How Does Money Get Left Behind

Very few people stay at one employer the entire length of their career.

But unlike your bank account which you may have from job to job, a 401 account is linked to your employer. It is up to you to do something about it.

When you leave your employer, the money may stay in the account for an indefinite amount of time.

However, if the company closes the 401 plan, files for bankruptcy, goes out of business or is acquired by another company, you may be forced to decide, within a short period of time.

Its possible that years will go by after you parted ways with your old job, and then youll get a letter notifying you that you need to move your 401 account, or take a distribution.

If this happens, youre much better off rolling the money into an IRA account, or transferring the money into your current companys 401 plan.

A Special Note For Pennsylvania Residents

If you live in Pennsylvania, you should start your search sooner rather than later.

In most states, lost or abandoned money, including checking and savings accounts, must be turned over to the states unclaimed property fund. Every state has unclaimed property programs that are meant to protect consumers by ensuring that money owed to them is returned to the consumer rather than remaining with financial institutions and other companies. Typically, retirement accounts have been excluded from unclaimed property laws.

However, Pennsylvania recently changed their laws to require that unclaimed IRAs and Roth IRAs be handed over to the states fund if the account has been dormant for three years or more.

If your account is liquidated and turned over to the state before the age of 59.5, you could only learn about the account when you receive a notice from the IRS saying you owe tax on a distribution!

Company 401k plans are excluded from the law unless theyve been converted to an IRA. If you know you have an account in Pennsylvania, be sure to log onto your account online periodically. You can also check the states website at patreasury.gov to see if you have any unclaimed property.

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

Read Also: Is 401k Required By Law In California

What To Do When You Find An Old 401

Once youve reconnected with your old 401, its time to decide what to do with it:

- Leave it with your old employer. If you contributed at least $5,000 to your old 401, you might consider leaving it where it is. But this may only be worthwhile if the account has competitive fees or offers access to unique investments. Otherwise, itll be yet another account to keep track of come retirement, and you may be better off rolling it over.

- New 401 rollover. Has your new employer offered you a 401? Consider consolidating your retirement funds by rolling your old retirement account into a new 401.

- IRA rollover. If you dont have a new 401 to move your old retirement funds into, consider rolling over into an individual retirement account. That way, your funds retain their tax-advantaged status.

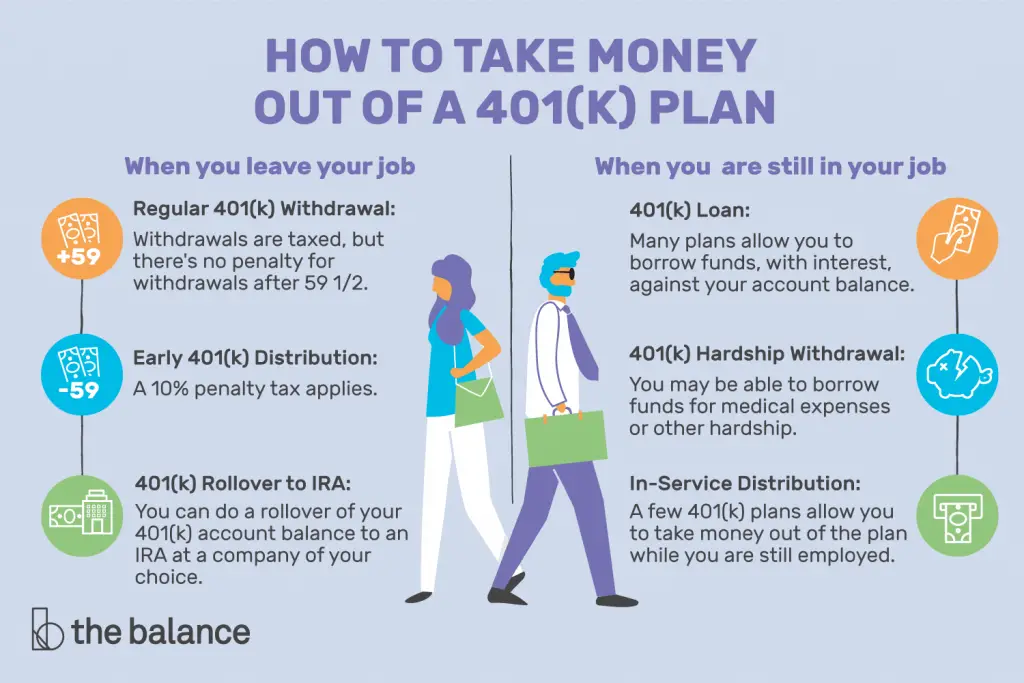

- Cash it out. Consider this a last resort because cashing out a 401 ahead of schedule can result in major penalties.

