How To Choose Your Vanguard Small Business Retirement Plan

Now that you have each Vanguard Small Business plan laid out in front of you, do you know which retirement plan is right for you? Youâll need to look closely at the structure of your business, your employeesâ needs, your business budget, and how you want your retirement savings to grow. Once you get a handle on your priorities for your retirement savings, youâre well on your way to choosing the right plan for your small business.

Best For Low Operating Costs: Charles Schwab

Not many names are as well known in the financial industry as Charles Schwab. Charles Schwab offers Index Advantage 401 plans with low fees it also has some other plans you can choose from.

You can get plan advice and access to accounts that offer interest through the Schwab Bank. Its plans have no annual fees plan members get full access to all investing services.

If you’re self-employed or own your business, you can pay into an individual 401 plan. These plans offer many of the same benefits as a traditional 401. One great thing about the individual 401 plan is that you can direct where you invest your money.

This plan has monthly service fees that vary based on your needs. Payments into your plan are tax-deductible, and gains are tax-deferred.

All Charles Schwab plans come with planning help and 24/7 service and support.

See What Vanguard Assets Qualify

Eligibility is first calculated using qualifying assets for an individual client. We then combine the qualifying assets of clients sharing a residential address to determine final eligibility*.Assets that qualify

- Any assets under management of Vanguard Personal Advisor Services.

- Vanguard mutual funds and Vanguard ETFs held by a client in certain personal accounts qualify. Personal account types include: individual non-retirement, education savings accounts, IRAs, Joint, Trust, Custodian, Guardian, UTMA, UGMA, Estate, Sole Proprietorship, and Single-Participant SEP IRA plans.

Read Also: Should I Borrow From My 401k

What Are Average Vanguard 401 Fees

We have evaluated the fees of a few Vanguard plans over the years as part of our 401 fee comparison service. Below are the averages we found for these plans.

|

Average Vanguard 401 Fees |

|

|

All-In Fees |

2.71% |

The most notable thing about Vanguard as a small business 401 provider is that they charge no hidden fees for plan administration like revenue sharing or variable annuity wraps. Charging no hidden fees makes it much easier for small businesses to calculate the total cost of a Vanguard plan. Well show you how to do so next.

How To Get Started

You will need to contact Vanguard directly and set up a 401 investment portfolio that includes Vanguard funds. The Vanguard Retirement Access plan is a product designed specifically for small businesses, but it is not a formal 401 plan that a small business signs up for directly. This makes the process a little more difficult and complicated than it has to be, but designing a 401 plan with Vanguards attractive funds is still very possible.

Don’t Miss: How To Find Lost 401k

Do I Have A 401 I Dont Know About

Making sure you donât have a 401 you donât know about is important. Managing your retirement accounts in one place can help make it easier to reach your retirement goals.

Contributing to a workplace-sponsored 401 plan should be a priority when starting a new job, especially if that company promises to match whatever contributions you make. Many companies automatically enroll their new hires into their 401 on their first day or upon eligibility. Itâs easy to lose track and forget if you have a 401 that you donât know about.

On top of that, leaving jobs at the frequency Americans are today can cause many 401 participants to forget to bring their 401s with them to their new jobs.

If youâre reading this wondering if you have a 401 you donât know about, there are ways you can search and find out.

The most obvious places to look are your current and former employerâs human resource department. Additionally, a few outside resources can help you, such as national abandoned plan databases and companies like Beagle.

Knowing where to look and when to utilize these different methods can help expedite your search and bring those forgotten 401s back into an account you can manage more effectively.

Best For Combined Services: Adp

ADP is another 401 provider that offers combined services for small employers. It offers 401 plans, payroll, insurance, human resources, tax filing, and other services. It specializes in small companies with up to 49 plan members and offers several 401 plans for businesses.

Advisor services are available to help you select the suite of products your company needs. Employers who switch to ADP from another firm have the option to transfer their plans over.

The 401 plans offer flexible options to invest in many mutual funds or other investment types. They offer three investment portfolio samples to help members choose:

- You can choose from a basic sample line-up for investors with little desire to manage their experience.

- A standard sample line-up helps investors who want to be somewhat involved in the experience.

- An advanced sample line-up helps you pick funds or investments that give you more options to tailor and manage your plan.

