the rules surrounding retirement accounts so we can take our money out more easily. The changes were part of the massive $2 trillion economic stimulus plan called the CARES Act.

However, Vanguard is advising investors that taking money out of our retirement accounts comes at a cost. Borrowing from your retirement plan may be a better strategy than withdrawing money. Heres why, according to Vanguard: When you borrow from your 401 or other IRA or retirement plan, you generally begin to repay the loan with every paycheck.

The automatic nature of repayment makes it more likely that the borrowed money will be returned to your long-term savings. Yes, you can repay a withdrawal from the plan for up to three years under the new law, but it can take more discipline and foresight to do so, the mutual fund giant said in a note to clients.

The biggest risk of any retirement plan loan is that you wont be able to pay the money back.

If your plan usually charges a loan origination fee, it will be waived.

You May Like: Which 401k Investment Option Is Best

You May Like: How Many Loans Can I Take From My 401k

What If I Dont Need The Rmd Assets

RMDs are designed to spread out your retirement savings and related taxes over your lifetime. If you dont depend on the money to satisfy your spending needs, you may want to consider:

- Reinvesting your distributions in a taxable account to take advantage of continued growth. You can then add beneficiaries to that account without passing along future RMDs to them.

- Gifting up to $100,000 annually to a qualified charity. Generally, qualified charitable distributions, or QCDs, arent subject to ordinary federal income taxes. As a result, theyre excluded from your taxable income.

Why You Should Consider A 401 Loan Instead Of Hardship Withdrawal

If youre in need of extra funds and have no other options outside of your 401 plan, consider taking a plan loan. First, check out your 401 plan document to see if it allows for plan loans. If allowed, you can borrow up to 50 percent of the vested portion of your 401 balance. Youll pay interest as youre paying the loan off, but it is credited back into your account. And as long as you pay the loan back, its not taxable. In addition, you can still contribute to the 401 plan and pay back the loan at the same time, although it may be wiser to put that additional money toward the principal to get it paid off in a shorter time saving on interest charges.

A loan is better than a hardship distribution because with a loan, you can restore your 401 balance by paying the loan back. But there are no payback provisions for hardships once the hardship distribution is made, its out your 401. You will need to make other arrangements to cover any shortage in your retirement savings objective due to the hardship distribution.

Read Also: How To Cancel 401k Plan

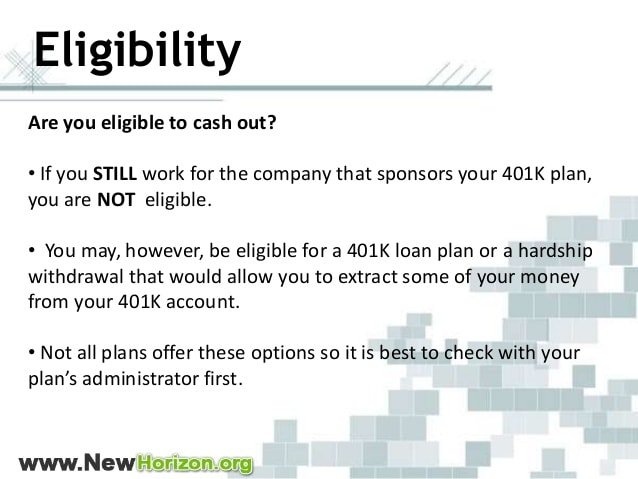

Eligibility For Cashing A 401 Plan

If you are still employed by the company that sponsors your 401 plan, you won’t be eligible to cash in your plan unless it offers a 401 plan loan, allows hardship withdrawals, or offers in-service withdrawals.

Try to avoid taking 401 loans. Most people are underfunded for retirement. Your money needs as much time as possible to grow. The loan also has to be paid back with interest, so you’d be losing money in multiple ways.

If you’re no longer employed by the company that sponsors your 401 plan, then you are eligible to receive your money. You can cash in the plan or roll over your 401 plan balance to an IRA.

If you choose to roll your money over instead of cashing out, you will not have to pay income taxes or penalty taxes, because rollovers to IRAs are not taxable transactions if you do them the right way. Rolling your 401 over to another plan is not considered cashing it out by the IRS.

When A Problem Occurs

The vast majority of 401 plans operate fairly, efficiently and in a manner that satisfies everyone involved. But problems can arise. The Department of Labor lists signs that might alert you to potential problems with your plan including:

- consistently late or irregular account statements

- late or irregular investment of your contributions

- inaccurate account balance

Recommended Reading: Where Do I Go To Withdraw My 401k

How To Roll Over A 401 While Still Working

Your 401k contains cash for your golden years, but you may end up closing your account long before you quit work. You can close your account when you retire, change jobs and, in some instances, while still employed. When you terminate a 401k plan, though, you have to contend with taxes and penalties.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: How To Do A Direct 401k Rollover

Whats The Best Way To Take Money Out Of My 401k

A better option is a 401 loan. Instead of losing a portion of your investment account foreveras you would with a withdrawala loan allows you to replace the money through payments deducted from your paycheck. Youll have to check if your plan offers loans, as well as if youre eligible. 3 A hardship withdrawal can be taken without a penalty.