- If youre older than 59 ½, you can access funds without penalty.

- If youre under 59 ½, withdrawals are subject to a 10% tax penalty and other fees.

Us Department Of Labors Abandoned Plan Search

In certain cases, such as in bankruptcies, employers abandon the 401 plans they provided to employees. If that happens, theyre required to notify you so you can receive the funds owed to you. If you werent notified or believe your plan may have been abandoned, you can use the U.S. Department of Labors Abandoned Plan Search. You can search by employer or plan name, and if a plan is found, youll receive the plan administrators contact information.

You May Like: How To Direct Transfer 401k To 403b

What Is A 401

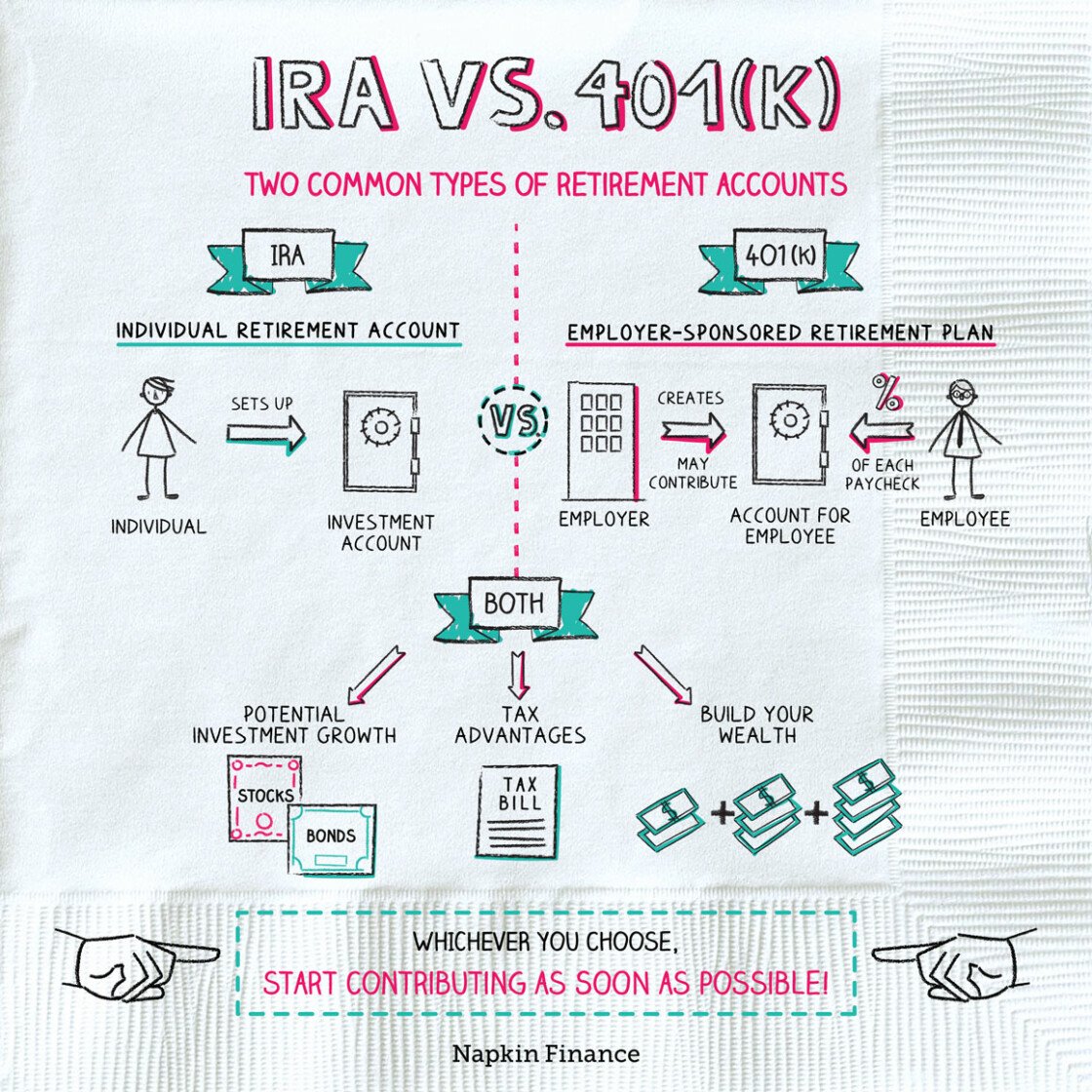

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

How Is An Ira Different From 401k

401K accounts are associated with your employment, as contributions are taken out of your wages before taxes. A traditional IRA is similar to a 401k in that contributions aren’t taxed , but the key difference is that they are independent of your employer. A Roth IRA is also independent, but contributions are made after taxes. Withdrawals from your Roth IRA are tax-free, which makes them a smart choice if you think taxes will be higher in the future.

Read Also: What Is A 401k Vs Ira

How Do I Find Old Ira Accounts

Search online for unclaimed funds in your name or that of the person who may have owned an IRA. You need not pay for an online unclaimed-property search. The National Association of Unclaimed Property Administrators maintains a free search facility at MissingMoney.com. Check with state unclaimed-property offices.

Do I Have A 401 I Dont Know About

Making sure you donât have a 401 you donât know about is important. Managing your retirement accounts in one place can help make it easier to reach your retirement goals.

Contributing to a workplace-sponsored 401 plan should be a priority when starting a new job, especially if that company promises to match whatever contributions you make. Many companies automatically enroll their new hires into their 401 on their first day or upon eligibility. Itâs easy to lose track and forget if you have a 401 that you donât know about.

On top of that, leaving jobs at the frequency Americans are today can cause many 401 participants to forget to bring their 401s with them to their new jobs.

If youâre reading this wondering if you have a 401 you donât know about, there are ways you can search and find out.

The most obvious places to look are your current and former employerâs human resource department. Additionally, a few outside resources can help you, such as national abandoned plan databases and companies like Beagle.

Knowing where to look and when to utilize these different methods can help expedite your search and bring those forgotten 401s back into an account you can manage more effectively.

You May Like: What Is A Robs 401k

How To Find An Old 401 And What To Do With It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