Investors can ask for help when choosing a plan or ask that a plan is chosen for them. Once enrolled, there is a useful mobile app that allows access to accounts from all devices.

Also Check: Why Cant I Take Money Out Of My 401k

How We Use Your Personal Data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

- Verify your identity, personalize the content you receive, or create and administer your account.

- Provide specific products and services to you, such as portfolio management or data aggregation.

- Develop and improve features of our offerings.

To learn more about how we handle and protect your data, visit our privacy center.

Who Its Best For

The Vanguard Retirement Plan Access is great for small businesses that dont have in-depth knowledge about how to run and administer a 401 plan for their employees. Vanguard is an attractive offering for employees as well, because the company offers a wide range of funds, both international and domestic, and has generally good returns and lower costs than other providers. Its important to note that Vanguard is focused solely on being a money manager, which gives small businesses the benefit of having a specialist focus on their 401 plan.

Check out our roundup of the Best 401 Companies for Small Business

Also Check: How To Find Out If I Have Old 401k

Vanguard Target Retirement Funds

The Vanguard Target Retirement Funds offer one-stop shopping for those seeking a simple approach to retirement investments.

These funds:

- Have built-in diversificationby investing in major asset classes such as bonds, US stocks, international stocks, real estate, and commoditiesthat endeavor to manage risk and performance over time.

- Are managed to become more conservative as the fund get closer to your retirement date, gradually shifting the funds investments from higher-risk to lower-risk investments.

- Are managed by professionals, whose objectives are to manage your portfolio, with the goal of creating a mix of risk and return appropriate to each stage of your life.

- Are one of the lowest-fee target-date funds currently available.

The target-date funds are offered in five-year increments. You invest in a fund according to your current age, as follows:

| If You Were Born |

How To Find & Calculate Vanguard 401 Fees

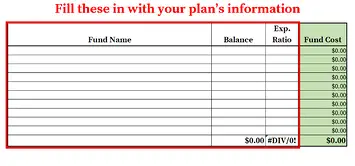

To understand how much youre paying for your Vanguard plan, I recommend you sum your admin fees and investment expenses into a single all-in fee. Expressing this as both a percentage of plan assets, as well as hard dollars per-participant, will ultimately make it easier for you to compare your cost with competing 401 providers and/or industry averages.

To make this easy on you, weve created a spreadsheet you can use with all the columns and formulas youll need to total your plans cost. All you need to do is find the information for your plan, then enter it into the spreadsheet.

Doing this for Vanguard is fairly straightforward. Well show you everything you need to do in 4 simple steps.

Step 1 Gather All the Necessary Documents

To calculate your Vanguard 401 fees, you need 2 documents:

- Disclosure of Services and Fees: Vanguard is obligated by Department of Labor regulations to provide employers with a 408 fee disclosure. This document contains plan-level information on the direct fees theyre charging, as well as any revenue sharing payments they receive from the funds. This information is intended to help employers evaluate the reasonableness of their 401 fees. This document can be found on the Vanguard employer website.

- Statement of Assets Report: this document provides a breakdown of how much money is invested in each fund in your 401 plan. These are also sent each year, and can be found on the employer website.

Step 2 Locate Vanguards Direct 401 Fees

Read Also: What’s The Difference Between A Roth Ira And A 401k

What To Look For In A Solo 401k

Going through the process of shopping around for a solo 401k provider, I’ve learned a lot about what to look for. There are a lot of options and nuances that you should look for when shopping for a 401k. Many of the “free” providers offer simple generic plans, and if those don’t work for you, you can have a third party provider create a custom 401k plan for your business, which you can then take to a brokerage.

Whoa, that sounds confusing, and it can be. So let’s look at the major options that you need to consider when selecting a solo 401k provider.

- Does the 401k provider offer both Roth and Traditional contributions?

- Does the 401k provider offer after-tax contributions to do a mega backdoor Roth IRA.

- Does the 401k provider offer loans from the plan?

- What types of investment options are allowed in the plan?

- Does the provider allow rollovers into the plan and rollovers out of the plan?