Series Of Substantially Equal Payments

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. It is named for the tax code which describes it and allows you to take a series of specified payments every year. The amount of these payments is based on a calculation involving your current age and the size of your retirement account. Visit the IRS website for more details.

The catch is that once you start, you have to continue taking the periodic payments for five years, or until you reach age 59 ½, whichever is longer. Also, you will not be allowed to take more or less than the calculated distribution, even if you no longer need the money. So be careful with this one!

Don’t Miss: Where Can I Get A 401k Plan

Hardship Distributions From 401k Plan

If you are younger than 59 ½, youre going to have to demonstrate that you have an approved financial hardship to get money from your 401k account. And thats only if your employers retirement plan allows it. They are not required to offer hardship distributions, so the first step is to ask the Human Resources department if this is even possible.

If it is, the employer can choose which of the following IRS approved categories it will allow to qualify for hardship distribution:

- Certain medical expenses

- Certain expenses for repairs to a principal residence

The only other way to get access to your funds is to leave your employer.

Leave Your Assets Where They Are

If the plan allows, you can leave the assets in your former employers 401 plan, where they can continue to benefit from any tax-advantaged growth. Find out if you must maintain a minimum balance, and understand the plans fees, investment options, and other provisions, especially if you may need to access these funds at a later time.

Read Also: How Do I Add Money To My 401k

Your 401 K And Income Tax

You may be wondering if your 401 k is subject to income tax. Once you’ve withdrawn the money from the 401 k, you need to pay tax on it. It is considered part of your taxable estate. This is why you must check the terms of your 401 k before you get any money from it. Terms like these should be clearly outlined in the plan. Withdrawing funds without understanding the implications of doing so is one common mistake that people make when changing employers in the USA. It’s important to consider the other options you have.

If you’re changing employers, you still have plenty of time to build up passive capital via investment and your 401 k. You’re unlikely to get much out of rushing into a decision that you aren’t completely ready for. Roll all of the funds out of your 401 k at once, and you might end up drowning in taxes.

Withdrawing From A 401 After Leaving The Company Without A Penalty

In any of the following situations, you may qualify for early withdrawal without being subjected to any penalty:

-

If you leave a company the same year you turn 55 years old

-

If you suffer from total or permanent disability

-

If you cash out in equal installments spread over an expected period of your remaining lifetime

-

If you need to pay for medical expenses, which are more than 10% of your income

-

If as a military reservist, you have been called to active duty

Don’t Miss: How To Transfer My 401k From Previous Employer

How To Cash Out Your 401k And What To Consider

4-minute readMay 18, 2021

One of the surest ways to create a comfortable retirement for yourself is to begin saving early on in your career. A 401 plan a type of financial contribution plan which allows you to put a percentage of your salary into an account whose investment gains remain tax-free until funds are withdrawn presents one of the most popular vehicles for doing so. Even better, employers will often match the amount of money set aside up to a certain amount, effectively guaranteeing you free income.

However, in the event that access to money is needed, especially in the wake of a large or unexpected expense, its not uncommon to wonder how to cash out your 401 as well. Here, well take a closer look at the process of cashing out a 401 early, how long it takes to get access to money, and the pros and cons of doing so, including how much early withdrawal before retirement may cost you.

I Still Have A 401k From My Last Job What Do I Do About That

As you move ahead from job to job, dont make the mistake of leaving a trail of old savings accounts behind you. Put your hard-earned savings to work for you by looking at all the options. If youve left a job and a 401k, here are the options available to you for those funds.

- Leave your balance

- Rollover to new 401 plan.

- Rollover to an IRA.

- Cash out your 401.

Recommended Reading: How Do I Find My Old 401k

Stay Away From Cryptocurrencies

Next-generation financial technologies like cryptocurrencies are even more dangerous than precious metals. For instance, all cryptocurrencies lost 80% of their values between January and September 2018.

Thus, the cryptocurrency crash of 2018 was worse than the dot.com crash of 2018. Bloomberg claims. For example, Ethereum , the second most popular cryptocurrency, had a Coin Price of $539.27 on March 24, 2018. However, Coinmarketcap calculates Ethereums price fell to $137.32 on March 24, 2019.

Consequently, cryptocurrencies are far more unstable than stocks, so you should stay away from them. Cryptocurrencies are more unpredictable because they are a new technology that most investors do not understand.

Obviously, cryptocurrencies do not belong in your 401K because altcoins are more likely to crash than stocks. Therefore, stay away from cryptocurrency unless you have a high tolerance for risk and money to burn.