There are billions of dollars sitting unclaimed in ghosted workplace retirement plans. And some of it might be yours if youve ever left a job and forgotten to take your vested retirement savings with you.

But no matter how long the cobwebs have been forming on your old 401, that money is still yours. All you have to do is find it.

Search The Abandoned Plan Database

If you cant find your lost money by contacting your old employer, searching the National Registry of Unclaimed Retirement Benefits, or the FreeERISA website, you have one last place to check, the Abandoned Plan Database offered by the U.S. Department of Labor.

Searching is simple, you can search their database by Plan Name or Employer name, and locate the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Recommended Reading: What’s The Difference Between A Roth Ira And A 401k

Contributing To Both A Traditional And Roth 401

If their employer offers both types of 401 plans, employees can split their contributions, putting some money into a traditional 401 and some into a Roth 401.

However, their total contribution to the two types of accounts can’t exceed the limit for one account .

Employer contributions can only go into a traditional 401 account where they will be subject to tax upon withdrawal, not into a Roth.

S To Find Your Old 401

Its not all that uncommon to lose a 401 especially if you didnt have much invested to begin with. Its possible you were automatically enrolled in a 401 by your old employer and didnt know the account existed. Or maybe you got caught up in the process of switching jobs and forgot to tie up loose ends.

Whatever the case, you can rest assured that your retirement funds arent gone, and youre entitled to them. Its a simple matter of tracking them down and you can start by contacting your old employer.

1. Contact your old employer

Start your search by reaching out to the human resources department of your previous employer. If you dont have HRs email address or phone number on hand, reach out to any company employees youre still in touch with to request the information.

In most cases, it shouldnt be too hard to reconnect with your old employer, but if your company merged with another firm or went out of business, you may need to move on to step two.

2. Speak to the plan administrator

Now lets say you havent had much luck reaching your old company. The next point of contact will be the plan administrator, which is the investment company responsible for managing the investments in your old 401 account.

3. Search national databases

If you follow these steps and still come up short, try a national database. There are numerous sites and services designed to connect former employees with lost retirement savings.

Also Check: How To Get Money From Your 401k

Alternatives To A 401

The most obvious replacement for a 401 is an individual retirement account . Since an IRA isn’t attached to an employer and can be opened by just about anyone, it’s probably a good idea for every workerwith or without access to an employer planto contribute to an IRA .