- The costs to maintain the plan

- The costs to invest within the plan

Based on your wants and needs, there are a lot of things to compare when shopping for a solo 401k provider. Let’s compare some of the main firms that offer solo 401ks. We’re going to start with the 5 major firms that provide Prototype Plans. These are the “free” plans that the companies advertise.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: How To Cash Out Your 401k Fidelity

Vanguard’s 401 Plan For Small Businesses

The Vanguard Group has developed Vanguard Retirement Plan Access, a 401 product, especially for small businesses. It makes it easy for new or modestly sized employers to offer employees the same retirement savings benefits as larger companies.

These types of small business offerings from large-scale institutions can take a lot of the guesswork out of selecting a plan for small business owners who are less likely to know what to look for than trained benefits specialists at larger firms.

Vanguard Solo 401k Plan Document

Starting a Solo 401K at Vanguard is easy. If you are already a Vanguard client, you can set the account up online by logging into your account and choosing Individual 401K. If you dont have an account with Vanguard right now, you must call 1-800-992-1788 and a representative will walk you through the process.

Before you can apply for a Solo 401K, youll need an Employee Identification Number. You get this number directly from the IRS and it only takes a matter of minutes as they provide it to you instantly. Head to the IRS website and complete the required information to get your EIN.

Beyond the EIN, youll need to sign a few Vanguard documents, which they will send to you. Youll need to sign them and send back the originals, but make sure you keep a copy for yourself.

As a part of the process, youll also need to choose a plan administrator. Many business owners choose to handle it themselves, but if you dont want the responsibility, you can assign it to your spouse or your accountant .

Don’t Miss: Is A 401k Considered An Annuity

Withdraw Money From Your Accounts In This Order

If your taxable distributions and RMDs aren’t enough to cover your spending, withdraw additional money from your savings in a way that will allow you to pay the majority of your taxes while you’re in a lower tax bracket.

That’s sometimes easier said than done, but for many people, the order below will make the most sense.

Employee Funds Sailing Away

Effective June 25, the following investments will be removed from Vanguard’s 401 retirement plan:

-

Vanguard High Yield Corporate Fund

-

Vanguard Short-Term Inflation Protected Securities Index Fund

-

Vanguard Balanced Index Fund

-

Vanguard Institutional Index Fund

-

Vanguard Small-Cap Index Fund

-

Vanguard Extended Market Index Fund

-

Vanguard Explorer Fund

Recommended Reading: Who Are The Top 401k Providers

Third Party Solo 401k Providers

If you need something a little more robust that the free prototype plans these five brokerage firms offer, then you need to find a third party service that will create the plan documentation for you.

Some of the common reasons why you’d consider using a third-party service to create your solo 401k documentation:

- You want a choice in brokerage

- You want to invest in alternative assets such as real estate, startups, cryptocurrency, promissory notes, tax liens, precious metals, and more.

- You want checkbook control over your 401k

- None of the prototype providers matches exactly what you’re looking for with options

We’re not going to go in-depth on these providers because this section effectively becomes al-la-carte with what you can get and pay for. I just wanted to list some of the most popular third party plan providers that you can reference in your search for the best plan.

Remember, just because you go with a third party provider also doesn’t mean you can’t invest at your favorite firm. For example, you can create a third party solo 401k and then have that 401k held at Fidelity. This gives you access to all of Fidelity’s investment choices, but your options are created by the plan, and NOT Fidelity.

Also, you can use these plans to execute a Mega Backdoor Roth IRA. In fact, several of these companies specifically advertise that they offer it.

This isn’t an exhaustive list. There are also local firms in most areas that can create 401k plan documentation as well.

Let Vanguard Help You

The Personal Online Advisor tool can help you choose the funds that are right for you.

- Get free online advice about your personal investments and an evaluation of your financial goals and your time frame.

- Start by logging in to your account. Select the Get Advice icon in the bottom right corner, and then select the Advice tab for the link to the Personal Online Advisor.

Vanguard Situational Advisor allows you to consult an advisor at 800-310-8952 for two types of help:

- Quick situational guidance, with no cost to Adobe employees.

- A one-time, in-depth financial plan and consultation with a financial advisor for participants age 55 or older. All your assets can be included in your plan.

You May Like: How To Make More Money With My 401k

Comparing The Most Popular Solo 401k Options

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

I’ve been doing my research over the last few months on the best solo 401k providers for small businesses and side hustlers like myself. I’ve shared in the past the best options for saving for retirement with a side income, and I’ve leveraged a SEP IRA in the past.