These tax-advantaged accounts do two things: First, earmark money for retirement savings, making it less likely to be spent beforehand second, provide tax savings of potentially tens or hundreds of thousands of dollars over a savers lifetime, says Jonathan Swanburg an investment advisor representative with Tri-Star Advisors in Houston.

However, there are limitations to an IRA. It’s very unlikely a worker can completely replace a 401 with only an IRA. Most glaring is the IRA’s contribution limit, which is a relatively paltry $6,000 per year versus the 401 limit of $19,500 in 2021 .

Some employers offer matching contributions for their 401 plans, which is essentially free retirement money for the worker. No IRA can include this kind of matching contribution since the IRA isn’t tied to any employer. Given these kinds of limitations, workers should supplement their IRAs with other retirement strategies.

Certificates of deposit were once a very attractive savings vehicle, but years of low-interest rates have effectively crippled them as a serious option. There are other riskier or more expensive alternatives for tax-deferred retirement income, such as annuities or permanent life insurance policies.

Check The National Registry Of Unclaimed Retirement Benefits

The National Registry is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

It is essentially a search engine of lost 401 plans.

The only thing you need to search the database is your social security number. No additional information is needed, and there is no cost to search the database.

Also Check: How Can You Pull Money From Your 401k

Where Has My 401 Gone

There are a few scenarios in which someone might lose track of their 401.

If you did a bit of job-hopping early in your career, you may have moved on and forgotten about your 401 plan. Or perhaps your company merged with another, but your 401 plan didnt transfer over. In other cases, you may have automatically enrolled in your companys 401 plan without realizing it.

You know all the paperwork from human resources you ignored? The information youre looking for probably was in there.

Regardless of why you lost track of a 401 plan, the good news is that whatever contributions you made no matter how long ago that may have been are yours to keep and always will be. Heres what you need to know to track down your old 401 and make it work in your favor again.

Move Your 401 To A New Employer

You can usually move your 401 balance to your new employer’s plan. As with an IRA rollover, this maintains the account’s tax-deferred status and avoids immediate taxes.

It could be a wise move if the employee isn’t comfortable with making the investment decisions involved in managing a rollover IRA and would rather leave some of that work to the new plan’s administrator.

Read Also: Can You Move Money From Ira To 401k

How A 401 Works

If your employer offers a 401 and you meet the eligibility requirements, you can enroll in the plan and begin making contributions via payroll. Before you start making contributions, though, youâll need to decide:

- What type of 401 you want: Traditional or Roth

- How much you want to save

- What you want to do with the money you save

401s come in two distinct flavors: Traditional and Roth. Although at their heart they aim to achieve the same purpose â to encourage Americans to save more for retirement by offering tax incentives â they do this in drastically different ways. Here are the main ways they differ.

Have more questions? .

Traditional 401: Your contributions are made before taxes and over the years your money grows tax-deferred. This means the contributions you make help lower your taxable income now, and you donât pay any taxes on either your contributions or investment growth until you begin making withdrawals in retirement. At that point, the money will be taxed as ordinary income.

Roth 401: Your contributions are made after you’ve paid tax on the income, but your money grows tax-free. Because you already paid tax up front, when you withdraw money during retirement, you wonât have to pay taxes.

How Does A 401k Work

A 401k plan is a benefit commonly offered by employers to ensure employees have dedicated retirement funds. A set percentage the employee chooses is automatically taken out of each paycheck and invested in a 401k account. They are made up of investments that the employee can pick themselves.

Depending on the details of the plan, the money invested may be tax-free and matching contributions may be made by the employer. If either of those benefits are included in your 401k plan, financial experts recommend contributing the maximum amount each year, or as close to it as you can manage.

Also Check: How To Find Out If I Have An Old 401k

Search The National Registry

Still not having any luck? Past employers may list you as a missing participant if you no longer work for the company but left your 401 behind. The National Registry of Unclaimed Retirement Benefits is a nationwide, secure database listing retirement plan account balances that have been left unclaimed .

What Happens To My 401k If I Change Jobs

You have a couple of options, but the one most would recommend is a 401k rollover. A 401k rollover is when you transfer your funds from your employer to an individual retirement account or to a 401k plan with your new employer. A much less popular option is to cash out your 401k, but this comes with massive penalties income tax, and an additional 10% withholding fee.

Read Also: How To Claim 401k From Previous Employer